When you earn millions of dollars a year, it might seem like money is endless.

Yet it has a funny way of disappearing.

Even successful celebrities have filed for bankruptcy, owed money to the IRS, or spent their last pennies on legal fees.

Johnny Depp, Nicolas Cage, and 50 Cent are among those in this sad hall of fame.

They may be famous celebrities, but guess what?

They get into the same financial troubles we all do at times, living beyond our means.

Just like us, celebrities can also lose everything in litigation or on bad investments.

Their spectacular mistakes provide cautionary tales for average Americans, even those not signing multimillion-dollar contracts.

A costly home renovation or nasty divorce can bankrupt a middle-class family.

A few careless purchases bought on credit will pile on debt.

Take out a bad loan and see what you pay in interest skyrocket.

Too many bad choices may force you to file for bankruptcy, which will affect your finances for decades, if not the rest of your life.

Anyone can get saddled with debt.

Even Mike Tyson, who made over $400 million as a boxer, has struggled to pay back his creditors after years of lavish living.

Sure, you probably won't end up in jail, like Dance Moms‘ Abby Lee Miller, or allegedly owe the IRS $1.7 million, like Pamela Anderson did.

But if there's a $500 emergency, 60 percent of Americans don't have enough savings to cover it.

Instead, many get into debt.

Poor financial management compounds, and in the future, your family's quality of life will suffer.

You might not have enough money to care for a sick parent or help a child pay for college.

Smart financial decisions today will set your family up for success in the future.

When you invest money instead of spending it on frivolous purchases—like, say, Tyson's Siberian tigers — you'll have more down the line.

In the long term, the stock market averages a 7 percent annual growth rate.

It doesn't take much to build a nest egg.

If you start with a $100 investment and contribute just $10 to the principal each month, you'll have $12,000 in 30 years.

Even if you struggled to save in the past, these 10 stories will teach you how to make better choices in the future and set yourself up for financial success.

Johnny Depp

Johnny Depp has long been one of the most well-paid actors in Hollywood.

He regularly gets some $20 million upfront per film.

Forbes calculated that he raked in $48 million in 2016 alone, making him the year's fifth-highest earner .

At the same time, the Pirates of the Caribbean star has seen his share of debt and legal trouble.

Despite his earnings, Depp has struggled financially according to many recent news reports.

In 2012, his managers bailed him out when he was about to default on a $5 million bank loan, then started foreclosure proceedings on two of his many properties.

When Depp had to sell assets to pay off his loans, he blamed his managers for his losses and sued them.

They countersued.

Juicy court documents reveal Depp's astonishingly lavish expenditures.

Take a look at what he was spending his money on:

- $30,000 a month on wine

- $150,000 a month on security

- $200,000 a month on private planes

- $300,000 a month on staff

- $3 million to blast the ashes of author Hunter S. Thompson from a custom-made cannon

- $4 million on a failed music label

- $18 million on an 150-foot yacht

- $75 million to acquire and furnish 14 residencies, including a French chateau and islands in the Bahamas

Depp also went through an expensive divorce with actress Amber Heard, paying her roughly $7 million in their divorce settlement.

According to his managers' 2017 lawsuit, Depp "refused to live within his means."

He incurred debt, it explains, because:

"When Depp's spending outpaced his earnings, and he refused to change his lifestyle, he was forced to borrow large sums of money to continue living the lifestyle he chose."

The Lesson: Live within your means

There's a limit to how much any of us can afford—even if you're making more than $20 million a year.

You should never, ever, go into debt to pay for discretionary expenses i.e. things you don't need, but simply want.

If Depp had invested just one of those $20 million Pirates of the Caribbean paychecks in the stock market, it would have grown to $55 million in 15 years.

Or, in Depp terms, enough to buy three yachts.

50 Cent

In 2015, Forbes named 50 Cent one of the top five wealthiest hip-hop artists, worth an estimated $155 million.

That same year, this same man would file for bankruptcy.

Huh?

Legal trouble and profligate spending did the trick.

At the time, the rapper, whose real name is Curtis Jackson, took in $185,000 a month in marketing deals.

But it all went out again to upkeep a Connecticut mansion and buy a Rolls-Royce, among other lavish expenditures.

