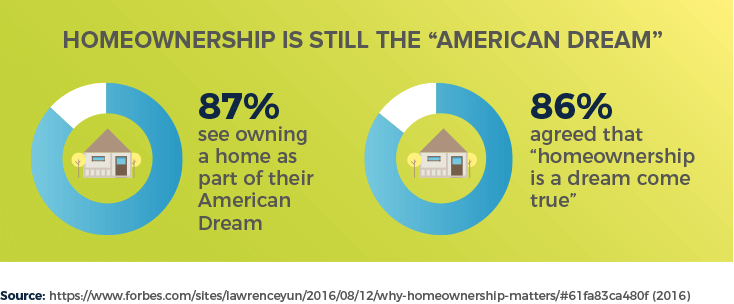

Owning your own home remains a quintessential part of the American dream. But it can also feel out of reach, especially for borrowers with bad credit

You might think anyone with a credit score under 680 shouldn't even bother applying for a mortgage.

But home loans are out there, even for borrowers without credit—if you're willing to shop around and take the steps necessary to improve your credit.

Plus, your situation may not be as bad as you think.

What is "bad" credit according to banks?

Brian Eachus, a branch manager at Ohio-based Supreme Lending, says his firm considers borrowers with scores as low as 580—but all lenders are different.

Borrowers with a score of 640 are typically considered "fair" risk.

For a prospective borrower on the border of bad and fair credit, Eachus says a few tweaks can help.

"We'll start the process and encourage consumers to correct their credit, whether that means paying off credit cards or fixing mistakes," he says.

If that's you, that means it's time to set a pay-down plan in motion—either go hard-core on payments for the card charging you the highest interest rate while paying the minimum amount on others, then move onto the next one (the "snowball effect"), or pay off the lowest balance first (keeping up with those same minimum payments on others) until you whittle 'em all down to zero.

Indeed, the path to homeownership is "a journey," says Don Giorgio, president of United Northern Mortgage Bankers, Ltd. in Levittown, New York.

He suggests prospective borrowers first understand the factors that go into their credit score and then work with a lender who will take a consultative approach to getting them into a home.

"Credit is a moving target," says Giorgio. "Every credit situation is a moment in time and can always be improved upon."

Once you've done everything you can to raise your score, follow these tips—straight from bankers' mouths—to further improve your chances of getting that loan:

1. "When in doubt, go the FHA route."

If you want to buy a home, most of your number crunching probably involves figuring out how much of a down payment you can come up with–in fact, every other part of the home-buying process hinges on it.

Beyond credit score, though, saving up a sizable down payment is often one of the biggest obstacles for buying a home.

Think about it: To put down the traditionally recommended 20 percent on a $200,000 home, you'd have to squirrel away $40,000, which can take years to do.

That's where the FHA (Federal Housing Administration) program comes in.

It provides mortgage insurance on loans made by FHA-approved lenders throughout the United States, and therefore, buyers get to enjoy more lenient lending requirements, one of which is having to put as little as 3.5 percent down.

This can help you maintain cash reserves, which can be a factor in qualifying for a mortgage with poor credit.

Being able to show that you have an accessible emergency fund–something that's difficult to do if you deplete all of your savings to use as a down payment–can be reassuring to banks.

"We'll consider the amount of cash on hand when we look at whether or not a borrower is a good risk," says Eachus.

2. "You're more than just your FICO credit score— learn to play up your strengths."

If your credit score is low, you might be feeling that all is not lost.

On the contrary, it's only one of the factors that banks consider–they are most concerned with your ability to pay back the loan.

To determine if you'll be able to do that, every loan application goes through an automated underwriting process, which assesses your risk based on various criteria; your FICO score is just one of them.

"A number of what we call ‘compensating factors' can help you get approved even with a low credit score," explains Eachus.

For example, banks favor applicants who have manageable debt-to-income ratios—in other words, that your earnings will allow you to comfortably manage your monthly debt.

If you have investments, a healthy income, and a strong employment history, those attributes work in your favor, too, he adds.

3. "Don't take no for an answer–we'll let you plead your case"

If you want to make your home buying dream come true, you may have to make your case.

