Understanding Credit Card Debt

If you have credit card debt, you aren’t alone. In 2017, the Federal Reserve reported that credit card debt hit an all-time high, $1 trillion.

You may feel like you have the situation under control right now, but it is important to understand the potential consequences of having too much debt. An emergency could quickly put you in a difficult situation, and the debt could be negatively impacting your finances in other ways too.

Why it Matters

Expenses can pop up at anytime. Unless you have emergency savings, you’ll be looking at credit cards and loans as a way to cover the costs. This could be a problem if your cards are close to maxed out already, or have a low credit score and worry about obtaining a loan.

Plus, credit card debt is part of your credit utilization rate, which makes up 30% of your credit score. It is calculated by dividing your credit card balance by your credit limit and multiplying by 100. In general, you want your credit utilization rate to be 30% or less. A ratio higher than that could be dragging down your credit score.

Most importantly, paying off credit card debt can bring you peace of mind. If you spend a bit of time researching your options, you can hopefully find a way that offers lower inteest rates, creates a repayment plan, and helps you escape credit card debt for good.

There are several ways to pay off credit card debt, but one of the most efficient is taking out a personal loan in order to achieve debt consolidation. This replaces everything that you owe on your credit cards with a single debt consolidation loan that will have monthly payments with a fixed, lower rate.

There are other options, too, and we created this overview to help you make a decision and create a plan.

Ask if a Debt Relief Program is Right for You

If you're behind on your payments, you may explore debt settlement. This is the process of negotiating with creditors to lower your debt.

The negotiation is conducted by a third party, but even if you succeed in doing so, there is a catch: It can potentially damage your credit score and will remain on your credit report for seven years.

You can also try a program of debt management. This strategy used by credit counseling firms doesn't involve borrowing money or reducing the principal of your debt.

Debt management means that credit counselors will work with the card companies to accept reduced interest rates and lower payments.

But the debt management programs come with a cost.

They normally charge you an origination fee, followed by a monthly fee that ends up folded into your monthly debt payment.

If you have a good credit score (670 and up) and want to keep it like that while avoiding the costs and complications of debt settlement or debt management, then you should definitely explore debt consolidation.

With a good credit score, you will also be able to get a personal loan that has a lower interest rate than what you're paying on your credit card debt.

Consider a Credit Card Balance Transfer

Transferring your balance to a 0% APR card is a popular option. Many people take advantage of promotional offers for a new credit card with your transferred debt at a 0% APR for periods that range 6–21 months.

But even if you qualify for one of these deals (which normally require having good credit) that covers the total of your debt, there are risks and costs associated with it.

0% APR cards will charge a balance transfer fee. It is normally 3% of the debt you're moving into your new card.

The 0% APR is always a temporary offer. After that period is over, the interest rate will go up to a regular one, normally above average.

If you haven't managed to pay off the principal of your previous card's debt or even make a dent in it, then you're exactly where you started.

You may even be in a worse spot: your new interest rate could be higher than the one you were paying on your original card.

A late payment regularly ends the temporary 0% APR. If you're late, you'll most likely start paying a penalty rate of 20% and above.

So a 0% APR credit card transfer is not necessarily the best option for everyone. And it may create the illusion that you're dealing with your debt when in reality all you're doing is kicking it further down the road.

Using your 401k for Credit Card Debt

Another option is taking a loan from your 401k to wipe your debt. Many employers allow for workers to borrow up to half their retirement balance for periods of up to five years, with a credit limit of $50,000.

This alternative has many pros:

- It doesn't affect your credit score

- You're paying interest to yourself

- The interest rate on a 401k loan is normally cheaper than that on credit cards

But borrowing from your 401k also has its cons:

- It's not available to everyone, and if you lose the job feeding the 401k, the lender may request to pay it in a shorter term.

