The Verdict

Unless you qualify for (better) student loan financing with private lenders, MyFedLoan is your best—and only—option

If you have student loan debt, you probably already know about MyFedLoan.org. Known officially as FedLoan Servicing, it is one of the companies that manages billing and customer service for student loans on behalf of the U.S. Department of Education.

It's not a very beloved service—many consumers say it takes awhile to reach a customer service representative by phone, and that when you do, he or she may provide misinformation.

The company, critics claim, routinely drags out processing payments and certification documents for student loan forgiveness.

So, why stick with MyFedLoan?

Simply put—you don't have much of a choice, especially if your credit score and income aren't as high as you'd like.

If you want to retain the perks that federal loans offer—including the option of income-based repayment, forbearance, and student loan forgiveness (more on that later)—you have to continue using MyFedLoan.

If you do have stellar credit, a high income, and no trouble making your monthly payment, you can save thousands of dollars (and headaches) by refinancing yourstudent loan repayment with a bank or a private student loan lender like SoFi.

About MyFedLoan

Created in 2009 to help the Department of Education manage student loan billing, repayment, and customer service inquiries FedLoan Servicing is owned by the Pennsylvania Higher Education Assistance Agency (PHEEA). It is one of the largest providers of financial aid services for students and manages more than $100 billion in total assets.

Who's It For?

Unless you can refinance or pay off your loan in full, you have to manage your student loan on MyFedLoan.org.

While refinancing can save you thousands of dollars in interest if you snag a lower interest rate, you'll lose out on the protections offered by federal loans, such as the ability to opt into an income-based repayment plan or apply for loan forgiveness or forbearance.

Strengths

MyFedLoan's website offers helpful resources

Take some time to explore the MyFedLoan website, which has a variety of helpful tools for managing your student loans.

Student loans 101. Learn more about how interest is calculated on your student loans, the differences between various types of loans, and how to be a smart borrower on the Student Loans 101 portal on the MyFedLoan site.

Manage your account. When you log into MyFedLoan, you can make payments, review your payment history, and obtain a loan payoff amount (how much it would cost to pay off your loan in full right now).

You can also view the number of qualifying payments counted toward loan forgiveness and upload forms and download forms needed for your taxes.

Explore repayment plans. Having trouble paying your monthly student loan bill?

Visit MyFedLoan's website to learn more about the various repayment options you may qualify for, some of which may lower your monthly payment (but add to the amount of interest you'll pay over time).

See if you qualify for loan forgiveness. Wondering whether the public service work you are doing would qualify you for loanforgiveness?

You can learn more about these forgiveness programs and how to qualify by visiting the MyFedLoan website.

Weaknesses

Poor business practices and low ratings

MyFedLoan doesn't have the best reputation, with consumers and professionals pointing out several weaknesses.

Undeserved late fees. Consumers say that their payments are not applied in a timely fashion, resulting in late fees and a reduced credit score.

Disorganization that costs consumers money. Many consumers who signed up for student loan forgiveness say that MyFedLoan muddled up the process of certifying their employers, resulting in their grants being converted into loans that they need to repay, and costing them tens of thousands of dollars.

Lack of choice. The Department of Education outsources the work of handling billing, collections, deferment, and general customer service functions to several companies, including MyFedLoan.

Consumers don't get to choose which company will manage billing for their student loans.

This lack of choice, and the sheer size of its assets gives MyFedLoan little incentive to improve its business practices, communications, and education of its call center representatives.

If you don't like working with MyFedLoan, you'll have to either pay off your student loan balance in full or refinance with a private lender.

