Bad credit hurts your wallet and lifestyle. You might find it harder to rent a car or you could be denied a mortgage. It will also cost you.

Nicholas Pell writing for The Street notes that the "difference between a good and an excellent credit score over a lifetime is a whopping $60,000. The difference between poor and excellent is over $200,000."

Obviously, that's a lot of money. Obviously, that's a lot of money, and a better credit score will benefit your life. But re-establishing credit can seem like a monumental task.

With that in mind, we put together these tips to get you started on your path to a higher credit score.

1. Mental and research prep is the foundation to any credit re-establishment strategy

Don't discount mental preparation

When it comes to bad credit, one of the least talked about paralyzers is your attitude and feelings. Us humans tend to ignore or suppress the bad, so if we're embarrassed about our credit score or past mistakes, we'll often end up in a seemingly overwhelming state of anxiety.

Lynnette Khalfani-Cox, writing about bankruptcy for aol.com, recommends focusing on the present and future to keep yourself on right track:

"[B]eating yourself up about your predicament won't make your situation any better. In fact, succumbing to a steady stream of negative emotions…can even be harmful to you by preventing you from moving forward in a positive way.

A better credit repair strategy, she says, is resolving "to make peace with the past by letting it go, and don't dwell on negative thoughts or wallow in self-pity."

An easy way to start building a constructive mental attitude is with a daily check-in where you write or talk out your feelings — whatever they are — about your credit. This might sound awkward or uncomfortable but bottling up your emotions will not help spur you into action.

Understanding your score breakdown to establish a winning strategy

Any credit card that reports your monthly credit history to the three major credit bureaus is likely good for building credit. A quick FICO credit score breakdown (the less used VantageScore credit score has its own methodology) will show you why:

- Payment history (35%). Have you paid all your past bills on time?

- Amounts owed (30%). How much money do you owe? The lower your credit utilization ratio (used/available), the better.

- Length of credit history (15%). When did you start building credit? The longer the better, typically.

- Credit mix in use (10%). What cards, accounts, and do you have? The more diverse the better.

- New credit (10%). How many cards did you apply for recently? Even a couple is often a red flag for lenders.

Speaking of strategy:

That being said, these percentage breakdowns differ and change over time from consumer to consumer. As FICO points out, depending on the major credit bureau — Experian, TransUnion, and Equifax —

"[f]or some groups, the importance of these categories may vary; for example, people who have not been using credit long will be factored differently than those with a longer credit history."

2. Rebuilding your credit doesn't happen overnight

Still, figuring out exactly how long it will take you is an important step to planning the right strategy. The first thing to keep in mind is that no matter how bad your credit history, it's always repairable.

Different types of ‘delinquencies' — as they're called in legalese — remain on your credit history for varying amounts of time. Here's the breakdown according to FICO:

- Late payments. 7 years

- Bankruptcies. 7 years for completed Chapter 13 bankruptcies and 10 years for Chapter 7 bankruptcies

- Foreclosures. 7 years

- Collections. Generally, about 7 years, depending on the age of the debt being collected

- Public Record. Generally, 7 years, although unpaid tax liens can remain indefinitely

That's a long time, you might be thinking. Don't get down though! The good news is that even though these delinquencies might still be on your history right now and may be for a number of more years, over time, they factor in less and less toward your score.

So a late payment five years ago hurts your score a lot less than a late payment last month, and an on-time payment this month helps your score more than a late payment last month. In other words, the credit bureaus reward you when you keep your focus ahead!

Avoid the ‘hard pull' if you can

One last thing to keep in mind: When you apply for a credit card, pay attention to whether the credit issuer will do a "hard pull" of your history because, as Georgette, writing for georgettemillerlaw.com, points out, such an inquiry will ding your score ever slightly.

"Hard inquiries made by a financial institution are used to determine lending eligibility in terms of a mortgage or loan. A few points will be deducted from the score each time, but it will gradually reduce until it falls off in two years time."