After his commercial peak in the early 2000's, Jackson diversified his portfolio into endorsements, investments, and movies.

Some of it paid off, like his early bet on VitaminWater, which scored him $100 million when it was bought by Coca-Cola.

Others, not so much, like a boxing promotion company.

His company G-Unit Records got into trouble for allegedly copying the headphone design of another brand.

A judge ordered Jackson to pay $17 million in an arbitration dispute.

In July 2015, another judge had him shell out $7 million for posting a sex tape without a woman's consent.

After the latter case, the "Get Rich or Die Tryin'" actor filed for bankruptcy.

Court papers showed that his debt was $32.5 million. His assets were closer to $25 million.

He emerged from bankruptcy in early 2017, having repaid nearly $23 million in debts.

Most of that money came from a malpractice lawsuit settlement with his former lawyers.Had he invested his VitaminWater windfall in 2007, 50 Cent would have seen his money nearly double to $196.7 million.

The Lesson: Stay out of court

You could charitably blame the copyright case on Jackson's lack of business experience.

But posting a sex tape online without permission?

That's just extremely bad judgment.

Be smart and keep on the right side of the law. It's a simple way to avoid financial disasters.

Legal fees are extremely expensive.

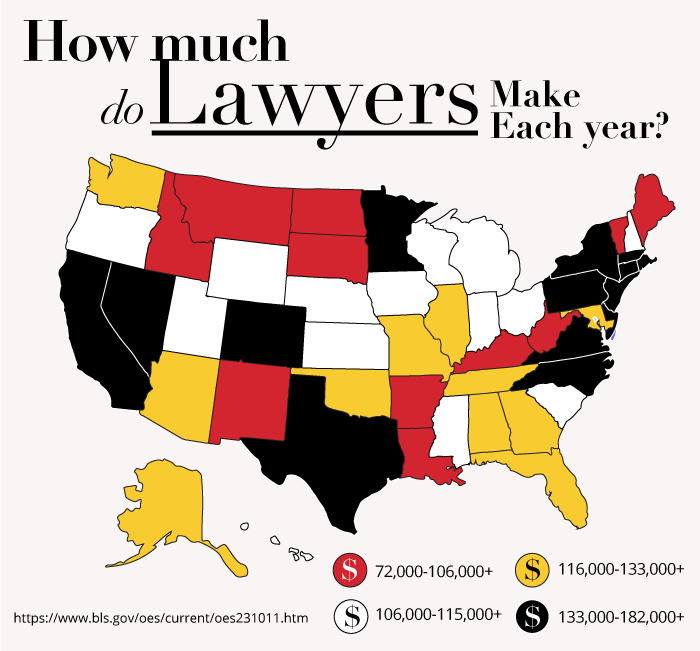

Lawyers typically charge $100 to $200 an hour, or more in big cities.

Settlements like Jackson's bring the cost even higher.

Donald Trump

Despite his alleged multi-million dollar wealth, Donald Trump has filed for bankruptcy six times.

Corporate bankruptcy, that is.

Trump the person, and The Trump Organization are two separate entities with different financial circumstances.

The distinction offers a lesson for entrepreneurs or anyone who's self-employed.

Trump's own money is rarely at stake when his developments fail.

His investors are the ones who paid for failed casino and resort projects.

According to Forbes' Clare O'Connor, Trump himself only took a hit in 1991, when he used junk bonds to finance the Trump Taj Mahal.

He was $900 million in debt.

He recovered by selling his share in businesses like Trump Shuttle.

After that, "he stopped guaranteeing debt with his own wealth."

Three more Trump properties went bust in 1992. The company filed for bankruptcy again in 2004 and 2009.

When a company seeks Chapter 11 bankruptcy protection, it makes a plan to reorganize and pay off creditors.

It would otherwise be liquidated and properties foreclosed. Chapter 11 (sometimes incorrectly referred to as "chapter bankruptcy") is a way to stay in business despite crushing debts.

"Bankruptcy has been the building block for Mr. Trump's wealth accumulation," wrote Mitchell L. Moss in the New York Times in 2016.

While his companies filed for Chapter 11, Trump himself still collected a salary and bonuses. As he readily admits, he did rather well for himself, using the laws available.

