Know Your Credit Report

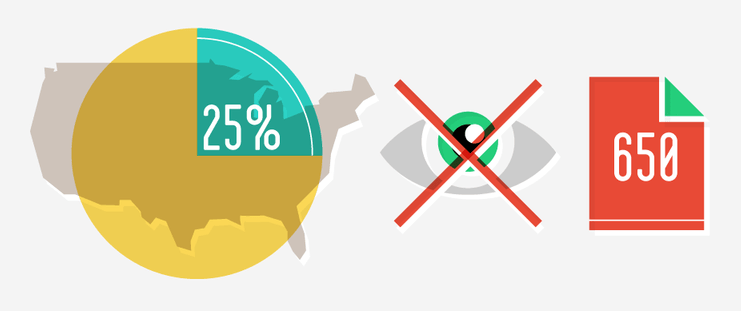

For many people, the idea of reviewing their credit report can be intimidating. In fact, almost a quarter of U.S. consumers have never seen their credit report, according to a recent survey from FindLaw.com. That means 25 percent of the population have no idea how accurate their report is. Millions of others have seen their credit reports but not taken the time to make certain their information is accurate. Mistakes in a credit report can affect all aspects of life, from interest rates to employment opportunities.

Understanding your credit report, and making sure it's accurate, is important for more than just your financial health. A great place to start is right here, where you can see your free credit Report Card and score without paying a dime!

Credit Report Basics

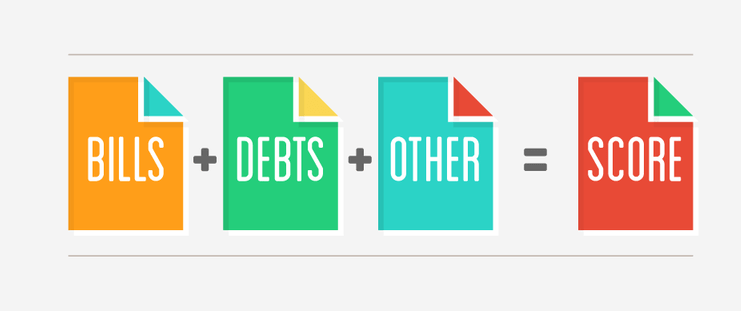

Your credit report is a detailed record of how you pay your bills, debts and other financial obligations. It reflects how much credit and debt you have, how many times you've shopped for credit, your employment status, bank account information and many other financial details about your life. Simply put, it is a detailed record of your credit history and worthiness.

What's In A Credit Report?

Although each credit reporting agency (or credit bureau) uses a different format, all reports contain these 4 groups of information. Because each section includes specific information, it's important for you to review each section carefully and ensure accuracy and correct any errors. If errors are present, and chances are you'll have a few, it's up to you to correct them. See How Do I Correct My Report for more.

Your credit report contains the following:

Personal Identification Information

This includes your name, address, date-of-birth, Social Security number and employer's information.

Credit Lines and Accounts

This includes all of your credit and loan accounts, including credit cards, mortgages and any other loans you may have. Bank accounts may or may not be included in your credit report. However debit card accounts and some overdraft protection accounts may be included.

Credit Inquiries

This record includes all the times your credit is checked, loans applied for, new credit card applications and any other instances that your credit is checked (including apartment leases, cellphone contracts, utilities and more). These are considered "voluntary" inquiries. Other times your credit might be checked by companies soliciting you for various products, including new credit cards or loans. These inquiries are considered "involuntary." Voluntary inquiries will affect your credit score, unless they are made by you.

Public Records and Collections

Your credit report will also contain public records and collection records. Public records include bankruptcies, lawsuits, liens, judgments, wage garnishments and foreclosures. Collections include the times a creditor has tried to collect overdue debt from you by sending your information to a collection agency or any other time you've been sent to a collection agency.

How Your Credit Report Is Used

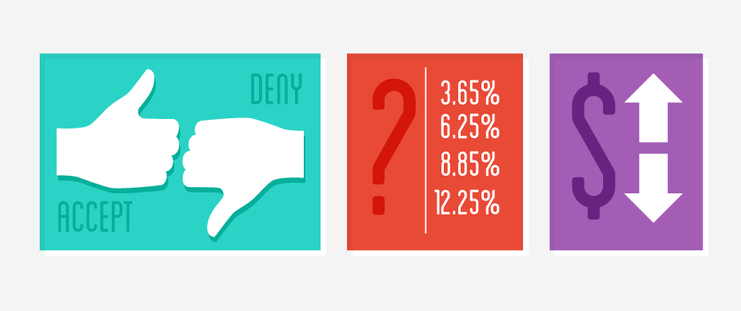

Your credit report is used by lenders, creditors, employers, utilities, cellphone companies and many other service providers to determine the level of risk you present. You may pay more or less for a service, or be denied altogether, depending on what's in your report. If you are applying for a loan, your interest rate is determined by what's in your report. Lenders and service providers want to know if you can be trusted with additional debt, if you will pay them on time and whether or not you are responsible with your finances.

