A Quick Rundown of Equifax

Trusting Equifax to help with managing credit might feel like a leap of faith.

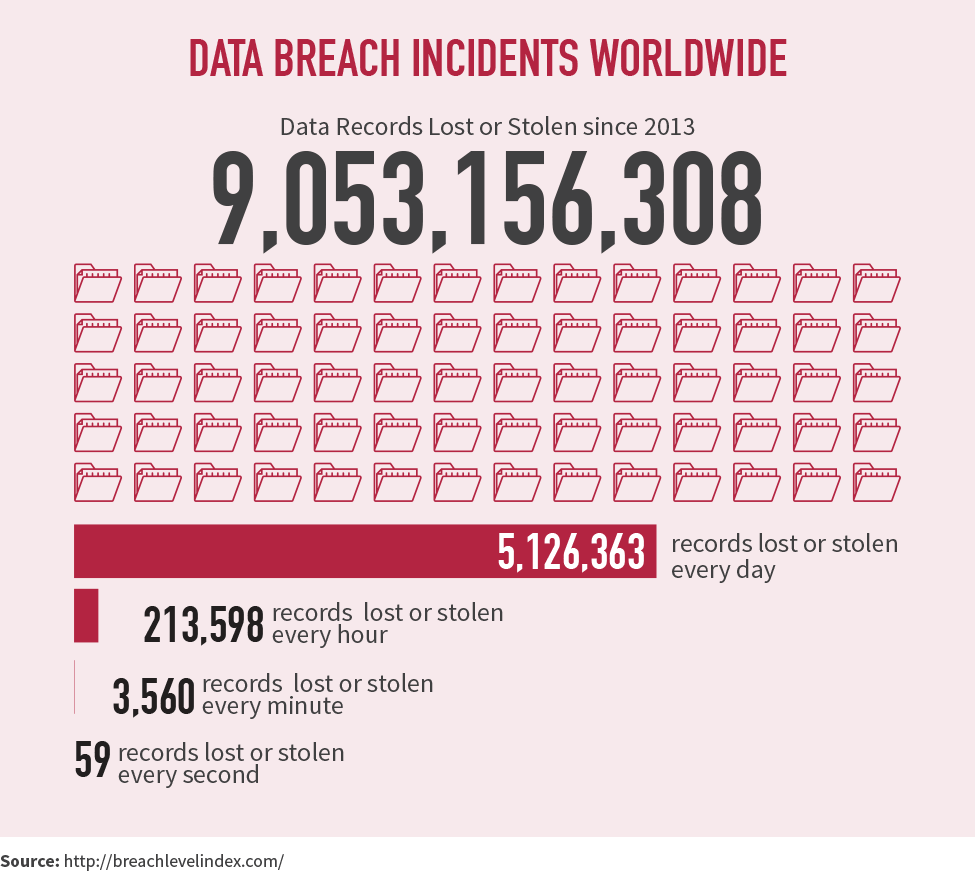

Over the summer, hackers found their way into the company IT infrastructure and exposed an estimated 143 million records.

The fallout has some questioning whether Equifax is a legitimate company.

If you would like to learn how to protect yourself from the hack, you have to read 9 things you need to do to protect yourself after the Equifax hack.

Luckily, while there's plenty of well-placed fear and hundreds of consumer complaints already documented, Equifax hasn't been idle.

Key executives in place during the breach have since been moved out, and a website set up to identify and serve affected customers provides instructions for freezing your credit accounts in the event of suspected identity theft.

The company is also offering its most premium credit monitoring service to consumers free for a year.

And come January 2018, a new free-for-life service will allow consumers to lock and unlock access to their Equifax credit files at any time.

Locking your credit file keeps creditors from accessing your information, and prevents an ID thief from opening up new accounts in your name.

Regardless if you were affected (and chances are VERY high you were), is it worth it to become an Equifax member?

Can having more insight into how creditors see you help improve your credit score?

