Sometimes making ends meet financially is tough, especially when unexpected expenses pop up.

For many people, emergency funds are limited (or even non-existent), so a personal loan is the best option to take care of things.

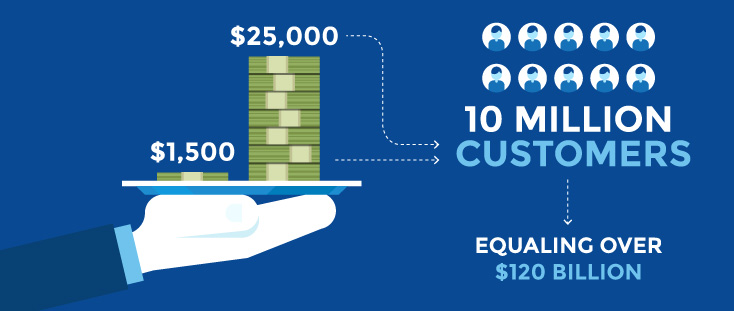

OneMain Financial is a personal and auto installment lender that specializes is small-to-mid sized loans ($1,500 to $25,000).

They have provided loans to more than 10 million customers equaling over $120 billion.

OneMain Financial prides itself on taking a personal approach to lending — using variables other than credit scores, like income and debt, to determine loan amounts and rates — so those with poor credit scores can still be eligible for loans.

In fact, it was one of the first and only lenders without a minimum credit score for years so it was used most often for debt consolidation and emergency funds.

OneMain’s interest rates and fees have remained higher than other lenders on the market today, and applicants would like more transparency about eligibility BEFORE their credit score is dinged, but it remains a well-established and safe lender for those with poorer credit histories.

With more subprime personal lenders on the market, if you credit is good or becomes good while you have a OneMain loan, it is worth shopping around for lenders with lower interest rates.For over 100 years, we’ve been helping hard-working people tackle life’s challenges by providing the help you need when you need it. Our loan experts are from your community, understand your unique situation, and will treat you with honesty, dignity, and respect. Our goal is to deliver the best customer experience and empower you to take control of your finances.

– Jay Levine, President and CEO

About OneMain Financial

Company History

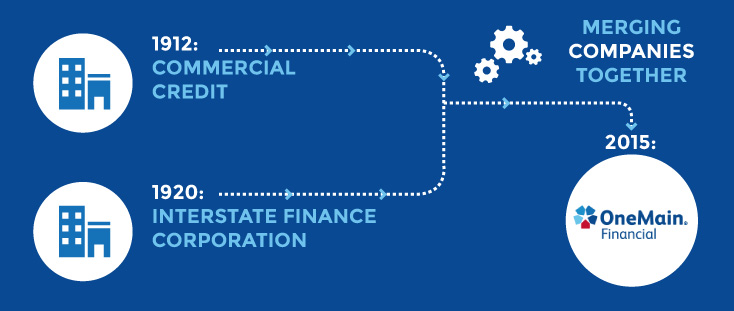

The history of OneMain Financial is filled with many mergers and acquisitions along the way.

The only way to understand the bank it is today is to look at the histories of two companies:

Commercial Credit and Interstate Finance Corporation.

1912: Commercial Credit

OneMain Financial — known then as Commercial Credit — was founded in 1912 in Baltimore, Maryland.

In its original manifestation, the bank provided working capital to manufacturers and building contractors.

In 1916, Commercial Credit began to offer commercial installment car loans, followed by loans for home appliances and other household products.

Then in 1934, in response to the National Housing Act, they expanded their services to offer home improvement loans.

In 1968, Commercial Credit is acquired by Control Data Corporation (CDC).

In 1987, CDC sells Commercial Credit to Travelers Group.

Travelers had already acquired Primerica (the parent company of Smith Barney).

These companies participated in cross-selling their financial services.

1920: Interstate Finance Corporation

The other company in this story is Interstate Finance Corporation which was founded in 1920 in Evansville, Indiana.

Interstate was an underwriter for sales of Inland Motor Truck vehicles, and while Commercial Credit was developing, they were also expanding branches throughout the U.S.

under the operating names of CrediThrift of America and CreditWay of America.

In 1982, CrediThrift is acquired by American General Corporation, who is then acquired by American International Group (AIG) and is renamed American General Finance Inc.

(AGF). In 2010, AGF is acquired by Fortress Investment Group and is renamed Springleaf Financial Services.

Merging Companies Together

In a $140 billion merger, Travelers Group merges with Citicorp creating the largest financial services company in the world.

Commercial Credit becomes OneMain Financial and finally, in 2015, Springleaf acquired OneMain Financial.

