Cooperative banking models like Achieva Credit Union are popular because they are not-for-profit, owned by members, and community oriented.

But the biggest problem with credit unions is strict membership rules.

In Achieva's case, to qualify to be a member you have to live or work in one of just ten counties located on Florida's west coast (known as the Suncoast).

Do you live or work in Charlotte, Collier, DeSoto, Hernando, Hillsborough, Lee, Manatee, Pasco, Pinellas, or Sarasota County, Florida?

If you answered ‘yes' then you're in luck!

For a $15 membership share fee you can become a member of Achieva Credit Union and sign up for any of the products or services for which you qualify.

If you answered ‘no' and don't plan to move your family or job to one of these counties, then you are not going to be able to bank, borrow, or do anything else with Achieva Credit Union.

We've reviewed Achieva's core services, including checking accounts, credit cards, and personal loans.

Our verdict is that this credit union only benefits people in these few communities who only need a good checking account.

The Competition

For fewer membership restrictions and a much better cashback rewards card, go with PenFed Credit Union

There are definitely some advantages to credit unions versus banks.

If you're committed to banking within a credit union model, or if you don't live on the Florida Suncoast, there are other options.

The best one is PenFed Credit Union.

It also has membership restrictions but they are not geographic — you can become a member no matter where you live in the United States.

But to qualify to become a member you have to be an active or retired military veteran, an employee of the government, or a member of an organization like the American Red Cross.

Don't be deterred so easily from applying.

Qualifying to become a member could be as easy as getting a $15 membership fee to the National Military Family Association or just donating blood through the Red Cross.

Once you become a member you can apply for PedFed's loans, mortgages, and other products.

When we compare PenFed to Achieva what jumps out at us is the difference between Achieva's Cash Back Rewards Mastercard and PenFed's Power Cash Rewards Visa Signature Card.

PenFed's cash back card gives you 1.5% cashback on all purchases. There is no small print that says you only get that rate if you're buying something that costs $10,000 or more.

And it also beats Achieva with a 0% APR on balance transfers for the first 12 months, plus a sign-up bonus of $100 when you spend $1,500 in the first three months.

Achieva Credit Union is weak because of the tiny membership region

Membership to Achieva Credit Union is restricted to people who live or work in one of the ten counties on the Florida Suncoast.

For people who live on the Suncoast, the community orientation of Achieva Credit Union will be appealing.

The company supports a lot of great community activities, events, and projects.

But for those who don't live in that community, you're out of luck if you want to access Achieva Credit Union's products and services.

