I know what it's like to have your life changed by accessing money when you need it.

I believe that people deserve to live the life they want. But to be on this path, they need to know how credit data works.

But more than half of Americans don't even know their credit score. I was once one of those people – are you one of them?

When I was in college, I was clueless. I didn't even know what a FICO score was. And I definitely didn't make data-informed choices.

Instead, I failed to pay back my student loan and didn’t get a credit card. When I realized I wanted to open my own business and applied for loans and credit cards, I was denied.

So I started paying attention to what matters. I checked my credit score for the first time. It was a lowly 500. No wonder I wasn't getting approved.

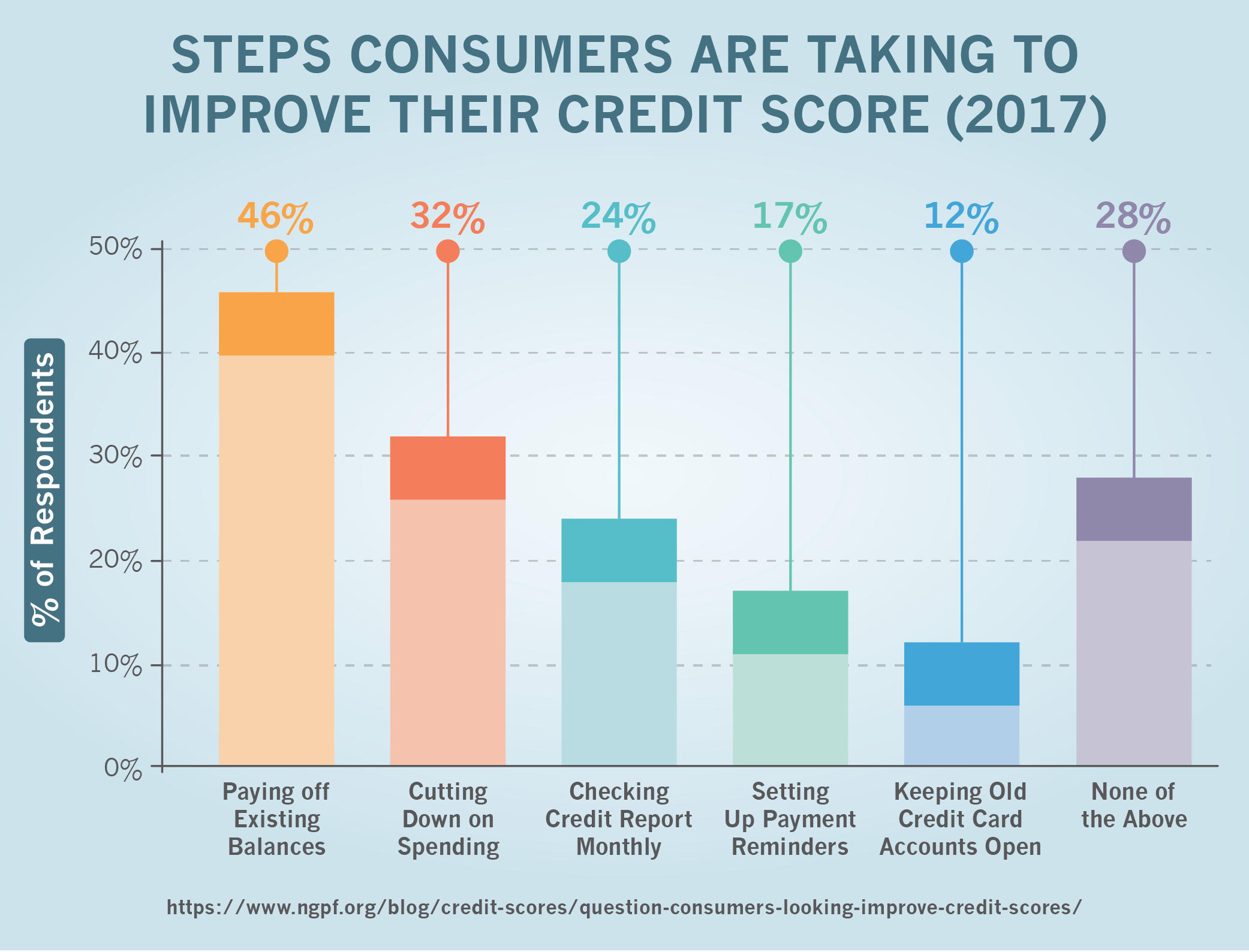

I started taking steps to improve this, like getting a secured credit card and paying it back on time for a year. Then I took out an installment loan, corrected errors on my credit report, and saw my score jump up 125 points.

