When it's time to buy a house, price definitely matters.

In fact, any realtor will tell you that the price of a home is the number one factor influencing people's decisions to put in a bid.

Being strategic about buying property is absolutely vital if you want the best deal for your money.

Overall, affordability in the housing market is influenced by three things: mortgage rates, prevailing home prices, and inventory levels.

You can't influence those factors, but you can learn the best and worst times to buy a home when you're trying to get the best possible price.

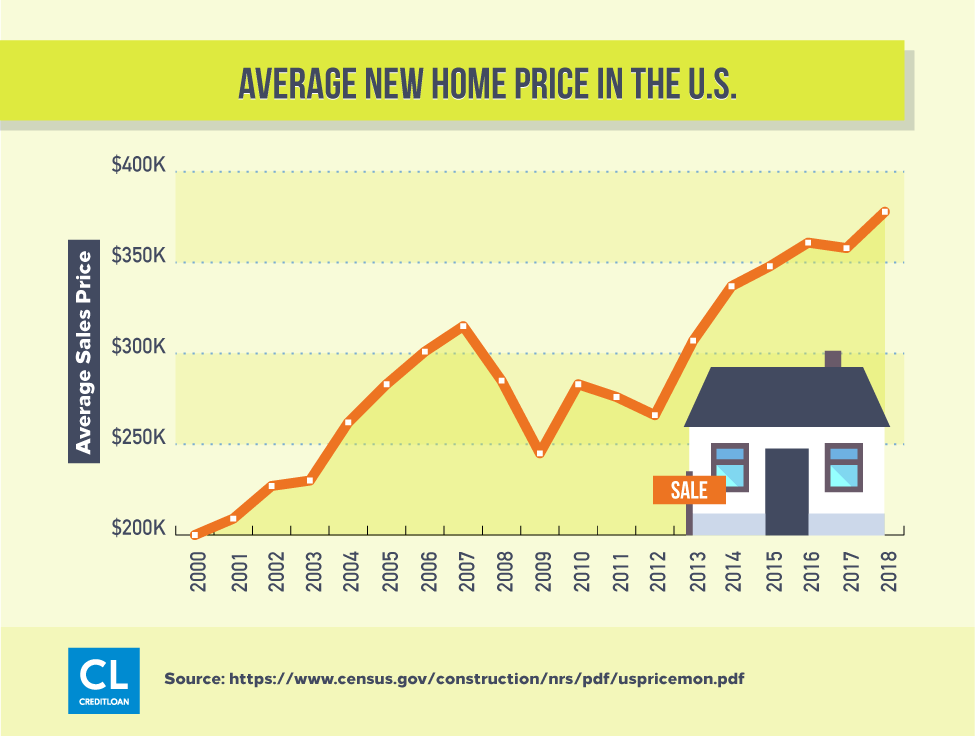

You can find home price indexes on the internet that break down price trends over time across the country, or in specific cities or regions.

Such indexes provide a simple and reliable way to track changes in the prices of homes in your market, but there are even more reliable strategies for getting the best price.

The home price indexes support the finding that real estate is highly seasonal, with certain times of the year—and even specific days of the year—offering lower prices.

In this article, we're offering a seasonal guide to buying a house, based on real estate market patterns experts have observed during different times of the year.

You'll learn all about the best and worst times to buy a well-priced home so you can get the best value for your housing budget.

Spring Is the Worst Time to Get a Deal on a Home

Supply is high but demand for housing is higher, driving prices up

If budget is your biggest concern when you're buying a house, you might want to avoid house hunting in the spring.

An abundance of spring home sales. Springtime is when everyone wants to sell, and typically the market is flooded with newly listed inventory.

Usually, a surge in supply in a market means the price goes down, but in the real estate market, the demand for new homes also spikes in the spring.

And you can guess which factor ends up having the most influence (hint: it's demand!)

Homes sell more quickly at a higher cost in the spring than any other season. Because of the competition for housing in the spring, you could end up in a bidding war, paying more than the listed price for the house you want.

Spring is the "mistake season" for real estate. Since there is so much activity in the real estate market during March and April, there is also a higher tendency for mistakes to be made.

In the spring it can take longer for lenders to process applications, or title companies to line up title checks and insurance.

In the middle of all this activity, it is easier for errors or omissions to be made in the paperwork, which is another recognized disadvantage for house-buying in the spring.

People who value choice over price will love buying a home in the spring

The one exception to the "stay away from spring" home-buying advice is for people who don't consider price to be the main deciding factor.

