The home buying process consists of several steps that begins with something as simple as checking your credit, and ends with signing a mortgage and moving into a new home. Consumers should do due diligence and be aware of their rights when it comes to mortgage-shopping, and should utilize home-buying checklists to prioritize the amenities and features of the home they'd like to purchase.

Steps in the Homebuying Process

- The U.S. Department of Housing and Urban Development lists the proper steps to take when considering purchasing a home, from figuring out how much is affordable to knowing your rights

- Discover's "Ten Steps to Buying a Home" for consumers who are wanting to finance a home loan on a new house

- Home.co.UK: A home buying introduction complete with 13 steps from beginning to end

- Foxton's step-by-step guide to purchasing property

- Housing NSW Family & Community Services: Steps to buying a home, including the Homebuyer's checklist and the A-Z's of Homebuying

- MarketPlace: introduces the best Homebuying and Real Estate Apps on the market

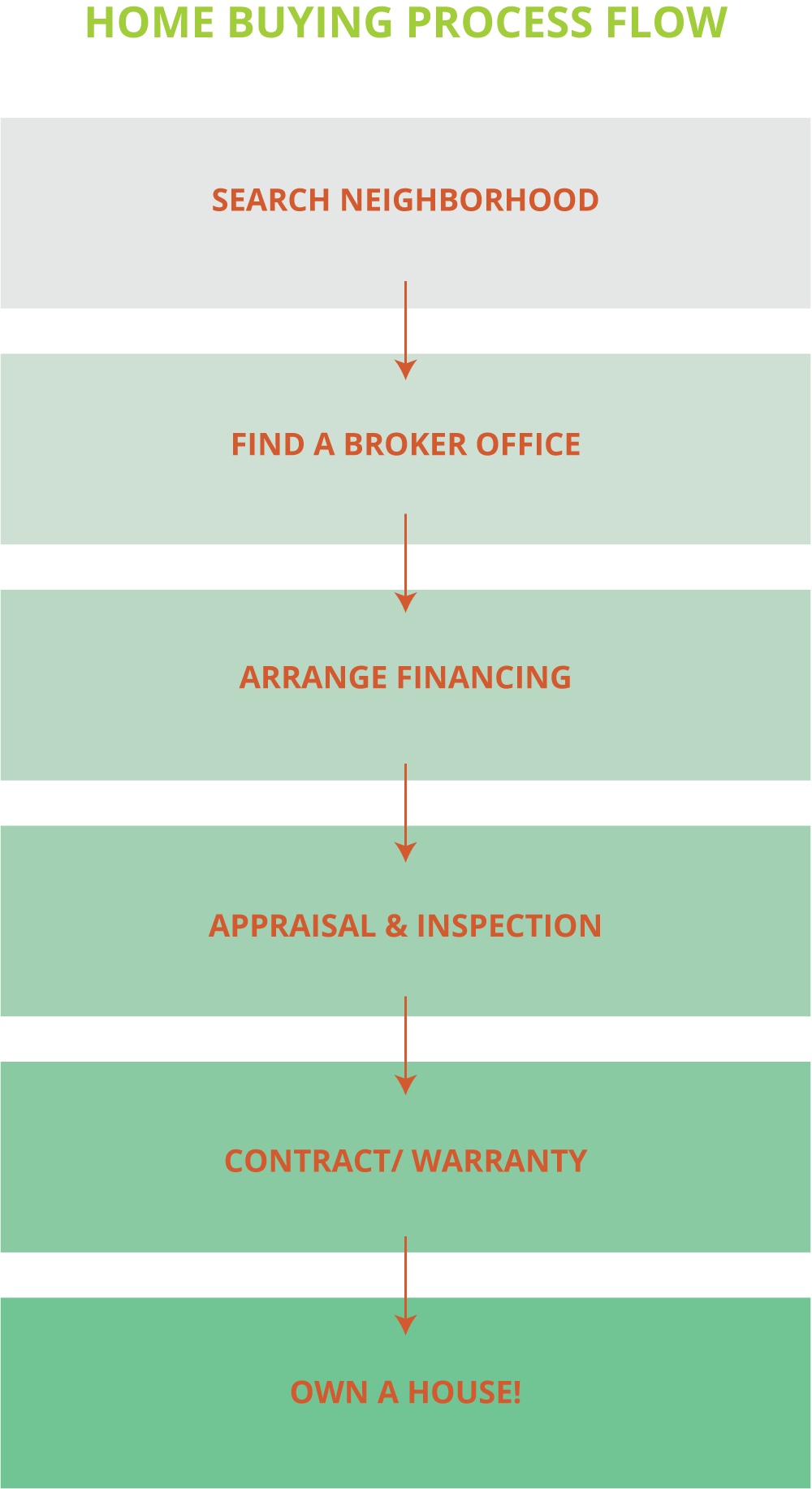

- Vermont Federal Credit Union: simplifies the Home Buying Process with a flow chart

- FindLaw.com's Home Buying cheat-sheet includes checklists and contingencies to consider

- Coldwell Banker shares its home buying process tips for families looking to purchase their first house

- Bank of Montreal offers alternative home buying steps to consider, such as checking out the neighborhood before making an offer

- Fonville Morisy Realty advertises that their goal is to reduce the stress of home buying with an easy-to-follow version of the home buying process

- The Council of Mortgage Lenders provides information on how to purchase a home in England or Wales

Homebuying programs (in your state)

The U.S. Department of Housing & Urban Development has a section for local home buying programs sponsored by state or local governments.

Know your rights

- Real Estate Settlement Procedures Act: this policy is responsible for making sure U.S. consumers are given all necessary information with regards to mortgage settlements