It wasn't easy. It took a lot of discipline and didn't happen overnight.

But within a couple of years, I was right up there with an excellent score. Here’s how you can get there too.

Know the score!

Let's start with the obvious.

First, you need to get your FICO credit score. You shouldn't resist the urge to find out what your credit score is. If you've never got it, go get it right now!

Most people can get their score for free from their lending institution through the FICO Score Open Access program. Or you can go to myfico.com and pay for a one-time report or an ongoing report.

Did you get it? Good! What you're now looking at is a three-digit number. That's your current FICO credit score.

The highest possible score is 850. The lowest is 300. In 2017 the average credit score among Americans was 700, an all-time high.

How did you feel when you found out your score?

Were you worried because your score is lower than the average?

Did you think you were going to score higher than you did?

It's OK.

Think of this moment as a turning point. The point in your life when you learned how to make credit decisions based on data.

When you make choices based on your credit score, you can change your credit score.

And when you change your credit score, the credit options available to you also change.

It's an empowering experience to build your credit back up. Like I said, I've been there.

When you know the system you can work it in your favor.

When you know what numbers FICO is based on you can start manipulating them.

You get strategic, and it pays off!

Understand the data and make it work for you

You've taken the first step and you know your score.

Now let's dig into some data so you can better understand what that number means and what you can do about it.

"Data" is a word you hear a lot these days. Baseball teams are playing "Moneyball." It means they are making strategic decisions based on game data.

Marketers collect data on what you buy. That way they can target you with ads. Computers are "farming" data and "mining" data. Data is a new commodity and a hot one at that!

There is probably a lot of data available about your credit. Every American who is receiving credit has a score. And that score is based on all of their credit activity.

Every transaction is logged. Down payments, monthly payments, or missed payments – they're all recorded. That's a LOT of data.

But when you break it down it becomes understandable. And when you understand it you have the power to change the data.

When your credit score is improved, your choices improve.

You get more credit made available to you.

The interest rates you're offered are lower.

You might get a car loan with zero down payment.

You might now qualify for a rewards or cash back credit card, and perhaps you're not even sure what the difference is.

This can add up to thousands of dollars of savings over your lifetime

Your FICO Score is an average of the scores collected by three major credit bureaus. These are Experian, Transunion, and Equifax. All three find out whenever you pay your credit card bill or make a payment on a loan.

They also find out when you make a late payment or have a debt sent to a collection agency. Everything you do with your credit contributes to these scores.

If you have a low score you might get denied credit. You might have to put a deposit on a secured credit card.

You might even find that a landlord checks your lousy credit score and turns you down for an apartment.

It makes sense, then, to know as much about credit scores as you can. But don't worry if all that sounds like too much work – we've done most of it for you!

We've done a lot of research to help you learn to make data-informed decisions. FICO Scores are based on people's credit behaviors. I've reviewed and crunched the data of 10.12 million people related to their credit behaviors.

I've broken it all down for you here. Once you're aware of the data, you can start bumping up your own FICO Score.

So what does your FICO score actually mean?

A 650 score or lower is considered "Poor" or "Bad."

If this is where you are, you definitely have to figure out a way to improve it.

If it's between 650-699 it's considered "Fair."

But you can do better than that.

If your FICO score is anywhere between 700-749, you've got a "Good" credit score.

And if it's 750 more you have an "Excellent" credit score.

Congrats, you're right where you want to be!

Everyone's goal should be to have a credit score of 750 or higher. But that's not easy to achieve.

Your score is calculated based on five things:

1. Payment history counts for about 35% of your score

Never missed a month of paying off your credit card balance in full? You'll have a good score.

Ever made a late payment (e.g. 60 or 90 days late)? Then your score was hurt.