3. Removing harmful notes on your credit report might just be one call away

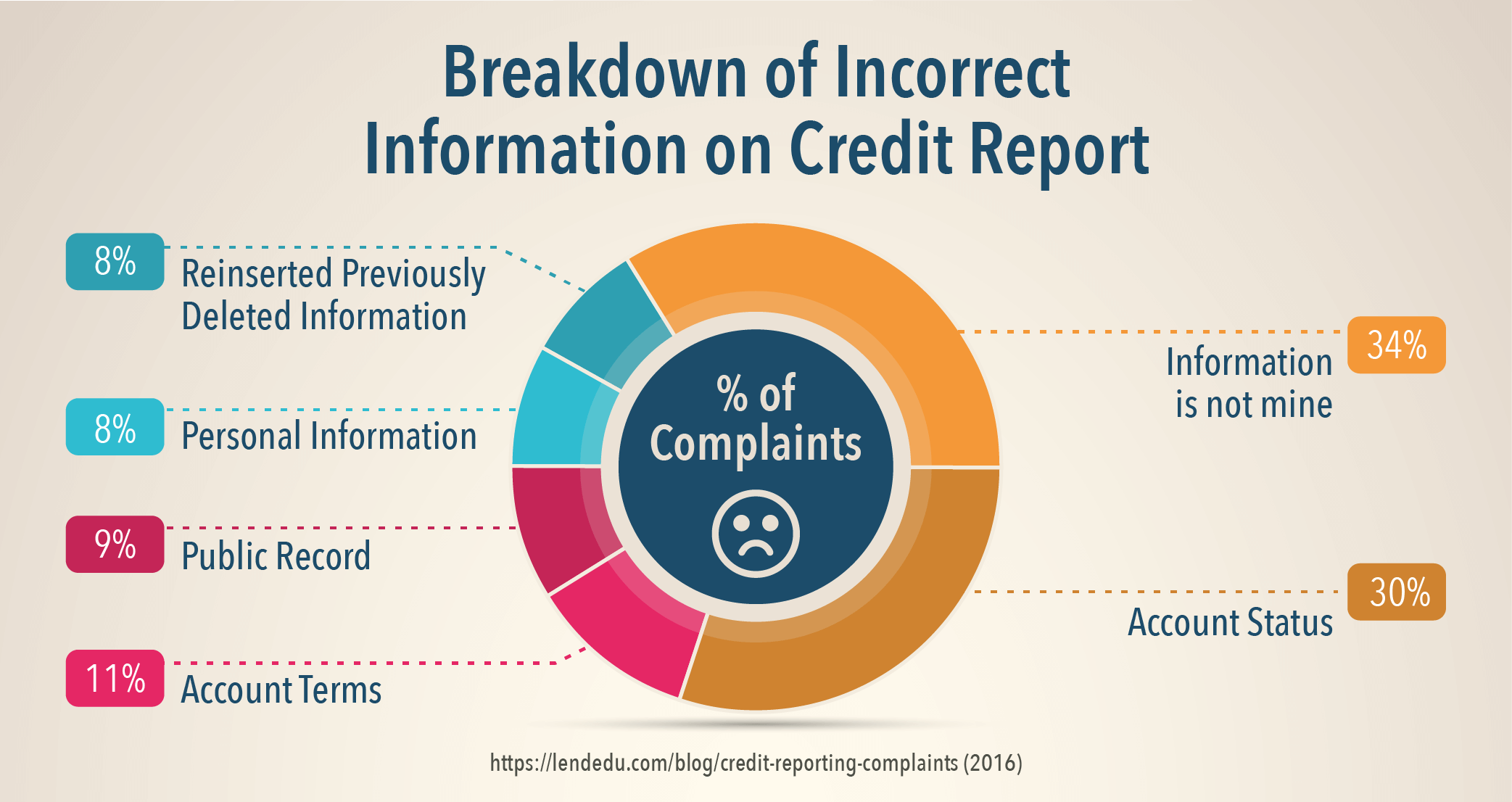

Before you attempt to get any negative items removed from your credit history it's important to make sure your report is entirely accurate. According to a report by the Federal Trade Commission, one in five Americans has an error on his or her credit report.

