If you're like most people, those news articles, videos, and even ads about cryptocurrencies like Bitcoin might have caught your attention.

You've probably heard how rapidly their value can skyrocket and concluded (correctly) that some people and companies are probably getting very rich buying and selling cryptocurrency.

But, like most people, you're probably also totally confused about how cryptocurrencies work.

By far, the biggest barrier people face when it comes to getting into the cryptocurrency market is a simple lack of understanding.

Many assume cryptocurrencies are reserved for wealthy people with special knowledge and abilities.

The truth is, the average person can absolutely cash in with the right information and tools at their disposal.

My main mission here at CreditLoan.com is to give people valuable information and the resources they need to make their financial goals come true.

And with the information I'm going to provide here, I'm confident anyone who reads through to the end can start getting into investing in cryptocurrency at any level.

A kid could even buy Bitcoin with their allowance money if they wanted to!

In 2009 Bitcoin—the mother of all "cryptos"—became the first decentralized digital currency.

"Decentralized" means the money system does not flow through a central bank, government, or administrator.

Bitcoin was invented by an unknown programmer—or group of programmers—operating under the pseudonym Satoshi Nakamoto.

It's based on a peer-to-peer network where transactions take place directly between users, with no bank or other intermediary involved.

All of the transactions are recorded in a shared, highly secured database called a blockchain.

Soon after it was first released in 2009, a person could buy a Bitcoin for $0.008 (that's eight-tenths of one cent).

When it hit a recent peak in December 2017, one Bitcoin was selling at just over $19,000.

If a person spent eight cents to buy 100 Bitcoins in 2009, they could have cashed out in December 2017 for over $1,900,000!

It's no wonder we're hearing more and more stories of "Bitcoin millionaires."

Jeremy Gardner traded a friend some cash for Bitcoin in 2013.

Today he spends his time traveling the world and partying, with a net worth well into the millions.

Another multimillionaire (who keeps his identity a secret) started off by investing $3,000 in Bitcoin back in 2010 when one was worth 15 cents.

As the cryptocurrency's value increased, he started selling off the 20,000 Bitcoins he owned.

Eventually, he cashed out for $25 million, and today he travels the world in lavish luxury.

Eddy Zillan took the $5,000 he was given at his Bar Mitzvah and another $7,000 he had saved and bought cryptocurrency.

By the time he turned 18, his investment had already grown to half a million dollars.

Keep reading if you're interested in learning how a regular Joe or Jane like you can join the ranks of the cryptocurrency millionaires.

Our beginner-friendly guide to cashing in on cryptocurrencies will give you all the information you need to understand how they work.

We'll also give you a step-by-step guide on how to play to win in today's sizzling cryptocurrency market.

Disclaimer: The following is a guide and doesn't constitute financial advice. You should do your own research, and fully understand the cryptocurrency space before you make any moves.

What You Need to Know

Understanding blockchain: the backbone of cryptocurrencies

The core technological innovation behind the rise of cryptocurrency is called blockchain.

But what exactly is it?

Just like you don't need to be a mechanic to drive a car, a person doesn't need to know how blockchain works in order to use it.

However, having some basic understanding of this revolutionary technology will give you a satisfying appreciation of how cryptocurrencies operate.

Digital information that can't be copied. The invention of blockchain technology by Satoshi Nakamoto allowed digital information to be distributed and exchanged but not tampered with.

It's basically an ever-growing database consisting of a perfect record of every single transaction of a cryptocurrency.

Blockchain isn't a centralized system. Every time a new transaction happens, the transaction is broadcast to a peer-to-peer network of independent users' computers known as nodes.

By incentivizing the processing-power-hungry process of solving complex mathematical problems required to maintain the integrity of the blockchain, the network is able to validate every new transaction that takes place.

Once a transaction is verified, its record is combined with the existing database to create a new "block" of data which gets added to the shared record or "ledger" in a way that is permanent and can't be changed.

This ledger is nothing more than a chain of verified blocks, hence the name, "blockchain".

Once the blockchain has been updated, the transaction is complete.

All the computers on the network will have the exact same record or copy of the newly-updated blockchain—there is no centralized records-keeping body that can be hacked to alter the ledger's contents.

