Do you know how to monitor your credit score?

You can't manage what you can't measure, as the saying goes.

When you monitor your credit, you become aware of the impact your financial actions make on your score.

And if you see something change in your score, you can take positive action to improve your credit score if needed.

A great credit score can get you the best interest rates on personal loans, lower mortgage rates, and the most sought-after rewards credit cards.

You may even end up paying less for car insurance or land a better job.

Indeed, most consumers know how important their credit score is.

Which is why many companies try to leverage this by charging $9–$39 each month for credit monitoring services.

That's $108–$468 per year!

What could you do with an extra $108–$468 a year?

How about pay down your debt?

Go on a weekend trip?

The choice is yours: You don't have to pay anything to monitor your credit score.

Choose one—or more—of the services we dig into here, and start monitoring your credit score for free.

An Overview of Credit Scores

But before we dive in, here is a little refresher on credit scores.

Scores range from about 300–900, depending on the issuing company and are categorized as follows:

- Poor: 300–629

- Average or Fair: 630–689

- Good: 690–720

- Excellent: 720+

The higher your score, the easier it is to open a credit card, get low-interest rates on loans, and pay less for things like car insurance.

How Credit Scores are Calculated

Payment History: Make a late payment and you can expect to see your score take a nosedive. But, you can boost your score by making on-time payments

Credit Utilization: Expressed as a percent, it tells creditors the amount of debt you owe versus your available balances on revolving credit accounts like credit cards.

Creditors like to see credit utilization of less than 30%, experts say.

Credit History: As with all things, history plays a big factor in this equation, too. Generally, the longer your credit history stretches back in time, the higher your score, espcecially if you have a record of positive payments.

Types of Credit: The variety in the types of credit you have counts: A car loan, mortgage, a few credit cards. Different types of credit accounts indicate a customer who can utilize and manage credit well.

New Credit: Credit inquiries can hurt your score, so think carefully before applying for new credit.

You could expect to see a slight dip in those digits when you decide to do so.

Know the "who's who" of the credit tracking industry so you can track them

Credit scores can vary by as much as 100 points or more depending on the company issuing the score.

Why the fuss over FICO? Your FICO score, issued by the Fair Isaac Credit Organization, is recognized as the gold standard for credit scores.

A whopping 90% of creditors use consumers' FICO Scores to determine their creditworthiness.

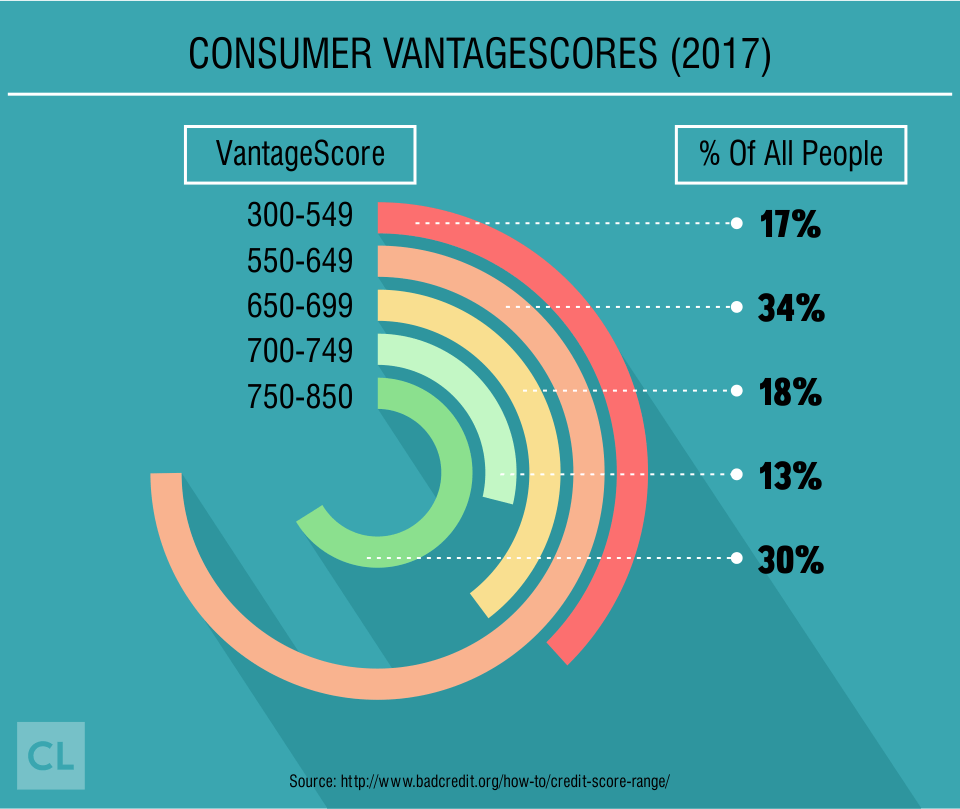

Is there any advantage to VantageScore? This is another popular score, although it's not nearly as popular as FICO.

