Think experience and education are the most important ingredients to land and keep a job?

Or that your credit report only impacts your chances of getting a mortgage or personal loan?

Think again. Your less-than-stellar credit report could cost you a job opportunity or promotion.

How? Because nearly half of all employers run credit checks on employees.

Even if you do great work, complete the tasks you were hired to do, and get results, your employer is just one of many groups who can view your credit report and potentially use it against you.

The Society for Human Resource Management (SHRM) found in 2012 that almost half of employers (47%) conduct credit checks.

This number has grown from 40% in 2010.

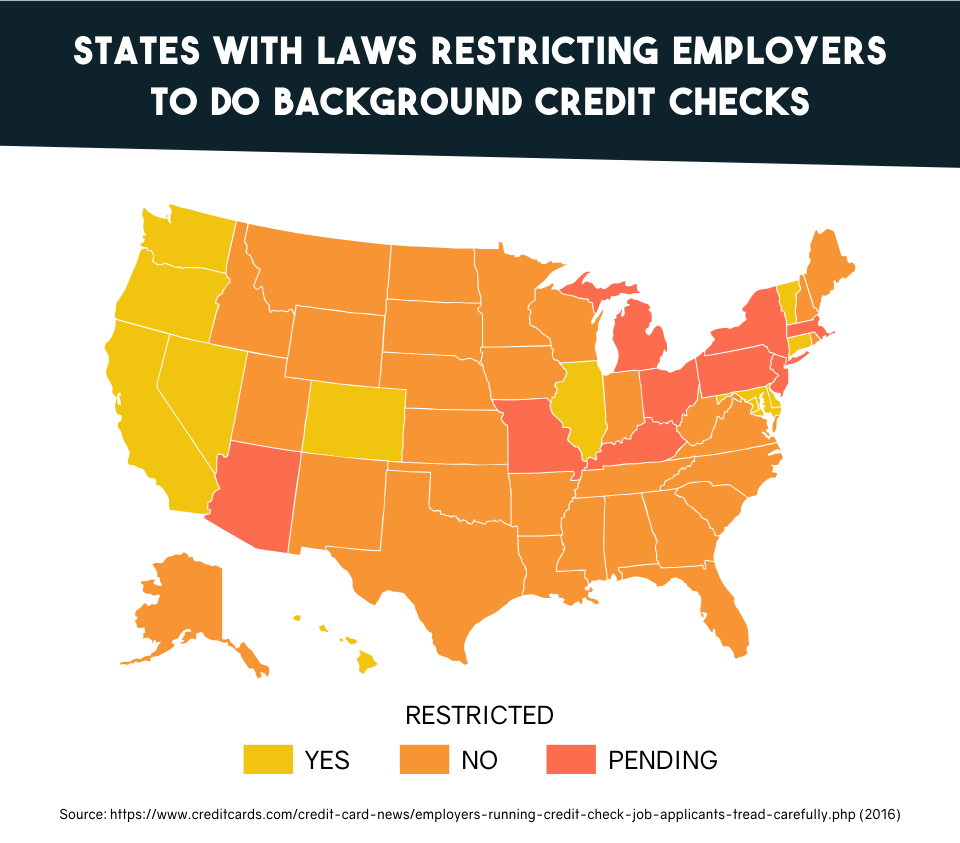

Your employer's consideration of external factors like your credit report might feel like a cheap shot, but bad credit can be a major factor in your job security (unless you live in one of the 11 states that restrict employer-run credit checks; those who live and work in California, Colorado, Connecticut, Delaware, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont, and Washington can skirt this demand.).

If your permanent digs are in a state where credit checks can be used to impact your job security, getting up to speed on the contents of your credit report will help you see how your employer could use your credit report against you.

Plus, you can immediately make a move to begin repairing your credit report.

1. Employers can't see your actual credit score, and that's a problem.

By law, employers must get written permission from you to run your credit report.

You may have signed a separate authorization for access to your credit report upon hiring.

The Fair Credit Reporting Act states that an employer only has to provide a one-time notice and receive a one-time permission from an employee to be authorized to pull said employee's credit report anytime, and as many times, as they like.

Unlike the credit reports received by lenders, an "employment screening" report does not reveal your credit score or make assumptions about your trustworthiness as a borrower.

It does, however, list the sources and types of credit you have.

These credit report omissions may seem like a win in your column, but a lack of concrete information could have you one step away from the unemployment office.

Without all the details, employers are forced to fill in the blanks—and very well might screw up royally.

Arguing + negotiating for changes to your credit report = winning

Instead of running a credit check themselves, "[t]he employer might ask you to request a free copy of your report and share it with them," says personal finance writer Louis DeNicola.

Don't be alarmed—this is a good thing.