When it comes to credit monitoring, every review of Equifax still says, "yes."

Here's why:

Equifax's scoring system closely mirrors the standard used by all lenders.

Though only myFICO offers consumers access to the credit scores that lenders see, Equifax's approach is a close second.

Fair warning: every lender differs when pulling a credit score, there's no consistent logic.

Access tools to help you boost your credit score.

Equifax's online dispute resolution and Interactive Score Estimator can help you improve your credit rating.

But here's the thing, while it may be top of the pile when it comes to credit monitoring, that shouldn't matter to most of us.

Most people do not need to pay a monthly fee for credit monitoring.

Most of us need to know our credit score which you can find out for free by pulling your free report at AnnualCreditReport.com.

If you're looking for just your credit score or a credit report, then you shouldn't bother with Equifax or any other credit monitoring service.

But if you are deeply concerned about fraud and identity theft, Equifax's credit reporting services and tools may be just what you need — when they become available again.

Equifax has temporarily halted sales of subscription products and is instead giving consumers free access to its TrustedID Premier service for defending against identity theft.

Still interested?

Let's talk a little more about what you can expect from using Equifax credit monitoring services.

The Competition

TransUnion should benefit most from Equifax's recent troubles

With a reported 1 billion global consumers in its consumer credit database, TransUnion is the world's largest consumer credit bureau.

Equifax, at 820 million records, ranks a close second while Experian lags at 22 million.

Is TransUnion at the top because it's a better bet? Not necessarily.

TransUnion uses VantageScore which lenders don't see as close to FICO as they like.

Most lenders use your FICO score to determine your creditworthiness.

What makes this a little confusing is that the three major bureaus, including Equifax, introduced VantageScore as an alternative to FICO since none of them has direct access to the FICO scoring model created and used by Fair Isaac, the creator of the FICO score.

So while Equifax is partly behind VantageScore, it's scoring model approximates your FICO score more closely, which lenders like.

Think of it like Equifax is having its cake and eating it too, being a part of VantageScore while billing itself as a proponent of FICO.

Equifax provides more data on consumers than TransUnion.

This richness of data explains why the company was such a ripe target for attackers, and why some are reporting that Equifax could face the largest class-action lawsuit in U.S. history.

TransUnion credit reports include more comprehensive employment data.

"You can update or correct several fields, including: your current or previous employer's name, the position you held and the date you were hired," writes Lynnette Khalfani-Cox at The Money Coach blog.

That's good if you're looking for a loan because some lenders are willing to consider more than just your score, like how reliable of an employee you are, for example.

But, unfortunately, having a perfectly accurate employment history won't affect your credit score.

TransUnion has a limited relationship with Experian.

So even if you sign up for the company's $19.95 monthly credit monitoring service, you won't be alerted to changes on your Experian report.

The Takeaway

While TransUnion may give Equifax a run for its money, until more credit card issuers, mortgage lenders, car dealers, etc. begin to use VantageScore, Equifax has TransUnion beat.

The Question Everyone Is Asking

How do you get a free credit report from Equifax?

While you are entitled to a free credit report every year, calling or writing Equifax won't necessarily do the trick.

Your best bet is to visit annualcreditreport.com and request a copy.

You can also call (877) 322-8228 or write to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

Be sure to include a note requesting your report.

Having said that, there are a handful of situations where Equifax will provide members with a free credit report directly.

You are entitled to one additional free copy during any 12-month period if:

- You are unemployed and intend to apply for employment within 60 days.

- You are receiving public welfare assistance.

- You believe your file contains inaccurate information due to fraud.

- You have been denied credit or insurance within the prior 60 days.

To get your free credit report, visit Equifax.com or call (800) 685-1111. You can also mail a request to: Equifax Disclosure Department, P.O. Box 740241, Atlanta, GA 30374.

You can also get a free credit report and score from us through our partnership with Transunion.

