Credit Sesame is a great option for monitoring and improving your credit score

Are you looking to get out of debt, improve your credit score, get a new loan, or all of the above?

If you said yes, then you're not alone!

In early 2018 it was reported that the average American held an average credit card balance of $6,375, which is up nearly 3% from the year before.

If you're among those whose credit card debt increases year after year, a free credit score tracking and debt management service like Credit Sesame can really come in handy.

Also, you may want to use it if you're looking for better lending opportunities, or if you want to take steps to protect yourself from identity theft.

Yes, there are other companies that provide similar services.

But since its founding as a Mountain View company back in 2011, Credit Sesame has remained a favorite among free credit report sites—and it keeps getting funding while the team behind it keeps on improving its product.

In late 2017, the company raised $42 million in growth funding preparing for an IPO and claims to have attracted over 12 million members in its 8 years of existence.

What's more, according to internal data, 45% of current users engage with its services on a monthly basis.

Is Credit Sesame a reliable partner on your quest for a better credit score, and could it really be helpful to your particular case?

Let's find out!

Why You Should Consider Credit Sesame

It does much more than keep an eye on your credit score

There are many free services out there that monitor your credit and using any one of them can be a good first step to improving it, but it's the extra services that set Credit Sesame apart from the competition.

Credit Sesame gives you a free credit report card that breaks down your score. This is an essential aspect of its service, and it does it right, by showing what specific factors may be impacting your score.

It looks for credit offers you're pre-qualified for. Without hurting your credit score, it looks for better credit alternatives than what you currently have and saves time by showing offers for which you would very likely get approved.

The robo-advisory technology automatically gives you a credit strategy. These automated digital platforms provide financial and investment management advice via computer algorithms.

It uses the information from an individual to give insight into the best ways you can take to make financial transactions.

Once you create and log into your account, Credit Sesame's robo-advisor technology will use your data to give you suggestions to take control of your credit while paying your debts.