In a 2013 Federal Trade Commission (FTC) study, one in four consumers identified errors on at least one of their three credit reports from major credit bureaus that might affect their credit scores.

While it may not seem worth it to argue over one late payment that didn't exist, this is your job on the line—every effort to safeguard your income is worth it.

And, you usually get results:

The FTC found that four out of five consumers who filed disputes experienced some modification to their credit report.

It's easy to dispute a credit reporting error, as explained by The "Get Out of Debt Guy":

- Request free copies of your complete credit report from all three major credit bureaus (Equifax, Experian, TransUnion) from AnnualCreditReport.com, a federally authorized site.

- Review the reports carefully and look for items that are not yours: closed accounts still marked as open, a possible mistaken identity, items that have been reported multiple times, etc.

- Visit Equifax, Experian, or TransUnion to file a dispute online through a detailed form.

- Do not try to dispute legit debts that you know you owe.

If the credit bureau hasn't gotten a response from the creditor in 30 to 45 days regarding your dispute, "The credit bureau will remove the account or correct the negative information and notify you of the results," says Ben, content manager and writer for Ready for Zero.

Embrace the good, bad, and ugly of your credit report so you can explain it to your boss

It's your right to limit your employer's access to your life, but being shady about revealing your credit history could make your boss suspicious that you're hiding something.

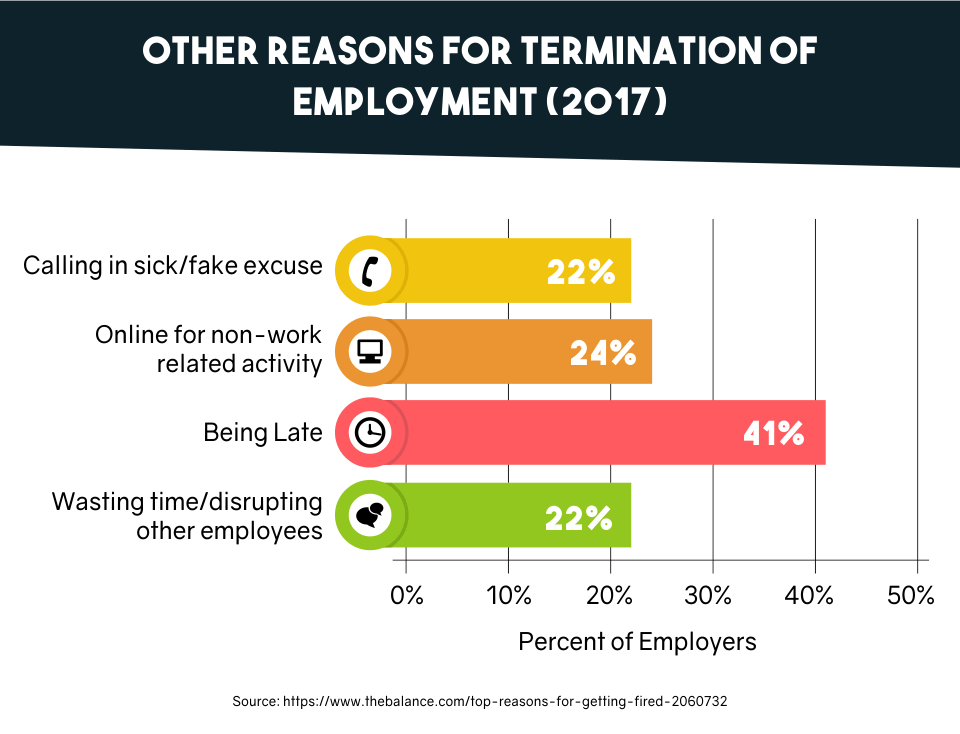

In fact, one of the top 10 reasons employees get fired today is because of dishonesty, evasion, or lack of integrity on the job.

Refusing to agree to a credit report check could make you subject to termination.

"It is important to be honest, straightforward, and forthcoming on the job with management and coworkers.

However, this does not mean that you should blurt out everything you know," says Patty Inglish, contributor to Tough Nickel.

Be straight with your employer when they ask a pointed question—don't volunteer info about every one of your IOUs.

Running your own credit check before your employer does the same not only lets you see more than what they're seeing, but provides you a chance to fix problems and prepare a defense.

Even if you have embarrassing details on your credit report, a SHRM survey found that 64% of employers give job candidates the chance to explain the negative information on their credit reports.

Put those hours of binge-watching "Shark Tank" to use and get your schmooze on—be real, but remember: how you deliver the bad news is half the battle.

2. Your credit report could differentiate you from a colleague—and not in a good way

Competing for an in-house promotion?

If you and your desk mate are carbon copies of qualifications and resume, a credit report is one way your boss will differentiate employees who have the potential to get a promotion—or a pink slip.

