There are plenty of reasons you may want to move to a big city

Cities with a healthy job market provide access to higher paying jobs and the exact same job titles in big cities almost always pay higher than their small town counterparts.

Options when it comes to restaurants, shopping, and entertainment are also at their best in larger cities, as there is simply more to do in urban areas, regardless of your interests.

Moving to a big city does come at some cost though.

People living in metro areas often complain about some of the following drawbacks:

- Higher cost of living

- Increased traffic

- Smaller living spaces

- Pollution

However, for most people, it's a worthwhile tradeoff and an overall better quality of life.

Whether you're relocating to a new city in your current state or heading across the country here are must-know tips and advice to make your move go smoothly.

Moving Advice

Make your move a less stressful one—before, during, and after

Research what your financial situation will be like in your new city.

Things to consider include the average salary for a job in your new city and the average cost to rent or purchase a house.

You also need to account for the cost of groceries, utilities, property taxes, and other essentials.

Check out a site like Expatistan, for the average cost of living in any city in the US.

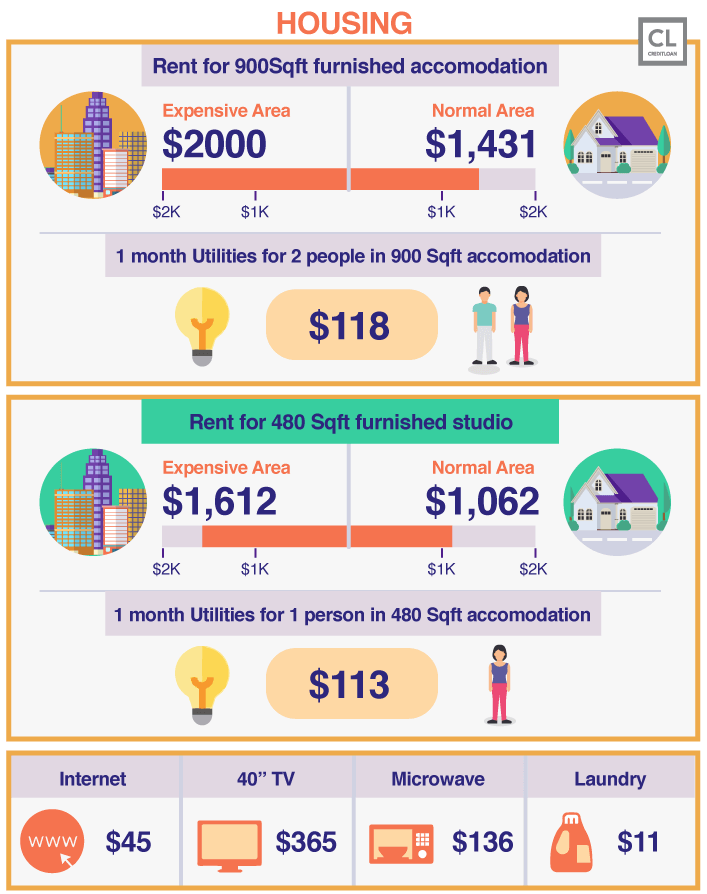

For example, here's a snapshot of some average housing costs in Chicago:

Make a budget for your life in the new city.

Now create a basic list or spreadsheet using your research from the first step.

Use separate columns or lines to compare your expected monthly incoming and outgoing money.

After everything is paid for, how much money will be left over for savings?

Does your budget end up showing that you may break even each month or lose money?

If so, you will need to either shift some priorities around or consider if moving to a new city will even be possible.

While you're at it, create a moving budget too.

Moving van costs, security deposits, insurance, storage and other fees can all start to add up quickly.

Having some idea of the total costs by budgeting will allow you to start planning and saving for it, which means you won't end up being surprised by a huge bill after the fact.

Get at least three estimates for major expenses like moving companies and check online to ensure they are reliable.

Consider opening a line of credit.

Chances are, you won't be paying for all of your moving expenses with cash.

A personal loan or credit card may be necessary to cover all those moving expenses.