The Lesson: If you're self-employed, shield your assets from your business

Entrepreneurs, freelancers, and others who are self-employed should consider creating a business entity such as an LLC, to protect their personal interests.

If the business goes south, even if you're not making Trump's millions, the protections offered via corporate bankruptcy laws can protect everything you have personally worked for, and then some depending on which state you live and work in.

United States Courts have long held that:

"The chapter 11 bankruptcy case of a corporation (corporation as debtor) does not put the personal assets of the stockholders at risk other than the value of their investment in the company's stock.

A sole proprietorship (owner as debtor), on the other hand, does not have an identity separate and distinct from its owner(s).

Accordingly, a bankruptcy case involving a sole proprietorship includes both the business and personal assets of the owners-debtors."

When you declare bankruptcy as a sole proprietor, your personal assets are put at risk, including your home, cars, or other assets, which is why it is imperative to keep your business and personal lives separated.

Nicolas Cage

Nicolas Cage got used to $20 million paychecks in the early 2000's, back when people actually saw his movies.

Blockbusters like National Treasure, which grossed $173 million in 2004, made him a bankable star. Between 1996 and 2011, he reportedly brought home $150 million.

Somehow that wasn't enough to pay his taxes.

By 2012, he owed the IRS $14 million.

Nearly half of that bill was for unpaid taxes on his 15 properties, which included a deserted Bahamian island and a Bavarian castle.

What he might have saved for taxes instead went to bizarre purchases like shrunken pygmy heads, a pet octopus and cobras, and a nine-foot tomb.

"When I'm not working I can be a little self-destructive," Cage told the LA Times in 2016.

If Cage had invested one of those $20 million paychecks in the market in 2001, he'd be sitting on over $59 million today.

To pay off his debts—and perhaps to protect himself from his worst instincts—Cage has starred in a recent spree of direct-to-video films.

USS Indianapolis: Men of Courage, anyone?

With 13 releases in 2016 and 2017, it seems like he's still working on it.

The Lesson: Pay your taxes

If you neglect to file on tax day, the amount you owe the IRS will balloon.

The IRS charges a penalty and interest for late or unpaid taxes.

If you don't file on time, you will be charged 5 percent of what you owe for each month your return is late, up to 25 percent.

As a multi-million dollar actor, Cage would be in the highest tax bracket.

A $20 million paycheck would incur some $7 million in taxes.

Left unpaid, it would get fined $350,000 in the first month, up to $1.75 million.

Even a more typical tax bill of $5,000 could balloon this way, incurring $250 to $1,250 in fines.

Better to pay your taxes right away than shell out extra to the IRS.

"Dance Moms" Abby Lee Miller

Reality TV stars illustrate what can go wrong when regular people come into sudden wealth.

They overspend on sports cars and plastic surgery or appear surprised to owe so much money come tax time.

Many have gone bankrupt.

Dance instructor and choreographer Abby Lee Miller, a star of Lifetime's Dance Moms, is just the most recent example.

Like Richard Hatch and Teresa Giudice before her, Miller went to jail for bankruptcy fraud.

Miller earned $8,000 to $25,000 per episode, according to court testimony.

As her popularity grew, she made money on merchandise and dance classes.

All the while, she scurried it away.

"LETS MAKE MONEY AND KEEP ME OUT OF JAIL," read one email subject line.

Between 2012 and 2013, Miller hid $755,000 in bank accounts created expressly for that purpose.

In August 2014, she allegedly concealed $120,000 in cash by giving it to friends in plastic bags to store in their luggage.

Miller had declared bankruptcy in 2010, claiming $325,000 in assets but owing over $400,000.

She had defaulted on her mortgage and had unpaid property taxes.

She said she filed Chapter 11 to keep her Pittsburgh dance studio afloat.

The bankruptcy judge struggled to square her supposed insolvency with the success of the TV shows.

In 2015, she was charged with bankruptcy fraud, false bankruptcy declarations, and the concealment of assets.

Miller pled guilty and was sentenced to 366 days in prison. She checked into California's Victorville Federal Correctional Institution in July 2017.

The Lesson: Keep it Legal

Sudden wealth can make people greedy. If you hit it rich, keep it honest. The Man has a way of catching up with even the quickest debt.

Miller would be sitting on hundreds of thousands of dollars today if she had decided to invest rather than conceal her earnings.

