Who is JG Wentworth?

If you watch TV, you likely know J.G. Wentworth's commercials. "I have a structured settlement, but I need cash now!"

There's a good reason it gets stuck in your head.

Over its 25-plus years in business, J.G. Wentworth has bought $2.9 billion in structured settlements, making it the largest settlement buyer in the United States.

When someone wins the lottery or a civil suit, the money is often paid in fixed monthly payments, instead of a lump sum of cash.

That's a structured settlement.

But the terms of a structured settlement can't be changed.

Buyers like J.G. Wentworth have found a market buying people's future settlement payments for large lump sums.

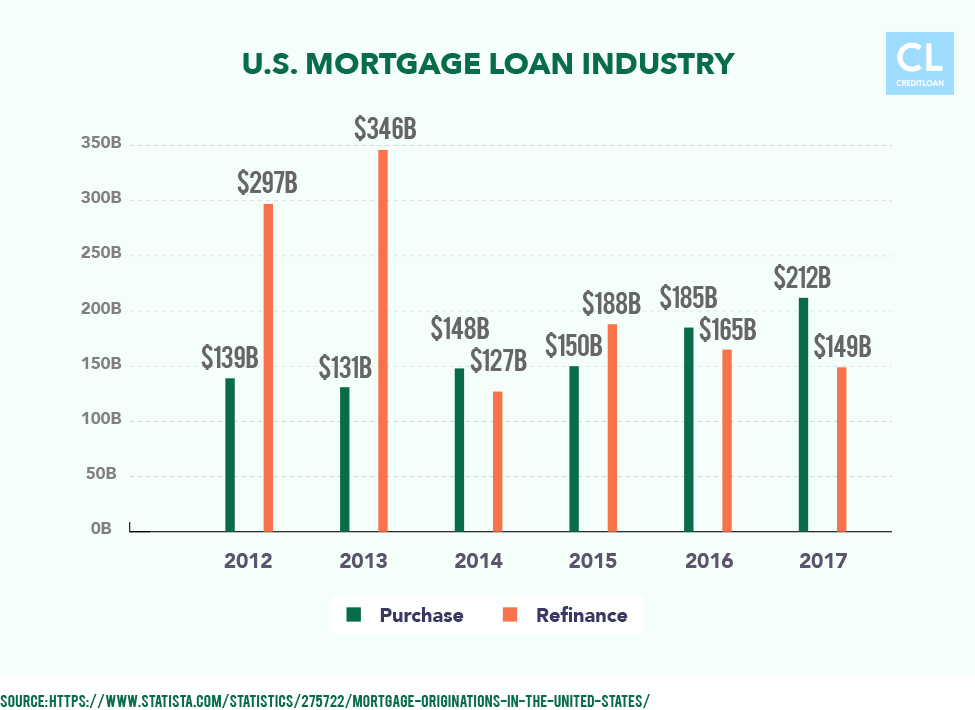

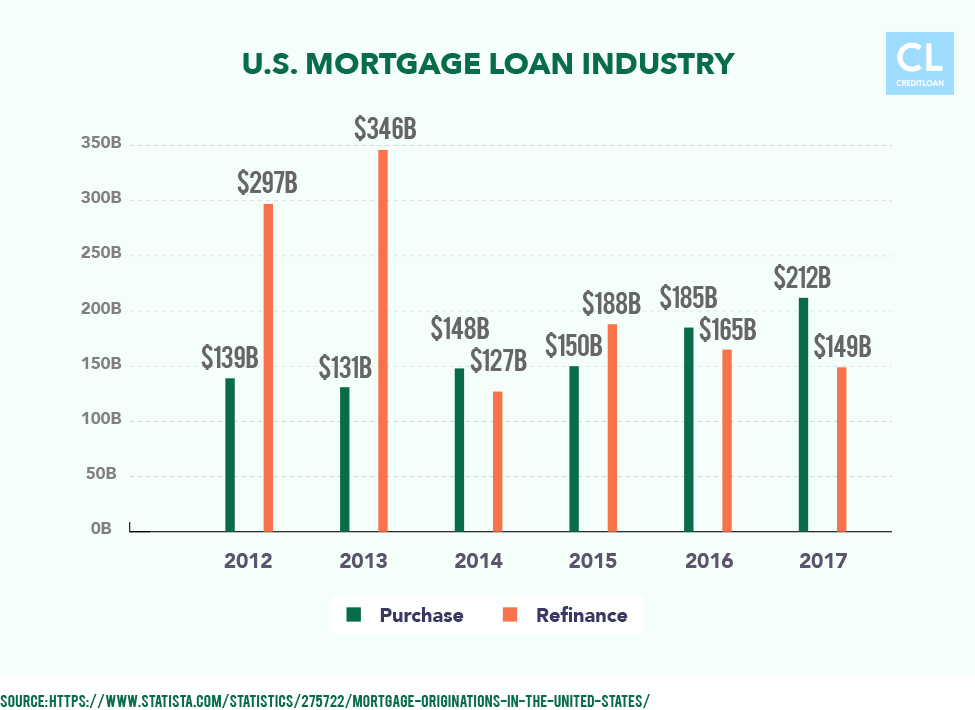

In 2015, the company bought WestStar Mortgage Corp. and started offering home lending products.

The company also offers pre-settlement funding, so people involved in civil suits can sell some of their future payments before the case is settled.

Products & Services

In addition to its structured settlement services, J.G. Wentworth also offers unsecured personal loans from $1,000 to $40,000, business loans from $5,000 to $250,000, several home mortgage lending products, and a Visa-branded prepaid debit card.

But J.G. Wentworth is best known for its annuity and settlement buying business.

When you sell a structured settlement or annuity, you pay a discount rate to the buyer.

The discount rate is like the interest on a loan. The lower the rate, the better the deal.

You get a big lump sum of cash, while the buyer gets to collect some, or all, of the remaining monthly payments on your structured settlement or annuity.

It's a good idea to get a financial planner's opinion before selling your structured settlement.

Reputation

J.G. Wentworth has a good reputation as a buyer of structured settlements.

This cannot be said of all buyers, and many states have laws regulating this business.

In 2015, the Consumer Financial Protection Bureau decided to look into J.G. Wentworth's settlement buying business, but it later dropped its investigation without explanation.

Customers reviewing the company online have said mainly good things. Of 49 ratings at ConsumerAffairs.com, 40 rated it five stars and five rated the company four stars for its settlement and annuity purchasing services. Reviewers praised its helpful customer service and quick turnaround times.

J.G. Wentworth also received many favorable reviews of its home lending services. Out of 35 reviews, 32 rated the company five stars for home lending. Customers praised its friendly and helpful customer service.

J.G. Wentworth has been accredited by the Better Business Bureau and has an A+ rating with the agency. Negative reviewers there mainly complained of poor customer service and issues with billing and collections.