Achieva Credit Union Checking Plus

Achieva's Checking Plus deposit account acts a bit like a rewards credit card

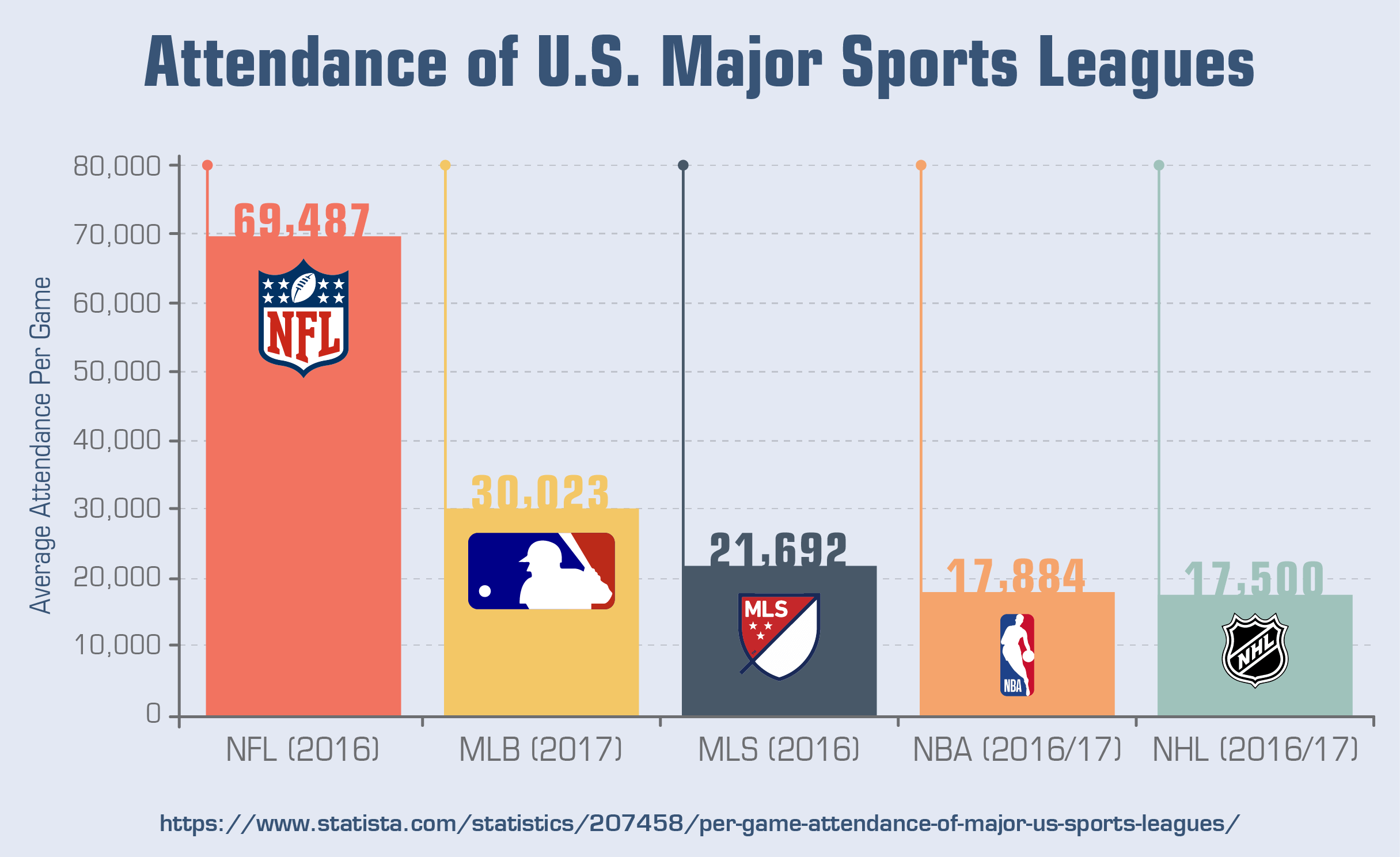

If you have an Achieva Credit Union Checking Plus account, you qualify for travel and leisure discounts, including discounts on hotels, restaurants, renting cars, going to museums, attending sports events, and even dry cleaning.

Account holders also get the chance to earn cashback rewards. Discounts on health services and travel are included.

You also save at your favorite retailers, and you can earn shopping rewards when you buy from them.

You can either get credit for future purchases or have a check sent to you.

Coupons are sent to Checking Plus members via email, smartphone, or online.

Checking Plus members also get discounts on health products and services. You get discounts on health-related expenses.

Members average 30% in savings on prescription drugs.

The vision plan offers 20-60% off eyewear and up to 30% discount on vision procedures like laser eye surgery.

And 10-50% discounts on dental services are available at over 24,000 providers.

People hate the Achieva Credit Union Checking Plus account because of the high monthly fee

When you sign up for an Achieva Checking Plus account you are also signing up for a $6.96 monthly fee (that adds up to an annual fee of $83.40).

Let's do a bit of math. If you open a Checking Plus account with a $1,000 balance and grow it by $100 per month, the "high yield" 0.5% APY will earn you $8.01 after 12 months. That's just enough to cover one monthly fee!

Achieva's interest rate for a deposit account is higher than average. Although that's not saying much since savings account interest rates are notoriously low.

But if you're getting this account for the "high-yield" interest, make sure you keep in mind the fee.