Who Creates Credit Reports?

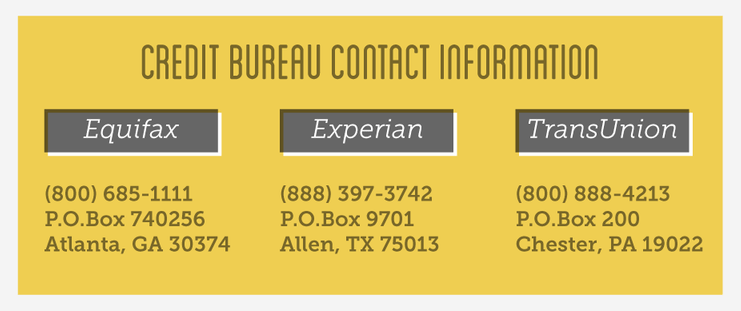

There are three major credit bureaus in the United States. These are Equifax, Experian and TransUnion. Your financial transactions are usually reported to all three bureaus. However, it's important to check your credit report with each agency to make sure your information is correct.

In addition to recording your credit history, these bureaus use your information to determine your FICO (Fair, Isaac and Company) score. While your score will vary depending on agency, credit scores range from 300 to 850, with 850 being a perfect score.

How Often Are Reports Updated?

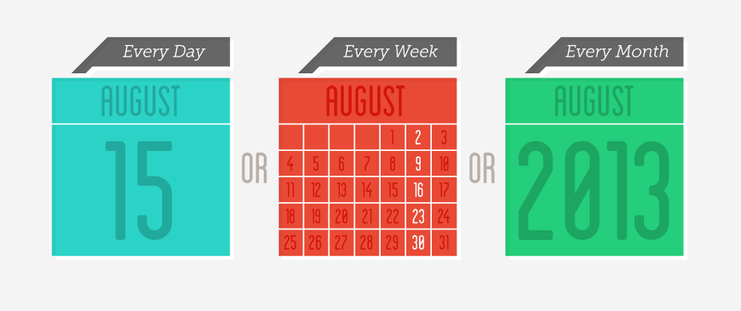

Your credit report may be updated daily, weekly or monthly, depending on the number of accounts you have and when those accounts are reported. For example, if you only have one account and you are never late on any bills, your report will be updated every month. However, if you have many accounts and delinquencies, your credit report could be updated every day.

How To Correct Your Credit Report

If your credit report has the wrong information, it is up to you to report it to the appropriate bureau. While the credit reporting agencies have a responsibility to report correct information, you do too. The Federal Fair Credit Reporting Act (FCRA) helps protect the accuracy and privacy of your information and encourages the bureaus to take action quickly when there is a dispute. If you find information that is not corrected, follow this two-step process to have it corrected.

Step One

Write the credit reporting agency and tell them what is inaccurate. The agencies have a responsibility to investigate your dispute within 30 days after receiving your request. The Federal Trade Commission has a sample letter for you to use when you find an error. Be sure to send copies (never originals) of all supporting material with your letter.

Step Two

Write directly to the creditor or other provider that sent in the inaccurate information. Like your letter to the reporting agency, you will want to include copies of all relevant information, along with your dispute letter.

Remember: Many times, creditors have specific mailing addresses for credit disputes. When writing, be sure to find the correct address. You can use the same sample letter as the one above.

How Often Should I Review My Credit Report?

Your credit report has the potential to change on a daily basis. It is important to review your report often to check for errors as well as for activity that could indicate identity fraud.

Unexplained account activity, inquiries or other transactions could indicate fraudulent activity. If you see suspicious activity, contact the credit bureaus immediately. They can take precautions that can help protect your credit. Visit our ID Theft page for more information on keeping your identity safe.

Credit Bureau Contact Information

What Goes Into Your Credit Score?

How Can I Check My Credit Report?

Get Your Free Credit Report!

- Knowing your credit score is the first step towards lower interest rates and higher approvals

- Full report from Equifax®, Experian®, and TransUnion®

- Find and prevent identity theft by understanding your credit history