The crypto network can't be cracked. The information is public, and is protected by cryptographic technology, making it incorruptible since a hacker would have to override all the computers on the network to make even the smallest change to it.

Cryptocurrency differs from normal currency because it's not backed by a government

Normal currency, known as "fiat" currency, is backed by a government, which declares it legal tender.

No national boundaries. Cryptocurrency isn't backed by any government. It doesn't come in the form of physical coins or bills.

Cryptos are global and decentralized and their supply is not controlled by any national bank or Federal Reserve.

Not legal tender. Cryptocurrencies are currently not accepted as legal tender.

You can't pay your taxes with them (although you do have to pay tax on any money earned when you sell them).

Think of it as having an online bank account except there's no bank.

Mining for cryptocurrency. Rather than the supply being controlled by a central bank or reserve that prints or mints new currency, cryptocurrencies like Bitcoin are created through a process called "mining."

A cryptocurrency relies on a network of powerful computers dedicated to solving incredibly difficult mathematical "puzzles."

These are required to maintain the integrity of the blockchain each time a new set of transactions come into the network for verification.

It takes massive amounts of computing power to just to solve a single puzzle to add a new block to the blockchain.

The lucky "miner" who's the first to do so gets handsomely rewarded with freshly created Bitcoin—making the mining process lucrative enough to be sustainable.

As time goes by, the puzzles get harder and harder to solve, requiring more and more computer processing power (and causing higher and higher electricity bills for miners).

The algorithm used to mine new Bitcoins was designed to create a total of only 21 million Bitcoins.

Currently, there are just under 17 million Bitcoins in circulation.

Accepted in more and more places. Although you can't pay your taxes with a cryptocurrency, they can be traded for real currency and used as a medium for exchange in many transactions.

The range of goods and services that can be purchased via cryptocurrencies is expanding as more and more merchants and retailers begin accepting them.

For example, the online retailer Overstock was among the first big companies to start accepting Bitcoin payments back in 2014.

Use digital currency for digital services. Microsoft and Apple both accept cryptocurrencies in their app stores.

Earn your degree with Bitcoin. There are public and private colleges and universities that now let students pay their tuition in Bitcoin.

The fact that you can use Bitcoin to purchase gift cards through sites like Gyft or eGifter means cryptocurrency can be used to purchase just about anything.

Have crypto, will travel. You can use Bitcoin for travel purchases (for example, hotel and plane tickets) through popular sites like Expedia.

Charities and crowdfunding sites are accepting Bitcoin, as are some legal and accounting firms.

You can even order pizza delivery anywhere in the United States and pay with Bitcoin through a site called PizzaForCoins.

Cryptocurrencies are easier to buy than you think

With a price tag of over $6,600 for just one Bitcoin, many people assume they can't afford to purchase one.

You can get a piece of the action. Fortunately, cryptocurrencies are divisible—you can buy and own a fraction of a Bitcoin based on your budget, which means any ordinary person can get into cryptocurrency.

Since you can buy fractions of Bitcoins and other cryptos, price isn't a deterrent whatsoever.

The smallest unit a Bitcoin can be divided into is called a Satoshi, which is exactly one hundred millionth of a single Bitcoin.

Cents are to dollars what Satoshi is to Bitcoin. Just like how a dollar can be broken down into cents, the Bitcoin can be broken into smaller denominations of Satoshi.

If the current value of a Bitcoin is $8,000, one Satoshi would be worth $0.00008.

This makes Bitcoin viable for making both large and small purchases.

1,000 Satoshi are worth 8 cents, and 100,000 Satoshi is worth 8 bucks.

If you spent $500 investing in Bitcoin today (at the current $8,000+ valuation), you would have 5,800,000 Satoshi (the equivalent of 0.058 Bitcoins).

When you buy Bitcoins or other units of cryptocurrency, you can choose whatever denomination you want down to the hundred millionth decimal.

You can afford it! Due to the divisible nature of the digital currencies, you can literally put down some pocket change and get yourself some Satoshi.

