Unless you are one of the wealthy few who can purchase a house upfront and in cash, owning a home typically requires a line of credit.

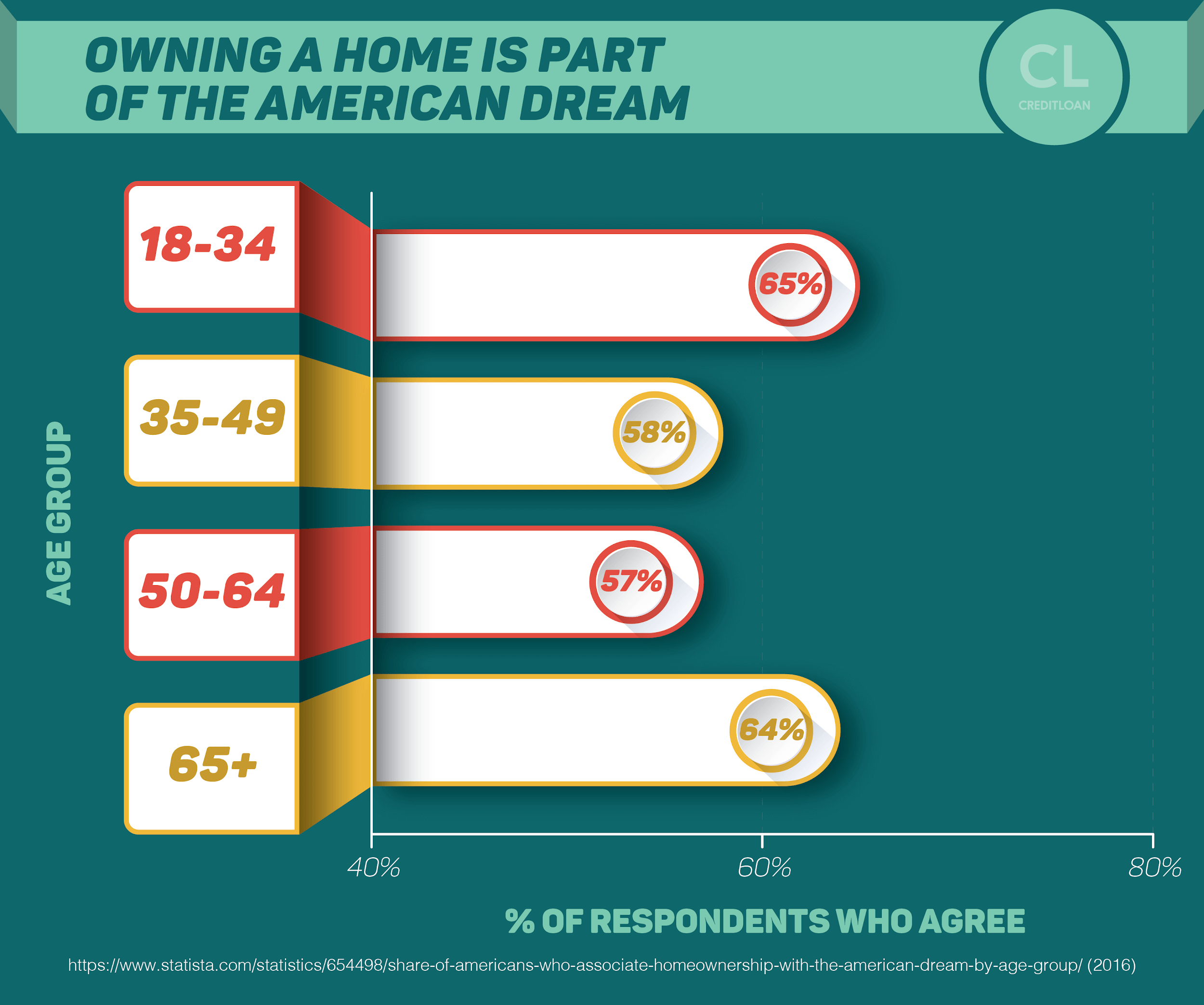

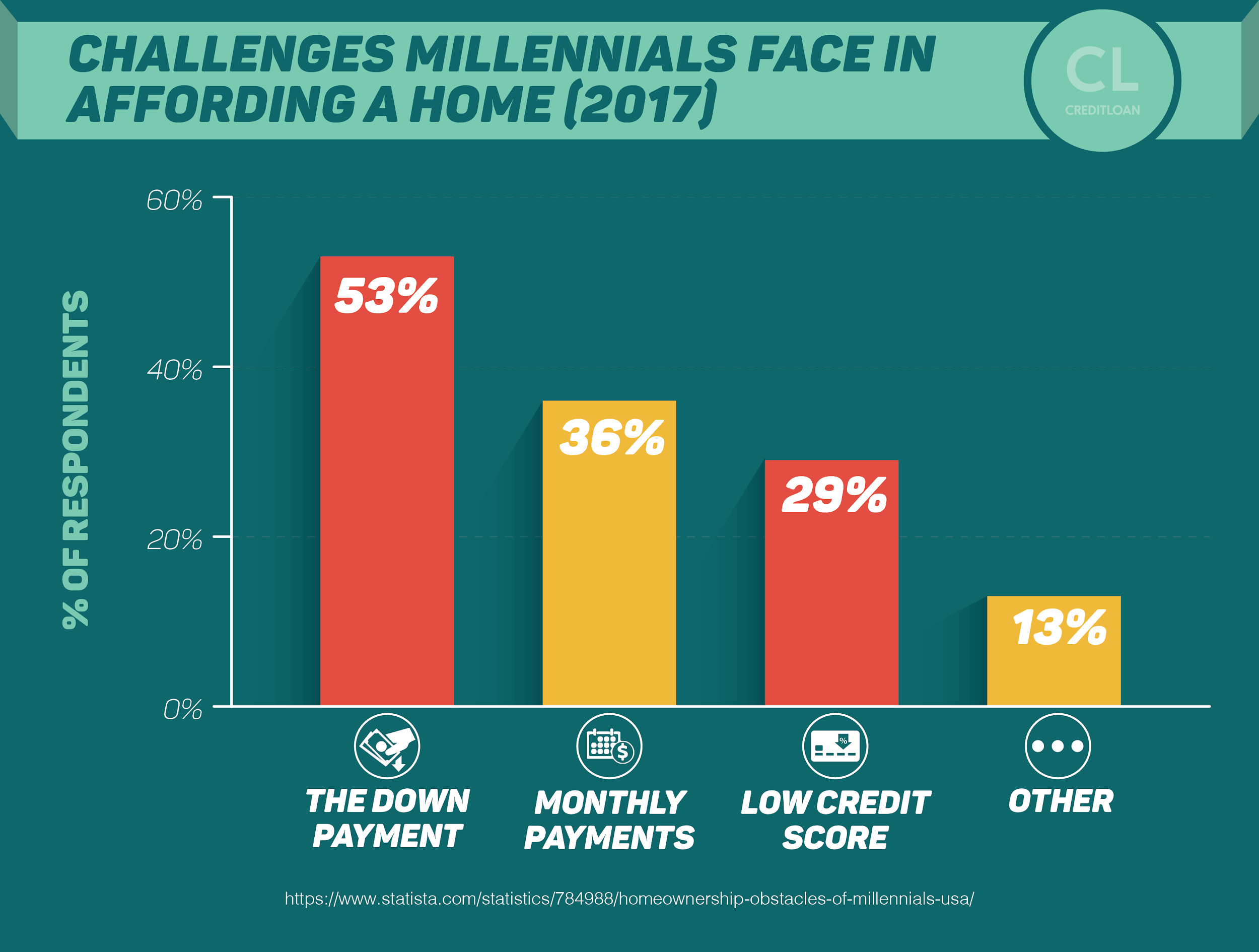

The problem is, there are more people who want to buy a home than people with the right credit to make it happen.

Subprime credit scores, sadly, are very common.

So much so, that "subprime" became the buzzword during the housing market crash in '08.