VantageScore 3.0 has the same range as FICO scores, 300–850.

Your VantageScore is more readily available for free than your FICO score—making it a good option if you want to track your score changes weekly or even daily.

Apples to apples, always. For comparison purposes, always make sure you are monitoring your progress based on the same score.

Know the score(s). You can't know for sure which credit organization and score a company will use to judge your creditworthiness.

That's why it's super important to check your credit scores through a variety of services.

Do 30-day check-ups (at least). Check your credit score at least every 30 days with one of the free services we'll share with you below.

Trade time for money. It doesn't cost anything to check your credit score but a few minutes of your time each month.

And taking that time to check is well worth it. As we've pointed out, a good credit score can save you thousands of dollars a year.

We will show you how to get your FICO score and VantageScore completely free—forever.

We will also show you how to monitor your credit reports from each credit bureau to analyze the factors that comprise your credit score.

Watching your score and paying attention to your credit will help you take the necessary steps to improve it.

Check Your Credit Scores for Free Through a Trusted Service

From CreditKarma.com (the first website to offer completely free credit monitoring), to Quizzle.com and others, you do have choices for free credit monitoring.

What should you look for in a credit monitoring service?

First things first: You'll want to consider a few factors before choosing a service.

Which credit score does it monitor? FICO > VantageScore. But as we mentioned earlier, both have value.

How often does it update your information? Some credit score monitoring services update their information every time you log in.

Others do it weekly or every 30 days.

Is an on-site credit simulator available? Credit simulators are handy ways to determine how your financial choices could affect your credit score.

Just select the action you want to take (say, paying off a $3,000 balance on one card) or something that could happen (you miss a payment).

Hit enter.

Like magic, (or just—you know—computer algorithms), your new hypothetical score appears.

These come in various forms, from interactive sliding scales, to basic, "just-the-facts-ma'am" charts.

What other features does it offer? Some credit monitoring services offer a free credit report, an app for easy access, and alerts to notify you of changes to your score.

Do I have to provide a credit card? The services we share here are completely free, no strings attached.

Use Credit Karma to see your VantageScore and monitor your credit health

Credit Karma broke new ground years ago by being one of the first services to provide credit scores to consumers completely free and still offers one of the most comprehensive credit monitoring services—for free.

You can check your credit score every two weeks through Credit Karma for changes.

Credit Karma also provides a number of other services, all completely free. For instance you can sign up for credit monitoring and have alerts to be delivered to your inbox or phone.

There is also a mobile app where you can check your score or dispute errors.

You have to create an account for any of these services. Then, once you sign in, you'll gain access to your credit score and free credit report immediately.

Open sesame: Credit Sesame introduces a whole new world of credit score monitoring

Like Credit Karma, Credit Sesame is another fee-free player in the field of credit monitoring.

Credit Sesame strives to make monitoring your credit score easy.

How's your debt doing? The site provides a wealth of easy-to-digest information about your finances.

First, take a look at your VantageScore 3.0 based on information from your TransUnion credit report.

You also receive a letter grade of A through F.

Finally, get a glimpse of your past six months of debt history.

Is that number going up or down?

Check the Credit Sesame dashboard. Credit Sesame analyzes each of the factors that make up your credit score: payment history, credit usage, credit age, account mix, and inquiries.

It also offers in-depth information about your total debt, minimum monthly payments, and debt-to-income ratio.

These last three factors don't directly affect your credit score, but creditors may take them into account when deciding if you should be approved for a loan.

Spot your credit trends to make changes. Tracking the ebb and flow of your credit score can help you improve your financial health.

Credit Sesame does a comprehensive job of letting you see trends in your credit score and your total debt.

A red or green arrow next to the number shows whether your monthly payments and overall debt have gone up or down in the past 30 days.

Seeing it all on a screen gives you a sense that your debt has now become more manageable.