Frequently Asked Questions

How do JG Wentworth's annuity purchase services work?

After getting in touch with J.G. Wentworth for a quote, the company will either connect you with a different buyer or will make an offer itself.

If you accept an offer, the company then asks a judge to approve the sale.

Why would I want to sell my structured settlement?

You can't change the terms of a settlement, even if life takes a turn for the worse.

If you've lost your job, for example, a lump sum might sound better.

During the recession, J.G. Wentworth said it saw more interest in its settlement buying services, though it didn't say how many more calls it got.

Financial advisors might caution against selling a structured settlement if you have other options.

The lump sum from an annuity buyer can be much smaller than the total amount you would ultimately get if you didn't sell it.

How can I sell my structured settlement?

It might sound simple at first, but selling your structured settlement can be quite complicated.

You start by contacting a buyer and reviewing your claim with an agent.

If they decide they want to proceed, they'll make an offer, including a discount rate.

The discount rate is like the interest on a loan and ranges from 6 to 29 percent.

You don't have to accept the first offer and can negotiate for a better deal.

Once you've accepted an offer, the buyer will then petition a judge to transfer the rest of the payments.

The judge will consider the discount rate, the buyer, and your plans for the money.

Most people sell just part of their remaining payments.

Few sell the whole settlement at once.

How do I know I have a structured settlement?

If you've been involved in a civil lawsuit, your lawyer should let you know if you'll get a structured settlement.

Sometimes people inherit annuities, too.

If you think you may have inherited some money, you should be able to find this in the probate file at the superior court in the county where that person lived.

What is the difference between an immediate and a deferred annuity?

An immediate annuity begins payments almost immediately, while a deferred annuity begins payments years later.

Structured settlements are a type of immediate annuity because they begin payments almost right away.

Sometimes people use immediate annuities to set aside money for retirement.

Because it may not start making payments for decades, a deferred annuity is a little more like an IRA or 401(k).

Most deferred annuities have a provision allowing you to cancel the policy and receive a lump sum, for a fee.

How much does it cost to use J.G. Wentworth?

J.G. Wentworth does not post its discount rate online, but some sources put it between 9 and 15 percent, or even higher.

This can be a better deal than a credit card, which can carry an even higher rate, but consider how badly you need the lump sum now.