Mistakes can cost you

With your credit report in hand — apply here for free if you haven't already — there are a number of common inaccuracies to look for, according to Kristin Wong of clearpoint.org:

- Accounts that don't belong to you

- Negative items that have expired but haven't yet dropped off the report

- Personal information errors

- A paid off account that's still listed as unpaid

If you find an error, notify your creditor using this sample letter offered by the FTC.

[The creditor] is "obligated to investigate the items in question, usually within 30 days," Wong says. "If they agree that there's an error, it's their job to notify all three credit bureaus so they can fix your report."Removing accurate negative items isn't impossible.

But it does depend on your specific situation. If you have a long history of delinquencies, like late payments, it's unlikely the creditor will remove the items. In such a situation, the best you can likely do is renegotiate a payment plan that includes an upfront large sum (if you can afford it) in exchange for removing the negative item.

Still, it doesn't hurt to try. And if your delinquencies are new, with persistence and a friendly attitude, you have a decent shot at getting them removed.

Wong suggests drafting a "goodwill letter" to send to your creditor. "You'll want to contact the creditor directly, either with a phone call or a letter. Either way, your request should include:

- A brief rundown of your history with the creditor

- A brief explanation of the financial hardship that led to your late payment

- A request to remove the negative mark from your credit report"

4. Consider a debt consolidation loan to diversify your credit mix

Remember earlier in the FICO score breakdown, we mentioned that credit mix accounts for 10% of your score? That means that if you have already paid down your debt as best you can and are on top of your current bills, diversifying the types of credit you use can add a nice, small boost to your credit repair strategy.

"While credit mix is a small category, it can make a difference if you are struggling to shift a FICO score up a notch — from, say, 720 to 740," according to Lisa Bertagnol, writing for foxbusiness.com.