Check your credit IQ with Quizzle to see how you can save

Unlike some of the other free services, Quizzle only lets you check your credit score every three months.

However, you can also get a free credit report from TransUnion with the service.

It takes about three minutes to get your free credit score and free credit report.

Quizzle also provides an easy-to-read glance of your credit report, including your payment history, the total debt owed, and credit inquiries within the past two years.

Like Credit Karma, you can find and dispute errors on your credit report easily with just one click.

Plus, Quizzle uses the personal information you shared to see if there are ways you can save on your monthly mortgage payments by refinancing.

You can use the money you save on your mortgage each month to pay down high-interest, unsecured debt, bolster your savings account, or enjoy a trip or luxury item you've been eyeing for a while.

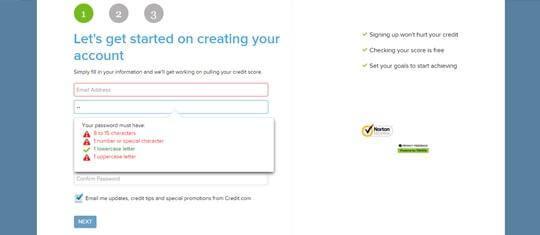

Take control of your credit in three easy steps with Credit.com

Signing up to retrieve your credit score at Credit.com is easy.

The site also delivers a customized action plan to help you improve your credit score.

Dig deep into your past. You'll need to answer some rigorous security questions related to your credit, personal information, and employment history.

Find your "why." Credit.com asks why you want to check your credit score.

Click one of the choices and it helps Credit.com match you up with products, such as mortgages or credit cards that meet your financial needs.

Monitor and improve. Once you've checked your credit score, Credit.com tells you what score may be achievable in the near future if you take specific actions, such as paying off debt or applying for a credit limit increase.

Improving your credit happens with incremental changes and it all starts with knowing your credit score.

See what your lenders see when you get your FICO score from FreeCreditScore.com

More lenders use FICO scores than any other credit score.

FreeCreditScore.com updates your FICO credit score and Experian credit report every 30 days, beginning when you sign in for the first time.

Suss out your score and free credit report. After you've accessed your free FICO Score 8, the most recent version of the credit score issued by Fair Isaac Credit Organization, click the link to access your Experian credit report.

While not as visual-graphics-oriented as other sites like Credit Sesame or Credit Karma, FreeCreditScore.com—a part of Experian—provides you with the pertinent information you need to monitor your credit.

Beware of upsells. For an additional fee, you can access other FICO score versions.

Lenders may use these to determine your rates for car insurance, mortgages, and other loans.

If you've paid your bills on time, you most likely don't need to check these other scores.

The numbers should be similar to your general FICO score.

Get Your Credit Score From a Credit Card Provider

Lenders like Chase, Discover, and Capital One offer free credit score monitoring services.

Even if you don't own one of these credit cards, these top lenders have programs that allow you to monitor your credit score for free.

Signing up for one of these services is easy.

Read on as we share details about the top three.

Chase Journey allows you to visualize your future with better credit

Chase Bank offers free credit score monitoring through the Chase Journey program even if you are not a Chase customer.

If you are not a Chase customer or have a Chase business account, visit the Chase Credit Journey website and click "Enroll now."

Fill out the form, including your password and answer to a secret question.

The second form asks for your address, phone number, and the last four digits of your social security number.

Be prepared to receive a voice or text message to that number to verify your identity.

Once you've verified your identity, you will immediately receive your credit score.

The process takes about five minutes.

Enjoy a special perk as a Chase customer. If you are a Chase personal banking customer, your VantageScore will be at your fingertips every time you log in from a desktop or laptop device with your username and password.

Just click "Your Credit Score" under "Your Accounts" to access Chase Journey.

Be aware this will not work via the Chase mobile app or if you are also a Chase business customer.

Chase business customers can access Chase Journey the way non-Chase customers do.

The login screen looks like this:

Credit Journey gives you access to handy information you can use to monitor your credit.

Use Chase Journey to:

Get alerts about changes to your credit report. Changes to your credit report could be signs of fraud.

Or it could mean you've taken positive action to improve your score.

Receive alerts to track the good, the bad, and the ugly about your credit utilization and other important factors that make up your credit score.

Get your free Vantage 3.0 credit score. Check your score whenever you want.

Remember, checking your own score does not affect your credit.