Some Americans aren't even aware if they have bad credit or not, and some don't have any credit history at all!

The majority of those looking to become homeowners will likely need to fall back on their credit history to make their dream a reality.

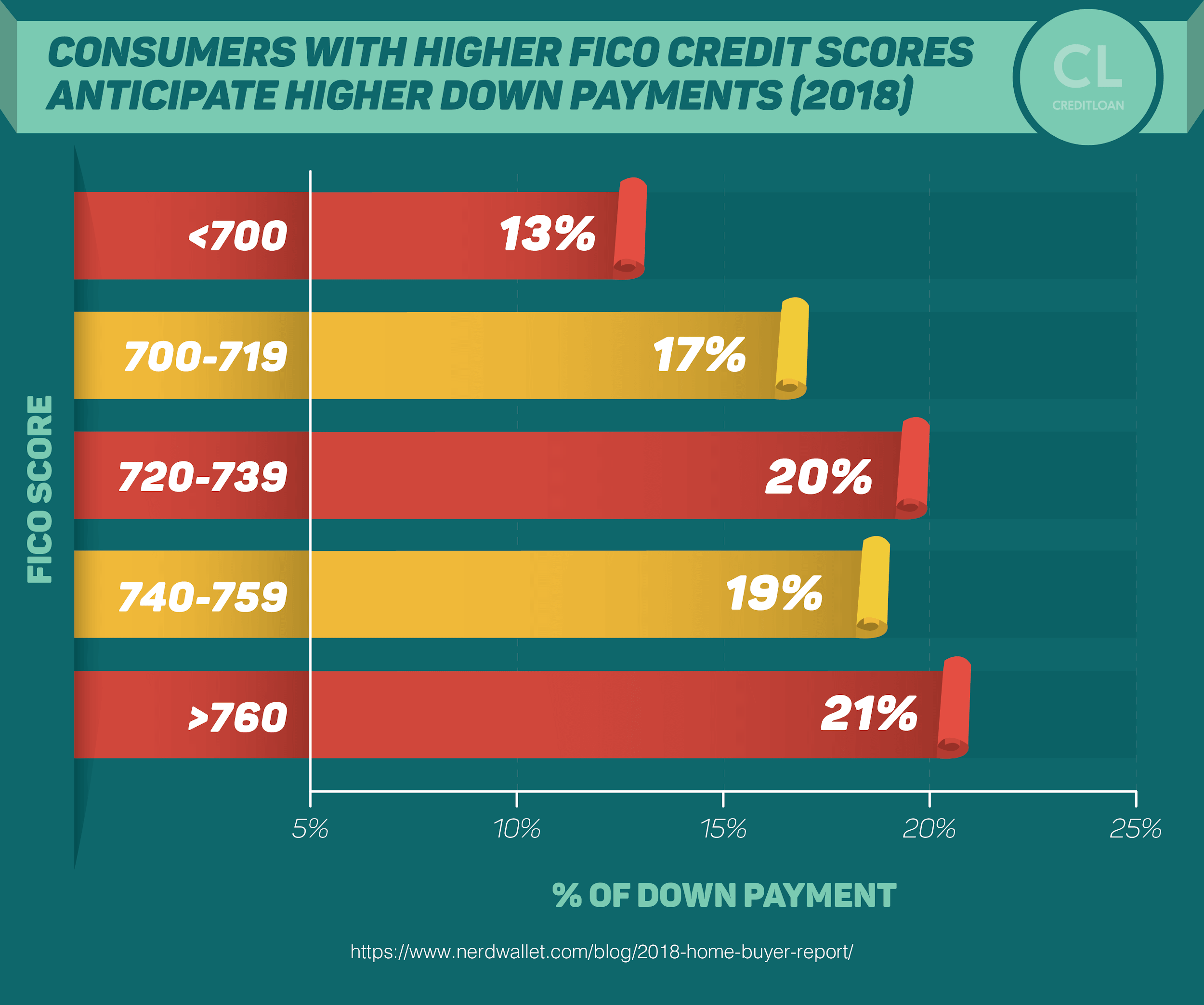

It's simple, really: The better their credit, the better their chances of realizing these goals.