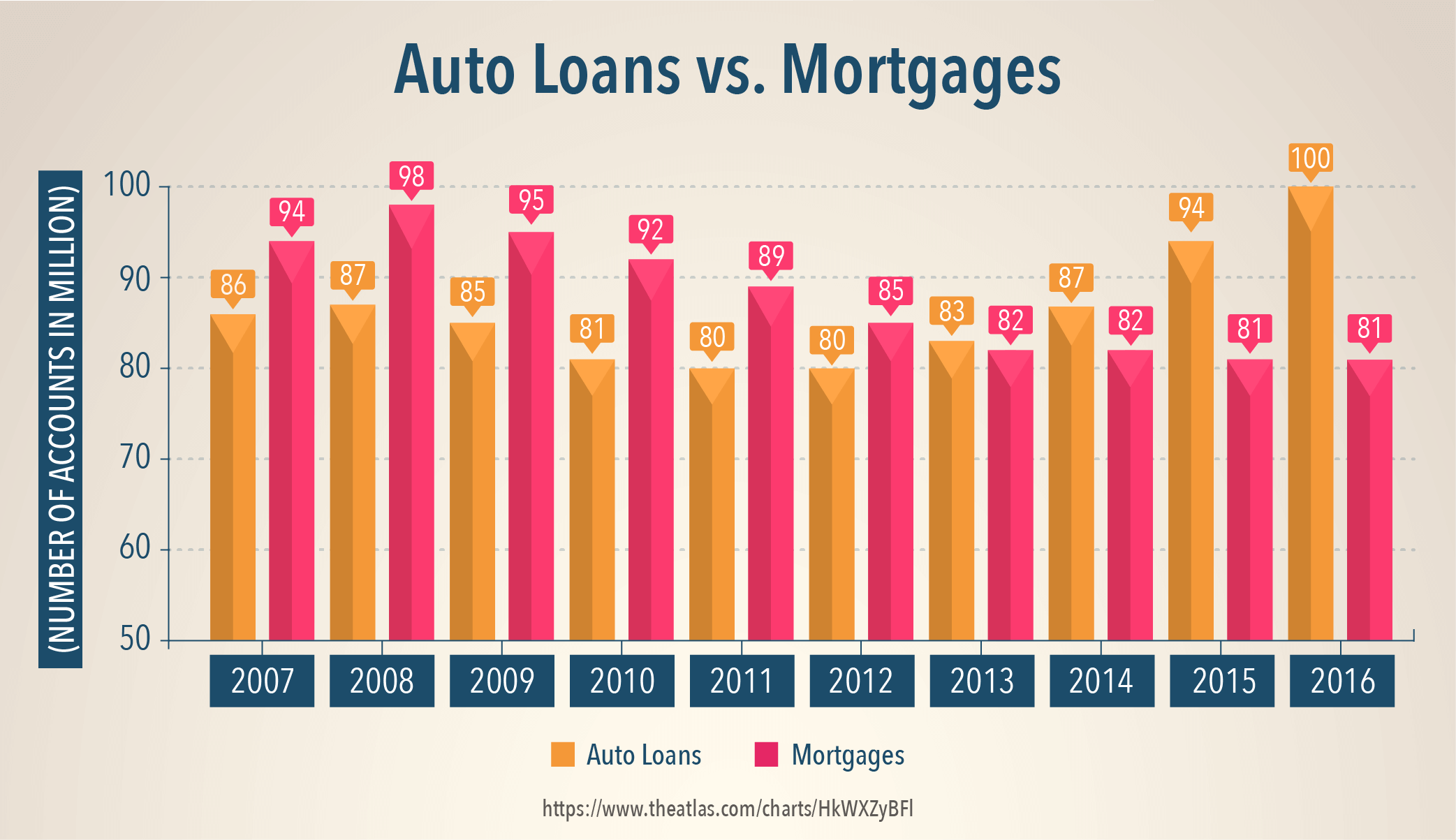

That means consider taking out a loan if you haven't already.

Loans — like a car, student, or personal loan — can easily feel more foreign and risky than credit cards. But more often than not, it simply comes down to doing your homework.

A debt consolidation loan is a good choice for long-term financing

First off, you should only consider a loan to consolidate your debt if you have a bunch of debt across multiple credit lines. Beyond the financial headache, you also risk making an innocent mistake as you try to keep track of all these debts each month and end up hurting your credit score further.

If you need help staying on track with your payments, a debt consolidation loan might be the perfect remedy because there's a definite end point to the payment plan, according to Matt Diehl of One Main Financial.

"A loan has a set amount of time during which you'll be paying back your debt. With a credit card, there is no set date when you know you'll be finished paying off your debt and you can continue to use your card, which can increase your total balance and the amount of interest you'll pay."

That being said, make sure you compare the relative interest rates and that you're certain you can keep up with the fixed payments; typically, they're higher than the minimum customer credit card payment.

5. Consider using credit cards to help rebuild your score

Credit cards can help you rebuild your credit score but only if you use them responsibly. This means making on-time monthly payments and not constantly maxing out your cards.

If you are not eligible for an unsecured card, find the interest rates too high, or have bad credit consider a secured card. Even though you'll have to make a deposit secured cards are generally a better option because the security deposit translates into lower interest rates and fees. Once your credit is back on track, you can eventually graduate to an unsecured card with more perks.

Jump into your credit rebuild by modeling good financial habits

At the end of the day, the type of customer credit card or loan you choose is a moot point if you don't stay on top of your bills and pay off your debt. The first step (if you haven't already done so) is building out a concrete budget. We suggest the 50/20/30 rule to help you map out your essentials, discretionary spending, and savings. Luckily, we already have another extensive guide to help you with this.

Have you had any experience with bad credit? Let us know in the comments below.