The Strengths

Equifax tracks credit scores and changes across all three bureaus

All three bureaus have tools for monitoring critical changes in your credit, whether they appear at Equifax, Experian, or TransUnion.

Equifax and Experian track changes in credit scores.

This close monitoring is why some people–who are afraid of fraud and identity theft–choose to buy credit monitoring services.

But again, there's a catch: only lenders see true FICO scores and myFICO is the only place where consumers can buy access.

So why should you place more faith in Equifax's offer?

According to Khalfani-Cox at The Money Coach, Equifax's scoring is a close approximation to the FICO score used by virtually all lenders and credit card issuers.

By contrast, Experian's credit monitoring service uses the FICO 8 model, which may not be consistent with how lenders view your creditworthiness.

(There are at least 10 different FICO models lenders can use when evaluating you.)

The Weaknesses

Equifax may not be as secure as we were led to believe

In July, attackers exploited a weakness in the company IT infrastructure via an online portal through which consumers are instructed to file disputes.

Security is a problem.

Roughly 143 million U.S. consumers appear to have been impacted. (Again, it's easy to find out if you've been affected.)

You could join a class-action lawsuit in hopes of getting relief — there are more than 50 underway right now — or you could take steps to protect yourself with credit monitoring.

Or you could do both.

Customer service is a widespread complaint.

Ironically, if you're signed up for one of Equifax's services you'd be among the first to know if anyone was trying to play and fast and loose with your credit.

But don't expect to get much help if you run into problems: customers say Equifax representatives are notoriously tough to reach and generally unhelpful.

Why You Need This Service

Equifax is for you if fears of fraud and identity theft keep you up at night

Does the thought of someone stealing your identity keep you up at night?

Have you ever been the victim of credit card fraud or fear you may become a victim?

If so, then buying credit monitoring services from Equifax may make sense.

But keep in mind, Equifax can NOT stop any fraud or theft. All they can do is:

- Tell you it may be happening.

- Help you freeze your credit score if you believe so – giving you time to deal with the issue.

The Company's History

Equifax is almost 70 (!) years older than its closest competition

Founded in 1899 in Atlanta, GA, Equifax is the oldest of the three credit monitoring agencies.

Of the other two, TransUnion appeared in 1968 — nearly 70 years later! — while Experian forerunner TRW Information Services spun up in 1970 as a subsidiary of the defense contractor made famous for helping to build NASA's first nuclear-powered spacecraft.

What The Company Does

Here's how Equifax's credit products work and what they do for you

Equifax is one of the three major credit bureaus whose business is to develop a record of your credit accounts for lenders who may want to know whether you're creditworthy.

The company also has a healthy consumer business, offering multiple subscription products for monitoring changes on your credit reports, your credit score, and to guard against identity theft.

Here's a look at the company's most popular subscription offerings.

Equifax Complete Premier Plan

Billed as the company's most "comprehensive" credit monitoring and identity protection product, the product has a few advantages that make it potentially worth the $19.95 you'll pay monthly.

Monitor changes in your file and your score across three bureaus.

While Experian offers a similar service, Equifax's own credit scoring model is similar enough to FICO that your reports should be an accurate reflection of how lenders see you.

Text message alerts. Admittedly an extreme step, you may want text alerts of changes to your account if you're one of the 143 million potentially affected by the Equifax data breach, or if you've been a victim of identity theft in years past.

$1 million in ID theft insurance. Others offer as much in terms of protection in the event ID theft, but we mention it here anyway because there's no point in paying up for a comprehensive service if you aren't also getting comprehensive coverage in the event an ID thief finds his way into your accounts.

Equifax Complete Family Plan

Essentially, the same the Premier Plan with some twists that make it potentially worthwhile.

But at $29.95 monthly, it's a big pill to swallow.

Notable additions for the price include:

Full monitoring for two adults. Say you're living with a partner or married but filing taxes separately.

Being able to monitor two distinct accounts could help you to get a full picture of your credit profile.

