No matter how carefully you plan your budget, occasionally you might find yourself facing an unexpected expense – like an emergency repair or an overdue utility bill – without enough funds in your bank account to cover it.

When that happens, short-term lenders like Speedy Cash can provide a stopgap solution to cover your expenses until you get paid again.

About Speedy Cash

The first Speedy Cash location opened in California in 1997, and the company now operates in the United States, Canada, and the UK.

Along with cash-advance loans (more commonly known as "payday loans"), Speedy Cash offers title loans, installment loans, lines of credit, check cashing, cash for gold, and prepaid credit cards.

These services can help you get through a temporary financial pinch and avoid late fees, overdraft charges, collection calls, or utility shut-offs.

However, the convenience comes at a price. If you're in need of a short-term financial solution, there are a few important factors to consider when choosing a lender:

- Interest rates and fees can be much higher than traditional banks, and customers may be vulnerable to unscrupulous tactics from predatory lenders.

- If you're unable to pay the loan off as scheduled, you may end up paying more in interest and fees than the initial amount they borrowed.

- The high cost of a short-term loan may lead to even bigger financial problems down the road.

Interested in learning more? Jump to a section or start at the beginning for everything you need to know about the lending service.

Services Offered

Speedy Cash is probably best known for its cash advance loans, but it offers a pretty wide range of short-term financial solutions. Here's what Speedy Cash has available:

Payday Loans

If you just need a small sum to float you until your next payday, cash advance loans—also known as "payday loans"—let you borrow a small amount of money for a short period of time (typically one week, two weeks, or one month, depending on your pay cycle).

Installment Loans

Let's say you fell a little behind on rent this month, and you owe your landlord $400—but your next paycheck is only for $300. A payday loan won't do the trick in this situation, since you know your next paycheck won't be enough to repay it. With a Speedy Cash installment loan, you can borrow the amount you need and pay it back over a period of a few months. There's no fee for paying it off faster than expected.

But before applying for an installment loan through Speedy Cash, there are a few things you should consider:

- You can only have one installment loan open at a time with Speedy Cash, so if you get stuck again next month, getting another installment loan won't be an option.

- Speedy Cash looks at your credit history when you apply for an installment loan, so if your credit is subpar, you may be turned down. But even if you have bad credit, you can still apply for a bad credit loan.

- Speedy Cash offers a "minimum payment" option, but keep in mind if you only pay the minimum each month, you'll rack up interest quickly.

Lines of Credit

If your financial situation is unpredictable, a line of credit can give more flexibility. Here's how it works:

- You borrow a lump sum—say, $1,000—which can be paid back gradually over time.

- You can access cash, up to your credit limit, as long as you have the loan open.

- Say you've made a few monthly payments, and the total amount you owe goes is now $850. If you suddenly find yourself strapped for cash, you can access up to $150 from your line of credit—the difference between the original credit limit and the amount you still owe.

Title Loans

If you own a car, you can use it as collateral to borrow up to $50,000 from Speedy Cash (based on the value of your car). You'll need a clear title and proof of insurance to apply for a Speedy Cash title loan. Even if you still owe money on your car, you may be eligible for a "Second lien title loan."

In-store Services

If there's a Speedy Cash location near you, they may offer the following financial services to help you in a pinch:

- Wire transfers

- Prepaid debit cards

- Check cashing

- Cash for gold

When you encounter an unexpected financial snag, you may need cash in a hurry to avoid late fees, overdrafts, and utility shut-offs.

Whether you need a little bit of money for the next few days or flexible credit for the next few months, Speedy Cash has a variety of options that can help keep you afloat.

Fees and Interest Rates

However you look at it, sky-high interest rates are a huge downside. This isn't unique to Speedy Cash. Most short-term loans have high interest rates—but you still need to be extremely vigilant and double-check your paperwork when applying for any Speedy Cash loan to make sure you fully understand your payment terms.

Fees, interest rates, and rules can vary widely from state to state, but here are a few examples.