In three years in the stock market, that hidden $120,000 could have grown by $30,000.

Mike Tyson

He just didn't know when to quit.

It sounds like the plot of a caper movie: How does $400 million disappear?

Ask Mike Tyson.

The boxer earned that figure over 20 years as a heavyweight champion.

Yet in 2003, he declared bankruptcy, with $23 million in debts.

In a detailed survey of this spectacular fall, New York Times writer Richard Sandomir called Tyson "a cash machine to himself and to others."

He spent $400,000 per month on things like jewelry, mansions, cellphones, motorcycles, prostitutes—oh, and Siberian tigers.

One birthday party cost $410,000.

It didn't help when Tyson got himself into legal trouble, like the 1992 rape conviction that put him in jail for three years.

When Tyson divorced Monica Turner, she got $9 million in the divorce settlement.

In late 2002, shortly before he filed Chapter 11, Tyson picked up a $173,706 gold-and-diamond chain from a Las Vegas jeweler, purchased entirely on credit.

The bankruptcy filings showed that he owed money to managers and trainers, law firms, the IRS, state treasuries, and a limousine company.

Tyson used to earn $30 million per fight.

Had he invested just one of those paychecks in the stock market 20 years ago, he'd have $116 million today.

Instead, Tyson is working to pay back his creditors.

His criminal record makes him unappealing to advertisers, so he misses out on endorsement deals.

He relies on acting, special appearances, and books, like his 2017 memoir Iron Ambition.

The Lesson: Youth and money can be a toxic mix

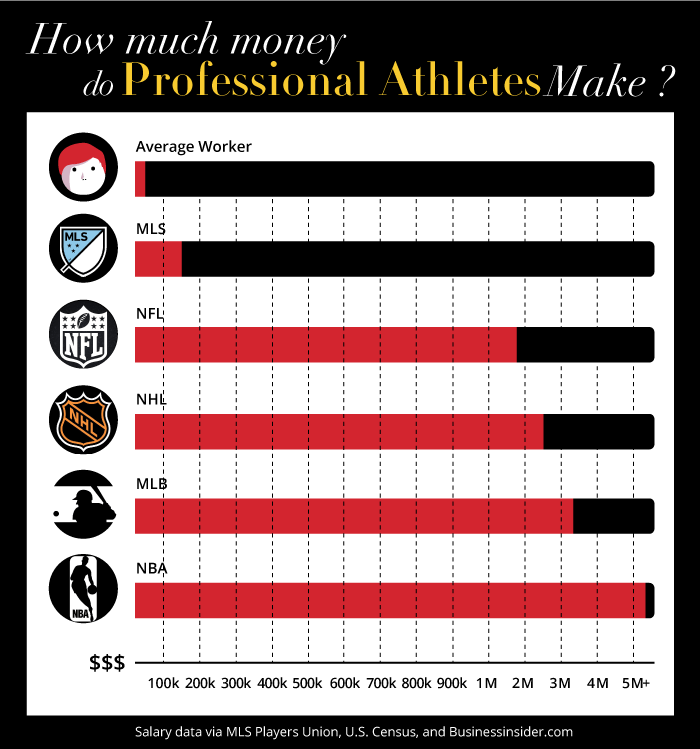

Tyson was only 20 years old when he became a heavyweight champ. Like many professional athletes, he came into money without knowledge and maturity to handle it.

He is just one of many sports stars—from Curt Schilling to Allen Iverson—to blow through his fortune.

Even though temptation is high, athletes shouldn't waste their money.

Their value depreciates over time and they'll soon, and sadly, find themselves without a job.

Even a relentless fighter ages out of work eventually.

Save money while you're still making it—or get financially knocked out.

Lena Headey

As Queen Ceresi on the HBO megahit Game of Thrones, Lena Headey seems to have done quite well for herself.

Yet when she was in the midst of an acrimonious divorce in 2013, the British actress claimed that she was broke, with barely $5 in her bank account.

In legal documents related to her split with musician Peter Loughran, Headey claimed she urgently needed $6,000 to pay expenses and support their young son.

She said she was living off credit, though she expected to get acting income soon.

That left many observers scratching their heads, since Headey plays a main character on one of the most popular shows on television.