Monitoring for up to four children. Why have this?

Every child has a Social Security number and sometimes that's all a miscreant needs.

Equifax locks their reports to prevent records from being compromised before they can even start building credit.

Equifax Complete Advantage

Slightly less expensive than the Premier Plan at $17.95 monthly, the major difference here is $25,000 in ID theft insurance and that you'll get a report and 3-bureau Equifax credit score once annually.

After that, you'll have the right to check your Equifax score — but not changes in your credit profile — anytime.

Equifax ID Patrol Premier

Another way to get $1 million in ID theft insurance, Equifax's ID Patrol Premier is the fraternal twin of the company's premier credit scoring service, and also costs $19.95 per month.

Other services include:

Annual access to 3-bureau reports and scores. In addition to monitoring for changes in your records, Equifax ID Patrol Premier includes an annual check-up that includes a comprehensive report and Equifax scores for all three credit bureaus.

Internet scanning. This is the sort of service victims of the Equifax data breach may need most.

Why?

It's designed to monitor the places where miscreants hang out, selling stolen data.

If yours is found anywhere in these dark corners of the web, you'll hear about it and be able to take action.

Financial alerts for key accounts. Here, Equifax promises to monitor accounts of your choosing and then notify you when there are substantial changes.

Think of it as an early detection system for ID theft.

Freeze your credit with Equifax Credit Report Lock. Whether or not you have a premier service, if you've been alerted to potential ID theft, you can request a "security freeze" on your Equifax file to prevent creditors from accessing information.

The Credit Report Lock works similarly, except with a bit more control because you can decide under what specific conditions your information gets hidden, and from whom.

Think of it as the difference between building a moat around your house and locking the doors.

With the latter, those with keys can still get in.

Equifax Credit Report and Score

For a one-time fee of $15.95, Equifax Credit Report and Score promises your report, your score, and an Interactive Score Estimator to check how certain actions could affect your Equifax Credit Score.

But be warned: the product is only active for 30 days, and there are no refunds.

Only invest if you're on the verge of a major transaction such as buying a car or refinancing a mortgage.

A word of caution before you buy… your Equifax report won't include everything you expect

Your list of bills probably doesn't begin and end with your credit card statement.

Doctors, hospitals, loans from credit unions, insurance companies, landlords — you've got to pay them, but only a handful will report your account or payment history, write the experts at Dummies.com.

Don't be surprised if Equifax has no record of you paying off the car loan you got from your local credit union.

What People Love About It

People love it when Equifax fights for them

Equifax gets mixed reviews depending on where you look.

Visit ConsumerAffairs.com, for example, and you'll end up reading a long list of complaints about the data breach and wondering if Equifax is even a legitimate company.

It is, okay?

And if you look at reviews of the products, you'll find plenty of consumers who've used Equifax to successfully dispute errors, though it's not clear that any of these consumers are actually using Equifax credit monitoring.

You don't need to subscribe to any service to dispute errors in one or more of your credit reports.

"I feel that Equifax is a quality service. They were helpful in correcting an error on my credit report. This led to an increase in my credit score. The [data] that they provided is easy to understand and comprehensive," writes one Equifax member.

Others agreed, while also noting that it can take a long time for Equifax members to get results.

"When I went through a divorce and noticed certain things were still on this company's report for my credit that weren't on other sites, I sent them all of the documentation that they asked for, and the process still took about 5 months to resolve along with about 10 requests for more paperwork along the way," writes another Equifax member.

Biggest Complaints

Consumers often complain about poor customer service

Equifax may be good at handling disputes, but when it comes to getting service in other areas, reviewers weren't as charitable.

At BestCompany.com, Equifax member lena writes that her calls to Equifax were often sent to an overseas call center where no one had the authority to give her the help she needed.

"No resolution… how can I get my issues corrected when all they do is read off a piece of paper?"

Other members cited a slow response to complex problems.