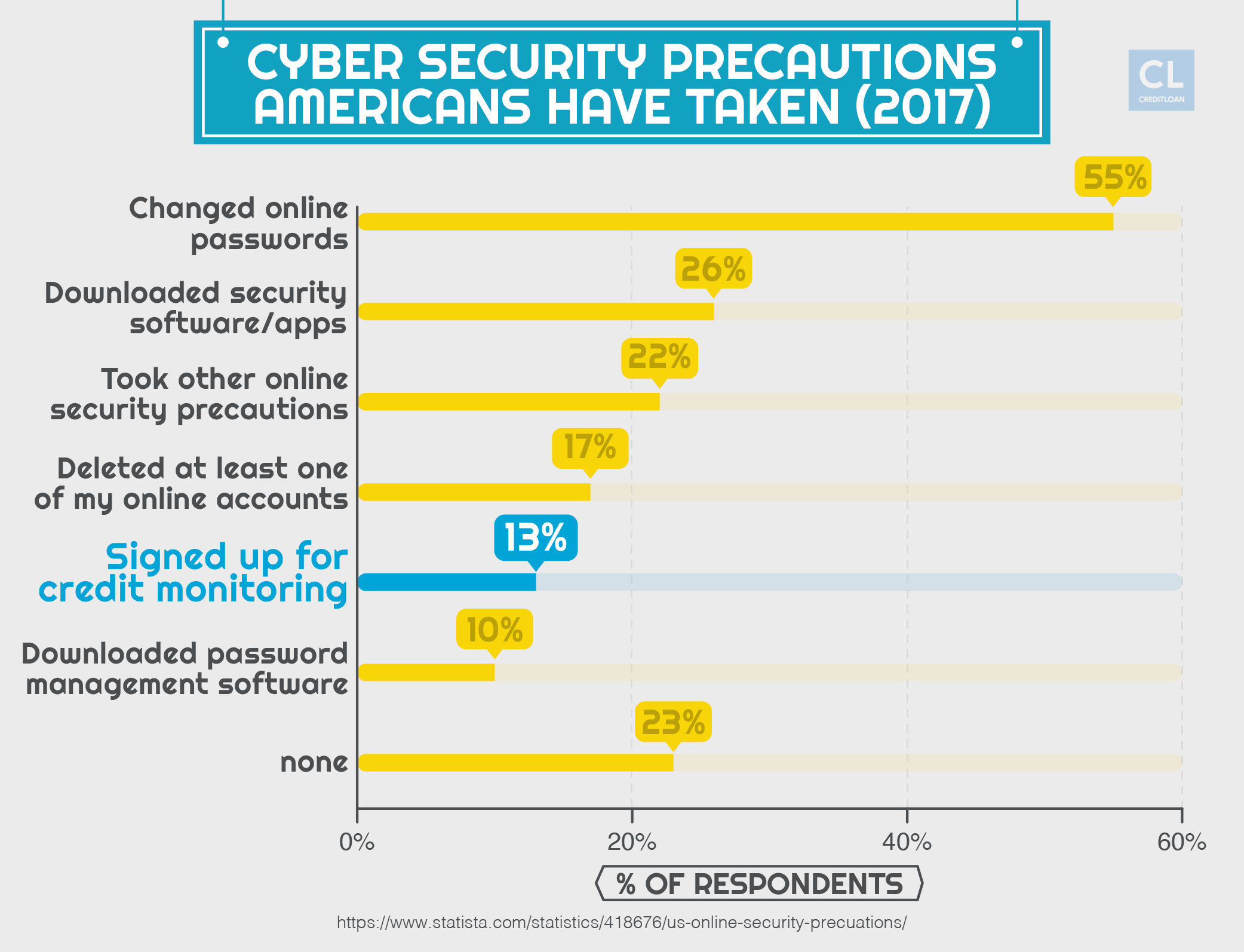

Get free credit alerts and monitoring 24/7. The credit score tracking features include early identity theft warnings and fraud detection.

You can set your own goals. Whether you're looking to transfer balances, pay debt, or get a mortgage, Credit Sesame allows you to set goals without the hassle that comes with other financial strategy services.

The My Borrowing Power feature gives you personalized recommendations. It will suggest good credit cards, mortgage rates, and refinance options tailored to your debt and credit profile.

You get $50,000 in identity theft protection insurance for free. This covers some expenses and legal costs that may arise from fraud or embezzlement, theft, forgery, and other cases of stolen identity.

Why People Love It

It's like having a free 24/7 automatic credit consultant that demystifies your credit score

According to surveys and news reports, many Americans are still largely confused by credit scores and how they work.

Some of us don't know just how important our credit score can be.

It pops up in places you might never expect, like when you apply for a cell phone contract or go to sign the lease on an apartment.

Some of us make mistakes like wrongly assuming that it's beneficial to your score if you carry a small credit card balance.

The most beloved aspect of Credit Sesame is the feature that analyzes your credit score in five categories, rating you from A to F in each one of them.

The categories are:

- Payment History

- Credit Usage

- Credit Age

- Account Mix

- Credit Inquiries

For each one of them, Credit Sesame gives you specific details—for instance, what late payment caused your score to drop—and even suggestions for improvement.

Credit Sesame users tend to mention this educational and advisory feature as one of the service's most helpful elements.

It is also one of the aspects of Credit Sesame that draws in users and creates a high level of user engagement: according to the company, 45% of its users are on its site every month.

Many users, both at Consumers Affairs and at the stores for the Credit Sesame apps, report being extremely happy with the automatized credit score reporting and how it explains what is behind a report.

Jackie, a New York-based reviewer of Credit Sesame at Consumer Affairs, recently wrote she was happy with the frequent updates of her credit score.

She said that the app "lists all my credit accounts, and the amounts are very current and accurate."

"It lets me know if I have gone over my limit or missed a payment," Jackie added.

It lists all of the places or people that have made inquiries into my credit, it gives advice on how to improve my score, and it recommends loans and credit cards both pre-approved and not pre-approved.

Should you follow her lead and use Credit Sesame?

Ask yourself the following questions:

- Are you looking to know and keep track of your credit score?

- Are you interested in knowing how your credit score is calculated?

- Do you want to receive tips to improve your credit score?

- Would you be interested in learning about other loaning options and offers?

- Do you want to get good credit card offers that you're already pre-approved for without having to do the digging yourself?

If you answered yes to three or more of these questions, then you should definitely give Credit Sesame a try and see what it can do in improving your credit score.

What Are the Problems?

Users complain about the frequent emails and constant offers

Understanding why Credit Sesame may send you frequent emails and offers is connected with understanding its business model—how the company makes money despite offering free reports.

The answer is simply that Credit Sesame makes money by matching its users with credit companies offering products, and getting a fee every time one of those financial products are purchased.

This is behind the frequent emails and offers you'll receive, which has caused some users to grow frustrated.

Dallice of Boulder, Colorado, for instance, noted on Consumer Affairs:

Instead of encouraging me to pay down credit card balances and pay bills on time etc, I have been bombarded with ‘offer' emails every day. Each email wants me to sign up for new credit card, refinance my house, or worst of all… increase my credit so that it will be easier to shop.