2. Credit utilization counts for 30% of your score

Credit providers like to see a credit utilization ratio of 30% or less. So if you have a $100 credit limit, issuers want to see that you only have a balance of $30 on your card.

If you're not using all the credit that you have available, you're demonstrating that you're a low-risk consumer. If you're borrowing up to the gills, it'll show on your score.

3. Credit history length counts for 15% of your score

The longer you've had a credit card or loan, the better. It shows you've been able to successfully carry credit.

Don't open up a whole bunch of new cards just to have more credit available. You need to hang on to them for a while to get a higher FICO score.

4. Credit mix accounts for 10% of your score

The types of credit you've used counts for 10% of your score. Have nothing but credit cards?

You won't score well.

You need to mix it up. Paying off a loan while having a credit card helps your score.

That way you're not putting all your credit risk in one basket.

5. New credit accounts for 10% of your score

Whether or not you've opened new accounts counts for 10% of your score. When you open a new account, it lowers your score.

This is because it looks like you need more credit.

Here is another important tip: your score is lowered every time someone requests your credit score.

Lots of requests for your credit score means you're looking around for new credit. But go ahead and ask for your own credit report – you won't get dinged with a lower score.

Understanding FICO score data is empowering

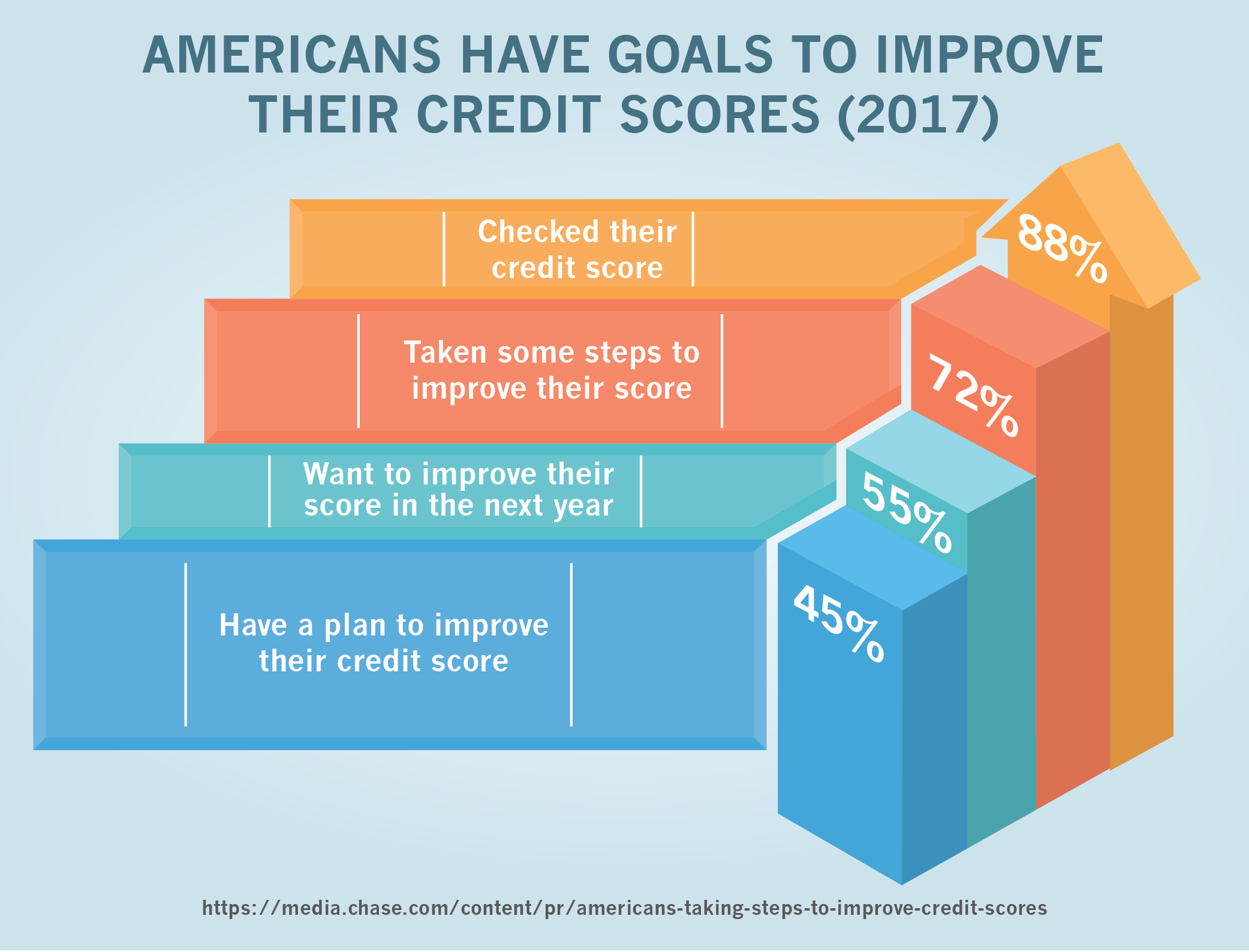

You've checked out your score, and you've learned what factors the bureaus use to calculate it.

Now let's figure out where you stand compared to the rest of the country.

The average FICO credit score for Americans is 700 or "Good."

This is the highest it has been since the bureaus started calculating average US credit scores back in 2005.

Americans with a credit score below 600 are at an all-time low of 40 million people.

That's about 20% of people with FICO scores.

20.7% of people with FICO scores have "Excellent" scores (800+). That's real improvement since the Great Recession in 2008.

Rising American FICO scores parallel the improving economy. But it's also a result of people becoming more informed.

Equifax and FICO see 40 million unique visits to their sites a year for credit scores.

How many times should you check your FICO score every year?