Likewise, J.G. Wentworth does not post its rates for its home loans and personal loans.

Do I need to qualify to use their services?

Yes – in a way.

Your credit score and history don't really matter when you want to sell a structured settlement, but a judge must ultimately approve the sale.

Buyers of structured settlements can sometimes be unscrupulous and some even target disabled people specifically.

A judge reviewing the settlement buyer's petition will consider factors like the discount rate, the buyer's reputation, and how the seller plans to use the cash.

Can I cash out my annuities?

That depends on the type of annuity. If you have a deferred annuity, you will probably be able to cancel for a fee.

You don't have this option with an immediate annuity, however.

If you want to cash out an immediate annuity, then you have to sell it to a buyer like J.G. Wentworth.

What other brands does JG Wentworth operate under?

J.G. Wentworth operates under many brands.

Its two main brands are J.G. Wentworth and Peachtree Holdings, but some of its other brands include Orchard Acquisition Company, Red Apple Management Company, Golden Apple Management Company, Green Apple Management Company, and CashNow Loans.

What's the difference between a structured settlement and an annuity?

A structured settlement pays out money owed from a civil case or lottery, in fixed monthly payments, as opposed to a lump sum.

Those payments are made through a tool called an annuity.

Broadly, an annuity is a lump sum that will be paid back over a fixed period of time.

In a medical malpractice case, for instance, the settlement would be paid out of an annuity the defendant had already bought.

The terms of a structured settlement can't be changed if, say, you lose your job and suddenly need cash, but you can sell future payments for a lump sum.

J.G. Wentworth deals in this business two ways.

The company might broker a deal between the seller and another buyer, or it might directly buy all or part of the structured settlement.

Should I sell my structured settlement?

That depends on why you need the money.

If you have a settlement that pays $300 per month, but your pipes just burst, then a lump sum of cash might sound like a very good idea.

p>While J.G. Wentworth is generally considered a legitimate and reliable business, you should be aware that some predatory companies do operate in this business.

According to the Consumer Financial Protection Bureau, some settlement buyers specifically target disabled people and in the days before these businesses were regulated, some of these companies would take as much as half the remaining payout.

The Consumer Financial Protection Bureau says you should do the math.

Calculate how much you would receive as a lump sum, after taxes, fees, and other costs, and weigh that against the total amount remaining and the number of payments left.

Depending on the cut the buyer wants to take, you may want to consider selling a structured settlement as your last resort.

What kind of FICO score do I need to be considered?

Your FICO score doesn't matter when you're selling a settlement or annuity.

It does matter, if you are applying to J.G. Wentworth for a loan of any kind.

How much money does J.G. Wentworth take from a settlement?

J.G. Wentworth doesn't post this online, but several sources say the company typically charges a discount rate between 9 and 15 percent, or more.

Where does J.G. Wentworth do business?

J.G. Wentworth is based in Radnor, PA, but it does business throughout the U.S.

Why does JG Wentworth sell unsecured loans? What are the benefits to it?

J.G. Wentworth makes unsecured loans for the same reason any other lender does.

Unsecured personal loans are especially popular with younger people who can't afford real estate market, but still have other borrowing needs.

Lenders can also charge higher rates for unsecured loans, and when interest rates are so low already, that sounds good to many lenders.

Can I use the prepaid cards to make purchases online?

You can use JG Wentworth's Visa-branded prepaid card wherever Visa is accepted.

You can also have your paycheck, or part of it, direct deposited onto your card.

You can also refill your card at a MoneyGram or Western Union store.

JG Wentworth charges a monthly fee of $2.95 for this debit card unless you direct deposit at least $500 on the card per month.

Verdict: Is it worth it?

J.G. Wentworth certainly deserves its decent reputation, but selling a settlement or annuity is a serious matter.

If you don't sell any of it, you'll get more money in the long term, but life is also unpredictable.

If you've lost a job or suffered weather-related damage to your home, that might be a good reason to sell some of the future payments on your annuity.

But first, you should calculate how much money you would get if you don't sell any of it.

Weigh this against the amount you would get in the short term, and consider whether it's worth it for this immediate need.

If life happens and you don't want to mess with your settlement, there are always plenty of loan options to get you out of a bind.

Remember, that you can sell just some of your settlement and that you don't have to accept the first offer an annuity buyer makes.

Don't be afraid to negotiate!

In short, it's really up to you.

While that's not exactly a verdict, we hope this review at least arms you with the knowledge to make an informed decision.

Have you used J. G. Wentworth, or any other annuity or structured settlement services? What was your experience? Let us know in the comments below!