Payday Loans

Say you drop your phone in a puddle, and you need $300 to replace it—but you're still a week away from payday. If you live in Kansas, your total fees for a 7-day loan of $300 would be $20.71. That's not too bad for the convenience of getting your phone replaced ASAP. But there are potential snags:

- If payday is two weeks away, your fees would go up to $42.42. That's a pretty big chunk of change, especially since you only borrowed the money for 14 days. That equates to a 360% APR—that's not a typo. (And some states may be even higher!)

- If you can't pay your loan off as scheduled, the interest can add up quickly. At a rate of $20.71 per week, it would only take a little over three months before you owed more in interest than you initially borrowed.

Installment Loans

Because installment loans are paid back over a longer period of time, it's easy to rack up interest. Say you live in Illinois and you need $500 to replace a broken refrigerator. You need a new fridge to keep your food from spoiling, but you don't have the cash to cover it—and you know you won't have $500 to spare in your next paycheck, either. An installment loan can cover the difference, but at a high cost. Here's a sample payoff schedule from the Speedy Cash website to show how your installment loan repayment might go:

- If you set up biweekly payments over the next six months—a total of 12 payments—your biweekly payment amount would be $86.83 (with a final payment of $86.89).

- Multiply that by 12 payments, and you'll pay a total of $1,042.02 over the course of the loan.

- That comes out to an APR of 359.032%—and you've paid more in interest than you initially borrowed.

- If you miss any payments or renegotiate the terms of the loan, you could end up paying even more in interest.

It's worth noting that many businesses offer financing options for customers, which may be a better deal. For example, in the fridge situation above, you could apply for a credit card from a home improvement store, which would have a much lower APR—often around 18%—and you may even earn discount or cashback rewards.

Reputation

Finding a short-term lender you trust can be a challenge—and in a financial emergency, you may not feel like you have time to research your lending options as extensively as you'd like.