It's unclear exactly how Headey got there, though divorce and custody battles have a way of emptying even royal coffers.

She is now rumored to be making around $2 million an episode for the final two seasons of Game of Thrones. Its stars have notably become the highest-paid actors in TV history.

In a July 2017 profile in the New York Times, Headey said that while the divorce led to some tough times, she has finally rebounded.

She's now engaged to filmmaker Dan Cadan and is on civil terms with Loughran.

The Lesson: Divorce is expensive, especially when there are kids involved

Nobody likes to think about divorce when they get married, but plenty of couples break up.

When you get engaged, it's worth researching the laws governing marital property in the state you live in, and possibly signing a prenuptial agreement.

We don't know whether a prenup would have made a difference for Headey, but her case illustrates just how messy divorce can be.

Do your homework before combining your money with someone else's.

Pamela Anderson

She is famous for being a Playboy cover girl, Baywatch star, plastic-surgery maven, and ex-wife of famous rocker stars, Tommy Lee and Kid Rock.

Anderson is said to have earned up to $50,000 per episode for her role as CJ on Baywatch, in 110 episodes.

If she received just half that, she would have made $2.75 million, not including income from worldwide syndication.

Anderson won another kind of renown in 2011, when the California Franchise Tax Board included her on its annual list of the state's top delinquent taxpayers.

By then, Anderson was already familiar to auditors. In 2009, the IRS filed a tax lien against her, calling her out for nonpayment of $1.7 million in taxes.

It hit her again in 2011 for $259,395.

During the same period, she reportedly went in for more plastic surgery and gave her Malibu home a makeover rumored to cost $1 million.

Five building firms later sued over unpaid bills.

Had she invested her Baywatch earnings in 1997, her last year on the show, Anderson would have seen it grow to over $10 million.

But things are looking up for Anderson. She's back in the reincarnation of Baywatch, and received $1 million in her divorce settlement from third husband, Rick Salomon.

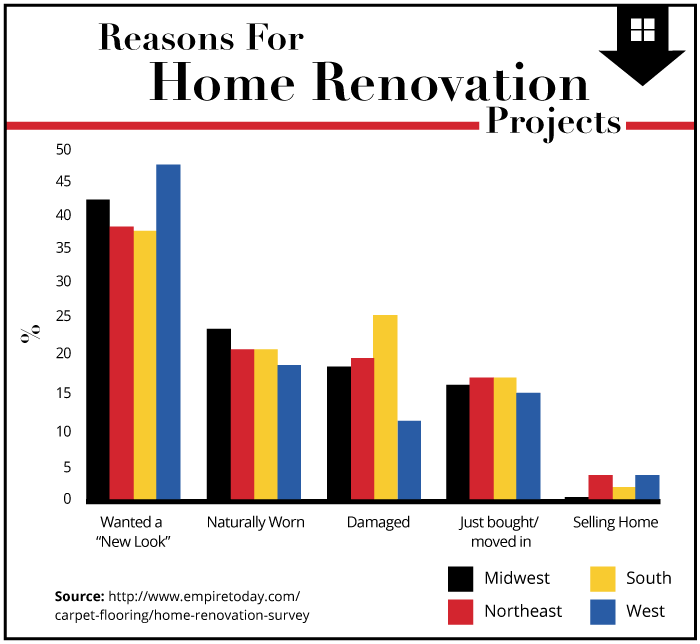

The Lesson: Do the math before a home improvement project

Home renovations are notoriously expensive and unpredictable. The average cost of a kitchen remodel alone is $21,000, according to HomeAdvisor.com, and some go up to $50,000 for an average sized home.

Even if your project is only a fraction of the size of Anderson's, the bills could add up.

You may need to refinance your mortgage or take out a home equity line of credit.

In US News and World Reports, Teresa Mears writes that many people finance their home improvements for too long:

"You don't want to be paying for home improvements long after their shine has worn off. Financing a paint job over 30 years means a very expensive paint job, plus you'll have to repaint two or three more times before you've finished paying for the first job."

For Anderson, the shine is certainly off in Malibu.

Alyssa Milano

Since she started acting in Who's the Boss? in 1984, Alyssa Milano has worked on dozens of TV shows, TV mini-series, and movie projects, building a fortune estimated to be as high as $45 million.