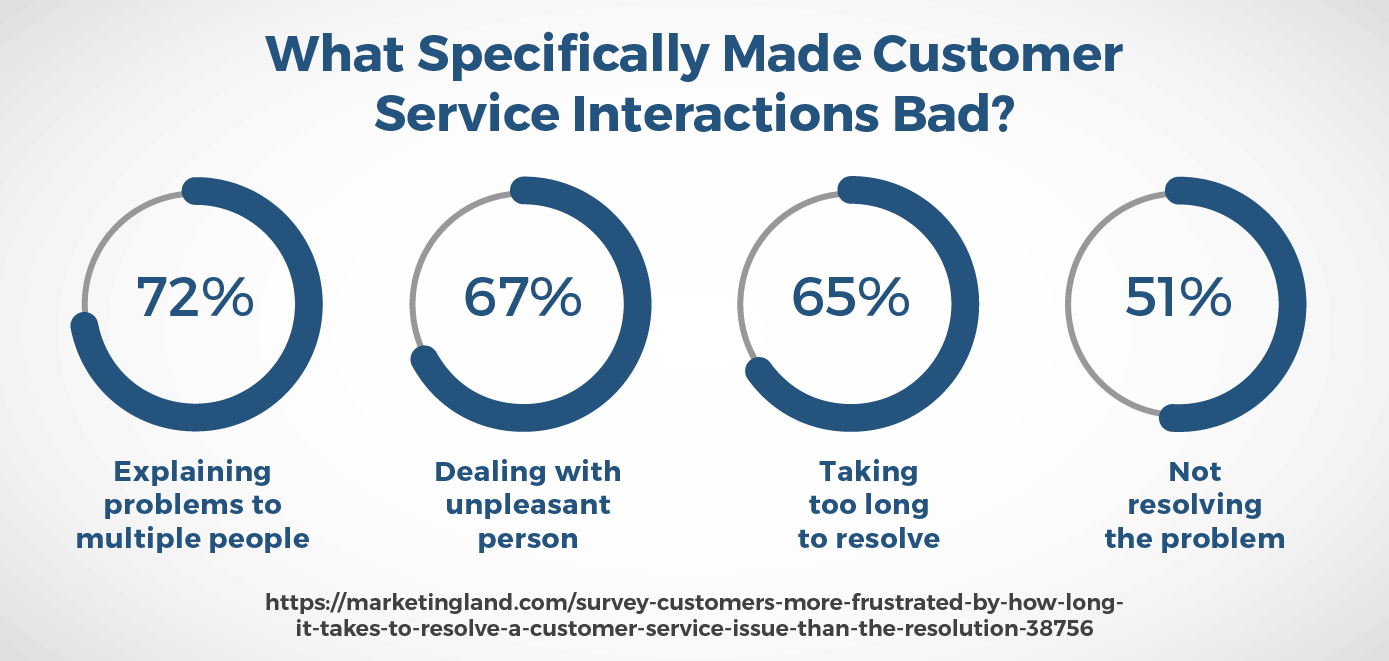

Subpar customer service. Customers say calls to MyFedLoan are notoriously long and often get disconnected, resulting in having to begin all over again with a new call.

Since many consumers report that MyFedLoan misplaced or never received their documents, it's recommended you send mail via certified mail and be sure to keep a copy of every document you mail or fax to MyFedLoan.

MyFedLoan vs SoFi

MyFedLoan can't match SoFi's rates or customer service

Here's how MyFedLoan compares to competitors, the most popular of which is SoFi.

If you have a great credit score and a high income, you may be eligible to refinance your student loan with SoFi. But this option is not accessible to everyone. The median income of SoFi borrowers is $106,000 and your credit score needs to be above 700.

The savings can be significant. People who refinance their student loans using SoFi save an average of $288 a month—and a total of $22,359, according to the company.

That's because SoFi's fixed rates start at 3.35% APR and variable rates start as low as 2.815% when you enroll in auto pay. Meanwhile, MyFedLoan is required to stick to the federal government's interest rates.

Let's say you have $20,000 in federal loans costing 6% a year in interest.

If SoFi qualifies you for a 3.35% interest rate, you'll save more than $500 a year in interest.

Plus, if you go by popular reviews, you'll have access to SoFi's beaucoup customer service that's available seven days a week, along with added perks like career strategists, invitations to SoFi events, wealth counseling, and more.

So if you're not a high earner and your credit is spotty, you may be better off sticking with MyFedLoan.

It's worth noting, however, the biggest benefit of the latter:

Uncle Sam's exclusive loan options. If you work in the public sector and qualify for student loan forgiveness—or are thinking of heading back to school—you may want to stick with your federal loans managed by MyFedLoan.