Find out how specific actions may affect your score. The Credit Journey score simulator lets you see what might happen if you pay off debt, take out a loan, maintain a solid payment history, and more.

And it's good to know Chase Journey refreshes your score every time you log in.

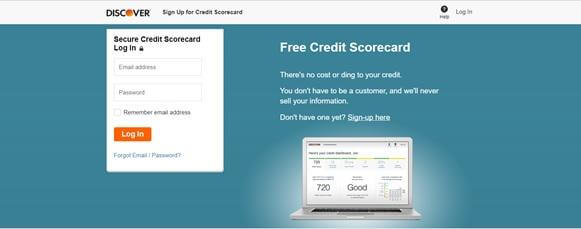

Log in to Discover Scorecard and discover how a better credit score can help you

Discover also provides its own version of free credit score monitoring.

The login is even easier than the one offered by Chase and doesn't distinguish between customers and non-customers.

Everyone takes the same steps to monitor their credit score for free.

Signing up is also easy. Follow these steps to sign up for the Discover Scorecard:

1. Create an account. You'll need to enter your name and a password that is 8–32 characters, and includes at least one number and one letter.

You'll need your full social security number to complete the process.

2. Verify your identity. Answer a series of questions that are part of your credit or employment history.

Some of the answers could be tricky because "None of the Above" is an option.

Past resumes, bank statements, or a good memory may help you answer these queries.

3. Get your free credit score. Once you answer the questions and click "verify," you'll have your FICO score in seconds.

Unlike many other free credit monitoring services, the Discover Scorecard gives you access to the holy grail of credit scores—your FICO score.

The FICO score is used by 90% of lenders to determine a person's creditworthiness.

Download your score to monitor your progress. You can also download your free credit scorecard to keep and monitor your progress over time.

See where you can improve. The Discover Credit Scorecard shows you what factors affect your credit score.

It goes in-depth to show your exact credit utilization, length of credit history, total number of accounts, and number of missed payments.

Gain actionable insights. Discover Scorecard provides customized tips to improve your credit score.

The downside?

You can only check your score for updates every 30 days.

Check your credit score on the go with CreditWise

Just like ChaseJourney, CreditWise from Capital One is available to customers of the bank as well as non-customers.

Customers can log in using the same information they use to access their Capital One accounts.

The CreditWise login screen is easy to access and is the same for customers and non-customers alike.

Using your free CreditWise account is easy. Simply follow these steps:

Enter your personal information. You'll need your birthdate, current address, and social security number.

Verify details. As with Discover, you'll need to answer some security questions gleaned from your credit and employment history.

Gain immediate access. Get your free FICO credit score from TransUnion in seconds.

Analyze the results. Like the Discover Scorecard, the service breaks down the factors that help determine your credit score and shows how you are doing in each area.

It displays exact percentages for on-time payments and credit utilization.

It also shows the exact amount of credit in dollars you have available in revolving accounts.

Play the "what if" game. The CreditWise from Capital One credit simulator helps you test different scenarios to see how certain actions improve your credit

See how taking positive action, such as paying down some of your debt or making on-time payments, can affect your credit score.

You can also use the credit simulator to simulate how negative actions, such as wage garnishment or foreclosure may affect your credit.

If you are considering taking out a loan, filing for bankruptcy, or canceling a credit card, you can use the credit simulator to see how it may affect your credit.

Dig deeper. Unlike many other services, your free CreditWise from Capital One account allows you to view your TransUnion credit report.

And with your credit report in hand, you can really take charge of your financial future.

You can see any delinquencies on your account, the number of accounts you currently have open, and even who made inquiries into your credit.

(Remember, checking your own credit score or accessing your own credit report does not count against you as a credit inquiry.)

Check in weekly. Your credit score is updated weekly.

Best of all, CreditWise from Capital One offers an app to let you monitor your credit score conveniently and for free from your mobile device.

Consider Free Credit Monitoring from Other Sources

After suffering a data breach, companies often offer free credit monitoring.

But should you take advantage of these free offers?

Before you decide, evaluate the service and its offerings on a case-by-case basis:

- Is it provided by a reputable company?

- How often can you monitor your credit score?

- What other benefits does it provide?

- Do they require a credit card to sign up?

Some credit monitoring services are reactive only—they alert you after there has been a change to your file, but you can't access your credit report or credit score anytime you want.

We recommend using a credit monitoring service in conjunction with a website like Credit Karma or Quizzle to stay proactive about tracking your credit score.