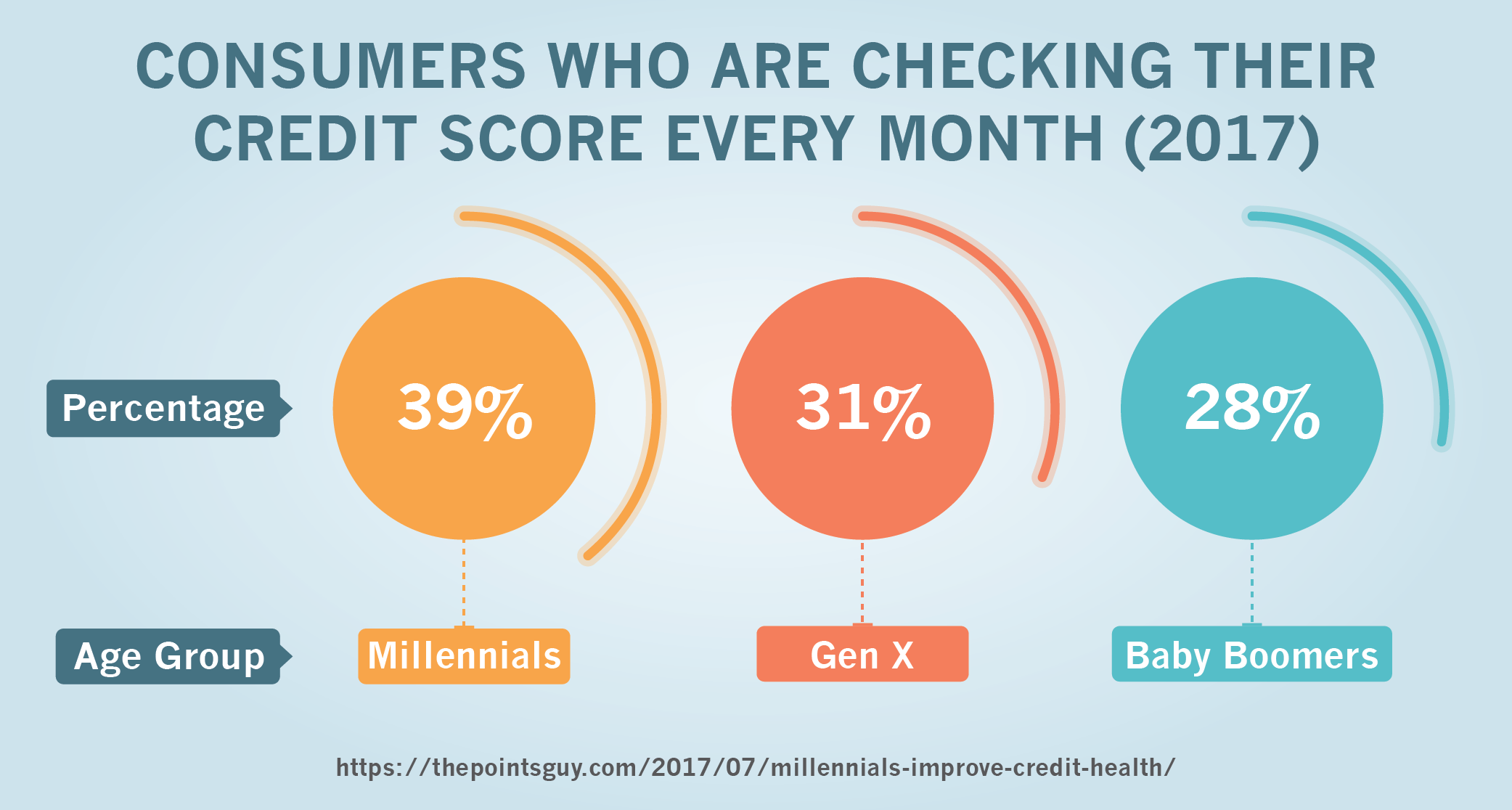

29% of Americans check their credit score at least twice a year. 21% check it once a year. It's a good idea to check it at least once a year.

You can request a free report from the three major bureaus once per year.

For a long time, I didn't think checking my FICO score was important.

I couldn't care less. Lots of people feel that way.

More than half of Americans don't know their score.

36% of Americans feel there's no reason to check their scores. 8% of Americans don't check because they don't know how.

And another 8% don't check because it's too expensive.

Age has an impact on credit scores

Age is a demographic influence on credit scores.

The average credit score for Americans aged 18-24 is 630.23.

For the 25-34 bracket, the average score is actually lower, at 628.46.

For people 35-44 it's 629.63.

At 45-54 it starts getting better at 646.53.

But highest scores go to 55-year-olds and higher – they have an average FICO score of 696.57.

It's easy to make sense of this data around age and credit. If you're younger you're probably not getting a high credit limit right off the bat. You have no track record of managing credit.

And you have no income to secure a high credit limit. The ratio of what you owe compared to what's available hurts your score.

When you're between 25-44, you're probably just getting a mortgage or a car loan for the first time.

You haven't had many years on record with loans and credit. And you're probably coming close to maxing out what you have available.

But if you're over 55, you've probably been carrying various kinds of credit debts for decades. You've had a chance to pay credit off.

Important links between race and credit scores

Reports show that people who identify as African American or Latino have lower confidence in their ability to access credit.

One reason for this is because members of these groups have lower credit scores.

