The Verdict

H&R Block is a trustworthy tax giant with locations across the country, but it could invest in technological innovation

Originally a bookkeeping service founded by the Bloch brothers, H&R Block is now a ubiquitous presence with 12,000 locations across the country. According to the company, 95% of Americans live less than five minutes away from an office.

All-in-one tax help. Whether you're an expat who needs help from abroad, prefer to DIY your taxes online, or need a tax refund advance loan, H&R Block offers everything in one place.

With more locations than any competitors and a free consultation, H&R Block has got you covered.

Technology is good but not flashy. H&R Block offers an easy-to-use online interface that guides users through the tax filing process.

It has a solid interface that will help you file, it's good but not flashy.

For customers who want the latest technological integrations and innovation, H&R Block might not be the right choice.

Why You Should Consider H&R Block

H&R Block offers several ways to file your taxes for free and has impressive offerings like 0% loans with no fees

H&R Block was originally a bookkeeping service founded by two brothers: Henry and Leon Bloch. But when Leon decided to go to law school and leave the business, their younger brother, Richard Bloch stepped in.

Together, Richard and Henry created H&R Block as it's known today.

Is H&R Block the best tax service for you?

Depending on your unique preferences, H&R Block may or may not be the best service for you.

Answer the questions below to help you decide.

Do you want a free way to file a simple tax return? With H&R Block's "More Zero" campaign, customers can file 1040EZ, 1040A, and 1040 with Schedule A online for free.

If you're looking to itemize your deductions, H&R Block's free offerings will save you upwards of $40 compared to competitors.

H&R also offers free in-person help on 1040EZ filings.

The 1040EZ is one of the least complicated forms, but free one-on-one tax help for filing sets H&R Block apart from its competitors.

It's also a great opportunity for first-time filers to get questions answered.

Do you need access to your refund sooner? In addition to tax filing, H&R Block offers customers the opportunity to apply for a $1,000 line of credit (which is better than a credit card for cash advances) on the Emerald Advance card.

H&R also offers a prepaid debit card that can be used year round.

In fact, refunds can be deposited directly to the card.

H&R Block also offers a 0% interest, no fee loan that allows customers access to their refund within 24 hours of filing with H&R.

Customers without the loan won't receive a refund from the government until late February (at the earliest) this year.

Why People Love H&R Block

File your taxes with H&R and you'll get excellent customer service, refund advance loans with great terms, and the ability to pay with your refund

Personalized help from tax experts. With locations around the country, H&R is committed to providing affordable, in-person help from qualified tax experts.

"[The H&R expert] went the extra mile trying to help me with my complicated tax issues that arose from having to refile the previous year. Although it was almost effortless on her part because she knew what she was doing, I really appreciated her coming through for me like that," explains Daniel from Fort Mill, South Carolina in an online review.

Get your refund within 24 hours. What really sets H&R Block apart is that it offers refund advance loans of up to $3,000.

Up to 80% of applicants are approved and H&R Block even takes care of the loan origination fees, which range $32–$36.

Pay nothing out of pocket. Instead of paying when your taxes are filed, H&R Block offers customers the option to pay later. Instead of paying upfront, the fees are deducted from your tax refund.

Known as a refund transfer, there's an additional $35 fee associated with the service, but if you can't afford to pay upfront (or simply don't want to) it's an excellent offering.

Biggest Consumer Complaints

The in-person fees are not fully transparent and if you're not careful, representatives may try to up-sell services

Add-ons can add up. With a variety of add-ons to choose from—tax audit defense, preparation check, and identity shield—H&R offers a lot of additional features, and most of them come with additional fees that tax experts try to add on at the end.

"The preparer was pleasant but at the end, I was asked whether I wanted a protection plan for additional fees…

Why would you need a protection plan when the company and its preparers should stand by their work product without the additional fee gimmick?" asks Krista from Pueblo West, Colorado in an online review.

Good technology but not the best. In the past few years, H&R has worked hard to revamp their online tax filing experience, but with fewer app integrations, a less intuitive interface, and occasional glitches, there is still a lot of room for improvement—especially compared to competitors in the same price range.