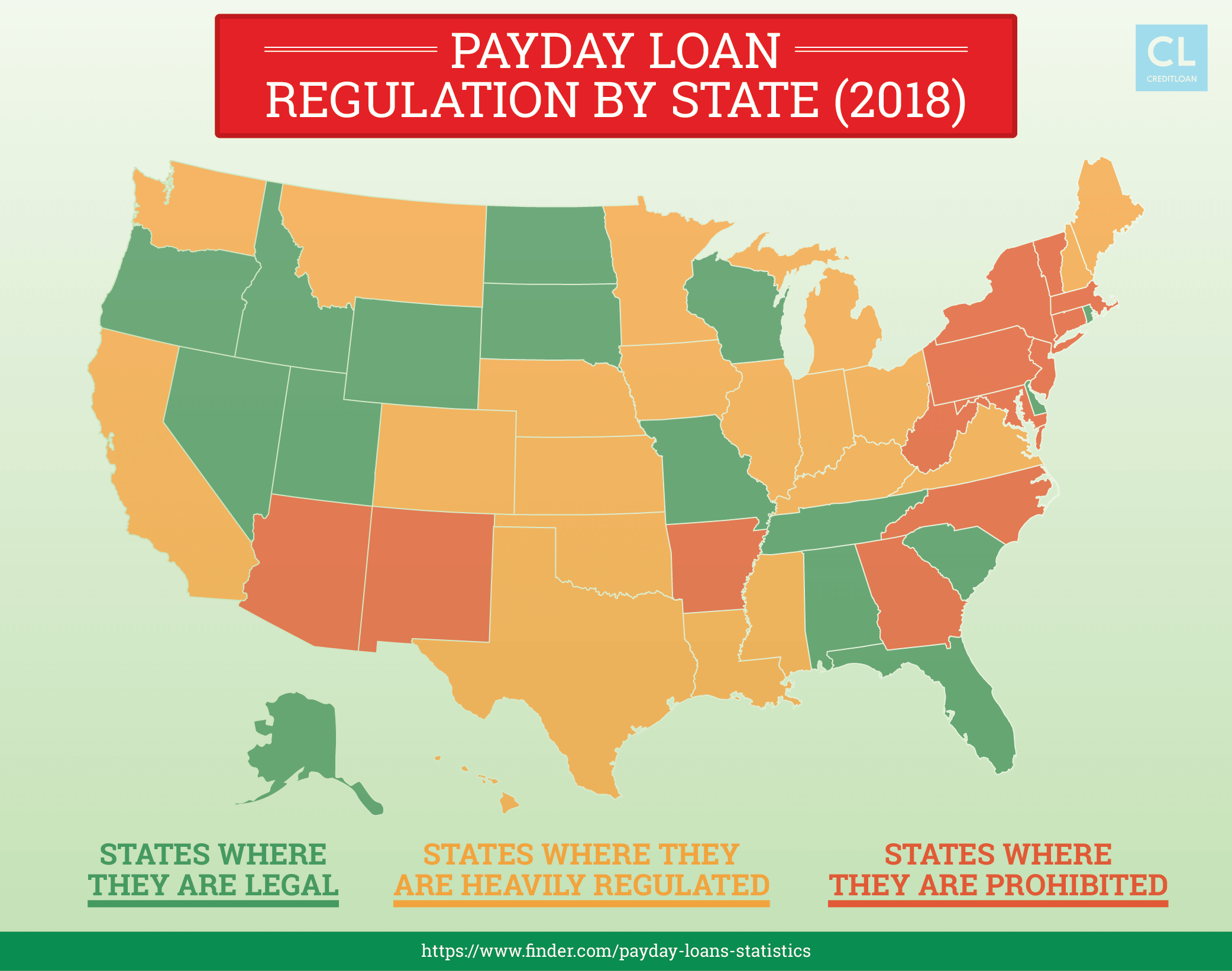

One key advantage of Speedy Cash is its above-board business practices—they're a licensed lender that follows the rules and regulations for each state they do business in.