"Equifax has my husband's social security number associated with another individual's name and information," writes Charles P. at the company review site for the Better Business Bureau.

"They are saying it normally takes 30 days to investigate this type situation. I realize the seriousness and agree with a thorough investigation. Surely there is a faster way to verify my husband's social security and credit as we have been totally debt free for years."

While these reviews are troubling, a more in-depth review at ASecureLife.com speaks not only to the customer service issues other face but also suggests Equifax's agents don't know how to differentiate its credit monitoring services from alternatives.

"Posing as a potential buyer, I contacted Equifax via live chat and had an odd experience. I was connected with an agent immediately and asked the agent why I should choose Equifax over another company to monitor my credit and identity.

"I ask most companies I review this question to give them an opportunity to brag about themselves. However, this agent couldn't really distinguish what Equifax was good at—he wasn't trying to sell me at all.

"I was disappointed and felt that he wasn't informed enough to motivate me to purchase Equifax," writes Kimberly Alt.

Key Digital Services

Equifax's digital apps are among the industry's best… when they're available

The online dispute system that consumers love has been altered and is being closely monitored because of how attackers penetrated the underlying technology to break into the Equifax database and steal information.

Equifax hasn't provided any specific updates on the state of the dispute system as of this writing, but it is online and appears ready to take new complaints.

That's not as true of Equifax's apps for iPhone and Android, both of which had been highly rated but were not available for download as of this writing.

In a LinkedIn post from over the summer, security researcher Jerry Decime explained that Equifax's apps didn't store all data securely, creating a simple yet unintended exploit for attackers looking to "intercept and modify response traffic" — a potential doorway to identity theft.

So, hang tight.

New apps are likely on the way soon, and it's a good bet they'll provide similar features, such as the ability to compare your credit score to others in your area or check your score wherever you are, or get help with a lost wallet.

How To Start The Service

Ready to get started?

While Equifax has agents, the number, and variety of complaints from consumers calling in to get information is scary.

If you're a customer or thinking of becoming a customer, you'll need to create a secure login upon signup.

"I called in to get written confirmation of product details [on Equifax ID Patrol], but was referred to their secure website to get this info using my product login ID," writes former Equifax member Therese Markert at BestCompany.com.

And if you aren't shopping but need information? Equifax demands you fill out forms to file a dispute or freeze new credit inquiries to keep identity thieves at bay.

Make sure you keep a copy of all your paperwork. Credit information is sensitive, so you'll want to make sure you have not only your username and password but also any identifying information about your transaction either printed or written down in the event you need to call Equifax about changes.

To start, have the following ready when you call:

- Social Security number

- Driver's license number

- Equifax account number

- Credit card number or the account number for anything on your account you'd like to question

- Phone number

- Address

- Birthdate

And on that note…

How to Stop Using The Company

Have all your documentation and call

Please don't make the mistake of failing to keep your account information.

While Equifax gets a big chunk of its business from helping companies make credit decisions about you, it also has a subscription-driven business with clear incentives to keep consumers paying credit monitoring fees month after month.

Buy only what you need, OK?

"I purchased a credit report in December and a few days later, decided I did not want it anymore. I called in to cancel my subscription/membership and I was given a confirmation number but did not write it down — stupid me," writes Ashley, a former Equifax member, also at BestCompany.com.

So, again, if you need to cancel, gather your paperwork and other identifying information first — a driver's license number and your Social Security number, for instance — and then call Equifax's customer service line after you create a profile and log in.

FAQ

Here are the answers to the most frequently asked questions (FAQ) about Equifax

The Equifax ID Patrol Premier Plan may be your best bet since automated fraud alerts are built into the service.

Have you been in debt and aim never to return?

Or are you in debt now and looking to break free?

If so, Equifax credit services may be for you.

But it's also not the only option.

In fact, since you're interested in credit reporting services and preventing identity theft, you may want to check out these reviews and articles.

Do you use any of the Equifax credit reporting services?

How have they worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.