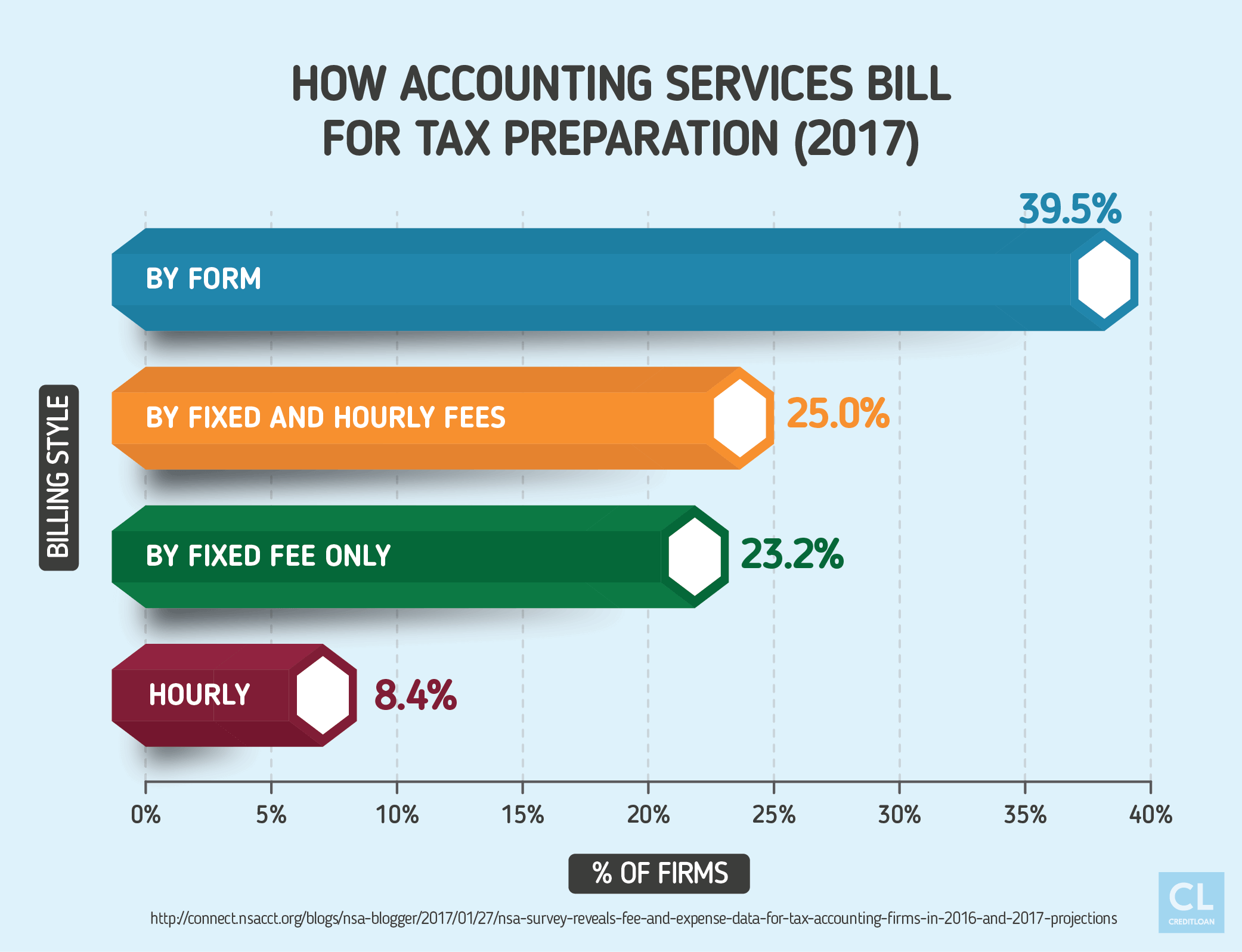

Pricing that fluctuates. Even though the online pricing is straightforward, the in-person fees are not.

Depending on the details of your taxes and who you work with, tax preparation fees at H&R can vary by hundreds of dollars.

Unlike boutique tax preparation firms, H&R Block does not bill hourly, so pricing for in-person help isn't very straightforward.

"After the lady was done [filling my taxes] she informed me it would be about $300 because ‘I had more than one W-2 and it was complicated'. I was told it would probably be about $100 before then so I was very upset," explains Geena from Smyrna in an online review.

The Competition

H&R excels at in-person help while TurboTax wins for superior technology

As two of the biggest tax preparation firms in the United States, H&R and TurboTax compete for customers.

Both companies serve similar clients, but there are some notable differences.

Here's how they compare.

Support is strong but different. Both H&R Block and TurboTax offer excellent support (both free and paid). For people that prefer in-person help, H&R Block is better.

For those who are comfortable getting help online, TurboTax is the best of the best.

TurboTax leads the way in technology. Owned by Intuit (the same company that created the popular budgeting app Mint), TurboTax leads the way in user-friendly software and intuitive ways to import tax information.

H&R Block is cheaper if you're self-employed. TurboTax requires self-employed filers who want to file online to purchase a specific self-employed option.

The price? $119.99.

H&R Block's self-employed option costs $94.99. It might not seem like a big difference, but over the course of 10 years, H&R Block will save you $250.

If you like H&R, then here are other competitive offerings to consider

Drop-in taxes at Walmart. With thousands of Jackson Hewitt tax locations located in Walmarts around the country, stopping by for a consultation is easy. Simply drop-in next time you pick up groceries —no appointment necessary.