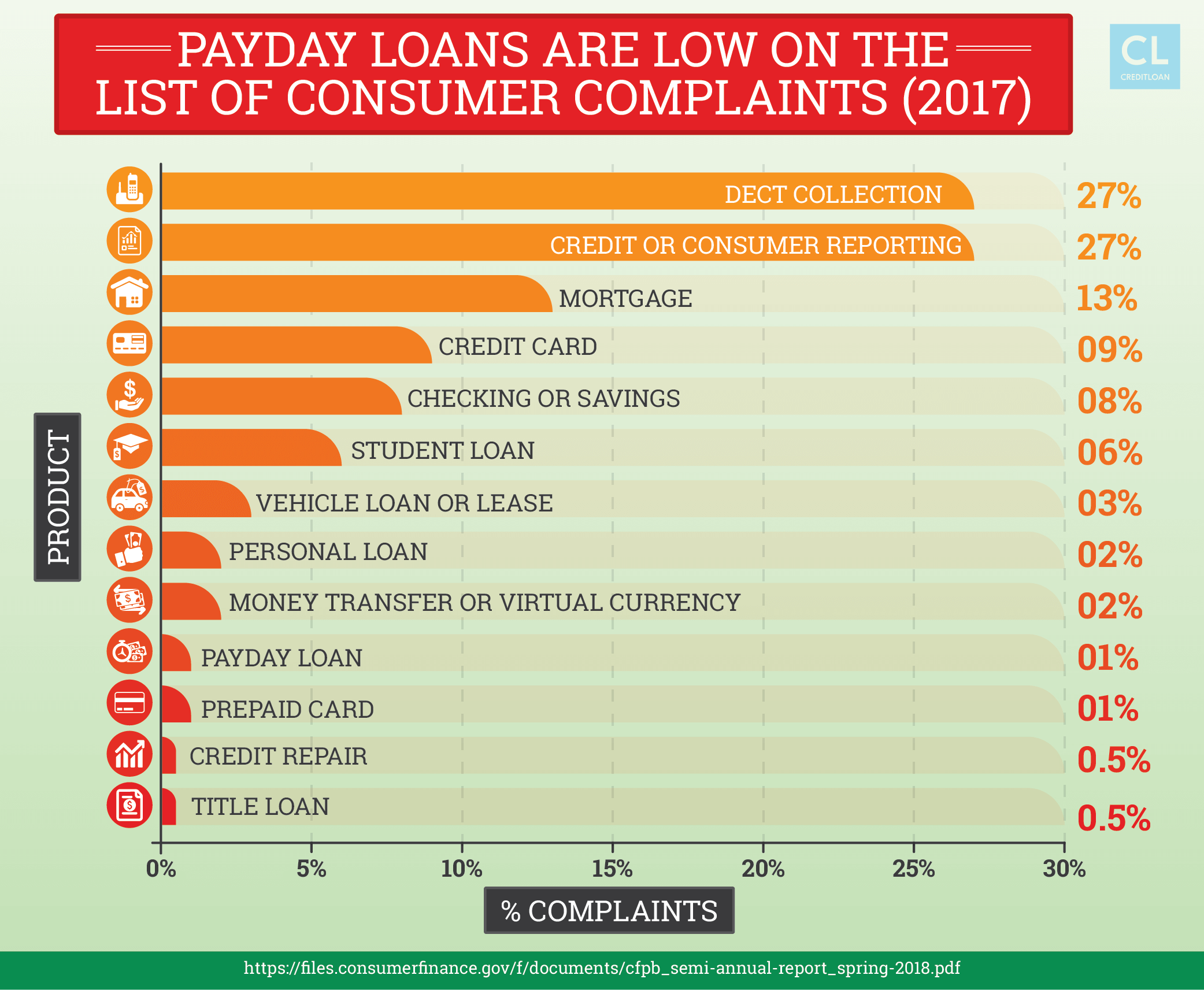

The Pew Charitable Trusts notes that Speedy Cash is subject to few complaints compared to many other short-term lenders.

Online loans are quick and convenient, and when issues arise, customers say it's easy to contact Speedy Cash by phone, and representatives are typically helpful.

Speedy Cash also offers the option of applying for a loan at in-store locations across the country—and the experience in-store can be hit or miss.

One reviewer on Consumer Affairs noted that the online service was okay, but the in-person experience as lacking. "I went to the store once, and customer service is not one of the traits that the loan officials possess…online is way easier, less of a headache, and you don't have to put up with attitude."

If you're considering a payday loan or other financial solution from Speedy Cash, it's important to make sure you've read your contract and understand exactly what fees, interest rates, and finance charges you may be responsible for.

Strengths

While the Federal Trade Commission encourages consumers to explore other options before taking out a cash advance loan, that's not always feasible in a financial emergency.

If you find yourself in a position where you need money immediately, there are a few key advantages to using Speedy Cash:

Speed

It's in the name, right? Speedy Cash is a direct lender, so they can process your application faster—sometimes in a matter of minutes.

Ease

The application process is fairly simple, and you can apply online or in-store.

Immediate Funds

There are no upfront fees, and once your loan is approved, you can have the cash within 24 hours—or instantly, depending on how you choose to receive the money.

Convenient Payoff

Customers have several payoff options, and there's no fee to pay off your loan early.

Helpful Customer Service Over the Phone

Online customers say the customer service department is typically easy to reach, friendly, and helpful.

A Variety of Loan Options.

For bigger expenses or ongoing financial woes, Speedy Cash also offers installment loans and lines of credit. In-store locations also offer prepaid debit cards, cash for gold, and check cashing services.

Reputation

There are some predatory lenders in the short-term lending industry, but Speedy Cash has a good reputation among its customers, and gets 4 out of 5 stars for customer satisfaction at Consumer Affairs.

If you're in a financial bind, Speedy Cash offers an easy application process and, in many cases, same-day funding. While Speedy Cash isn't immune to the usual downsides of payday loans, customers seem to appreciate the helpful, easy-to-reach customer service department when issues do arise.