Once you refinance with a private company like SoFi, you're no longer eligible to apply for the federal government's income-driven repayment options or loan forgiveness programs.

While SoFi does offer loan forbearance due to a lost job or health issue, it can change its policy at any time since it is not mandated by the government to do so.

And while the fed will pick up the tab on the interest accrued on your subsidized loans while you pursue further education, SoFi won't do that.

Nonetheless, the takeaway is clear:

If you don't qualify for student loan forgiveness, SoFi is a better bet.

Services

MyFedLoan offers several services to help you manage your student loans during the whole course of your student loan history.

They help with financing:

- while you are still in school

- during the grace period, which is usually six months after graduating from college or graduate school

- once the loan comes due and is in repayment

Stay on top of your loans while you're still in school

Typically, you won't need to make any payments on your student loans .

View your loan balance. Even though you don't have to make payments while you are still in school, it's still a good idea to log into your MyFedLoan account and view your student loan balances so that you're aware of just how much debt you are responsible for paying back once you finish school.

You can find your loan details online through Account Access.

Just select "View Loan Details" from the left-side menu to review your account.

If possible, start making payments while you are still in school. It will save you money in the long run.

Calculate and then make your monthly payments during the grace period

Once you leave school or drop below half-time status, you enter a six-month grace period where you are not required to make payments on your student loans.

Pay interest. Though you are not required to make a payment for six months after graduation, it's a smart idea to pay the interest on your loans before it is added to your principal balance at the end of the grace period.

Find out your monthly payment. MyFedLoan can help you estimate what your monthly payment will be once your grace period is over.

Six months goes by quickly, so you will want to find out how much you will owe each month on your student loans and begin tweaking your budget accordingly.

Get on track to finally pay off the loan.Once your grace period ends—usually six months after graduating—your loan will officially come due and a monthly payment will be required.

Often it's not until student loans enter repayment that people realize that they can't afford their current monthly payment.

Don't just ignore the bills—doing so can ruin your credit and exacerbate the situation by adding late fees and additional interest to your student loan bill.

Instead, explore the following student loan repayment options on MyFedLoan.org:

Consolidate your loans. Having trouble keeping track of several different loans?

If they are all federal loans, you may want to consolidate them into a single loan so that you only have one payment to worry about each month—and fewer late fees.

Typically, your new consolidated loan will feature a weighted average of the interest rates on the loans being consolidated.

Repay based on your income. If you can't afford the standard monthly payment on your student loans, there are many different repayment options you can qualify for that take into account your income.

Some require as little as 10% of your income.

You may even qualify for a $0 monthly payment if your income is low enough.

Visit the Repayment Strategies page on the MyFedLoan website to learn more.

You can also use the Repayment Schedule Estimator to see what your monthly payment would be under these different options, depending on your income.

Just be aware that any option that results in a lower monthly payment will end up costing you more in interest over the life of your loan.

Seek student loan forgiveness. If you work full-time for a public service organization or school, you may qualify for loan forgiveness after you make 120 student loan payments.

You'll need to certify that your employer is eligible for this program on an annual basis.

Digital Services

People love MyFedLoan's helpful online resources.MyFedLoan.org offers several useful resources for understanding your student loan repayment options.

Quiz your way toward the right repayment program for you. You can take a simple and quick online quiz to determine whether student loan consolidation is the "right fit" for your personal situation.

You can also click your way through quiz questions to determine if you qualify for student loan forgiveness for working in qualified public service and education jobs.

Watch, and wonder no more. MyFedLoan.org offers a series of video tutorials to help clarify confusing things like income-driven repayment plans, forbearance, and other key loan terms.

Calculate away your repayment concerns. Curious how much money you'd save if you switched to a different payment plan?

Use the Repayment Schedule Estimator to learn more about other repayment plans that may offer a lower monthly payment.

The MyFedLoan's website is great, but its digital app is glitchy

Besides its website, MyFedLoan offers an app to manage your student loans, including the ability to:

- Check your loan balances and amount due

- Make payments on your loans and view past payments

- Set your repayment goal

- View different repayment plan options and estimated monthly payments

- Upload your income verification for an Income-Driven Repayment (IDR) plan

You can download the MyFedLoan app in the iTunes store or Google Play for smartphones that run Android.