Contact Details

OneMain Financial Headquarters:

601 N.W. 2nd St.

Evansville, IN 47708

Website:OneMainFinancial.com

Customers can also apply for loans at iloan.com

Social Media:

Facebook

Twitter

YouTube

Contact Numbers:

Nearest Branch or to Apply – 800.961.5577(M-F 8am-5pm Local)

Technical Web Assistance – 877.520.6246 (M-F 7am-7pm Central)

Existing Insurance Questions – 800.325.2147 (M-F 8am-4:30pm Central)

Former HSBC Account – 800.742.5465 (M-F 7am-7pm Central)

Existing Mortgage Account – 866.698.8332 (M-F 7am-7pm Central)

Contact Local Branch:

There are 2,000 local OneMail branches in 44 states. See all branches by state here.

President & CEO: Jay Levine

Number of employees: 8,000

Subsidiaries: Merit Life Insurance Co, MorEquity, Inc, Yosemite Insurance Co, Ocean Finance and Mortgages, Ocean Finance

Parent organization: Springleaf Financial Services

NOTE: OneMain Financial DOES NOT Operate In these States:

- Alaska

- Arkansas

- Connecticut

- Massachusetts

- Nevada

- Rhode Island

- Vermont

- Washington, D.C.

Products & Services

OneMain provides personal installment loans up to $25,000.

Their loans have both fixed rates and scheduled payments for up to a five year duration without penalty if you pay the loan off early.

How It Works

OneMain Financial provides an quick and easy online application for a personal loan.

The have local branches in 44 states and the one nearest you will contact you after you have submitted your application to set up a meeting to review your eligibility.

The funds can be released as quickly as the same day if you apply before noon and have included all the required documents.

Unsecured Personal Loans

Unsecured loans are approved based entirely on the borrower’s credit history, income, etc., and are also called “personal” or “signature” loans.

Secured Personal Loans

OneMain also uses vehicles as collateral to secure loans. Each vehicle must be appraised for its value and must be insured for the duration of the loan period.

Accepted collateral:

- Automobiles

- Trucks

- Motorcycles

- Boats

- Campers

- RV's

NOTE: Active duty military, their spouse or dependents covered by the Military Lending Act may not pledge any vehicle as collateral.

Precomputed Loans

In a precomputed loan, the interest is included in the balance and is calculated at the time the loan is made (as opposed to when the payments are made).

These loans include principal amount, the precomputed interest and prepaid finance charges (origination fee or administrative fee).

All payments on a precomputed loan pay off the entire balance, and earned interest is based on how quickly the loan is repaid.

If the loan is paid off earlier than agreed, the unearned interest is refunded to the any balance owing and unpaid fees or charges.

Daily Simple Interest Loans

In a daily simple interest loan, the interest accrues everyday until the loan is repaid. To keep interest rates down, the borrower must consistently pay the standard monthly payment before or on the due date.

Insurance Products

Unemployment Insurance: Covers minimum payments should you lose your job.

Disability Insurance: Covers minimum payments should you become disabled.

Life Insurance: Covers the loan should the borrower die.

Uses for Loans

OneMain’s loans can be used for almost any purpose with the exception of business spending or tuition fees. These are the most popular ways they are used:

Consolidation or Refinance

Debt Consolidation Loans: Borrow money to pay off multiple debts.

Cash-Out Refinance: If your car is worth more than you owe on an existing car loan, you can borrow to pay it off and have extra cash to spend on something else.

Auto Refinance Loans: Borrow money to pay off your existing car loan for one with a lower APR or less monthly payments.

Vehicles

Borrow up to $25,000 to purchase:

- – Car

- – RV

- – Motorcycle

- – ATV

- – Boat

Repairs

HVAC Repair Loans: Air conditioner or furnace repairs, purchase new heating & A/C systems

Auto Repair Loans: Transmission repair, general maintenance, auto body repair, engine replacement, other major repairs.

Home

Furniture Loans: Living room, bedroom, patio furniture.

Home Improvement Loans: Supplies and labor costs for a home improvement project.

Healthcare

Medical Loans: Emergency medical procedures, planned medical procedures ad medical devices.

Dental Loans: Basic dentistry, cosmetic dentistry, oral surgery

Events

Funeral Loans: Burial plots and caskets, funeral costs, burials or cremations.

Wedding Loans: Flowers & decorations, wedding dress, tuxedo rental, venue rental, entertainment, honeymoon.

Vacation Loans: Cruises, resorts, theme parks, vacation rentals, plane tickets, weekend getaways, honeymoon or holiday travel.

Lending Terms & Interest Rates

Terms:

Loan Amounts: $1,500 minimum to $25,000 maximum.

Loan Time Period: 3-5 years

Interest Rates:

Annual Percentage Rate (APR) Range: 12.99% to 35.99% ― APR rates are higher on unsecured loans

Interest Rate: 25%-36%

NOTE: All OneMain Financial’s Fees, Charges & Penalties vary by state.