Weaknesses

Even though Speedy Cash is a licensed, reputable lender, there are still some downsides you should be aware of before applying for a loan through them. One important consideration is that the amount of money you can borrow can vary. Here are a few factors that might affect your ability to borrow from Speedy Cash:

High-Interest Rates and Fees.

Not just a little high, but triple-digit-APR high—and you could end up paying back significantly more than you borrow. (We talk a bit more about interest rates below.) Depending on the type of loan you choose, you may also have to pay an origination fee or monthly maintenance fee. Rates and fees for short-term loans are rarely competitive with other options.

Not Everyone is Eligible

Speedy Cash requires proof of steady income to apply for a loan, so if you're unemployed, you may not be eligible. You'll also need an active bank account in order to apply, so Speedy Loan services aren't available to the 17 million "unbanked" Americans. And, Speedy Cash is only licensed to operate in certain states—much of the East Coast, for example, is out of luck. Before you apply, make sure there's a Speedy Cash near you.

Low Loan Amounts

The maximum amount you can borrow varies from state to state and depends on the type of loan—but it can be fairly low. In California, for example, you can only borrow up to $255 as a cash advance.

Eligibility Requirements

Before you apply, you'll need to have:

- A government-issued ID

- Proof of steady income

- An active checking account

Applying for a Loan

Depending on where you live and what's available in your area, you can apply for a Speedy Cash loan online or in-store. (Other services, like wire transfers, check cashing, and cash for gold, are only available in-store.)

Because Speedy Cash is a direct lender, you'll typically find out within a few minutes whether your loan has been approved and how much you can borrow.

Once you're approved, Speedy Cash will transfer the borrowed funds to you. There are a few ways to do this, and how fast you get your money will depend on which method you choose:

- Cash (if you apply in person)

- Prepaid debit card

- Direct deposit

Will a Speedy Cash loan affect my credit score?

It depends. Certain locations, and certain loan types, may require a credit check before approval. If that's the case, the credit inquiry can slightly ding your credit score.

Also, while paying off a Speedy Cash loan on time won't help you improve your credit score, it can lower your score if you miss a payment. If you're working to build better credit, ask your local Speedy Cash location if they'll run a credit check, so you know what to expect.

Paying Off Your Loan

When you borrow money from Speedy Cash, there are several options for repayment:

- Online with a debit card

- Cash at an in-store location

- Automatically from your bank account

- A post-dated check for the borrowed amount plus any finance charges and fees

It's important to note that if you agree to a post-dated check or automatic payment option, the money will be withdrawn from your account even if you have insufficient funds, which could result in an overdraft fee or bounced check.

If you're unable to pay off your Speedy Cash loan in the agreed-upon time frame, contact their customer service department by phone or in-store.

You may be able to get an extended due date or an alternate payment plan—but keep in mind that doing this will likely cause you to pay even more in interest.

User Experience

Dealing with a financial emergency is stressful enough as it is — the last thing you need is for a shady lender to make the situation even worse. Here's what you can expect from your Speedy Cash experience.

How do Speedy Cash rates compare to other loans?

The rates on a short-term loan can cause some serious sticker shock.

Again, this isn't unique to Speedy Cash, but it's definitely something to be aware of if you're comparing Speedy Cash to a traditional lender (such as a home equity loan through your bank).

In a typical loan, you'd be charged a low-interest rate with a lengthy payoff period.

For example, you might pay 4.25% interest on a 30-year mortgage, or 2.99% interest on a 5-year car loan.

But payday loans are meant to be paid off faster—literally on your next payday.

So while the fees may not seem terribly high as a lump sum, the APR may be shockingly expensive.

Here's how to use the Speedy Cash website to learn how much you'll pay for a cash loan.

Interest rates for cash-advance loans vary per state, because each state has their own laws regulating how these type of lenders can manage lending you money.

Speedy Cash has the cost of the loan on their site per state, but they don't make it very easy to find.

It may be that they want you to come into the store, where they know you'll be tempted to take the money and run, no matter the cost.

Once you find your state and location on their website, it's still unclear how much you'll pay from looking at the info.