- Under regulations upheld by the U.S. Department of Housing and Urban Development, mortgage borrowers have the right to certain things, such as shopping for the best loan, be informed of the entire cost of the loan, ask for a Good Faith Estimate, and to know how much the mortgage broker is getting paid

- HomeLoan Learning Center's "Borrowers Bill of Rights": developed by the Mortgage Banker's Association and upheld to protect the rights of mortgage and home loan borrowers

- Better Business Bureau's article titled, "Your Rights as a Borrower"

- The Nest presents Borrower's Rights, including Foreclosure rights, Truth in Lending, and the Real Estate Settlement Procedures Act

Shop for a loan

- Mortgage News Daily differentiates between Pre-approvals versus Pre-qualifications, two different but often confused terms for home loans

- Forbes article titled, "A Look Behind the Curtain: How to Choose a Mortgage Lender"

- Single Family FHA Insured Mortgage Programs

- Interest Only Loans versus Adjustable Rate Mortgages: which is better for you?

- HUD cautions to avoid Predatory Lenders with these tips

Shop for a home

Average Time Spent to Build Privately Owned One-unit Residential Buildings

Purpose of Construction

| Year | Average # of Months Required to Build | Average # of Months Required for Contractors | Average # of Months Required for Owners |

|---|---|---|---|

| 2000 | 5.6 | 6.5 | 9.2 |

| 2001 | 5.6 | 7.0 | 9.2 |

| 2002 | 5.5 | 6.6 | 9.6 |

| 2003 | 5.5 | 6.8 | 9.9 |

| 2004 | 5.7 | 7.0 | 9.1 |

| 2005 | 5.9 | 7.6 | 9.8 |

| 2006 | 6.3 | 7.8 | 10.7 |

| 2007 | 6.5 | 7.9 | 10.2 |

| 2008 | 6.8 | 8.5 | 11.1 |

| 2009 | 6.9 | 8.7 | 11.9 |

| Source: United States Census Bureau, Statistical Abstract of the United States: 2012 | |||

New Manufactured Homes for Residential Use & Their Sales Price

2000 to 2010

| Year | Average Sales Price (Dollars) | Units Placed (In Thousands) |

|---|---|---|

| 2000 | 46,400 | 280.9 |

| 2001 | 48,900 | 196.2 |

| 2002 | 51,300 | 174.3 |

| 2003 | 54,900 | 139.8 |

| 2004 | 58,200 | 124.4 |

| 2005 | 62,600 | 122.9 |

| 2006 | 64,300 | 112.4 |

| 2007 | 65,400 | 94.8 |

| 2008 | 64,700 | 79.3 |

| 2009 | 63,100 | 52.5 |

| 2010 | 62,700 | 49.5 |

| Source: United States Census Bureau, Statistical Abstract of the United States: 2012 | ||