If getting your dream home is a higher priority than getting a bargain, the large inventory and variety of available properties is a reason to shop around during the springtime.

The biggest crop of new homes on the market appears in the spring, and the more options you have, the more likely you'll find the perfect home.

You'll be competing with many buyers and may end up paying the dearest prices, but with enough cash, you'll have a much better chance of getting a home that's ideal for you.

School locations and schedules can be a bigger factor than price. Experts have also observed buyers are often motivated to get a home close to the school they'd like their kids to attend.

So they buy in the spring so they can settle into their new home before the school year starts again in the fall.

If school proximity is your top priority and you're prepared to pay a little more to send your kids to the school of your choosing, springtime is going to be your best season to buy.

Winter Is the Best Time to Buy a Home

Sellers are motivated to make a deal

The best time to buy a house is when no one else is looking for one.

By the time winter rolls around, the spring and summer frenzy is long gone.

Some homes have been sitting on the market for months.

Homeowners who have had their home on the market since the summer or the fall will be more likely to accept a lower price when there are no other buyers or bids.

The housing market disappears. In fact, most sellers don't even bother listing their homes in the winter, dropping out when the holiday season comes.

Experts know, if someone is listing their home during the holidays it's usually a "must sell" scenario.

These sellers are much more likely to be willing to negotiate on price, offer flexible terms for the buyer, and even extend the closing schedule.

The drawback? Fewer choices for the buyer. Buying in winter is very price-friendly, but the tradeoff is having far fewer homes to choose from.

In the United States in 2016, in the month of April, there were 509,600 new houses listed on the market.

For the month of December that same year, only 278,600 new listings appeared nationwide.

Which means there was just a little over half as many listings in the last month of 2016 than there was in April, the highest point of the spring season.

More homes sell above the listing price in the spring. The same seasonal pattern influences the number of bidding wars on homes listed in the spring versus the winter.

In April 2016, over a quarter of all home listings (26.4%) were sold above the price they were listed at.

In November of the same year, only 15.3% of homes went above the initial asking price.

If you want to avoid getting into a bidding war and paying more for a house than what it was originally valued at, stay away from house-hunting in the spring.

Your mortgage will get you a lot more in winter. For many prospective homebuyers (especially people looking for a starter home), your budget is determined by the mortgage for which you've been pre-approved.

For example, your mortgage lender might tell you that you've been approved for financing on a $200,000 home with a $20,000 down payment.

The mortgage term could be 20 years at a fixed APR of 4.25% with monthly payments of $1,200.

Make the most of the credit you've been offered. Now that you've been pre-approved, it's your job to choose the best home you possibly can for your budget of $200,000.

In the spring, a home that's listed at $200,000 could easily go for $225,000 after a bidding war, putting it out of your price range.

Taking the competition into account, you'll have to set your sites on homes listed at $180,000 to stay within your $200,000 budget.

In the winter, on the other hand, desperate homeowners who'd normally list theirs at $225,000 might gladly accept an offer of $200,000, with no other competing bids in sight.

Rather than hoping your $200,000 will be the highest winning bid on a home valued at $180,000, you'll be all alone with the lowest winning bid on a home worth $225,000.

When Should You Start Looking for Your Ideal Home?

Don't wait until winter to shop around for the best house deals

Although winter is the best time to buy a house, it doesn't mean you should wait until then to find the best prices.

The best time to go scouting for available homes is in the late summer after the spring boom has started to subside.

By this time, you should ideally have your mortgage offer details lined up so you know exactly what you can afford.

Make a watchlist. Go through the listings in your preferred buying area and identify all of the houses that are within your budget.

Bookmark them on your computer so you can keep an eye on the listings.

You'll soon start to notice a couple of things (both of which work in your favor).

The price goes down in late summer. First, you'll notice price reductions posted for many of the listings, as sellers try to offload their properties before the winter real estate doldrums hit.

Some of the sellers reducing their prices are the same people who bought new homes in the spring before they had sold their old homes, and now they are under pressure to sell the old ones.

The highest monthly percentage of U.S. listings with price reductions in 2016 was in August when 15.1% of all listings cut their price down.

Some properties stay, and others go. Second, you'll notice some houses on your list being successfully sold, and others remaining unsold.

It's highly unlikely you'll see many new listings in the fall and early winter, but if any do come up in your price range, bookmark them and add them to your watchlist.

Although it's tempting to feel disappointed when a house you've had your eye on disappears, look on the bright side.

You have fewer homes to choose from so it's less overwhelming, and the homes that remain will hopefully be offered at a better price.