The Big Four

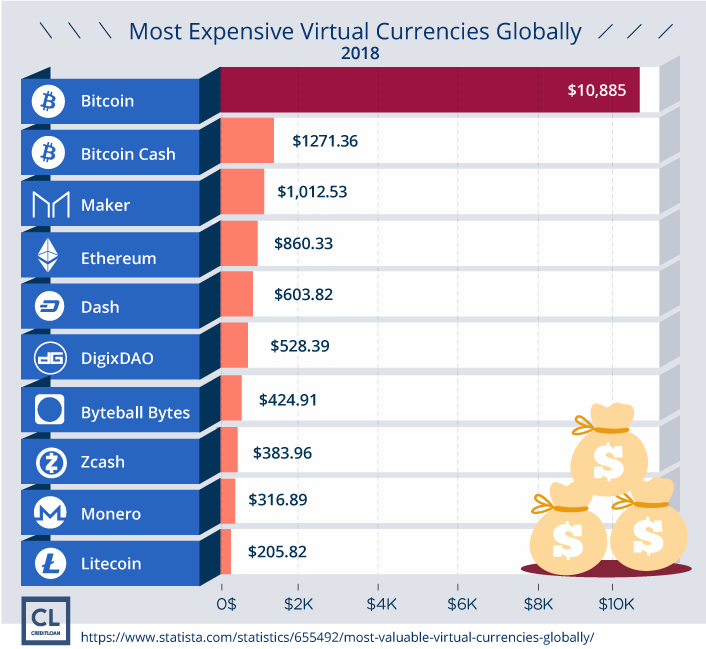

There are hundreds of cryptos, but these four are on top

"Market cap" is short for market capitalization.

You calculate it by multiplying the available number of units or shares of a currency or a company's stock by how much each is worth.

The result of the calculation equals the total value of a particular currency in circulation.

Bitcoin is by far the biggest cryptocurrency in terms of market cap.

With 16,935,087 Bitcoins in circulation and a value of $8,514.66 (at the time of writing), its market cap is $144,196,507,875 (almost $144.2 billion).

The next four are Ethereum (with a market cap of over $51 billion), Ripple ($24+ billion), Bitcoin Cash ($17+ billion), and Litecoin ($9+ billion).

Bitcoin: The original cryptocurrency is going strong despite dips

In 2008 Satoshi Nakamoto bought the domain name bitcoin.org.

At the exact same time, the unethical practices of the major banks were causing a collapse of the economy.

The original goal was to create a decentralized, peer-to-peer alternative to the banking system, where the buyer and seller were in charge and there was no middleman.

The "key" was the key to the invention. Transactions were completely secure since trading Bitcoins involve highly secure cryptographic "keys" made out of seemingly random numbers.

This lock and key system is so robust, it would take the world's most powerful computer more time than the entire duration of human civilization to crack the codes held in those keys.

The benefits were big. Fees were cut, international transactions were made much easier, and transactions became a lot more transparent.

Bitcoin has not been without its problems. Over its history, thieves have succeeded in hacking people's Bitcoin accounts.

Customers using Bitcoin have also complained about delays in transactions.

Due to the currency's bullet-proof encryption, lack of central regulation and in-built anonymity, it has become a preferred form of payment for criminals, drug smugglers, and money launderers.

Skyrocketed in 2017 then adjusted back. Bitcoin started to become a household name in 2017 when its value went through the roof.

In December 2017 it hit an all-time high of just over $19,000.

Since then it's dipped back down to its $8,500 value (in March 2018).

On August 1, 2017, some miners of Bitcoin created a new form of the currency based on the same blockchain technology known as Bitcoin Cash.

The main problem they were trying to solve was the issue of slow transaction speeds.

The credit card company Visa processes 1,700 transactions every second, and is capable of doing 24,000 purchases per second.

Bitcoin? It maxes out at 7 transactions per second.

Which means it currently takes about 10 minutes for every Bitcoin transaction to go through.

The data blocks for Bitcoin Cash are bigger in size, which means transactions are much more efficient and therefore faster.

As more and more Bitcoins are mined and more and more transactions are taking place, the problem with slow transaction times with Bitcoins could get worse, making Bitcoin Cash potentially more attractive.

Ethereum added apps to the blockchain

The second-biggest cryptocurrency distributor, Ethereum, appeared in 2015.