- It poses a risk to your hard-earned retirement savings if you're not able to keep up with the loan

- It could carry tax consequences and penalties

Personal Loans for Credit Card Debt

Determining if a personal loan is the right option to pay your credit card debt—or if you should use the other popular option of a 0% APR transfer balance credit card—can be tricky.

But here's the gist of it: if you have good credit and you're sure you can pay off your debt well within the introductory zero-interest period, then you should go with a balance transfer credit card.

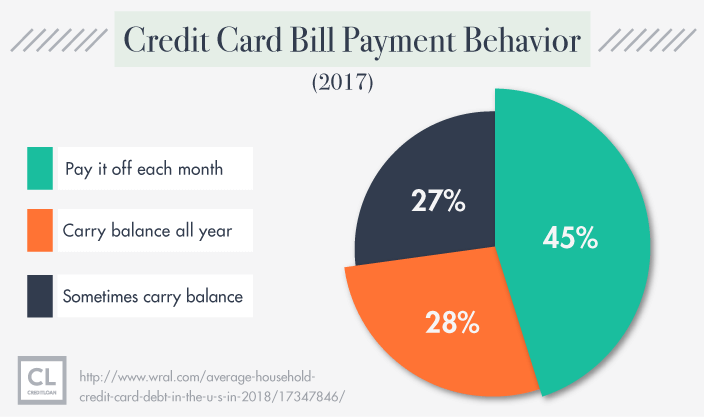

Again, you need to be committed—and have a plan—to pay all or most of your balance before the 0% APR rate expires; lest you want to risk being subjected to above-average interest rates when the honeymoon period is over.

A personal loan can give you more time to pay than a 0% APR credit card. Balance transfer deals usually range 6–21 months, so if you need more time, you probably want a personal loan to get out of the hole you're in.

Personal loans also give you an extra push to keep up with your payments. One of the most dangerous things about credit cards is that you can keep adding debt to them even as you try to pay them off.

And if staying on top of that is hard for you, the fixed payments can be a great psychological help you stick to your payment plan.

The key is getting a personal loan with a lower APR than your credit card. Go to a few sites—see Lending Club or Lending Tree, for instance—and see available offers based on market and personal conditions.

Then, use a personal loan calculator to see what your monthly payments would be.

Find the Right Loan for You

Before you apply, learn the basics of personal loans and what you'll need beforehand

There are two types of types of personal loans: secured (where you put up a collateral, like a car) and unsecured.

When you're looking to consolidate credit card debt, you're probably looking at an unsecured one.

The term on personal loans can range from a few months to five years. It's typical for lenders to offer lower interest rates for longer loan terms.

Most lending institutions can get you an unsecured loan for up to $10,000. But there are other options, and a top personal loan lender like Wells Fargo offers amounts that go as high as $100,000.

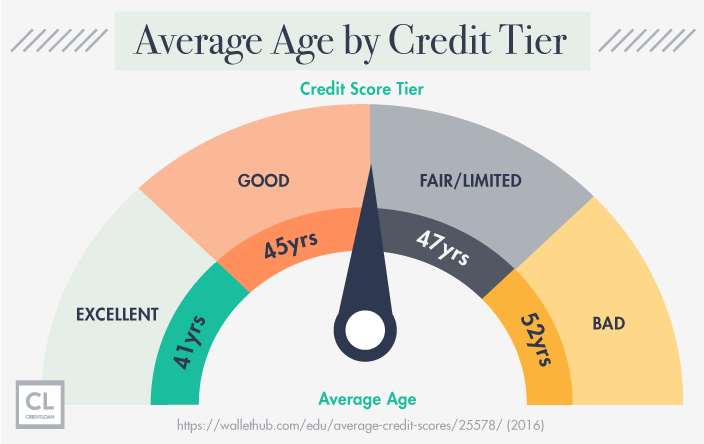

The interest rate will depend on your credit score and loan length. Personal loans can range widely from 2.5 to 36%, but if you're a borrower with Good credit (690+), expect to pay around 8.5–14.5% for a five-year term loan.