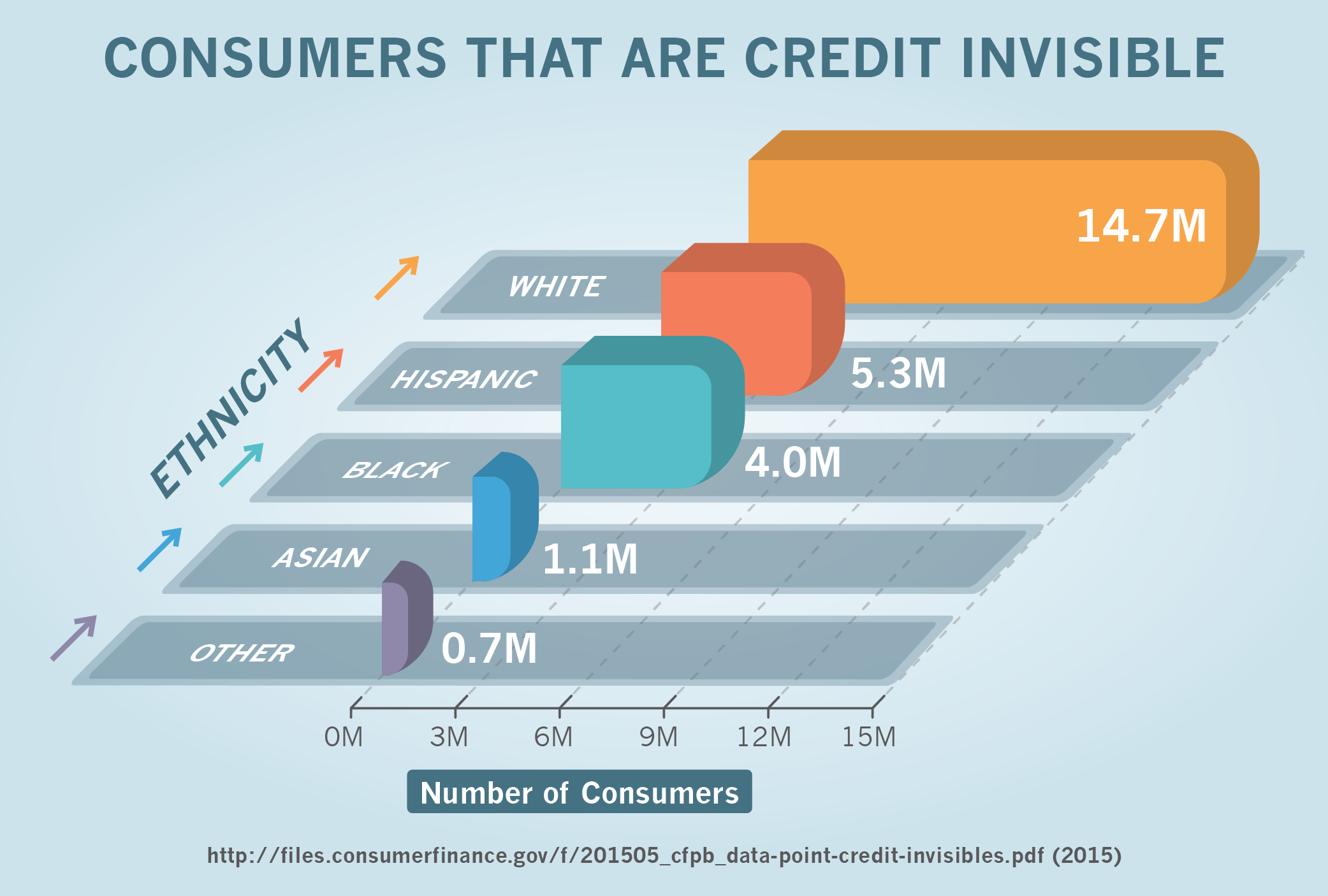

Minority groups are more likely to not have enough credit history to even have a score.

This is called being "credit invisible."

7% of White people were found to be credit invisible in the United States. Compare that to 13% of African Americans and 12% of Latinos.

In 2013, more than 64% of Whites in America had a credit score higher than 720. Meanwhile, only 41% of Latinos who used credit and 33% of African Americans scored higher than 720.

That said, the data also shows that this situation can motivate members of these groups to improve their scores.

72% of Latinos stated that they were highly motivated to increase their scores.

Compare that to 66% of the general population.

Although minorities have lower credit scores than caucasians, caucasians do have higher amounts of credit card debt.

The average credit card debt for White Americans in 2013 was $7,315. For Latinos that average was $6,066 and for African Americans it was $5,784.

Gender data demonstrate score differences between the sexes

On average, American women have better credit scores compared to men.

In 2016, the average Vantage Score for women was 675. The average for men was 670.

Other data can help us understand this gender difference. 63% of women aged 18-24 carried debt in 2016. That same year, only 36% of men in that age group reported having debt.

So women are more active earlier when it comes to exercising their credit. In 2016, women were 23.5% more likely to have open credit cards than men.

The data on credit access reveals many are "invisible"

One important piece of data is known as the "Overall Credit Economy."

That's the number of Americans who are getting some form of credit.

Do you use credit? You will be happy to know that you're not alone! 89.5% of all Americans over the age of 18 have a credit score. Almost nine out of every ten of us have used credit.

The blog Let's Talk Payments cites data from the Consumer Financial Protection Bureau indicating that 26 million Americans are "credit invisible."

That means they have no form of credit and therefore don't have a credit score.

Of those 26 million credit invisible Americans, 12 million of them are millennials.