Bad credit can force you to accept a less-than-desirable mortgage.

Over the course of time, this can cost you tens of thousands (or even hundreds of thousands) of dollars more in extra interest than if you had a solid credit score to fall back on.

The dream of owning a home seems to be stuck as just a dream for more and more Americans every year, and the prevalence of subprime credit isn't helping!

Buying a home is not an easy one-step process, it takes time and preparation.

And when it comes to preparing your credit for taking out a mortgage, there's no better time to get ready than the present.

The sooner you start, the easier things will be down the road.

The best advice I ever got about buying a home came from my mom, who also happens to be a realtor.

Her advice: Get your credit score in line and then begin the search.

What a lot of people don't realize is that there's a lot of things you can do to change your credit score in just a few months' time.

Even if you know you're already stuck with bad credit or if you've been turned down for a mortgage once before, the steps and advice we've laid out below can help you achieve your dream of owning a home.

If you've never done it before, now is the time to check your credit report.

It's important to make sure you're in the right shape before moving towards applying for a mortgage.

This guide will help walk you through the process step-by-step.

Understanding Credit for Homeowners

Purchasing a home isn't quite like buying a new TV or piece of furniture.

For most of us, it'll mean taking out a mortgage.

On the surface, housing loans may all look alike, but on closer look, the soon-to-be homeowner will notice that the types of mortgages can be as diverse as the kinds of homes they help purchase!

Luckily, we've compiled enough info here to guide and help you make sense of the various home loans available.

A mortgage is a home loan

The first step to understanding credit for an aspiring homeowner is learning about mortgages.

Simply put, mortgages are loans taken out to pay for homes.

You might hear them called "liens against property" or "claims on property," but it is all the same thing: a loan to buy a house.

Homes cost a lot of money, anywhere from $100,000 to a cool million.

For most of us, the only way we can become happy homeowners is by taking out a loan.

With that in mind, it's best to learn as much as possible about mortgages before taking one out.

Mortgages also have interest rates. Just like a credit card or an auto loan, you will have to pay interest on the money borrowed.

And just like a credit card, the interest paid is usually listed as the mortgage's Annual Percentage Rate (APR).

The interest can have fixed or adjustable rates (more on that below) and can vary from 3–5%, though some might have rates outside this range.

A loan's interest rate is its most important feature, so make sure you have a solid understanding of a mortgage's APR before proceeding further.

Your credit history will affect your application for a mortgage. Before you lend someone money, you want to first make sure they are good for paying that money back.

Taking out a mortgage is the same way, and to make sure you'll pay it back, lenders will want to check your credit history.

When a lender makes a pull on your credit report, any red flags cited therein might keep you from getting the mortgage you want, while a healthy credit status will likely help you score the loan you need to own your dream home.

Your credit carries a lot of weight here.

That means one of the first steps to take when planning to buy a home is to make sure your credit is good.