Its co-founder is a 24-year-old Russian-born Canadian named Vitalik Buterin.

Before starting Ethereum, Buterin was co-founder of Bitcoin Magazine.

He noticed there were limitations, particularly when it came to developing apps for use in the blockchain network.

He created a different script using the blockchain technology (Bitcoin's software is open-source which means anyone can use it).

Applications such as those that provide the ability to release payments when certain criteria are met and transferring ownership when a payment is made are available in the Ethereum network.

Unlike Bitcoin, the Ethereum blockchain network also lets users create "smart contracts," which can be applied to non-financial transactions.

So applications like voting, fundraising, memberships, and dividing an asset into shares can all be done via the Ethereum blockchain.

The currency used to conduct Ethereum transactions is called "Ether."

Currently, one Ether is valued at $552.

In January 2018, it cost $1,389 to buy an Ether, so its value has recently dipped quite a bit.

This drop in value came after a massive sell-off of Bitcoin in January 2018, after it peaked at $19,498 some time in December 2017.

Ripple was built for the banks

The third-biggest cryptocurrency by market cap is called Ripple.

It was released in 2012.

In addition to being a type of digital currency, Ripple also involves a real-time payment settlement system aimed to be used mainly by banks for international transactions.

The ability to securely send currency of any size almost instantly over any border at a low cost caught the attention of the banks.

One unit of Ripple costs just $0.63 at the time of this writing, which is a significant dive from the high of $3.65 it hit in January 2018.

Litecoin is just like Bitcoin, only faster

The last of the Big Four cryptocurrencies, Litecoin, uses the same open-source, peer-to-peer blockchain technology as Bitcoin.

Bitcoin is notoriously slow. It takes the Bitcoin system 10 minutes to process one block of data.

Litecoin has improved upon Bitcoin's system by processing a block every 2.5 minutes.

Transactions are faster with Litecoin, and mining is also faster, although the mining technology is much more expensive than Bitcoin's.

In March 2018 Litecoin was valued at $163.19 per unit.

Back in December 2017, it was worth $331.59, so Litecoin has also slumped significantly after the big sell-off of Bitcoin happened early in 2018.

How to Start Trading

The only two things you need to start trading cryptos

No matter what cryptocurrency you are dealing with, you're going to need to choose a software to store and transmit the data (known as a "wallet") and a platform to trade it (called an "exchange").

As a rule, you have to set up a separate wallet for every cryptocurrency you use, but platforms like Coinbase let you manage multiple wallets from the same platform.

Cryptocurrency wallets don't actually store currency

Unlike a regular wallet, which is designed to carry money, digital wallets don't store cryptocurrency.

In fact, it isn't possible to store cryptocurrency in a single place since it exists in the form of transaction records across the entire blockchain.

Rather, these software programs store the mathematical keys used to perform transactions in the blockchain.

The digital wallets are used to monitor your balance and send or receive crypto funds.

When a person sends or pays another person cryptocurrency, their two wallets submit a transaction number known as a public key.

Each wallet has a private key which a digital signature or proof of ownership of the wallet, and when it matches the information in the public key, the transaction is verified and goes through to become part of the blockchain.

There are five different types of wallets.

Online wallets exist in the cloud. You access them from any computer located anywhere with a connection. These are less secure since they are run by third parties.

Mobile wallets are app-based. If a store accepts cryptocurrency, the easiest way to pay is through a smartphone wallet app.

By scanning a QR code, the retailer's public key can be obtained to complete the transaction from your wallet to theirs.

Hardware wallets are offline. For increased security, you can store your private key on a hard drive or USB. It won't get hacked since it doesn't live on the internet.

You still do your transactions online through transaction websites.

Paper wallets are printouts. Finally, there is a format known as a paper wallet where you can have public and private keys generated and then printed out rather than stored for the highest level of security.

To spend cryptocurrency using a paper wallet you need to transfer funds to a software wallet.

Cryptocurrency exchanges let you buy with dollars or with crypto

When you're ready to buy some cryptocurrency, the next step is to choose an exchange to buy and sell.