Robbie, of Dallas, Texas, expressed similar frustration, noting dissatisfaction with customer service:

I am inundated with frivolous email at least twice per day for services not welcomed. I have deleted my information and sent them multiple emails to curtail future emails."

Who Does It Compete With?

Credit Karma is its closest competitor in the free credit reports category

Both Credit Sesame and Credit Karma seem to be in a race to provide the most attractive, easy-to-use, and free credit score management service.

Credit Karma offers most of the same features that Credit Sesame does. Its tools to help you improve your credit score include:

- Showing your credit score

- Explaining the factors that affect your score

- Detailing how much each factor weighs towards your score

- Giving you suggestions to improve your score

Both companies are free and share a similar business model. Just like with Credit Sesame, Credit Karma makes a profit by referring its users to lenders and other services.

The most striking difference is in the sources of the credit score they provide.While Credit Sesame gives you a credit score sourced solely from TransUnion, Credit Karma relies on TransUnion and Equifax.

This creates a more robust score.

Credit Sesame comes out ahead in terms of extra perks. Things like its free $50,000 in identity theft protection or the wider range of suggestions for improving your credit give Credit Sesame an edge over its competition.

If you want to cover all your bases, sign up for both. Using both these services is free and won't affect your credit score, so why not give them both a try and see which one you like more?

The Question Everyone's Asking

Does using Credit Sesame lower my credit score?

According to the company, no.

There are two types of credit inquiries: hard ones and soft ones.

The hard credit inquiries, which normally occur when you give a lender permission to check your credit to make a lending decision, may diminish your credit score.

Examples of hard inquiries include applications for mortgages, auto loans, and credit cards.

If you didn't give a lender that permission or if it's conducted as a background check, then it's reported as a soft inquiry, and it doesn't affect your score.

A common example of a soft pull is when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers.

Your employer might also run a soft inquiry before hiring you.

How It All Works

After you sign up, Credit Sesame does most of the work for you

The great thing about Credit Sesame is that it makes monitoring your score and looking for alternatives to improve it relatively stress-free.

Once you sign up for an account, most of the job is done.

Signing up is easy. You don't need to provide your credit card number or pay anything.

Just give some basic personal information (name, address, phone, and the last four digits of your Social Security number), and Credit Sesame will be able to pull your info for you.

You'll get a credit score report and suggestions in no time. The site will give you suggestions on how to improve your score even if it's already Excellent.

(Hint: they'll probably include getting another card to increase your total credit limit.)

Selecting financial goals will refine the recommendations you get. This service (which is still in beta) lets you choose between goals like card payoff, financing a car, getting a loan, and finding 0% financing.

Using this new feature should allow Credit Sesame to give you more specific and targeted suggestions.

You can upgrade to the premium service for more features. Credit Sesame offers three levels of paid premium service (Advanced Credit, Pro Credit, and Platinum Protection).

Monthly costs range from $9.95–$19.95.

These three packages increase the robustness of your credit report and the level of ID theft protection and insurance you'll receive.

Key Digital Services

Besides the web platform, you can take advantage of the Credit Sesame app

If you're interested in using a credit score monitoring service, you will probably want to have it with you at all times, and that means having it on your phone.

Credit Sesame lets you do just that with its app of the same name, available both for Android and iOS devices.

The app allows you to perform all of the tasks that you can find on the desktop version of Credit Sesame, with the great advantage of getting notifications in real time, 24/7.

The app has gotten mostly positive reviews on both Google Play and iTunes stores, with respective ratings of 4.3 and 4.7 out of a possible 5.

Most users love the app because it allows them to know right away when their credit score has changed, and what factors are behind it, all from their phone.

For instance, one Android user praised the app for having "everything on your credit," and the feature that allows you to simulate your score if you close or add accounts.

Credit Sesame is a safe alternative to monitor and improve your credit score, but be ready to receive a ton of unsolicited offers

Credit Sesame is a free credit monitoring service that has helped millions of users stay on top of their financial plans and achieve some of their credit goals while educating them about their credit reports and scores.

It's easy to use, non-invasive, and doesn't damage your credit score, so you have very little to lose by giving it a try.

The main complaint of some of its users rings true, though: It will try to help you by sending you more offers and credit information than what you may want.

So if that doesn't sound pleasant to you, think twice before signing up.

Have you tried Credit Sesame?

Did it help you understand and manage your credit score?

Did you end up following its advice or signing up for some of the offers presented to you?

Let us know in the comments below!