About Merrick Bank

Merrick Bank was founded in 1997 and has carved out a speciality in credit cards for people with bad or non-existant credit.

Their expertise is in secured and unsecured credit cards, but other services are offered. Its products include:

- Secured credit cards

- Unsecured credit cards

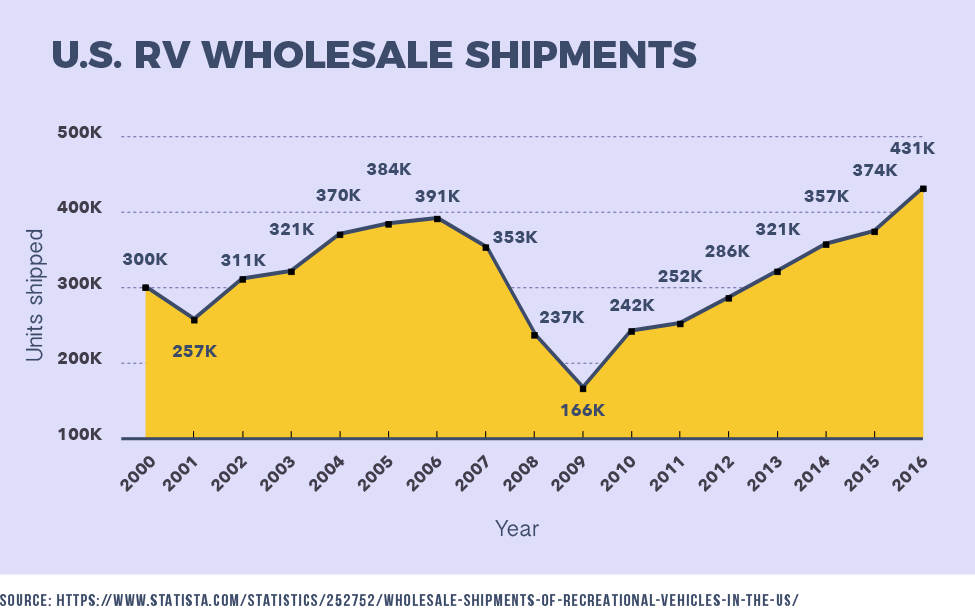

- Loans for boats, RVs and horse trailers

- Merchant services

- Certificates of deposit (CDs)

The secured credit card, by far Merrick Bank's most popular product, is fairly unimaginative as far as secured credit cards go.

Yet it gets decent enough reviews and has a low-enough APR that it's at least worth a look if you're trying to build or rebuild your credit.

There is no minimum credit score needed to qualify for the secured card.

Though it doesn't really offer any special perks with its cards or loans, Merrick Bank still has some vocal fans online and may be worth a look if you have bad credit.

Why People Love Merrick Bank

Forgiving of bad credit and willing to raise limits

A good starter card. You will eventually want to "graduate" to another card, but consumers generally like both Merrick Bank's secured and unsecured credit cards for rebuilding credit.

Merrick Bank requires no minimum credit score to qualify.

Some online reviewers said they were approved with sub-500 scores and plenty more simply said Merrick Bank approved them when they were turned away elsewhere.

Easy to raise your score. Make your payments on time every month and you should see results in 6-12 months, its fans say.

And double your limit while you're at it. Merrick Bank's Double Your Line Visa card, its unsecured card, promises to raise your credit limit after seven months of on-time payments, and reviewers say it delivers on this pledge.

Biggest Consumer Complaints

Mediocre rates and poor customer service top the list of complaints

So-so customer service and late fees. Consumers frequently complain about Merrick Bank's customer service and its readiness to ding them with a late fee, up to $38, even when they paid their bill on time.

The unsecured card is tougher to qualify for. You can apply online to be pre-qualified for this card, but Merrick Bank is vague about the minimum score you need to get this card.

The APR on its unsecured card is also higher than its secured card.

If your credit score is just mediocre, you may be able to find a better rate elsewhere.

The Competition

Don't feel you have to settle just because you have poor credit

More lenders are getting into the secured card space, meaning Merrick Bank has some compelling competition.