We combed through their website and found the easiest way to learn the Speedy Cash interest rate for your state. Here's how:

- Don't bother clicking on "Find a Store."

- Instead, click this link: Terms and Rates

- Select your state.

- Depending on your state, you'll see all the loan types and their interest rates as tabs.

- Click on all tabs to make sure you see all the loan interest rates. Some tabs may be user-friendly. Others may just be links to PDFs and legal notices.

What can I expect from Speedy Cash customer service?

Customers can ask questions about their loans and resolve any issues through a customer service phone number.

Reviewers at Consumer Affairs gave generally the customer service glowing reviews:

- "Customer service was very good. Answered all my questions…I am very thankful for all their help."

- "If I ever have an issue, their customer service representatives are always helpful and polite."

- "The customer service is great… If there is something that you don't understand or need help with, all you have to do is call them and they will walk you through it."

Is Speedy Cash safe to use?

Speedy Cash makes the privacy and security of its customers a priority, and they continually update their technology to safeguard your personal data.

However, they warn of a common phone scam in which the caller claims to represent Speedy Cash, and demands payment for a past loan.

While these scammers aren't affiliated with Speedy Cash, it's worth noting that former Speedy Cash customers are more susceptible to this scam—mainly because it's easier to believe you owe money on a Speedy Cash loan if you've actually had a Speedy Cash loan at some point.

If someone contacts you requesting money to pay off a past due loan, and you aren't aware of any missed payments, be sure to contact the Speedy Cash Fraud Department directly to verify whether it's a legitimate request.

In addition, there have been occasional complaints of customers being held liable when a fraudulent loan is opened in their name.

One TrustPilot reviewer said:

A few months ago, someone fraudulently accessed my account, changed the customer address and banking info, and requested a $1500 loan…I made a police report and a report with the Federal Trade Commission. Out of the blue today, I discovered that Speedy Cash entered my original bank account and deducted the $1500 from me.

Before applying for a loan, ask the Speedy Cash representative how fraudulent transaction are handled and what steps you should take if you notice fraudulent activity on your account.

Is Speedy Cash legit?

As short-term lenders go, Speedy Cash is one of the more reputable options, and the glowing reviews for their customer service line are promising.