Refer a friend and earn $50. After you file your taxes at Liberty Mutual, you'll get a unique send-a-friend code. When one of your friends files in-person at Liberty Mutual, they'll get $50 off their filing fees and you'll get $50 cash. Win-win.

Cheap filing for complicated taxes. If you're tired of paying upwards of $50 to file your taxes, FreeTaxUSA might be for you.

With the Deluxe option for complicated taxes ringing in at just $6.99, you'll save $48 compared to H&R. That's $480 in savings over 10 years.

The Question Everyone's Asking Now

"Is the tax refund advance too good to be true?"

Fees and rates are the real deal. With 0% interest and no fees , the loan may sound like its too good to be true, but don't balk.

The only requirement?

You must file your taxes in-person with H&R Block and you must open an Emerald Prepaid Mastercard, which doesn't have any fees.

Savings are high. With an average interest rate of 16% for personal loans , customers who are approved for the refund advance loan (which allows you to receive your refund within 24 hours) are looking at big savings.

Compared to a loan with a 16% interest rate, people who use a tax refund advance and pay $100 for 24 months will save $175 on a purchase of $1,000.

H&R considers it an acquisition fee. If you're wondering what H&R gets out of the deal, it's simple.

In a saturated tax preparation market, H&R wants to do everything possible to encourage people to use their service, including offering 0% loans.

How H&R Block Works

H&R Block is committed to meeting customer needs with different tax filing options and additional services

Options that are easy to understand. Broken down into three initial categories—"I can handle it," "check my work," and "leave it to the experts"—the tax filing options are easy to navigate.

The good news is that regardless of how you file, you can always opt to "check my work" with a tax expert for an additional fee that starts at $49.99.

Three distinct ways to file your own taxes. As more and more people move online, H&R Block has adapted its tax filing options to include online filing, downloadable software, and in-person filing with a representative.

The online forms are completed on the H&R Block website while the software is downloaded and completed using your personal desktop.

The software provides a little bit more control, but the main difference is personal preference.

How to get started. Once you know whether you want to do it yourself or get help, you'll be guided through an automated interview process (selecting categories that relate to your situation) to help determine the specific tax form you need to complete.

If you want to get started online, you'll need to answer a few simple questions about your lifestyle (like if you're a homeowner or have children).

You'll then be directed to the tax filing software that's best for you.

Creating an online account takes about five minutes and after that, you'll be good to go.

If you're interested in filing your taxes in-person, you can make an appointment online or simply visit your local H&R Block office.

These are the documents you need. Make sure you have basic documentation ready before you file—a W-2 form for regular employment or 1099 form for self-employment. You'll also need social security numbers for yourself, your spouse and any dependents.

Here's the pricing breakdown:

Free tax filing for simple taxes. Customers can file 1040EZ, 1040A, and 1040 with Schedule A online for free.

- Deluxe filing for $54.99 which is best for the most deductions.

- Premium filing for $74.99 which is best for homeowners and investors.

- Self-employed filing for $94.99 which is best for freelancers and contractors.

You may have to buy Premium. Customers who are self-employed and/or earn income from retirement accounts or investments are required to use Premium.

Premium also comes with more capabilities, like importing tax data from apps like Stride and Uber.

Three types of guarantees. The first guarantee offered by H&R Block is that customers will receive the maximum refund.

The second is 100% accuracy on their tax preparation, and the third is guaranteed audit support.

In addition to the guarantees, H&R also offers free online chat support and expert chat support with a tax specialist for paying customers.

Key Digital Services

Taxes are confusing, especially when you are filing yourself online or through downloadable software.

H&R eases some of the stress with 24/7 online chat hours during tax season.

Two ways to chat. H&R may be known for in-person support, but it also offers free online chat support and expert chat support with a tax specialist for paying customers.

Worth the price. If you have questions and want them answered from the comfort of home, the expert tax support might be worth the upgrade to Premium.

Talking with a qualified tax expert typically costs upwards of $100 per hour—nearly double the price of the $54.99 upgrade.

File from your smartphone. You can also use the H&R Block Tax Prep app to prepare and file your taxes on your smartphone.

Access chat from MyBlock. Skip the hassle of trying to access chat from the H&R Block website and go directly to your MyBlock account instead.

MyBlock is created when you buy your tax product (even if the product is free).

Once you're in, click on "need help" or "help center support" at the top of the page.

Frequently Asked Questions (FAQ)

H&R Block is best for people who value in-person help and face-to-face interactions

Even though H&R Block may not be the flashiest tax preparation company, it has a good reputation and will be able to help you file your taxes—regardless of your situation—with minimal stress.

Have you filed your taxes with H&R Block?

Did you love it or hate it?

Let us know in the comments below.