You might want to go with Achieva's regular checking account which has no monthly fee.

But the regular checking account doesn't come with the discounts, rewards, or other features of the Checking Plus account.

The Checking Plus account is top-notch for security features

It offers really strong identity theft protection that includes identity and credit file monitoring and $10,000 in identity theft reimbursement coverage.

There is also coverage of cell phone theft or damage up to $300 (with a $50 deductible).

Buyers' protection is included, which means that if something you buy gets stolen or breaks you're covered.

There's even accidental death insurance for members up to $10,000.

Achieva Mastercard: Lackluster Cashback Benefits

The Achieva Mastercard Cash Back Rewards credit card is terrible if you actually want to earn some good cashback

Although the card has good features like a $0 annual fee and price protection, it is not a good card for cashback rewards.

It's actually pretty terrible compared to similar cards offered by other institutions.

On the Achieva website its Mastercard Cash Back Rewards card is advertised as giving you the chance to "earn up to 1.5% cash back".

But when you look at the credit card agreement you learn that the 1.5% cashback rate only applies to purchases $10,000 and over.

You get 1% cashback on purchases from $5,000 to $9,999. And for all other purchase, you get 0.5%.

Really good cashback cards like the Discover It Cashback Match card offer up to 5% cashback on specific purchase categories.

People love the Achieva Cash Rewards Mastercard because there is no annual fee and it includes price protection

There are a couple of good features for people who have the Achieva Cash Rewards Mastercard.

For one, it doesn't have an annual fee.

And second, it also comes with price protection, which means that if you purchase something and then find it at a lower advertised price within 60 days after you bought it, the card will redeem you the difference.