In the early 2000's, Milano was earning $80,000 per episode for Charmed.

She would have earned $1.76 million in 2002 alone.

Had she invested that in the stock market, she'd now have $4.85 million.

Instead, Milano and her husband, talent agent David Bugliari, are in millions of dollars of debt.

In 2017, Milano and her husband filed a $10 million lawsuit against their business manager, Kenneth Hellie, accusing him of financial mismanagement.

Their suit claims that Hellie induced her to make bad investments, forged Milano's signature on checks, and failed to pay taxes.

Hellie fired back, blaming the couple for their financial woes. He compared Milano's situation to Johnny Depp's, citing her penchant for overspending.

Milano's financial trouble began when she spent $5 million to remodel a $3 million home.

Building code violations resulted in $376,950 in fines.

She says Hellie caused costs to spiral, yet he claims she ignored his plea to stop the work.

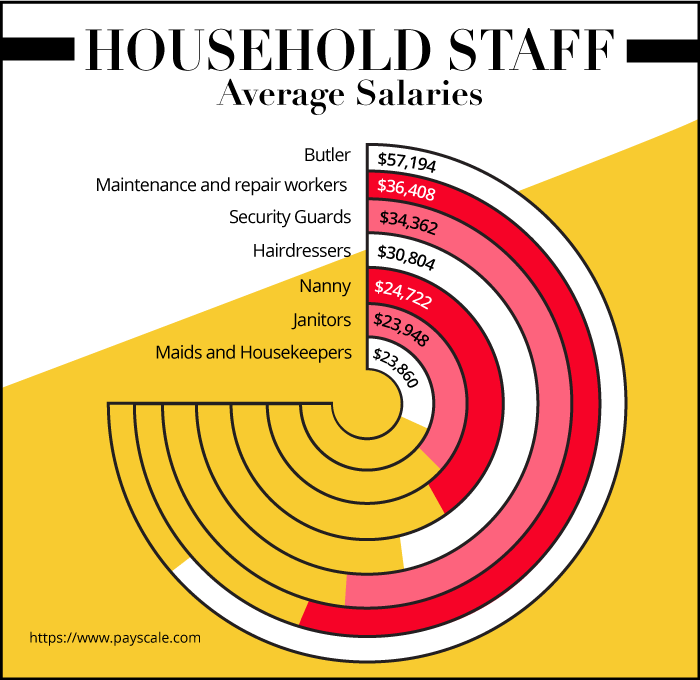

Hellie says the couple ignored his financial advice and lived beyond their means, spending freely on a second home, private planes, and household staff.

Milano's career, at least, is still on track.

She recently filmed the movie Little Italy, due out in 2018, alongside Emma Roberts.

The Lesson: Always monitor your finances

With all the finger-pointing, it's hard to know what actually happened here. But Milano seems to have been way too hands-off when it came to her own finances.

It's great to find a good financial manager, but you should never abdicate responsibility entirely.

You should always have an eye on your money, expenses and projects, even if you are as busy as a Hollywood starlet.

Kim Basinger

In 1989, the year her film Batman grossed $250 million, Kim Basinger did something unusual.

She bought the 500-person town of Braselton, Georgia for $20 million.

Basinger hoped to turn Braselton, 30 miles from where she grew up, into a tourist destination with film studios.

That money would have come in handy four years later when Basinger declared she was bankrupt.

Basinger filed for Chapter 11 after a judge ordered her to pay $7.4 million for pulling out of an oral agreement to star in the film "Boxing Helena."

Her attorneys said that she had $5.3 million in assets.

Yet even in bankruptcy, Basinger continued to live well while residents of Braselton got screwed.

The town bank was sold in her bankruptcy and locals lost jobs.

Since then, Basinger has rebounded, appearing in films like LA Confidential and 8 Mile.

At 60, she signed with IMG Models.

She is thought to be worth around $36 million.

The Lesson: It's costly to pull out of a contract

Contracts do not have to be signed on paper. Oral agreements are enforceable as well. Although Basigner denied making an oral contract for "Boxing Helena," her case is a reminder that non-fulfillment of a contract can have costly repercussions.

Also, it's a bad idea to buy an entire town.

Which of these celebrities and their foolhardy money management mistakes shocked you the most?

Let us know in the comments below!