Around October, take the time to go to open houses for the listings still available on your watchlist, so you can get a feel for which ones you like the best.

Make your move in January. January is a whole new year and it brings with it many of the best deals for buyers.

Your watchlist will be much smaller now than it was when you started it in late summer, but the unsold homes remaining on the list can be purchased at a much better price.

Homes have been on the market more than 3 months. In January 2016, the median number of days a home was on the market before it closed was 104 days.

Compare that to May 2016, when the median time homes spent listed on the market before they sold was just 68 days.

The bottom line: Prices are lowest in January. For January 2016, the median sales price for a U.S. house at closing was $254,914.

In June of the same year—just six months later—the median closing price for a home bought in the United States went up to $307,571.

By November of that year, the median closing price for a house then went down to $270,329.

See your home at its worst. One thing about selling a home in the spring is it's a lot easier to have curb appeal when flowers are growing, and the sun is shining.

When you shop for a home in the winter, you'll see the property in its least attractive state.

You'll also get a firsthand look at winter maintenance issues like clearing driveways and sidewalks, and whether the roof leaks when it's covered in snow.

Easier and cheaper to line up contractors. If you need to do some renovations like replacing the windows and doors or remodeling the kitchen, contractors are much more available in the winter than in summer.

Due to slow demand, you can also usually hire skilled help to work on your house at a lower price in the winter than you can in the spring and summer.

Take Advantage of the Holiday Season

Why buying a home makes the perfect Christmas present

Although January is the best month to score a good deal on a house, the two weeks leading up to New Year's can offer even better opportunities.

Once the holiday season starts, no one wants to deal with selling a home.

People want to decorate their house for the holidays and host lots of out-of-town guests rather than worrying about keeping their home in pristine staging shape.

For that reason, many sellers simply pull their listings from the market when the holidays hit and decide to wait until the next spring.

A holiday listing is a prime opportunity. If you do find a listing still active during the holidays, you've got a live one on your hands.

You can assume the sellers are really looking to sell off their properties and likely to be willing to take a lower price.

Maybe they have a new job, or their kids moved out, or they can't afford to live there anymore—one way or another they want to sell, and they want to do it now.

And on top of all that, the sellers are probably full of the holiday spirit (an air of generosity can't hurt during price negotiations!).

Getting a feel for what the house looks like inside and out when decorated for the holidays is another advantage of house shopping during December.

Much less competition. During the holiday season, other buyers aren't as likely to be looking at houses.

In a lot of cases, the money the potential buyers could be using as a down payment is being spent on holiday treats, and presents for their family.

‘Tis the season for home improvement bargains. December is also a really good month for deals, especially Boxing Day specials.

You couldn't have better timing for purchasing upgrades to major appliances for your new home including new stoves, refrigerators, dishwashers, and air conditioners.

You'll have your agent's undivided attention. Another problem with buying in the spring and summer high season is real estate agents are so busy they get pulled in a million different directions.

As long as your agent is willing to work through the holidays (which many are since it's so slow) you'll have their complete attention.

The agent will likely have more time to spend helping you find your dream home at a dream price during the lull in their otherwise busy year.

The best time to buy a house is when you're ready

You can wait for the best season, but you need to be financially prepared first

Before jumping into the winter housing market to take advantage of the best available deals, potential new homeowners need to look at their financial situations first.

Do you have enough for a down payment? First, you need to save up enough money for a down payment, which is at least 5% and ideally should be closer to 10% of the mortgage total.

If you need to take the time to save the additional 5%, it could be worth it.

Less is not best with down payments. A lower down payment might get you into a home faster, but it doesn't get you the best terms for your mortgage.

The more you can put down for a down payment, the lower your monthly payments will be, and the lower your mortgage interest rate will be.

If you can save enough for a 20% down payment, you can avoid paying mortgage insurance (and you'll already own 20% of the equity in your home!)

The better your credit score, the less you'll pay. The higher your credit score is when you apply for a mortgage, the lower the interest rate you'll be charged.

Even a difference of 1% between mortgage APRs could mean the difference of thousands of dollars over the life of a mortgage.

But depending on your current rating, it could be worth taking the extra time to build up your credit score before getting serious about buying a house.

Be strategic and buy your home during the best season for buyers

If you can wait until winter, do so. It makes financial sense and avoids getting caught up in the springtime real estate zoo.

Have you experienced buying or selling a home during different seasons?

Which time of the year worked out the best for you?

Any additional tips you'd like to share with us?

Let us know in the comments below!