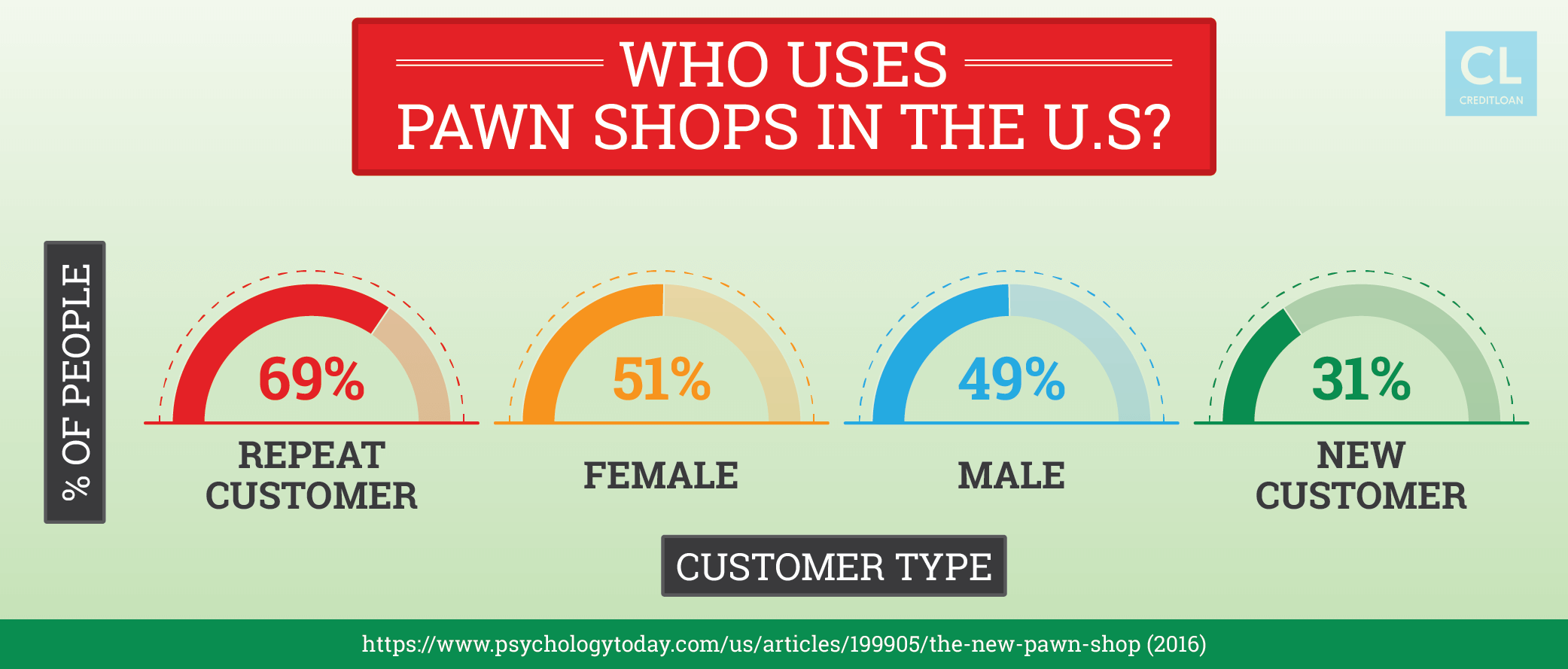

But as personal finance writer Amy Livingston reports, many borrowers can't break free of the cycle of lending and debt without taking extreme measures like pawning items or borrowing from friends and family.

Overall, unless it's an absolute emergency, you may want to explore other borrowing options with lower interest rates.

The Consumer Finance Protection Bureau recommends exploring the following alternatives before you apply for a payday loan:

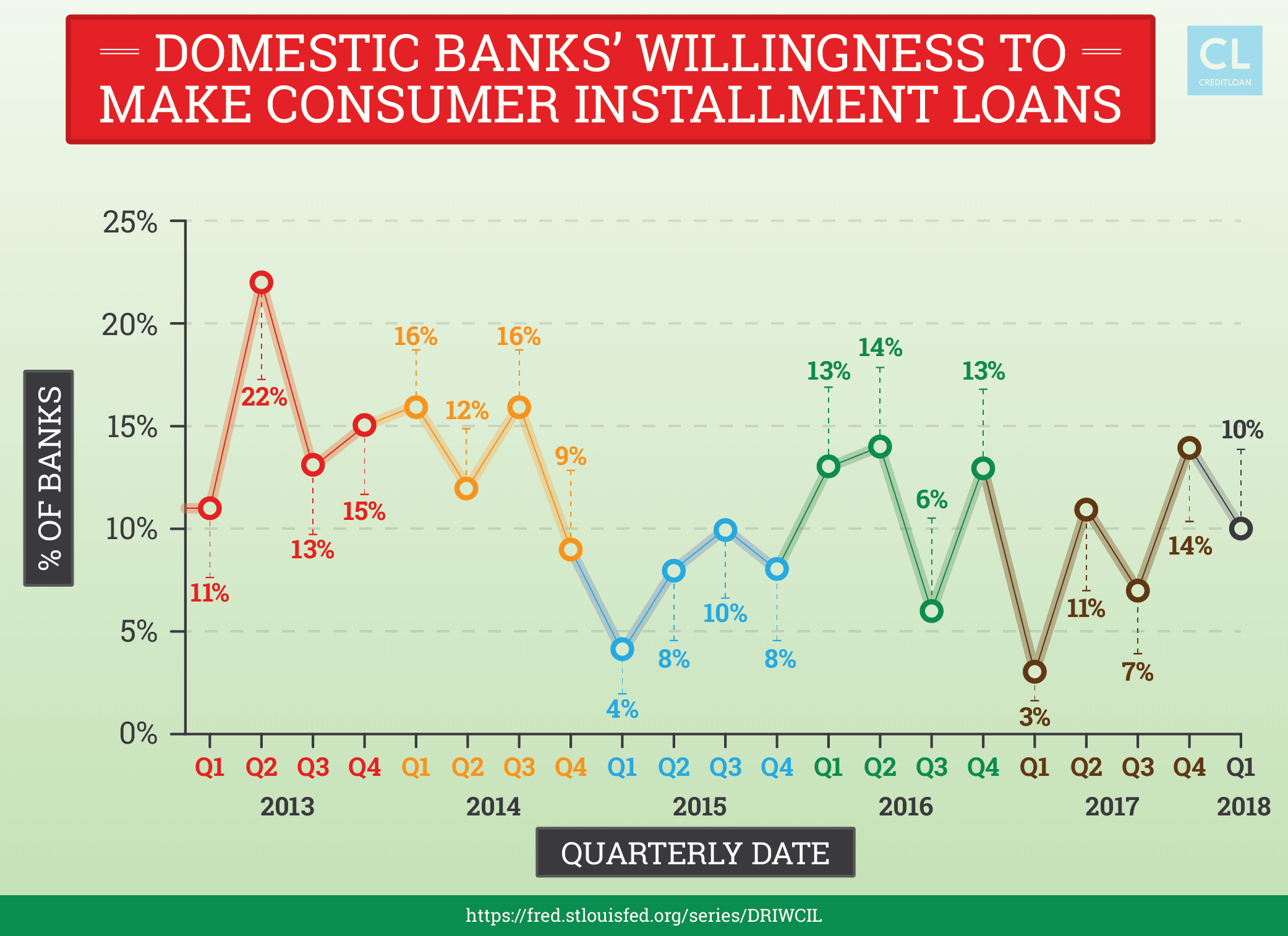

- Ask your bank what loan options are available to you.

- Charge the item to your credit card.

- Look into nonprofit organizations and community groups that may offer emergency credit.

- Negotiate with your creditor about the money you owe. They may be able to negotiate a lower interest rate or smaller payment amount.

What is the Speedy Cash app?

Customers can manage their loans through a mobile app, which is available for both Apple and Android phones.

The following features are available through the app:

- Manage existing payday loans, title loans, installment loans, and lines of credit.

- Apply for a new loan.

- Draw additional cash on an existing loan.

- Search for store locations and contact information.

Users have complained about painfully slow loading times for the app.

However, another user noted that the app: "May be awfully slow to load, but at least the company behind it provides painless walk-through via phone."

Common Complaints

The primary complaint about Speedy Cash is the high-interest rates, especially for customers who have taken out installment loans or lines of credit: "I borrowed $900. Now after 4 months of paying $350, my balance is $1147. I am sorry I made this mistake."

Automatic payments and post-dated checks can also cause issues with customers.

If a payment is automatically applied to your Speedy Cash account, and you don't realize the amount was deducted from your bank account, you may be vulnerable to overdraft fees from your bank or accidentally bounce a check to another creditor.

FAQs

Bottom Line: Is Speedy Cash right for you?

In a pinch, there are definitely some advantages to choosing Speedy Cash.

The application process is fast and easy, and the company has a solid reputation, especially in an industry that can be prone to predatory lenders and scammers.

Speedy Cash offers a wide range of products that can help you keep your head above water — whether it's for a few days or a few months — in a financial emergency.

However, like most payday loans, the fees and interest rates can be extremely steep.

And when compared to a credit card or a loan from a traditional bank, the interest rates are extremely high.

If you carry a balance for more than a few months, you'll often end up paying more in interest than you initially borrowed.

And if your finances are already a bit unstable, that can lead to severe hardship down the road.

Quick-fix financial solutions can be pricey at best, and disreputable at worst.

Better solutions can often be found by calling your bank, applying for an in-store credit card, or negotiating directly with your creditors.

But when you've exhausted your other options and need quick cash, Speedy Cash can take some of the guesswork out of the process.