Beyond the automated process, you may have a chance to provide an explanation for your low credit score.

"There should be a common sense eye evaluating the loan from a manual perspective," says Giorgio.

"That underwriter should be able to understand what happened to the borrower when their financial circumstances changed—whether that was unexpected medical bills or a messy divorce—and the point when the client started moving toward a better place."

To help the lender understand your specific circumstances, document your financial situation and be prepared to show evidence that you will be able to pay your mortgage.

Even the FTC encourages you to speak up for yourself, "If your credit report contains negative information that is accurate, but there are good reasons for trusting you to repay a loan, be sure to explain your situation to the lender or broker."

When documented in written form, this is commonly referred to as—appropriately enough—a "letter of explanation."

Rule of thumb: Be as specific and as thorough as possible. (Visit MyFico for some samples to get you started.)

4. "Show us the money, and improve your application."

You want to do everything in your power to bolster your chances of getting approved for a mortgage.

As they say, money talks, especially in the form of a hefty down payment. The higher the amount, the less risky you are to lenders.

Back before the housing bubble—and subsequent crash—20 percent down would get you a no-income-check, no-credit-check loan.

Today, the best it will do is encourage lenders to overlook a low credit score.

You'll still need to show proof of income and undergo a credit check, but a good chunk of change can loosen up the restrictions.

"The more you put down, the lower your monthly mortgage payment and debt-to-income ratios are going to be," says Giorgio.

"That might give an underwriter consideration to approve that loan." (Play around with mortgage calculators to figure out what your down payment, mortgage term, and interest rate will look like.)

Talk with your prospective lenders to ask if you'd be better off putting your saved money toward the house, or holding it in the bank to show cash reserves.

5. "Maintain a squeaky-clean credit and payment profile."

It would be a shame if you went through all of the hard work of home buying just to let a money mistake (or two) trip you up.

Eachus says it's standard for most lenders to look at a borrower's payment history, even for items that aren't reported to the credit agencies, like rent and utilities.

"We'll ask for 12 months of canceled checks to show on-time rent or mortgage payments, or we'll call the landlord for verification."

Most banks will provide you with a handy-dandy checklist to get you started, like this comprehensive chart from Chase Bank:

Must-have items to get ready to apply for a mortgage

- Copies of pay stubs for each applicant (minimum of 30 days of income); if self-employed, year-to-date profit and loss statement, plus signed returns for last two years

- Names/addresses of employers and W2s for two years

- One to two years of tax returns

- A completed and signed Form 4506-T or 4506T-EZ (provided by your mortgage banker)

- Bank statements for two to three months

- Proof of pension income, Social Security, and/or disability payments, if applicable

- Dividend earnings

- Bonuses

- Child support or alimony payments (optional disclosure)

- A copy of earnest money deposit

- Information on other debts (car loans, student loans, credit cards)

- Security accounts (stocks, bonds, life insurance)

6. "Be a smart consumer, and get a better deal."

Having a thick skin and determination can help you get better home loan terms–so don't jump at the first offer.

Although a mortgage loan application will count as a "hard inquiry" on your credit report—which can temporarily reduce your score by a few points—if all those "shopping around" inquiries are made in a short time span, it is counted as a single inquiry.

In other words, comparison-shopping is highly encouraged.

Don't be like the 50 percent of mortgage applicants who don't shop around—you may miss out on the best deal for you since lenders use different criteria to qualify their applicants.

If you're in the midst of the process and keep getting rejections, consider putting your home ownership dreams on hold while you work on improving your credit.

"If someone's score is less than 580, we may help them explore ways they can increase their credit score and tell them we will re-visit the loan application in two or three months," says Eachus.

Home ownership is a dream worth pursuing even with "bad" credit

If you feel you're ready to buy a home, don't be discouraged just because you may have a "bad" credit score.

Home buying is not just for those with impeccable scores.

Yes, everyone needs to take steps to ensure their credit score is as high as possible.

But even with a relatively "bad" score, an aspiring homeowner still has options to explore.

By doing your research, and paying heed to advice from bankers, you can find the lender and mortgage program that fits best with your particular situation.