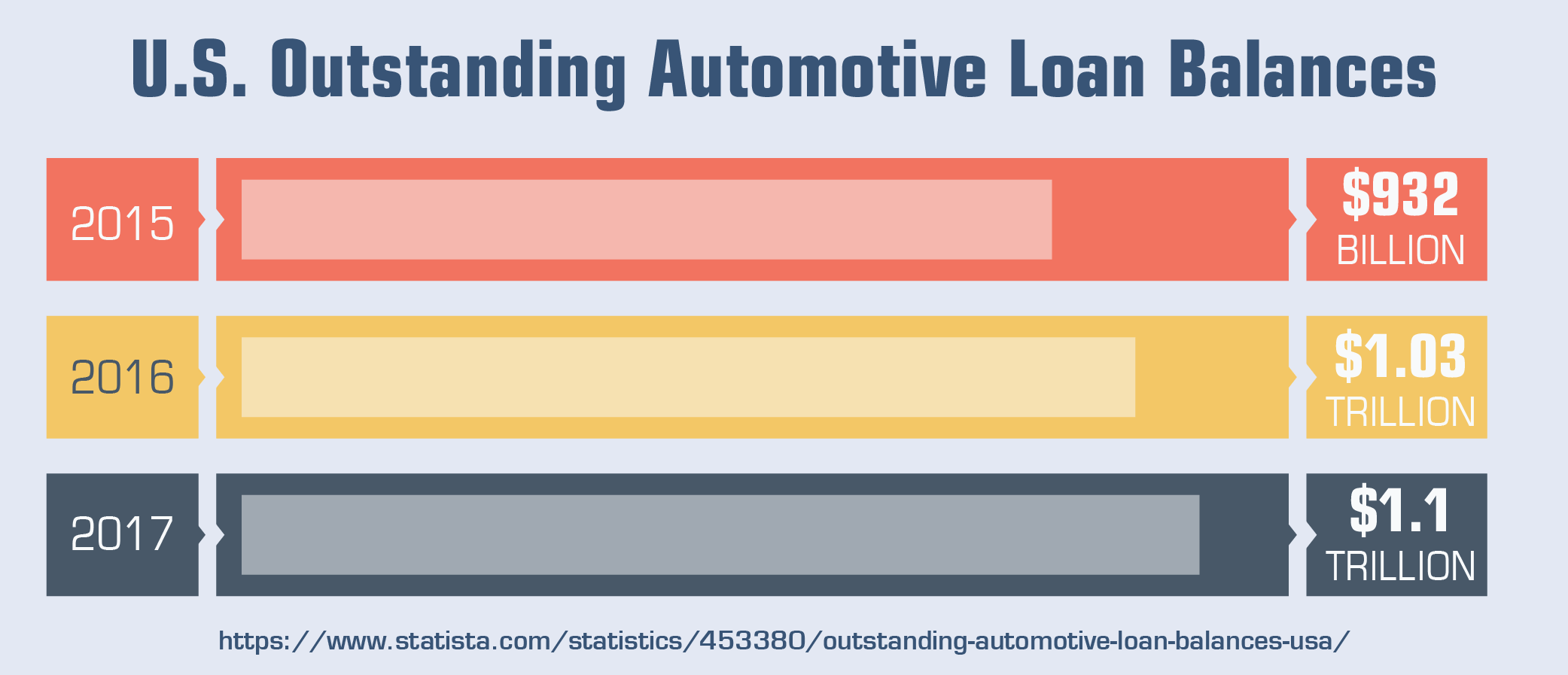

Achieva Credit Union's auto loans will get you on the road at a good APR

Achieva also provides a range of loans for its members that include personal loans and loans for motorcycles, RVs, and cars.

We found the car loans to be very competitive. But we're not sure why the credit union is dabbling in insurance and used car sales.

Pros

Many of the customers who post reviews for Achieva online say they are pleased with the auto loan they have with the credit union.

Taking a look at Achieva car loan APRs we see why the customers are happy. The Achieva website page breaks down its car loan costs for us. Generally, they're competitive compared to national averages.

If you get a new car loan for $25,000 over 60 months and have a good credit score of 730, your APR would be 2.85% and your monthly payment would be $448.10.

If you got a $10,000 loan for a 2013 used car over 48 months with a 730 credit score you' would qualify for the 2.85% APR and your monthly payment would be $225.50.

For people who are looking to buy a new car, the APR can be as low as 2.85% (for loans up to 36 months).

Again, these rates are for those with good to excellent credit. If you have less than good credit, you could pay as high as 15% APR for a car loan.

Cons

Achieva offers car loan customers "insurance solutions." That means if you don't have insurance for the car it's helping you buy the company will connect you with a policy.

Which sounds convenient, except when you get the bill. One reviewer posted that because of a miscommunication between Achieva, the car dealership, and his insurance company, the new car he bought had to get temporary insurance from Achieva.

His bill for 50 days of collision and comprehensive insurance through Achieva's bonded company was $800.

Needless to say, he was not happy.

Achieva's mobile app lets you do all your banking on your phone no matter where you are

Mobile banking is a free service for all Achieva members. Achieva has a new mobile app and it's pretty impressive. You can choose to login with your fingerprint (which is super secure) or with traditional log-in info.

A Balance Peek feature lets you see your account balances without even being logged in.

You can do everything with the app from cheque deposits to paying bills to transferring funds.

It works with all carriers and devices and its dashboard also looks pretty snazzy!

How to Find a Branch Near You

You can use their online branch locator, or download their app on Google Play and iTunes.

Achieva Credit Union Routing Number

Routing number: 263182312

Frequently Asked Questions

Our Verdict

If you are in the area, consider Achieva's checking account services. Pass on the credit card

For the very few people who qualify to become members because they live on the Florida Suncoast, getting a Checking Plus account with Achieva is recommended.

But make sure you take advantage of the rewards and discounts, or else the monthly fee won't be worth it.

Other credit unions have better membership rules and products compared to Achieva.

Definitely don't go for the Achieva Cash Rewards Mastercard.

The $10,000 qualifying purchase amount for the 1.5% cashback option is almost insulting.

Do you use Achieva Credit Union?

How has it worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below!