Jay Meschke, president of executive search company EFL Associates, explains why the baffling use of your credit score as a job decider makes sense to employers:

"Credit report information is an excellent data point when comparing and contrasting two or more candidates for the same position.

If an applicant reports a significant level of personal debt obligations or credit delinquencies that might distract that person from his or her job responsibilities, then a hiring entity may take that information into consideration when comparing such an applicant to another comparative candidate without such distractions."

Be patient about improving your credit report and you will reap the rewards

The last thing you want to do is lose a job opportunity or promotion because your credit report stinks.

But it's also difficult to transform your credit report quickly.

The moves below (and a lot of patience) can help:

- Know and understand credit utilization rate. | Money Crashers

- Pay off debt (rather than move it around). | Wise Bread

- Refrain from needlessly applying for more credit. | Experian

- Pay twice a month. | Clark

- Raise your credit limit. | Common Sense with Money

- Keep balances low. | Experian

Most of all, avoid trying to change your credit quickly, and don't fall for schemes that promise to change your credit report in a month.

Closing accounts, opening too many accounts at once, and applying for credit that you won't get approved for are three big moves to avoid when trying to improve your credit, according to Christy Bieber, contributor to The Motley Fool.

Be proactive about the contents of your credit report—and your job security

You will feel more confident defending yourself as the best person for your job when you get educated about your credit usage.

The last thing you want is to be caught off guard.

"If there is something negative in your background, be prepared to explain it and why it shouldn't affect your ability to do the job," says Ben Goldberg, CEO of Aurico, an employer-employee matching company.

Take baby steps.

You will see your credit score creep up.

Plus, being able to explain to your employer that you are in the process of revising your credit report can win you serious points in the honesty and motivation departments.

3. Your employer is tired of getting burned by hiring unreliable candidates

No industry or employee is immune from credit report checks by their employer.

Why?

Your boss needs a backup plan.

A staggering 75% of employers report they have hired the wrong person, according to a Careerbuilder survey.

The average cost of just one bad hire is almost $17,000.

No company wants to pay to fire someone any more than you want to be fired.

It makes perfect sense why many employers look at employee credit:

- to decrease theft

- minimize embezzlement

- prevent lawsuits for hiring the wrong person.

Spencer D. Cohn, author of "Beat the Boss—Win in the Workplace," says, "Some companies use credit reports as part of employee evaluation."

Unfortunately, some employers will hire a person before they've completed the background check, including a review of their credit report.

"Then, after you've worked for a month, they find something and let you go."

Alas, the good credit you may have had when you started your job may not be the credit you have now, which could make you look unreliable.

One unfortunate life situation could tank your credit.

The Great Recession hit plenty of people hard and they're still feeling the sting.

Life happens.

Money gets tight.

But what you do to cope with financial challenges will impact your credit report and how your employer views you.

Show your boss you're reliable, even if your credit currently stinks

Here are some of the credit score and credit report apps that can help you get on track.

Plus, using these is concrete proof that you're taking steps to improve your credit:

- CreditRepair.com: Track credit repair progress to see what items have been removed, those still being disputed, and to view credit alerts.

- Credit Sesame: Get credit score monitoring, identity theft protection, and study historic and trending finance charts.

- DebtTracker Pro: Keep track of all debts, figure out what to pay off first, and monitor credit utilization to keep that number low.

- Equifax: Gauge identity theft in your area, how your credit measures up to others, and get alerts about key changes to your credit file.

- Mint: See all your finances at a glance and receive bill-pay reminders before you get charged another late fee.

If you're hiding behind your smartphone to avoid your debt and troubling credit report, download an app that can push you in the right direction.

Personally, I'm a big fan of Mint, which has helped me curb my tendency to splurge all too often on my new found love of an afternoon latte.

But, rest assured, any of these apps, if used earnestly and persistently, will get you and your credit back on track.

Don't allow fear or confusion to prevent you from tying up the loose ends in your finances.

You'll be a better and less-stressed employee when you get educated, and get busy making changes to your credit.

4. Thanks to your credit report, your employer thinks you can't stick to a budget

Companies run on budgets.

There is a certain amount of money to go around and where and how it is allotted is planned carefully by the powers that be.

When you have been entrusted with a company credit card or expense account, or if you handle cash, your employer wants to know you can manage the responsibility you've been given.

If your credit report shows you've maxed out your credit cards, that's a big sign you may not be the kind of person who can stick to a budget.

Your ability to be a responsible employee will come into question, no matter what kind of professional track record you have so far.

Prove you can manage a budget by creating and using one

One of the biggest reasons people get into trouble with their credit report isn't necessarily because of student loans, car debt, or a mortgage—it's because of daily spending.