The average borrower pays 10.64% on a 24-month term given by a commercial bank.

What does that mean?

For instance, suppose you owe $10,000 in credit card debt and have an APR of 16.5% (roughly the current national average), it would take you 48 months to pay the debt with a monthly payment of $286.

Now assuming you have a "Good" credit score (690+), you can get a personal loan with an interest rate of 13.5%, and erase your debt in the same period by paying $271 per month.

If your credit is "Excellent" (720+), you will get an even lower APR.

That may seem like a small difference in your monthly bill, but it adds up over time and, more importantly, the interest rate on your personal loan won't change like it would on a credit card.

You will also not be subject to the penalties of a credit card nor be tempted by your card provider to keep adding to that debt by constantly using your card.

Things to do before applying for a personal loan

If you've decided to go ahead and apply for a personal loan, you'll want to make sure you know your credit score. You may want to take steps to improve this before applying for a loan. You can boost your credit score by making credit card payments on time, making a large payment, and disputing any errors your credit report may contain. You could also try getting pre-qualified for a loan.

You should also be prepared to provide your lender with documents. Along with basic personal information, they may ask for information like your monthly debt obligations, annual income, and employment history.

Get the best possible personal loan for you

There are many options out there, from large commercial banks to credit unions to peer-to-peer lenders, and a bit of legwork could save you a lot of money in the long run.

Your goal is to lock the best possible personal loan rate, get flexible terms, and know that you'll be able to trust your lender as much as they'll trust you.

The key here is shopping, shopping, shopping. And the best way to do so is by starting with the 8 best places for personal loans.

Of course, it also pays to find a company that truly cares for you.

Pay the Loan Off for Good

Stop me if you've heard this one before, but after getting that loan you'll need to pay it.

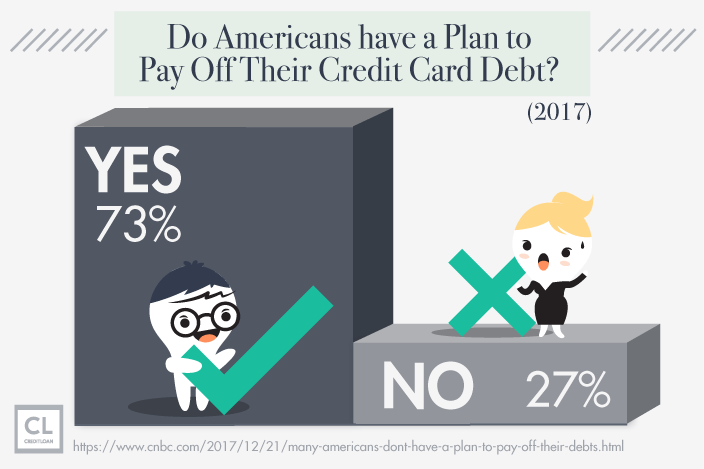

And for this, you'll need a plan. The good news is that a personal loan will give you a fixed interest rate, so you'll know exactly how much you'll be paying every month.

The only thing left to do is to set a fixed amount of money apart in your personal budget to cover your loan every month.

If you didn't have a budget before amassing that credit card debt, now is the best moment to start. There are many ways to set up a budget.

Don't close your cards

Closing credit cards will not help your credit score. In fact, it may actually damage it.

So unless the card you were using has an annual fee that can't be waived or that you no longer wish to pay, it's better to just keep them open and put that piece of plastic you keep getting in the mail in a drawer.

You could even cut them in half.

You simply don't want to repeat this cycle of debt again.

Since 1998, CreditLoan has been helping to educate consumers on financial issues while providing the tools and solutions they need to effectively manage these issues.

Whether you're working on a better budget, establishing joint accounts, getting a loan on bad credit, or buying your first home, CreditLoan.com has the advice you need from experts you can trust.

Have you refinanced your credit card debt before?

What was your experience and who did you go with?

Would you do it again?

Let us know in the comments below!