Open a new bank account in your future city.

Especially if you're moving to a different state, your current bank may not have any branches in your new location.

Plan in advance and open an account with a more convenient bank if necessary.

Check out some reviews and make sure you select a bank that suits your needs, then transfer all of your money and investments over and close your existing accounts, ensuring that your finances are ready to go in your new place from day one.

Apply for jobs before you move.

If your move to a new city isn't part of your current job, you will need to find a new job pretty quickly.

Landing a job in the city of your choice before you move removes a lot of initial pressure.

Many employers are now willing to do telephone or Skype interviews, making it easy to interview for jobs across the country.

Secure a living arrangement in advance.

Once you've landed a job in your new city, you'll want to begin looking for a home to rent or buy.

The other alternative is to get an Airbnb for a month or two while looking for your own house or apartment, but this can get expensive.

If your lease starts early, you may also need to be paying rent at both your old and new locations for a couple of months during the transition period, so make sure this transition is included in your budget.

Have an emergency fund.

Moving is a significant process, and something will inevitably go wrong or cost more than expected.

What if some of your belongings are damaged during transport or your shower breaks after a week in your new home?

If something happens, you'll be glad you had some extra money saved up for such an occasion.

Verify what your employer will cover.

If your company says it will cover relocation costs, it's important to ask exactly what that includes.

You may be reimbursed for packing services, travel expenses and transportation, shipping, and more.

During the hiring or job transition period, try to negotiate other costs as well, which can include expenses such as temporary housing, storage, and lease cancellation fees for your current home or vehicle.

Keep your paperwork for next tax season.

Some relocation expenses are tax deductible if they meet specific time and distance requirements.

Check out the IRS website for full details on what you can claim when filing your taxes and make sure to keep your receipts and other documentation so that you can pay less in taxes next year.

Be prepared for partial-year state taxes.

Your expenses will be deducted on your federal tax return, but you may be required to file two separate state tax returns if you're moving out of state.

If you're moving to or from Texas, Nevada, or Washington you're in luck—these states do not collect individual income taxes.

Every other state will require a state tax return for the period you lived there.

If you want more information on state tax returns or how to file partial-year taxes, many tax accounting companies and websites offer this information.

Update your information.

If you're keeping your current car or phone plan, you will need to update payment information for these recurring bills, as well as student loans.

Make sure you inform the US Postal Service of your address change, which will prompt them to forward your mail for up to a year, which helping to catch anything you missed.

You will also need to obtain a new driver's license.

Actionable First Steps

Ensuring your move goes smoothly through early planning.

Now you know what kind of impact you can expect on your finances when you move to a big city.

In order to assess how that will impact your own finances, you just need to go ahead and do the following:

Visit your potential city before you make a move!

Take at least a week of vacation in advance to go explore your new city and make sure it's somewhere you can see yourself living.

Try to experience the city as an ordinary resident, instead of hitting popular tourist spots.

You're going to be in this new city for years, so take some time up front to make sure you won't be miserable there!

Ask locals for advice online.

Many large cities have a multitude of online forums and other communities.

Locals are eager to provide you with the good (and bad!) about their city, and often have an FAQ section for new or prospective residents.

Things to ask about include the following:

- Good vs. bad neighborhoods

- Average rental or house prices in different parts of the city

- Popular stores

- Childcare

- Doctors

- Public transportation

- Any other vital details you're curious about

For instance, Austin provides their own relocation guide, with lots of information and tips from community members.

Make a timeline.

Stay organized and have a plan to gradually get prepared weeks in advance, which will help you avoid last minute convenience expenses.

Start gathering moving materials in advance.

Boxes can be expensive to buy, but you can get free boxes from the grocery store or other shops to cut costs.

Start collecting newspaper and bubble wrap to protect fragile items such as plates and dishes too.

Do little cleaning jobs as you go.

After a room or even a single shelf has been cleared, take a few minutes to clean the area.

This will prevent multiple hours of cleanup at the end, or of having to hire professional cleaners when faced with an overwhelming job at the end.