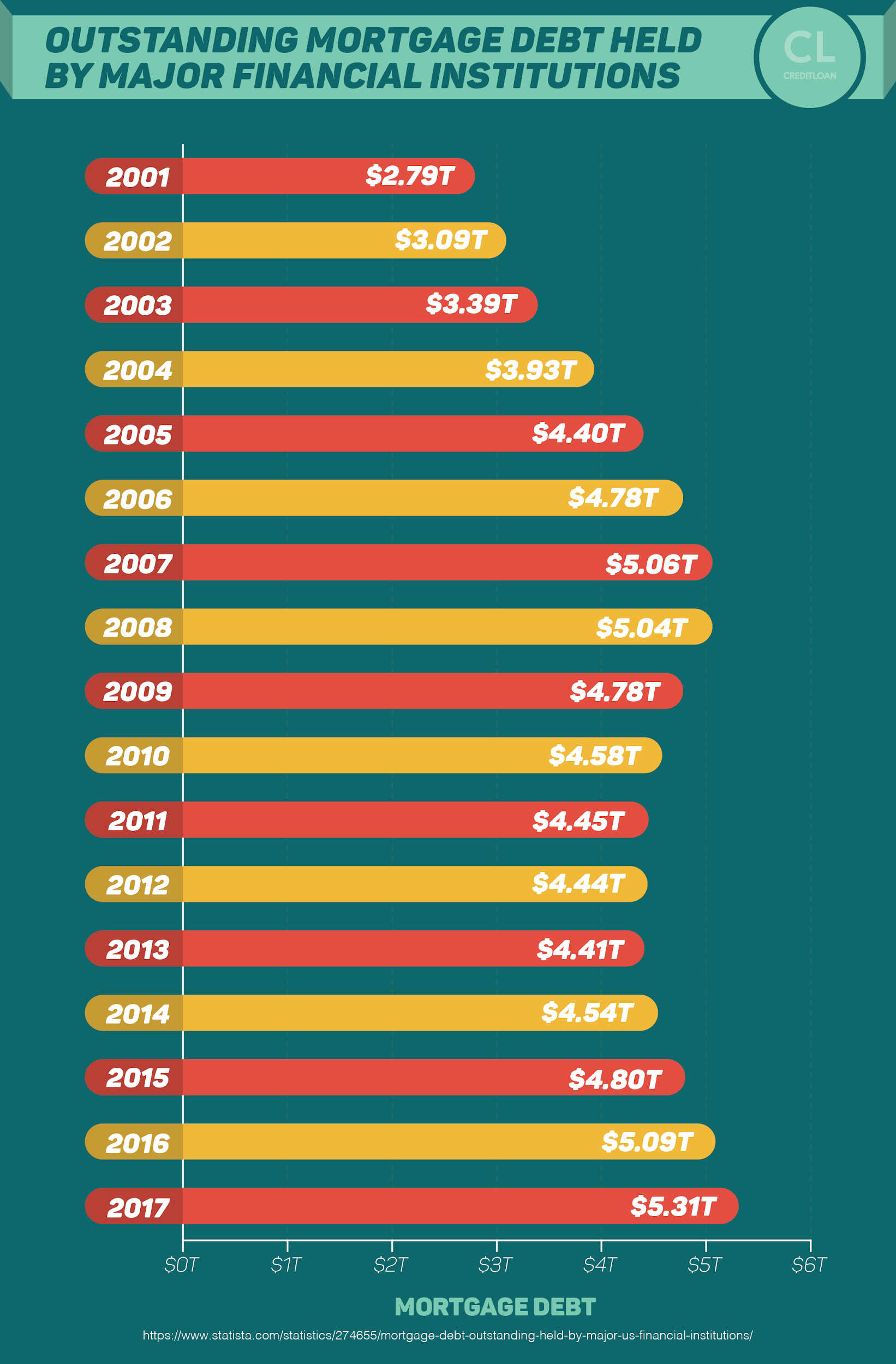

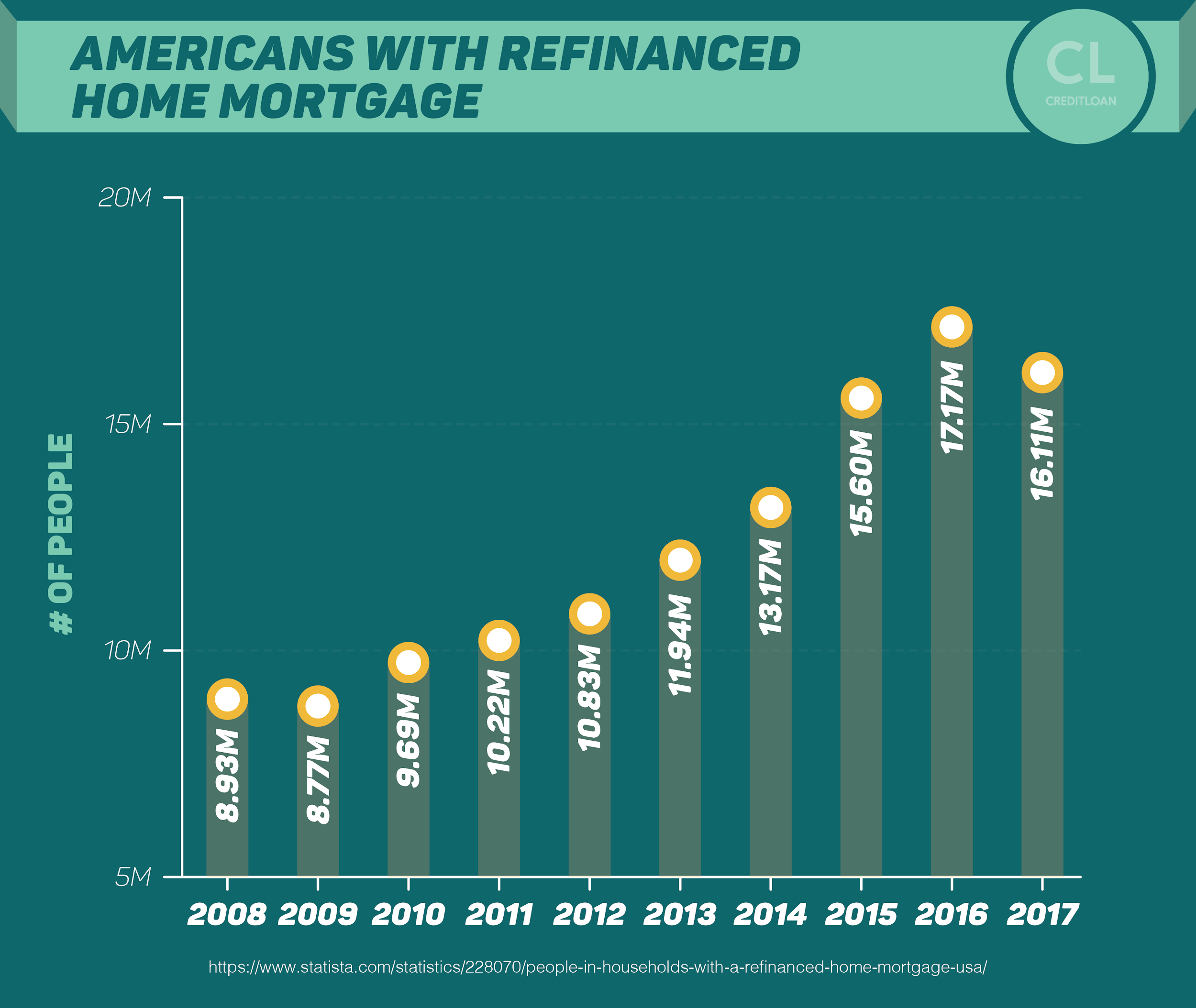

Like some loans, you can often refinance a mortgage. For those of you who got stuck in a less-than-desirable mortgage, there's good news—you usually can refinance.

If you had a 650 credit score when you went to purchase your house but have a 750 score today, your loan might be able to reflect that.

We'll go more into refinancing later, but it's important to know you don't have to stay stuck with the interest rate you had when you first took out the mortgage.

If you become delinquent, the lender may seize the home. The home is the collateral on which the mortgage is valued.

When you buy a home with a mortgage, you're putting the house up as collateral in case you fail to pay back the mortgage.

This means, if you do begin to become delinquent (fail to make payments), then the lender may have to foreclose your home after too many missed payments.