Without paying attention to every purchase you make, you truly have no accurate idea of where your money is going.

Budgeting can help you keep track of your finances, set aside money to pay off debt, and improve your credit report.

Some budgeting tips:

- Track and categorize monthly expenses for two months, from groceries to child care to gas. | Daily Worth

- Define your goals. | Smart Asset

- Keep it real and don't try to budget like you have more funds than you do. | Every Dollar

- After a month, reevaluate your budget based on your spending. | Living on a Dime

- Keep tracking expenses, from day to week to month, so you stay accountable. | Man vs. Debt

- Give yourself an allowance. | Bustle

Successfully maintaining a personal budget will also give you a leg up on the job.

You'll be more aware of how money is distributed in your department. And you'll be better at managing cash in all areas of your life.

There are always factors beyond your control—and that's OK

If your employer is cleaning house by running credit reports, you could be a casualty depending on what your report reveals.

As Rachel Farrell, a writer for Career Builder warns, "Supporters of credit checks don't think [reviewing a credit report] is any different than checking a candidate's references. But opponents see it as unfair—especially in this economy—because medical problems, divorce, or a job layoff and subsequent missed bills can wreck an otherwise perfect credit score in an instant."

When CreditLoan.com was still in its infancy, money was really tight, and my wife and I lived a bit precariously for a number of years.

We had a very, very modest wedding and reception, because that was honestly all we could afford.

Thankfully the site was my own business, as any number of the loans I took out could have raised an eyebrow with an employer.

In other words, I can empathize with that job insecurity.

Maybe your spouse was very ill and you had to file for bankruptcy because the medical bills took all you had.

Being up-front about this understandable reason for a bankruptcy prevents an employer from assuming you're just incapable of managing your finances.

5. Your curious spending habits could point to a bigger problem, and your employer wants no part of it

You've likely heard the anecdote that every relationship has one spender (you) and one saver (your employer).

If you're giving your employer a reason to be concerned about the money you seem to be blowing in your personal life, they will think twice about sharing company finances or brand secrets with you, or giving you more power than you're capable of handling.

And there's a good chance they'll run your credit report to confirm their suspicions.

Just because you have credit doesn't mean you should use all of it

Besides maxed-out credit cards, there are other pieces of evidence on your credit report that could indicate your inability to manage money, and put your job in jeopardy.

Just to name a few: multiple late fees, liens, opening and closing too many accounts, foreclosure, or bankruptcy (though section 525 of the U.S. Bankruptcy Code prevents employers from firing someone because they are bankrupt).

There is also clear evidence available when your credit might be sinking.

Writer Chuck Saletta explains on AOL that "[i]f you are having money troubles, the first step toward regaining control is to stop trying to put on flashy displays of wealth you don't really have.

You're neither fooling nor impressing anybody by showcasing your spending, and your employer already knows what you make."

You might have plenty of plastic in your wallet, but that doesn't mean you should use it.

In fact, the skinny from credit experts is that you shouldn't be using more than 30% of your available credit on any one card at any one time.

Spending less is even better.

Good practices for holding credit cards:

- Pay off your credit cards on time.

- Try not to hold a balance on your cards or accrue interest.

- If you do have a balance, keep it well below your credit limit.

- Don't use your credit cards unless you have the cash to pay off each statement.

- Only apply for credit you need.

Be mindful of credit card usage—it's not just about the amount charged, but the amount paid off.

While your employers may be unable to view specific activity on your credit cards, significant amounts on the same card month after month could indicate a distracting habit, addiction, or spending problem.

Say you have a GameStop credit card, and you consistently rack up major charges.

All that time you've spent "working from home" lately could have your employer wondering if you're gaming instead.

AOL writer Saletta takes this example one step further:

"At most companies, having personal money troubles are not a fireable offense. But if your performance is slipping, the odds are slim that your boss will pick you for the next available role of increasing responsibility.

If the company also has reason to believe money troubles are behind your performance slippage, you can expect significantly tighter scrutiny on whatever areas you do have any individual discretion over."

If you want to maintain job security, you need credit report security too.

And that begins with being smart about how you use your credit cards, pay off loans, and minimize your debt.

The Bottom Line

Before you get too hard on yourself for any credit mistakes, remember this: Having bad credit does not automatically disqualify you from your job.

A less-than-awesome credit score does not mean you're a failure.

But what you do with the financial dire straits you're in does say a lot about who you are as a person and an employee.

Protect yourself and your job by applying the advice provided in this guide. View your credit report.

Dispute errors.

Monitor your spending.

Pay your bills on time.

Use credit cards wisely.

And don't lie about your credit history to your employer.

Has an employer credit check ever impacted your career, negatively or positively?

Did you ever work to improve your credit report to make sure your job stayed safe?

Let us know in the comments below.