Look for a card with no annual fee first. At 18.45%, the APR on Merrick Bank's secured card is pretty decent, especially for a product that's designed for bad-to-low credit, but the $36 annual fee is a weakness.

The Discover's it Secured credit card, meanwhile, offers 2% cash back on gas and restaurant purchases and carries no annual fee.

The interest rate for the Discover it card is a little higher than Merrick Bank's, so if you regularly carry a balance forward, you may wipe out any fee savings.

Before you take the plunge on Merrick or Discover, you should familiarize yourself with the best secured credit cards out there.

How the Bank Works

No frills credit products for people with bad or no credit

Merrick Bank has carved out a niche lending to customers with poor credit and patchy financial histories.

Most consumers know the bank because of its credit card products, but it also provides dealer-arranged financing to people who want to purchase recreational vehicles and trailers.

We're going to take a look at those services and how they may work for you.

Credit cards for subprime consumers

Consider the secured card if you need a second chance. By far its most popular product, Merrick Bank's secured Visa card is worth a look if you are trying to rebuild credit.

No rewards, but a good interest rate. The 2% foreign transaction fee makes it less than ideal for travelers, and with an 18.45% APR and an annual fee of $36, it's neither the best nor the worst deal out there.

However, the credit line can range from $200-$3,000, so this card is a good option if you don't have a lot of cash to spare up front.

But the unsecured card shouldn't be your first choice. Merrick Bank's Double Your Line Visa card promises to double your credit line after seven months of on-time payments, and consumers say it generally lives up to this promise.

However, the APR on this card is relatively high i.e. between 20.45%-29.95%, and the card does not come with any rewards.

If you have even a moderate credit score, you may be able to find a better card elsewhere.

You can apply to Merrick Bank online, although they don't always make it easy to find this information.

For the secured card, you can apply directly here.

To see if you are on the pre-screened list for the unsecured Double Your Line Visa card, start here.

If you qualify for the unsecured card, Merrick Bank will send you an application number to apply for it.

You'll have to refer to your application number when finalizing your application for the card.

So-so savings accounts

Go elsewhere for a savings account. Merrick Bank offers certificates of deposit (CDs) with maturities ranging from 30 days to five years, but the bank doesn't post rates on its website, nor does it market this product to mass-market consumers.

Additionally, the $90,000 minimum to open a CD makes this an unrealistic product for many people.

Worth a look if you're shopping for an RV

But don't bother unless you're buying through a dealership. Merrick Bank makes boat, RV, and horse trailer loans, but does not lend directly to consumers.

If you're buying through a dealership that uses Merrick Bank, you should be able to qualify with a credit score as low as 550 or a previous bankruptcy.

Outsourced merchant services for business owners

Merrick may be worth a look for merchant services – depending on your business. Merrick Bank does offer certain merchant services, like Automated Clearing House (ACH) processing (handling all your credit and debit charges) and e-commerce services.

The main drawback is that Merrick Bank does a good bit of this business through independent agents, meaning that your customer service experience can vary wildly depending who you end up dealing with.

Merrick Bank is vague about exactly what kinds of businesses it serves, but it does say that some businesses are off-limits, like online gambling and online pharmacies.

Key Digital Services

Mobile and digital channels leave a little to be desired

Consider the app — but only if you're an Android user. Merrick offers online and mobile banking to manage your accounts, but consumer reviews are mixed at best: Android users seem to like it a lot more than iPhone users do. It gets 3.9 stars in the Google Play store, compared with 2.1 in the Apple store.

How to Find a Branch Near You

Although they don't have branches near you, you can visit the "contact us" section of their website to find their mailing address and phone numbers.

Also, you can download their app on Google Play and iTunes.

Merrick Bank Routing Number

Routing number: 124384602

FAQ

If you have bad credit, consider Merrick Bank's secured card

While Merrick Bank's Secured Visa offers no rewards, the interest rate is reasonable and consumers generally like it for the second chance it offers.

You would eventually want to move onto a card with a better rate or better rewards, but if you're looking for a card to help you boost that credit score, then Merrick Bank (along with a few other secured credit card issuers) can help you out.

Have you used Merrick Bank? We'd love to know what you think.

Any nightmares or success stories?

Please tell us and leave a comment below.