If this happens, the lender can take your house and sell it to someone else to make up for lost money!

Since we don't want this happening to any of our readers, or anyone for that matter, we put together this guide to help out new buyers!

Understanding your credit report is crucial to getting healthier credit

We all know a good mortgage is needed for a good house, and we just went over how good credit is needed for a good mortgage.

But how do you get good credit?

And what exactly is good credit?

A credit score of 750 or above is considered "Excellent." Truth be told, once you hit 750, anything beyond is mostly for bragging rights.

Excellent credit, which is often called "super prime credit," will get you the best treatment from lenders every time.

Likewise, 650–700 is considered "Fair" credit, and is probably the bare minimum needed in order to get a manageable mortgage.

Numbers below 600 are usually considered "subprime," and any mortgage you take out with a subprime score is called a subprime mortgage.

Your credit report is based on your credit history. Your credit history is recorded and analyzed by credit bureaus, particularly the three largest: Equifax, TransUnion, and Experian.

They take all of the data on how you use credit and create your credit score via an algorithm.

There are two different credit scores worth mentioning: FICO and VantageScore.

These scores are similar but the way they are calculated leaves a little difference between them.

90% of lenders rely on FICO scores when making decisions, so expect your FICO score to play an important role in your application.

The items that go into your credit score include how good you are at making payments on time, how old your lines of credit are, and what types of credit you have, (e.g., loans and credit cards).

If you want a better credit score, you need a solid credit history.

The lender will do a hard pull to see your credit report. When any lender goes to see your credit report, they will make either a soft pull or a hard pull.

Hard pulls affect your credit score but only lightly.

Expect this when applying for a mortgage.

It's what allows the lender to know if you're trustworthy or not.

Credit monitoring is the first step to healthier credit. If you want to make your credit score super-prime, you need to make sure you're actively monitoring it.

Keeping an eye on your credit will help you make sure there are no errors or mistakes dragging that number down lower than it should be.

While there are many services that do this for you for a fee, including those offered by the big three credit bureaus, you are also legally entitled to request a free look at your report from each bureau once a year.

If you aren't already in the habit of doing this, now is the time to start!

Tactics and Strategies to Prepare Your Credit

Your future home is only as good as the mortgage that buys it, and we're not just talking about the size of your house here.

The APR, the size of the loan, and whether the interest rate is adjustable or fixed can make the difference between being a happy homeowner and someone struggling to make payments.

But to get the mortgage you want, you'll need the credit that lenders like to see.

We put together a list of strategies to help get your credit in order before making that big purchase, and hopefully, applying some of the tips below will keep you from ending up with a less than ideal mortgage on a home.

Proper credit hygiene can make a difference of 100 points or more in your credit score

Just like brushing your teeth or bathing your body, your credit needs to be cleaned regularly in order to keep it healthy.

Checking your credit report, looking for and disputing errors, and making sure your credit score is as high as it can be, are all part of good credit hygiene.

A clean credit report often comes with a high credit score, and as we've pointed out, that's going to mean a good mortgage.

Monitored credit is clean credit. As we mentioned above, the first step to cleaning up your report is actually checking it.

While there are a ton of services that come with monthly fees, you can also do this for free by going to annualcreditreport.com.

From this site, you can request one free credit report from each of the big three credit bureaus per year.

Some people suggest pulling one every four months so you're getting your updates spaced out over time, but the important thing here is to make sure you're habitually checking the reports.

Dispute any errors or mistakes that show up on your report. Your credit report should only display the facts—a history of the way you really use credit.

But these reports aren't always free of smudges and errors—so actively watching out for mistakes is a must for maintaining good credit!

Go through your credit report with a fine-toothed comb and see if there are any marks that seem out of place.

Showing up delinquent on a line of credit you never took out?

It's possible that it's just a clerical error, but it can also be a sign of credit fraud.

If you catch it, you can dispute it. To dispute anything on your credit report, you can write, phone, or type to tell the credit bureau you want to dispute a claim.

While there's no set way this has to be done or written, it should be simple, clear, and specific.

If the error or fraud appears on reports from all three bureaus, you're going to have to dispute it with each bureau separately—but this can be done easily by simply copying and pasting an email!

I have successfully disputed a few errors over the years, but minimized the time it took to do this by monitoring my credit report and promptly filing the disputes.

Depending on how many errors you've successfully disputed, you may see a large leap in your credit score after the changes have taken effect.

Don't make sudden changes to your credit, because old credit is the best credit

It's not impossible or even hard to take a bad credit score and make it good.

But building up excellent credit that will last takes time and consistently good practice.

It's one thing to have shown lenders you know how to clean up your credit on short notice, but what really turns heads is consistently good credit practices.

Lenders want to see a borrower that isn't just pretending to be credit smart—they want the real deal.

it's already too late in the game to start

It takes time to build that kind of credit, but if you find yourself thinking "it's already too late in the game to start," that's the perfect reason to start now!

Take out a line of credit so you have a history. I know this one seems obvious, but there are plenty of people who have never even had a line of credit.

If you're one of those people, don't worry!

Now might be just the moment you were waiting for to apply for a card or a credit-building loan.

Closing old accounts hurts your score. Have a credit card you're not using anymore? Keep it open—the last thing you want to do is close it out.

Any accounts you have open now are providing the history that makes up your credit score.

Since you're thinking of closing it out, that means you've already paid off any balance on that account, so the only thing that line of credit is currently doing to your credit score is giving it age—and with credit, the older the better.

If you ARE adamant about closing out an account (possibly due to an annual fee or other related charges that exist regardless of balance), just try to hold off until after you have purchased your home.

Avoid >opening new accounts before buying a house. Half a year to a year before making that purchase, try not to take out any new lines of credit.

Not only does it add unwanted youth to your report, but each line you apply for will require a hard pull on your credit report.

When lenders make hard pulls, it will ding your credit a bit.