If you do sign up for a free service following a data breach, make sure the service does not require a credit card number with the intent to bill you after your free trial expires.

Equifax offers free monitoring to anyone with a U.S. social security number

The Equifax data breach was the largest in history, potentially affecting 143 million U.S. consumers.

As a result, Equifax offers free credit monitoring through TrustedID for one year.

If you signed up before January 31, 2018, TrustedID will also monitor your Equifax credit report for life.

But should you take advantage of this free monitoring service?

The TrustedID Premier plan provides access to all three of your credit reports.

It also provides insurance protection against fraud.

Beginning January 31, 2018, the service will permit you to lock your Equifax credit report, preventing new credit inquiries.

With all these benefits, why does it make sense to sign up for one of the many programs listed above?

TrustedID does not provide access to your credit score.

And after one year, it will only provide free monitoring for your Equifax credit report, not the others.

TrustedID is an option to consider, but it should only supplement the other credit score monitoring services you use—not replace them.

Monitor Your Credit to Strengthen Your Financial Future

Of course, your credit history is more than just a three-digit number.

You can monitor activity on all your accounts through your bank or a third-party service.

Yes, of course, we'll show you how!

Choose an online personal finance tool to stay in control of your spending

Budget trackers like You Need a Budget (free for 30 days) and Mint.com (free forever) can send alerts whenever new activity occurs on any of the connected accounts.

They also put all your financial information in one place, making it easy to review all your accounts at a glance.

Spot something amiss?

It's time to contact your bank or credit card company about potential fraud.

Major banks can notify you whenever unusual activity occurs

Banks like Wells Fargo, Chase, and Capital One let you sign up to receive email, text, or phone alerts whenever something happens.

By something, we mean any changes to your account.

Sign up for alerts. Receive an email anytime a purchase is made for more than a certain dollar amount. Or any purchase. Cash advances. International purchases.

What would represent unusual activity for you?

Stop cyber-thieves in their tracks. Staying aware of account activity can help you detect fraud and avoid or minimize any damage.

Even if you aren't liable for the unauthorized or fraudulent charges, it may take some time to recover those funds or reverse the charges on your credit card.

It's best to stop cyberthieves in their tracks with account alerts.

Monitoring your credit reports gives you a wealth of information to help keep your finances on track

Look to the three main credit bureaus in the U.S. to monitor your credit for free.

Only by checking your credit reports from each credit bureau (Experian, TransUnion, and Equifax) will you get the full picture of your credit history.

Your financial life, in black and white. You can check all three credit reports once a year through AnnualCreditReport.com.

Inquire strategically. Since you are entitled to check each report once a year, space out your inquiries every four months so you can monitor changes to your credit reports more frequently.

Denied credit? Find out why.

You are also entitled to a free credit report from each credit bureau any time you are denied credit.

Remember: Checking your own credit score or credit report never affects your credit.

It is considered a "soft pull."

Monitor Your Credit Score to Improve It

With all these free tools available, it doesn't make sense NOT to monitor your credit score.

Whether you choose to check through your online banking service, through an app on your phone, or with alerts delivered to your inbox, your free credit score is literally at your fingertips every day.

Watch the number rise as your debt falls

Once you get into the habit, you'll enjoy monitoring your credit score just like a fun little game.

Seeing your credit score go up with a clean payment history, and enjoying the benefits of lower interest rates or better rewards credit cards, can motivate you to stay on track, making further improvements a lot easier to achieve.

Take the first steps on the road to a better credit score

Actionable first step: Take a look at the options above. Then, go ahead and …

- Choose a service.

- Enter the personal information required to sign up.

- Start monitoring your credit score to gain control of your financial future.

Next, level up your credit savvy with these advanced steps

Take advantage of any free credit monitoring offered by affected banks as restitution for possible fraud.

Use your own bank and other services to stay alert regarding possible fraud without paying for credit monitoring.

Remember to get your credit reports once a year at annualcreditreport.com or anytime you are denied credit.

Since 1998, my company, CreditLoan, has been helping consumers gain a better understanding of financial matters while providing helpful tools and solutions to effectively manage their finances.

So I sincerely hope you found this guide helpful, especially if you've been looking for cost-free ways to monitor your credit for quite some time.

I also hope these tips have inspired you to take action—to take a more proactive stance in building a brighter financial future, one credit report at a time.

Do you know of any other free credit score resources we've missed?

Feel free to share your thoughts by letting us know in the comments below!