Use credit card data to understand the market

The data shows that the average credit limit for credit cards is $8,042.

Your credit limit is tied to your credit score. People with the lowest credit scores (300-499) have an average credit card limit of $1,834. The highest credit scores (781+) have an average credit limit of $11,357.

So it is much easier for someone with a good credit score to use less of their credit that is available to them. Those with a bad credit score are not given high limits.

The data also shows that people are accessing credit card loans at high rates. The total amount of credit card debt in the US was calculated recently as $953.6 billion.That number has increased by $100 billion since 2011.

However, Americans owed less than the $1.03 trillion to credit card companies before the economic crisis in 2008.

So that means today on average adult Americans have $4,717 of credit card debt. If they all made minimum payments it would take 10 years to pay that off at the average interest rate of 15%. And they'd end up paying $18,155 in interest on a pretty small loan!

The data shows a link between credit limits and credit scores

According to The Motley Fool, people's credit limits are directly related to their credit scores.

For people with Super Prime scores (781-850), the average credit limit is $9,543. For Prime scores (661-780), the average limit for credit is $5,209.

For those with a Near Prime score (601-660), the average credit limit is $2,277.

For Subprime (500-600), the average credit limit is $966. And for Deep Subprime (300-499), the average credit limit is only $509.

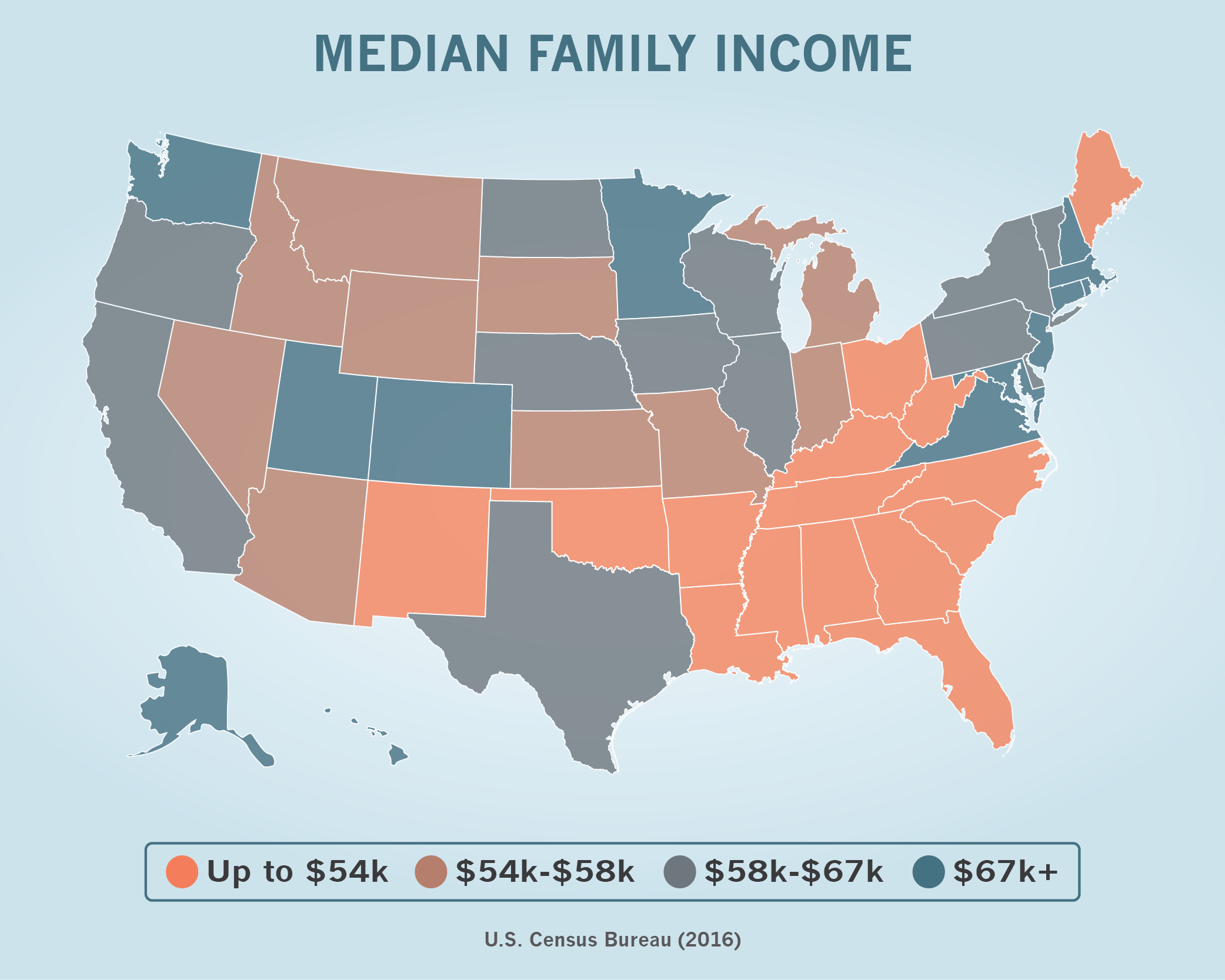

Neighborhood income data connect where people live with credit scores

The data shows differences in credit scores between low/moderate-income neighborhoods and middle/high-income areas.

Delinquency rates are often 200% higher in low/moderate income areas compared to middle/high-income ones.

Data has revealed that 30% of people living in low/moderate income neighborhoods have subprime credit scores.

Median family income data is directly linked to credit scores

Median family income is the point where half of the country falls beneath that income level and half the country is above it.

The median family income in the United States is $55,775.

For families who make under $27,887, the average credit score is 664. For $44,062 and up, it's 716.

For middle-income households up to $110,992, it's 753.

And for upper-income American households earning more than that, it's 775.

Student loans have a huge impact on credit score data

Student loans have the highest delinquency rates of all forms of credit.

Student loans for low-income borrowers had default rates of 17.9%. Compare that to delinquency rates for credit cards (16.3%), car loans (10.7%), and mortgages (9.9%).

Although the delinquency rates are lower for higher-income areas, student loans still had higher rates across all accounts.