Be aware that the iPhone version only has two stars, with many users complaining about trouble logging in and using the app.

The Android version of the app only got a score of 2.8.

Users say the app runs slowly, and that while you can make payments via the app, you cannot indicate how you would like your payment divided up among your outstanding loans.

How to Start Using MyFedLoan

Sign up on MyFedLoan.org

When you receive notice that your student loan account has been transferred to MyFedLoan, you will need to log onto the website to create an account and update your billing information.

To do so, you will need to enter your date of birth and your Social Security number.

This is important to do right away, or else you may incur late payment fees, additional interest costs, and your credit score can go down.

Your best bet is to sign up to have FedLoan Servicing automatically deduct your monthly payment from your checking account.

This way, you won't have to worry about missing a payment and incurring a fee, and you'll even qualify for a 0.25% reduction in your interest costs.

How to Stop Using MyFedLoan

You'll need to pay off your student loan balance or refinance with a private lender to close your MyFedLoan account

If your student loan is being managed by MyFedLoan, you have no other choice than to continue using the service until you pay off your entire student loan balance.

If you have good credit and a solid income, however, you may qualify to refinance your loan with a private lender, such as a bank or SoFi.

This is an appealing option, since the interest rates they offer may well be lower than your current interest rate, assuming you have a credit score of 700 or more.

However, if you do choose to refinance with a private lender, you will lose out on the perks of federal student loans such as the ability to apply for income-based repayment or student-loan forgiveness programs.

And if you suffer a health setback or lose your job in the future, private lenders likely won't let you put the student loan in forbearance and take a break from paying it like the federal government does.

FAQ's

Here are the answers to the most frequently asked questions (FAQ) about MyFedLoan

How do I contact the MyFedLoan Servicing department?

To contact customer service representatives at MyFedLoan, call 800-699-2908 from 8 a.m. – 9 p.m. EST on Monday through Friday.

You can also log onto your account on MyFedLoan.org to email a representative.

Does FedLoan Servicing offer income-driven repayment plans?

Yes. You may qualify for one or more of the following income-driven repayment plans: Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), or Income-Contingent Repayment (ICR).

What is the Public Service Loan Forgiveness (PSLF) program?

The PSLF program enables those who work full-time in public service to qualify to have their student loan balances forgiven once they have made 120 qualifying payments.

You will need to complete an Employment Certification Form annually to ensure that the organization you work for is a qualified employer for this program.

Are there other lenders I can go with?

If you want to keep your loans categorized as "federal loans" and have the ability to defer them at some point in the future or apply for income-based repayment options, then the answer is no.

If you are willing to give up those perks, however, and you have good credit and a solid income, you can explore the option of refinancing with a bank or service like SoFi.

Will I be reported to the federal credit bureaus if I miss a payment?

Yes.

Why was I put on an "administrative forbearance," and is it costing me money?

Often, when FedLoan Servicing is taking longer than usual to process paperwork or is reviewing documentation, the organization will put an account in "administrative forbearance."

While you don't need to make a monthly payment during this period, your student loans will continue to accrue interest.

What happens if I have trouble paying my loan back?

You may be able to change your payment plan (such as enrolling in income-based repayment) or postpone payment through deferment or forbearance.

You can explore these options in your account portal on the MyFedLoan website—just click on "Manage Repayment."

Please note that the less you pay each month, the more interest you incur over the lifetime of paying off your student loan.

Does FedLoan Servicing offer consolidation services?

Yes.

Can I change my loan payment due date?

Yes, as long as your account is not past due.

You do need to make your first payment as scheduled before requesting a new due date.

To request a due date change, call FedLoan Servicing at 800-699-2908, or email them once you are logged into your account.

Due dates must fall on days 1-13 or 15-28 on the calendar.

Make the most of MyFedLoan or refinance sooner than later

Do you have a loan serviced by MyFedLoan?

How has it worked out for you?

Any great tips (or nightmares) to share with the rest of us?

Let us know in the comments below.