For renting, this is especially important, since you'll want to get your security deposit back.

Downsize.

If you've always wanted to move toward a more minimal lifestyle, moving is your perfect time.

Take a good look at all the items in your house and see which ones you haven't even touched in months.

All that stuff at the back of the closet is probably better off being sold in a garage sale, donated, or just thrown away rather than lugging to another city.

Some thrift shops will even provide a donation receipt that could prove useful next time tax season comes around!

Consider selling large items.

How attached are you to that 10-year-old stove, the freezer that makes a weird noise sometimes, or sofa covered in cat scratches?

Sometimes it can be more cost-effective to buy new items in your new city.

This allows you to avoid the cost of a larger moving truck and the extra hourly mover rate for all those oversized items.

Depending on your specific situation, it's worth investigating.

Consult with your partner.

If you have a partner who is moving with you, make sure you take their income and expenses into account as well when budgeting.

Label all of your boxes.

It can seem like a bit of a hassle up front but will save a lot of time unpacking.

Ideally, label the box with both a general overview of the items it contains, as well as which room the box will belong to in the new house.

Avoid making too many "miscellaneous" boxes—in my experience these end up just sitting in the garage or spare bedroom for months after you move in.

-

This will hold markers, packing tape, scissors, medicine, toilet paper, or other items you'll need right up until the moment you leave for good.

The less time you have to spend finding misplaced items, the quicker you can get everything packed up.

Look into storage units.

You may want to consider a low-cost storage rental for some of your items that you want to keep, but don't want to deal with moving right away.

For a cheaper option, friends and family members may be able to hold on to some of your belongings during the move.

-

This is sort of the opposite of your moving box, with things you'll want access to right away when you arrive at your new home.

Consider filling it with items such as the coffee maker and some toys to keep your kids occupied during the unpacking process.

Get several moving company quotes.

Prices can vary drastically but you should also consider online reviews and reliability as well as simply the cost.

Renting your own moving truck and doing all the heavy lifting yourself is certainly an option as well.

Although from experience, I can tell you that you may later regret this decision, especially if you aren't in the best of shape.

Paying a few thousand dollars for professional movers is usually well worth the money, particularly for major moves—and your knees and back will thank you later!

Bring your own food on moving day.

Packing your own drinks and snacks in a cooler means you'll only have to stop for lunch and dinner.

It also helps you avoid paying a premium for these items at gas stations and convenience stores.

Look for cheap hotel deals.

If you're traveling across the country, your move will likely take more than one day, and you'll want some rest.

Look online in advance for coupons and other deals for restaurants, hotels, or any other services you may need.

State or city websites will sometimes offer welcome packages of coupons to new residents.

If you have friends in your new city, see if you can crash on their couch for a night to save the cost of a hotel.

Don't buy new items right away.

Resist the urge to take a trip to the hardware store as soon as you move in.

Let yourself relax into your new home and see what's really needed, and what you can put up with for now.

Ideally, live in your home for six months or more before you consider any large remodeling or painting projects.

Choosing a New City

Make a careful decision in advance about where are you going and why

If you are lucky enough to have the freedom to choose your new city, instead of having it dictated by your employer, you have a ton of options available!

Choosing where you will live in the next several years will have a huge impact on how your life plays out.

Make sure to consider all the possibilities carefully.

Many websites are claiming to have a definitive list of the best big cities to live in, but below is my personal top 10 ranking.

1. Austin, Texas

- Population (2016)947,890

- Median household income$55,216

- Median house price$375,000

Austin has been an up-and-coming city that has made most "best large cities to live in the USA" lists for a while now.

However, it was only last year that it began to crack the #1 spot on many lists.

People move to Texas' capital every day last year for its fantastic music and culture, as well as its bustling business scene.

Austin isn't the only city in the state experiencing a population boom.

According to the US census bureau, 10 of the 15 fastest-growing large cities are in the South, with four of the top five being in Texas.