There are two types of cryptocurrency exchanges, but all of them charge a fee for trades, which can be as low as 0.1% or a high as 5%.

Purchase crypto with regular money. The first type of exchange is known as a "fiat exchange."

On these platforms, a person can buy or sell cryptocurrencies using US dollars or other government-backed money.

Buy crypto with crypto. The second type of exhange is one where you use cryptocurrency to purchase other cryptocurrencies.

Crypto-to-crypto exchanges have much lower trading fees than fiat exchanges.

The fiat exchanges are mostly used to buy the Big Four cryptocurrencies.

It's more difficult to use regular money to buy other forms of cryptocurrency, so in those cases, you have to use the cryptocurrency-to-cryptocurrency exchanges.

Lots of choices. You can choose your exchange based on its fees, currency options, safety, customer service, or volume.

Some of the most popular fiat exchanges are Coinbase, Coinmama, Bitpanda, and Kraken.

Four of the most highly used crypto-to-crypto exchanges are Binance, Bittrex, Bitfinex, and Kucoin.

Winning with Crypto

Follow this step-by-step guide and you could be on your way to becoming the next cryptocurrency millionaire

Once you've decided you're ready to get involved with buying and selling cryptocurrency, there are six steps you should take to help you succeed.

Step#1: Set up an exchange account.

Whether you make your decision based on the lowest fees or the best reputation for security, pick an exchange and set up an account.

Once you've signed up for an exchange like Coinbase, you're ready to buy the Big Four.

Step #2: Get a wallet.

Based on your knowledge of the different types of wallets, choose the format you'd like to use.

Now you can store all the data related to your cryptocurrency and make transactions.

Step #3: Set a budget and start with the Big Four.

There's a golden rule in the crypto community, which is to never invest more than you're willing to lose.

Figure out how much you could easily afford to lose and budget it across the four cryptocurrencies.

If you want to go with the slightly more established cryptos, you could invest more heavily in Bitcoin and Ethereum and put a little bit into Ripple and Litecoin.

Step #4: Learn about smaller-value cryptos.

When there is a smaller market cap, it usually means there is more potential to increase the value of a cryptocurrency over time.

But it also means there is more risk of it disappearing altogether.

Do your research and choose a couple of great picks to bet on.

Step #5: Open up an alternate exchange account.

You won't be able to purchase smaller value cryptos via the big exchanges you bought the Big Four from.

Open up an account with an alternate exchange such as GDAX.

If you choose a crypto-to-crypto platform, you can easily use your existing cryptocurrency to buy new forms.

Step #6: Evaluate and reallocate.

Monitor your crypto portfolio over time to see if there is a chance to optimize for bigger wins.

If you see one investment drastically outpacing another you might want to use the slumping currency to buy more of the high-performing crypto.

Step #7: HODL.

"Hold On for Dear Life" is another golden rule among cryptocurrency investors.

It means you shouldn't sell your Bitcoin or any other currency under any circumstances.

Why not?

Because "crypto-liftoff" might not have even happened yet.

So even though you may be hearing all about crashes and bubbles bursting, don't sell off!

All Your Crypto Questions Answered

Anyone can invest in cryptocurrency

Now that I've told you everything you need to know to get your feet wet in the world of cryptocurrencies, hopefully, you've gotten over the common misconception that you need to be rich or some kind of tech genius to invest in Bitcoin or other cryptos.

I've always believed knowledge is power, and I hope you realize you now have the power to explore your options and profit from Bitcoins and other cryptos with the knowledge I've shared here.

Although you should still be cautious, and not invest anything you're not prepared to lose entirely, cryptocurrencies present a golden opportunity that's waiting to be seized.

It hardly seems believable, but the cryptocurrency industry is less than 10 years old.

It's practically in its infancy, but in many ways, both experts and ordinary people have already touted its world-changing potential, so you definitely wouldn't want to turn a blind eye towards it, lest you want to risk getting left behind.

Many more people will become cryptocurrency millionaires as this revolutionary technology continues to disrupt and create opportunities in ways and places that are familiar and new.

Could you be one of them?

If you have any thoughts or first-hand experience on winning big on Bitcoin or any other cryptocurrency, please share your story in the comments below!