Number of New Privately Owned One-family Houses Sold

1980 to 2010

| Year | Units Sold (in Thousands) |

|---|---|

| 1980 | 545.00 |

| 1985 | 688.00 |

| 1990 | 534.00 |

| 1995 | 667.00 |

| 2000 | 877.00 |

| 2003 | 1,086.00 |

| 2004 | 1,203.00 |

| 2005 | 1,283.00 |

| 2006 | 1,051.00 |

| 2007 | 776.00 |

| 2008 | 485.00 |

| 2009 | 375.00 |

| 2010 | 321.00 |

| Source: United States Census Bureau, Statistical Abstract of the United States: 2012 | |

Once you figure out what features you want, such as how many bedrooms, what amenities, etc. it's time to start looking for homes for sale.

- The HUD advertises single-family as well as multiple-family homes for sale

- Century 21 details how to shop for a home, including tracking properties that have been seen and keeping a spreadsheet of the attractive features of each

- RealEstate.com includes things that should be included on a home-buying checklist, such as storage space, age of water heater and furnace, and which appliances are included in the sale

- ForSaleByOwner.com offers a printable checklist for areas that might be important to you, such as proximity to school or work, number of stories, wood versus brick and estimated utility bills, among many others

- Search engine Zillow allows consumers to search homes for sale within their area

Make an offer

Existing Apartment, Condos and Co-ops Mediam Sales Price

2000 to 2010

| Year | Median Sales Price (Dollars) | Units Sold (In Thousands) |

|---|---|---|

| 2000 | 86,900 | 272 |

| 2001 | 89,000 | 333 |

| 2002 | 114,000 | 571 |

| 2003 | 168,500 | 732 |

| 2004 | 197,100 | 820 |

| 2005 | 223,900 | 896 |

| 2006 | 221,900 | 801 |

| 2007 | 226,300 | 713 |

| 2008 | 209,800 | 563 |

| 2009 | 175,600 | 590 |

| 2010 | 171,700 | 599 |

| Source: United States Census Bureau, Statistical Abstract of the United States: 2012 | ||

- Zillow gives advice for how to make an offer on a home

- FrontDoor Real Estate states that making an offer on a house isn't a roll of the dice if you know what to do, and offers recommendations for how to make a solid offer.

- REALTOR.com has an article titled "The Basics of Making an Offer"

- Fox News' article, "How to Make an Offer on a Home," includes seven tips that end with "stick to your guns!"

Home inspection

- Angie's List is a local search engine that can help identify well-ranked local home inspection companies to perform a non-invasive evaluation of a home as part of the sale of the home

- American Society of Home Inspectors (ASHI): this organization answers all manner of common queries as well as explaining cost, why an inspection is needed, and what it entails

- Allstate outlines, "What to Expect from the Home Inspection Process"

- Investopedia answers the question, "Do you Need a Home Inspection?"

Homeowners insurance

Homeowners are wise to purchase homeowners insurance once they've purchased a home, to prevent financial ruin from events like earthquakes, floods, fires and theft.

- The Insurance Information Institute explains what homeowners insurance is and what is covered under a policy

- Investopedia covers the "Beginner's Guide to Homeowners Insurance"

- GEICO outlines what is involved in a standard homeowners insurance policy

- A Forbes article gives advice on "Four Costly Homeowners Insurance Mistakes to Avoid"

Sign papers

Closing on a house is a process, and is not as simple as just signing one piece of paper and receiving the keys to one's new house.

- Zillow's advice and information for closing on a house

- Realtor.com's article, "Understanding the Closing Process," claims that knowing what to expect brings peace of mind to the home buyer, and outlines all the steps involved with closing

- BankRate.com's article, "Survival Guide to a Real Estate Closing," describes the steps to a closing and what a first time home buyer can expect

- About.com's article, "Documents to Keep after a Home Closing," describes all of the paperwork that is important to hang onto after the closing culminates