Open up enough new cards in a short time, and lenders will see this as a red flag.

If you're new to credit entirely, this doesn't mean you shouldn't ever open up a line of credit—you just need to wait a little longer for that line of credit to become a solid credit history.

Avoid new expenses. This one is probably the hardest for new homeowners to follow.

You just got all that counter space that you never had when living in your cramped apartment downtown—now you have to leave it bare?

Just like buying a house took time, filling it up should too, especially considering you probably just paid a couple hundred thousand for this new space.

This is especially important for those who might want to refinance down the line.

Refinancing only makes sense if your credit score is going to net you a better APR.

But the only way that's happening is if you continue working on that credit report, even after purchasing that home.

Going on a new homeowner's shopping spree is the exact opposite of what you want to do at this time.

Once you have the bare essentials, let that credit rest a little.

Your wallet will thank you down the line!

When I was purchasing my first home, I was young and impulsive and couldn't wait to drop a new leather sofa and a giant TV in the living room.

But then I began to get serious about managing my finances, including the mortgage I just took out.

I paid what was a good price for a house at that time, but when I began to calculate the interest that would be owed over the life of the loan, I realized I was ultimately paying more than I wanted or had to.

After that, I began to make refinancing my mortgage a serious goal.

My score was 680 when I applied for the mortgage—not a bad score, but I knew I wasn't receiving the treatment from lenders that I wanted.

So instead of maxing out my cards just to match the living space I just purchased, I kept a healthy, careful balance and slowly built up my credit report.

When I went to refinance my mortgage, I was able to save hundreds of dollars on payments.

Because of my thrifty patience, not only was I able to eventually get the sofa and TV I wanted, I ended up refinancing with money I had saved rather than money I had borrowed!

Sometimes, patience really is the key!

Using credit wisely is the only way to build healthy credit

Unfortunately for those looking for some quick hacks to boosting credit overnight, while there are tips and tricks, the real path to healthy credit lies in making sure you use your credit well.

Only utilize 10–30% of your credit. Credit utilization is one of the biggest factors in figuring out your credit score.

While you're expected to use the entirety of your mortgage, your credit card should be handled a little differently.

When using a credit card, make sure you aren't maxing them out monthly and that you're making your monthly payments on time, and ideally in full.

Otherwise, this will pull your credit score down quite a bit.

Lenders like to see responsible credit usage, and that means a monthly balance that stays around 15–20% of your total credit limit.

The best way to do this is to put small weekly expenses on your card, depending on your credit limit, and paying that balance off in full at the end of the month.

That will keep utilization down and payments on time. Speaking of…

Pay off your balances in full. To the impulse shoppers and those with hot credit cards, getting serious about buying a home requires patience.

And sometimes that means being careful about how often you use your credit card.

The best practice is to make sure you're making purchases on your credit card you know you can pay back when the month is over.

It takes a little math, but you should treat your credit card like a debit card that you have to remember to pay back.

That means making sure you have the cash before making the purchase.

The only way to do this with 100% certainty is to budget, but if you're going to get into the business of owning a home, making budgets might soon become your new favorite hobby!

At least a year to half a year before purchasing your home, try not to buy luxury items with your card, instead, use your plastic for grocery shopping or putting gas in the car—expenses that you're going to have to pay anyway.

This way, when the month ends, your credit card bill will carry no surprises, and you should be able to pay off your balance in full.

While it all might sound like a hassle, it's the foolproof method to staying out of debt and building good credit.

Plus, it gets easier after a while once it becomes a habit.

The Lenders, Terms, and Lines of Credit

Technically speaking, a mortgage is a loan to be used for buying a house.

That means anyone can be a lender, but there's a big difference between getting your mortgage from a bank and getting it from your cousin.

Know who you're borrowing from

Mortgages come in all shapes and sizes, with different payment plans, terms, and lenders.

This is the big leagues of borrowed money, so you shouldn't go into it without knowing what it is exactly you'll be looking at.

Direct/retail lenders lend the money directly to borrowers. That makes this type of lending the simplest to understand: lenders are lending the borrowers money directly, with no middleman.

Plenty of banks and similar financial institutions offer this type of lending, although some banks will offer both retail and wholesale mortgages (see below).

Because lenders are lending directly, they set the terms and all payments are made directly to them unless something should happen to the loan itself.

A wholesale mortgage is provided through a third-party agent. A common example of this would be a large bank offering its mortgages through a credit union or mortgage broker (more below).

Usually the third-party collects a fee for referring borrowers to these lenders.

Wholesale mortgages ensure that you have a higher chance of hearing about a particular bank's particular mortgages through third-party referrals.

They are called wholesale because, just like in a marketplace, a middleman acts as an agent in the application and the money is being supplied centrally by a bank or other financial institution that employs the middleman.

The most common mortgage in the U.S. is provided by a mortgage banker. These lenders, also known as brokers, work on behalf of banks to loan money out to people who will repay their loans.

They then sell the mortgages they make to investors through Fannie Mae or Freddie Mac.

The benefits of taking out a loan from a mortgage banker are time saved, price, and availability.

Mortgage brokers are very common, so finding one that suits your needs is easy.

They are also efficient, so you don't have to waste time shopping around for options.

Most importantly, mortgage bankers are more likely to be able to get you a competitive interest rate and an affordable monthly payment.

Portfolio lenders and hard-money lenders are an option for unique cases. Both portfolio lenders and hard money lenders lend money from their own pockets.

Since they do not have to satisfy investors, they are free to choose whom they lend to.

This means if you have a unique situation, like having bad credit but a good stream of finances, perhaps choosing to get your mortgage through a portfolio lender or a hard money lender can be ideal for you.

However, this option is not good for everyone.

These lenders often want high-interest rates, high down payments, and short-term loans.

The freedom on the lender's end can be abused if borrowers aren't savvy.

