Applying for a Credit Card

When you have good credit, applying for a credit card is fairly straightforward. You more or less can take your pick of cards that come with rewards like points or cashback.

For applicants with bad credit, the options are limited. Most credit cards with perks are out of reach until you improve your credit score. One way to do this is to responsibly use a secured credit card, also called a “bad credit card”.

Why Credit Scores Matter

Your credit score, excluding errors and exceptional circumstances, reflects spending habits relatively accurately. Good savings and spending habits lead to a good credit score.

But if you regularly miss payments, max out credit cards, and apply for a lot of new credit, you can expect to have a low credit score.

This has serious implications. When you apply for a credit card, mortgage, loan, etc. your credit score will be a major factor the lender uses to decide if you are approved or denied. If you are approved, your score will influence the rates and terms you’re offered as well.

FICO Scores

The majority of lenders will look at your FICO score. The number is based on a variety of factors like payment history, how much debt you have, types of credit, and credit history. Because credit history is part of the equation, someone applying for their first credit card will have no, or low credit.

When people have recently gone through bankruptcy or are trying to rebuild their credit, they might find themselves in the market for a "bad credit credit card."

5 Keys To Making Bad Credit Credit Cards Better

"Bad credit credit cards" are just what the name sounds like – they are a type of credit card for people with poor credit histories who are trying to improve their credit score and rebuild their personal finances. Often, people apply for bad credit credit cards when they cannot get approved for a regular credit card, but they still want to have the convenience of paying with credit, while improving their credit score by building up their credit history.

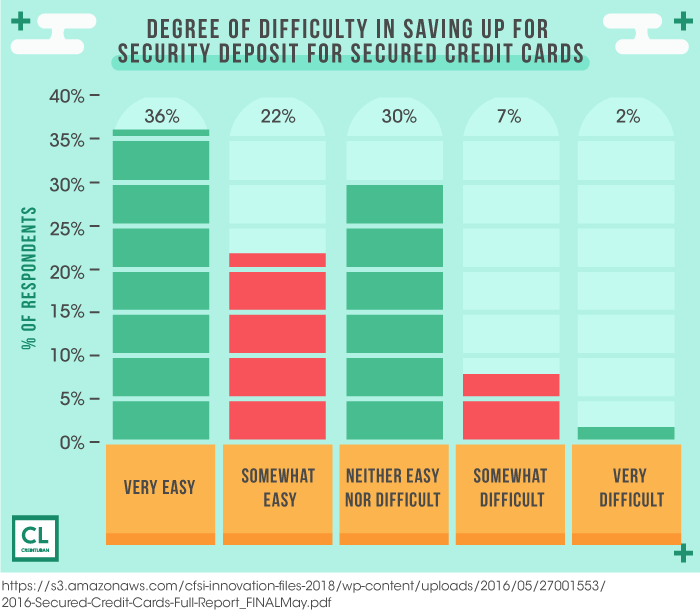

One of the most common ways to get a credit card is to sign up for a secured credit card, which requires the person to pay a cash deposit in advance in order to qualify for a line of credit. For example, in order to get a $500 secured credit card, the person would have to put $500 into a dedicated bank account – which guarantees the bank that the credit card debt can be repaid.

Before applying for a secured credit card, here are a few of the things you need to know.

You Might Get Turned Down

Not all banks will issue bad credit credit cards to all customers. If you have recently gone through a bankruptcy, debt settlement or debt consolidation program, it might be difficult to get approved for a bad credit credit card. The Consumer Action Secured Credit Card Survey found that many banks prefer for applicants to have a minimum of six months without any late payments, and some banks, such as Wells Fargo, require people to have a minimum annual income of $12,000 before they can be approved for a secured credit card.

You Might Get More (or Less) Than Your Deposit

Different banks and credit unions have different standards for how much they charge for the deposits on secured credit cards. A standard arrangement is a dollar-for-dollar match of the security deposit and credit line – for example, if you put $500 down as a security deposit, you can get $500 worth of credit on the secured credit card. However, some banks offer different arrangements where you can get more of a line of credit than the amount of your security deposit. For example, Capital One offers a secured credit card with a minimum security deposit of $49, which ensures a credit line of $200. These security deposits are refundable. When you close your secured credit card account (or convert it to a regular unsecured credit card), the security deposit will be given back to you.

Beware of Fees

Secured credit cards often have an annual fee and various late payment fees. You also might not earn interest on your security deposit. According to the Secured Credit Card Survey by Consumer Action, only six of the 13 banks and credit unions surveyed paid any interest to customers on their security deposits. There is a reason why secured credit cards tend to have higher fees: banks are taking a bigger risk by offering credit cards to people with bad credit, and so the banks want to make sure they don't lose money on these customers. (Annual fees are one area where a secured credit card is not much different from a regular credit card, since annual fees for credit cards are becoming much more common. According to the Pew Charitable Trust Safe Credit Cards Project study from 2011, 21% of banks were charging an annual fee for credit cards, with a median annual fee of $59.)

Try a Credit Union

Since credit unions are non-profit organizations, they often charge lower credit card interest rates and fees, even to people with less-than-perfect credit. According to a report from the Pew Charitable Trust Safe Credit Cards Project, interest rates charged by bank credit cards can be as high as 20.99%, while average credit union credit card interest rates ranged as high as 17.00%. A survey by Consumer Action found an average APR of 16.60% for secured credit cards.

Ask About Credit Reporting

Most secured credit cards report the customer's payment history to credit bureaus, just like a regular credit card. This is a good thing, since most people who need secured credit cards are intending to use them as a credit-rebuilding tool. The Secured Credit Card Survey has details on which cards report monthly to the credit bureaus, and which ones do not. Make sure that using your secured credit card each month will actually help improve your credit score.

Secured credit cards can be a valuable tool for people to use in rebuilding bad credit. After 12-16 months of making on-time payments to a secured credit card account, most people will have repaired their credit enough to be able to get an unsecured credit card. Many secured credit cards can convert to an unsecured credit card with a larger credit limit.

No matter how bad your financial situation might have become, even if you have gone through serious financial trouble, a costly divorce, or a bankruptcy, there is always hope. Secured credit cards offer an option to get back on your feet.