In fact, delinquency rates on student loans are the highest they've ever been today. Approximately 8 million US student loan borrowers have stopped paying around $137 billion in education debts.

That's more than the annual GDP of many countries!

The data tells us that having a higher credit score and lots of healthy accounts is a good thing

This was a lot of data to take in all at once, but we can definitely identify a few key lessons.

Then I'll show you some actions you can take right now to improve your credit score based on these lessons.

More credit is better but go slow. The more credit you have available the easier it is to have a good credit score.

Look at the relationship of age and income levels to FICO scores. People who were older and who made more money had higher amounts available to them.

It was easier for them to keep their ratio of credit used compared to their available credit low.

Mix it up if you can. Having multiple and varied credit accounts is a good thing. You won't get a good credit score if you don't exercise your credit. Look at the impact of age and income on FICO scores.

Older people probably had several different credit streams. And they've had them for a long period of time.

Those who have more income qualify for more forms of credit. They also get higher credit limits.

It's not enough to just have a credit card.

You have to also show that you can be trusted with a loan, and/or a mortgage to get a high score.

Knowledge is power. When you know your FICO score you can better understand what credit you qualify for. Then you can do things to change it.

When you get your credit rating you're empowered. Make the most of it now that you have the data you need.

Go after credit with your eyes wide open. Do calculations to compare the rates and terms you're offered.

Then you can find the one that is best for you.

You have the power and knowledge. You can do what you need to do to make that score go up.

Play "Moneyball" With Your Credit

Alright, it's time for action! I'm a huge sports fan and loved the movie Moneyball.

When the baseball team started using data to make their decisions it was a total game changer. They went from the bottom of the league to the World Series.

Are you ready to play "Moneyball" with your credit?

You know your score. You've seen all of my research data.

Now you can do something toincrease your credit score.

We're interested in hearing your stories about your FICO credit scores.

Do you know any facts or data about credit we've missed?

Have you had success building a poor FICO score back up?

Do you have a success story like mine?

Did anyone out there ever experience the shock of a low score in the 300s?

Or feel the bliss of a perfect score of 850?

Did any doors for credit open to you when your FICO score improved?

Please comment below, we'd love to hear your take on this!