Mortgages come with different interest terms, and the wrong terms can cost you more

If I told you I was going to give you a ton of money to buy a house, you just have to pay me back later, you'd expect there to be a catch, right?

You're right to be suspicious, you should always have as many questions as you can ask when you go in to apply for a mortgage.

While interest might come with every loan, just how that interest works, and any other terms that go along with it, will vary from mortgage to mortgage.

So make sure you take time to read the fine print, and understand your mortgage and what you get with it before agreeing to anything.

Fixed-rate and adjustable-rate repayment feature different interest rates. A fixed-rate mortgage loan is exactly what it sounds like: it has the same interest rate for the whole life of the loan.

An adjustable-rate mortgage, on the other hand, changes over the life of the loan.

There are pros and cons to both.

A fixed-rate mortgage stays at the same rate and will never change, just like your monthly payment.

If you already have a steady job with a steady income, a fixed-rate may be better for you due to stability.

If you'd like, you can usually still refinance for a better rate.

An adjustable-rate mortgage loan will change over time, typically every year.

Adjustable-rate mortgages normally start at a lower rate than the fixed-rate ones, but they're designed to increase rates over time.

If you are at the start of your career and can't afford big payments yet, this may be the better choice.

Mortgages can be conventional mortgage or government-insured. A government-insured loan is, of course, a mortgage insured by the government, whereas a conventional mortgage simply isn't.

The former is ideal for those worried about defaulting on their loan.

There are three types of government-insured loans: FHA, VA, and USDA.

The first, FHA, is insured by the Federal Housing Administration and is available to all homebuyers.

The other two, VA and USDA, are only available to specific borrowers.

If you were a member of the military or if a family member was, you may be eligible for a government-insured mortgage from the U.S. Department of Veteran Affairs, also known as a VA loan.

This program offers zero down payment for those who qualify, so it is worth looking into!

The last is a mortgage insured by the United States Department of Agriculture.

This option is only available to those who live in rural areas.

The other name for this loan type is RHS, which stands for Rural Housing Service.

If you are considering living in a rural area, you should check if you qualify.

If you are concerned about defaulting in the future, then a government-insured mortgage may be best for you.

You will have to pay the monthly cost of insurance, but if you are looking for a safety net, that insurance provides it.

A line of credit is another option for someone who isn't looking for a term-loan

A mortgage acts like a traditional loan, but those who are already homeowners and would like to borrower more money have the option to use their home as collateral and take out a line of credit on it.

Want a second mortgage?—consider a home equity line of credit (HELOC). Rather than a traditional mortgage, a line of credit acts sort of like a credit card where your home is the collateral.

Typically, you can take out as much as 85% of your home's value.

To qualify, you have to owe less on your mortgage than what your house is worth.

In other words, you need to have equity in your home in order to qualify.

A HELOC is a great option for a second mortgage or if you need to take out a loan for home improvement.

Advanced Strategies

Not every homeowner has the same situation, and some of us will have to work a little harder to put up four walls and a roof, but luckily we've compiled some other tips and tricks that might be of help.

Even if you have bad credit, there are still ways to make a home a reality.Don't let bad credit stop you from owning your own home.

It may take a little extra work, but you can make it work.

For many with bad credit, a subprime mortgage with a high-interest rate was the only answer.

If a high-interest rate makes you nervous, don't worry!

If you save up some cash and come in with a higher down payment, you could reduce your interest rate or monthly payment.

Another option would be a government-insured loan like an FHA, VA, or USDA.

If you qualify, you could have a lower down payment and then use that money for building up your credit score through monthly payments on the mortgage.