2. Colorado Springs, Colorado

- Population (2016)465,101

- Median house income$54,228

- Median house price$273,225

Natural parks, cultural attractions, and quality schools all make Colorado Springs a great place to call home and raise a family.

Medical technology and innovation are a significant part of the city's job market, along with military jobs.

Residents are only an hour away from Denver by car and world-class ski resorts like Aspen are also just a short drive away.

3. Virginia Beach, Virginia

- Population (2015)452,745

- Median household income$61,805

- Median house price$258,206

With its high household income and reasonable housing prices, Virginia Beach is one of my favorites.

Residents also enjoy the lowest crime rate of all America's big cities and the lowest percentage of the population living in poverty.

4. San Francisco

- Population (2015)864,816

- Median household income$78,378

- Median house price$1.61 million

If you can get past the exorbitant cost of living, San Francisco is a great place to take up residence.

The city has over 30 international finance headquarters, meaning plenty of business-related jobs are available.

Thousands of tech companies, college graduates, and startups have flocked to San Francisco within the last decade.

San Francisco is also the center of the LGBT rights movement.

It's also one of the most vegetarian- and vegan-friendly cities in America.

The beautiful weather allows for plenty of outdoor activities which could be why an Francisco is among the happiest and healthiest places to live in the US.

5. San Diego

- Population (2016)1.4 million

- Median household income$63,400

- Median house price$529,750

While the cost of living isn't as bad as San Francisco, San Diego is still one of the more expensive cities to live in.

It's well worth the price when you take the city's beautiful beaches and year-round sunshine into account.

The seaside also plays a significant part of San Diego's economy, with over 30 million visitors per year and a major US Navy and Marine Corps presence.

6. Des Moines, Iowa

- Population (2016)215,472

- Median household income$46,430

- Median house price$127,950

You might have just done a double-take at that median house price after some of the other cities on this list, but it's correct!

Housing in Des Moines is that cheap.

There are plenty of locally owned restaurants and quiet neighborhoods in Des Moines creating just the right blend of small-town charm and big-city perks.

There are 80 insurance companies in the city, including Wellmark Blue Cross Blue Shield and Allied Insurance.

This means there is a thriving job market.

7. Fayetteville, Arkansas

- Population (2016)204,759

- Median household income$44,5140

- Median house price$103,713

Fayetteville started as a small town but has grown into a university city and center of commerce.

It sits along the beautiful Ozark Mountains.

There are also seven Fortune 500 companies headquartered within the surrounding area.

Some big names include Tyson Foods and Walmart.

It also houses the flagship campus of the University of Arkansas.

8. Washington DC

- Population (2017)693,972

- Median household income$56,835

- Median house price$307,658

DC isn't just for politicians!

This Mid-Atlantic city has mild weather, a strong job market for education and health services, and fewer natural disasters than other cities on this list.

Enjoy the beauty of watching the leaves change in the autumn, as well as beautiful summers.

Its central location makes a day trip to Baltimore, Philadelphia or New York no big deal.

9. Portland, Oregon

- Population (2016)639,863

- Median household income$54,148

- Median house price$345,500

Portland takes pride in calling itself a "weird city," which may really appeal to some people.

The city is known for its microbreweries and coffee shops, as well as thriving music, theatre, and art scenes.

It still has plenty to offer for professionals with major employers such as Intel Corporation and Nike.

10. Huntsville, Alabama

- Population (2016)193,079

- Median household income$48,900

- Median house price$234,698

Huntsville is another sleepy little town that grew into a major thriving city, gaining notoriety in the 1960s when much of NASA's space program was carried out here.

Residents can take advantage of great shopping and dining experiences here in the fastest-growing city in Alabama, while still having a low cost of living.

Huntsville may be undergoing another revitalization, with plenty of craft breweries and tech companies setting up shop in the city within recent years.

Just make sure you can handle the heat and humidity!

Now All That's Left to Do Is Start Packing!

Are you planning on moving to a new city soon?

What factors played a part in deciding which city to move to?

How do you think the move will change your finances?

Tell us in the comments below!