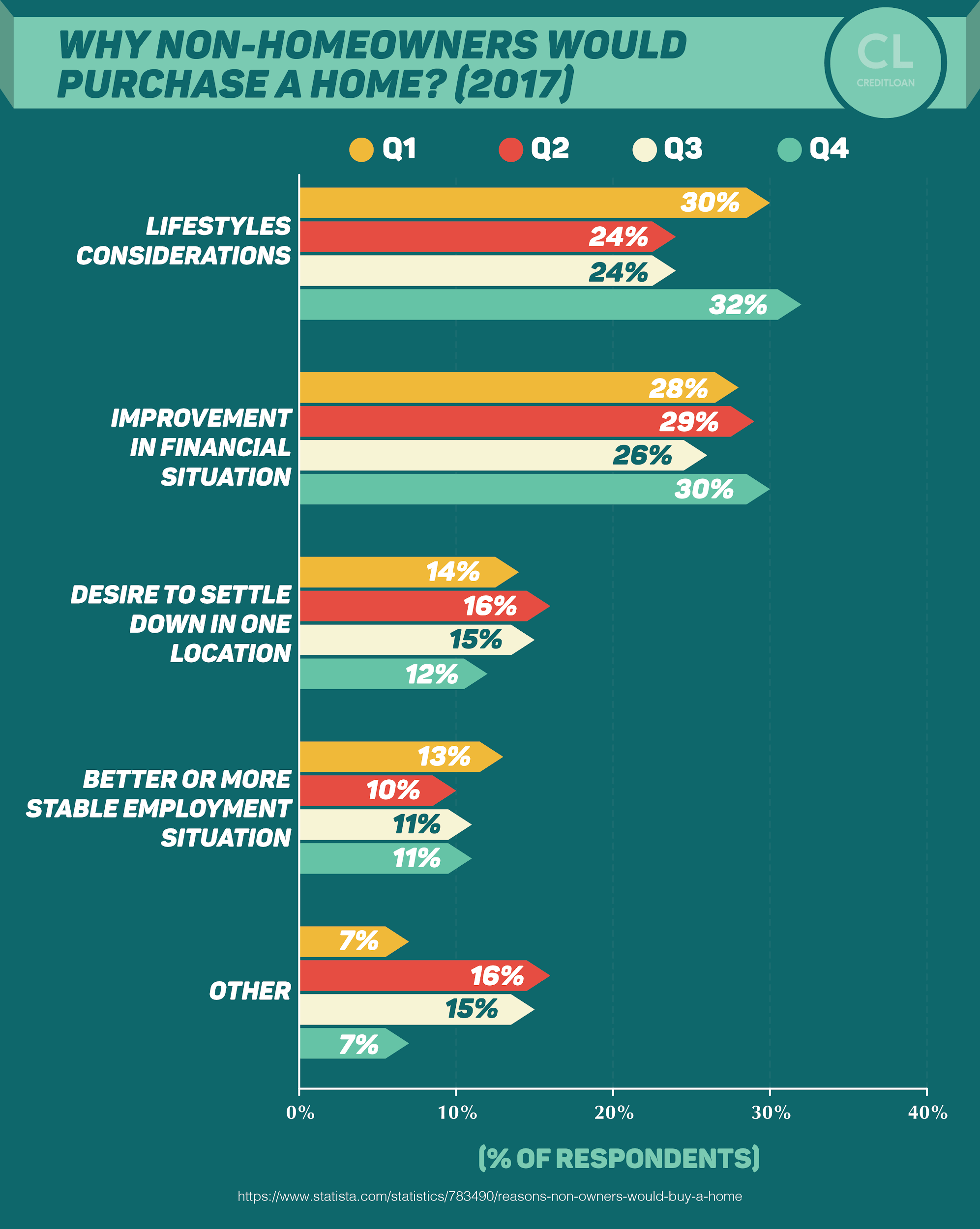

If you're able to, another option would be to wait.

You can work on improving your credit score until the time is ideal for you to take out a mortgage.

Though waiting can be hard, in the long-run it can be worth the lower interest rate or lower monthly payment you can end up with.

If your score is better than when you first applied, time to refinance. Refinancing your mortgage loan is a good idea to keep in mind a few years after you have taken out the initial loan, especially if your credit and financial situation has changed for the better.

Refinancing may allow you to negotiate for a better interest rate or to change your monthly payment.

A lower interest rate on a mortgage can save a few hundred dollars a year, and that money saved could go back into paying off the mortgage quicker, saving even more money!

To refinance, you can contact your mortgage company or other mortgage companies to see what options are available to you.

It is important to remember that refinancing is not free, so if the additional fees it takes to refinance are greater than the amount you would save, then it may not be worth it.

Spot the signs of a predatory loan, and then walk away. A predatory loan is one that places unfair terms on a borrower.

These loans can make it nearly impossible for a person to get out of debt.

Predatory lending can include failing to properly disclose all the information of the loan.

This means you have to pay more later down the line, which will cause unnecessary hardship.

This includes hidden fees in the fine print, which is also a tactic of predatory loans.

Even though your credit score does impact your interest rate, it is important to know when the interest rate is too high for your credit score.

Even if you have bad credit, do not agree to a mortgage loan if the interest rate is higher than you can afford.

If you are refinancing your house, watch out for "balloon mortgages."

These will appear to have a low-interest rate at first but then will grow to be huge in the long term.

Be smart when refinancing and know what to expect. Be sure to ask your lender plenty of questions so you get the rate and terms that suit you.

You can protect yourself by making sure you take a mortgage out with an officially licensed broker and don't let anyone rush you into signing anything.

Make sure you read all the fine print before signing onto a mortgage.

Your mortgage may actually help you improve your credit score. When you first take out a mortgage, your credit will decrease, but this is only temporary.

By making regular payments to your mortgage, you can slowly, but surely, build up your credit score.

Owning a home is considered installment debt.

Like a student loan or a car loan, it is a sum of money that has been taken out at one time and paid off over time.

It affects your credit score differently than the revolving debt of a credit card.

By having different types of debt and repaying them all consistently, you will improve your credit, as this shows that you are a responsible borrower.

Manual underwriting takes longer but may allow for wiggle room. When being approved for any loan, you will need an underwriter for the money being lent.

Underwriting is the verification by an agent on the lender's behalf that the borrower is financially able to pay back the loan.

During the underwriting process, you have two options: automatic or manual underwriting.

Automatic underwriting is faster and convenient, but sometimes taking the slower route is better.

Manual underwriting means that your case goes to a real person for review.

Automatic underwriting is simple and easy, just punch the info and documents into the computer and let it work its magic.

The downside to this is that a computer thinks in ones and zeros, there's no grey area when it comes to getting approved and deciding favorably for your mortgage.

If you have the time and patience, manually underwriting your loan will allow you to actually meet with a person and present your case and all your supporting information in a personal manner.

Underwriters can be more open-minded when looking at the whole case.

This means you could get approved by viewing your situation overall, rather than get rejected over just one trivial aspect of your case.

There's no guarantee this will get you the loan you're looking for, but you'll have a little more involvement in the process, and if you play your cards right, you can possibly direct the situation in your favor.

Getting your dream home starts with getting your dream mortgage

But not everyone understands what that looks like.

It takes time to know and understand the difference between the various types of loans—and the lenders that offer them—and getting your credit where you want it to be when applying for that loan.

By practicing good credit hygiene and checking your credit report carefully, you can get the treatment you're looking for from lenders.

Good credit means good loans, and that translates to good home-ownership.

Knowing the difference between the types of lenders you're borrowing from will allow you to make the right decisions when applying for a mortgage.

Not all loans are made equal, but if you know what it is you're looking for, you can shop around for terms that fit your particular situation.

If your credit has improved since you first took out a mortgage, you should make sure your APR reflects your current credit report.

Refinancing allows you to continue with the loan you wanted to take out originally, but with a better APR and terms that are more in your favor.

Just check the fees first.

Hopefully, this guide will help you take the next steps toward buying a home, saving you money and making your transition into a homeowner easy and comfortable.

See anything we missed?

Perhaps some tips or tricks about mortgages that we forgot to mention?

Let us know in the comments below!