Eligibility Requirements

Loan eligibility is based on the applicant’s ability to repay the loan, as well as current bills and living expenses.

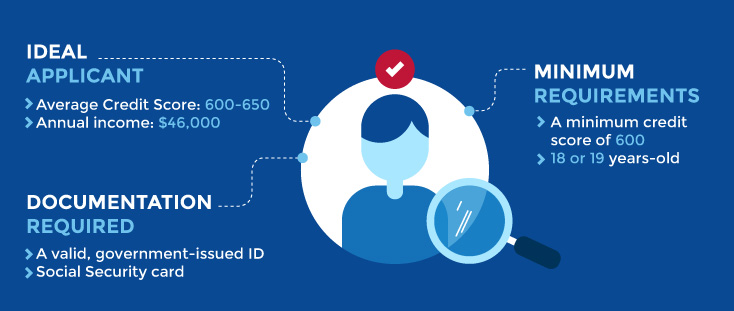

Ideal Applicant:

- Average Credit Score: 600-650

- Annual income: $46,000

Minimum Requirements:

- A minimum credit score of 600

- 18 or 19 years-old depending on state of residence

- No bankruptcy filings

- U.S. resident

- Demonstrated ability to pay bills on time or repay other loans

Documentation Required

- A valid, government-issued ID

- Social Security card

- Proof of residence (driver’s license or utility bill)

- Proof of income (paystubs or tax returns)

- A few years of tax returns if self-employed

- Other documents as requested

Application Process

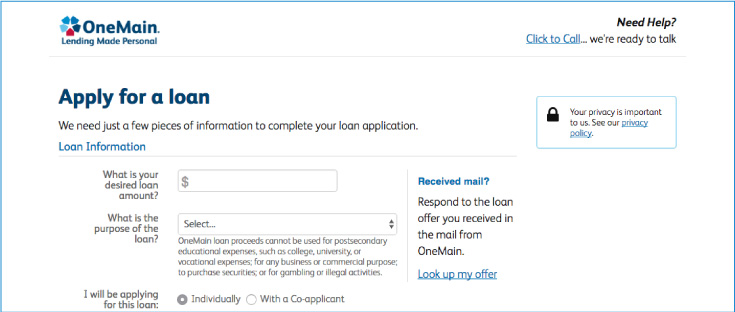

OneMain Financial has a relatively easy online three-step application process.

Step 1

Complete the online application with all loan, personal, employment, and financial information, and OneMain Financial will respond with a quick decision on the loan request and an email with additional information.

Step 2

If approved, a OneMain loan specialist makes contact to schedule an appointment at the local branch to discuss your loan options, as well as verify your identification and financial information.

Step 3

At the meeting, the loan term are reviewed and if accepted, the contract is signed and the funds are released.

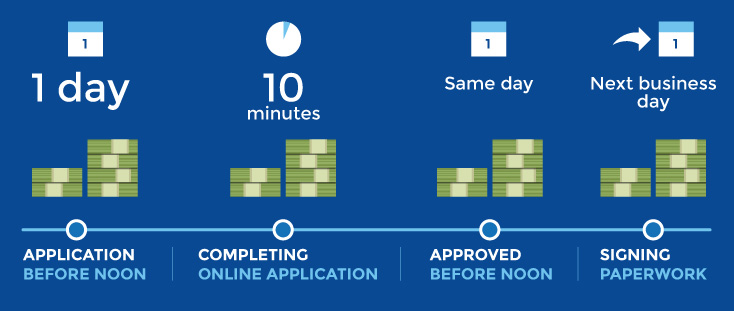

Average Time to Complete Application Process

OneMain’s online application process is quite simple and expedient.

Here are the average times it takes to complete the tasks involved (assuming all documentation was delivered on time and there were no variables that contributed to a longer review process):

- If you complete your application before noon, the time until you receive funds: 1 day

- Completing online application until you receive loan decision: less than 10 minutes

- If you are approved before noon, the time until you receive funds: same day

- Signing paperwork until you receive funds: Next business day

Receiving Funds

Funds can be released by check or by direct deposit.

Making Payments

There are several ways to make payments, including:

- Online Account Management:

- – ACH transfer

- – Debit card

- By OneMain Mobile App (iOS or Android)

- At any Branch:

- – Cash

- – Debit card

- – Personal check

- – Payroll check

- – Government check

- – Cashier check

- – Traveler’s check

- – Third party personal check

- – Money order

- – Bank draft

- – Insurance draft

- – ACH

- By Phone at Customer Service (800.961.5577) or calling your branch:

- – ACH transfer

- – Debit card

- By Mail to the PO Box listed on your monthly statement

- – Personal check

- – Cashier check

- – Money order

- At any Walmart Service Desk

- – CheckFree payment

Online Account Management

OneMain offers an online system where customers can view all their loan statements, make payments and update contact information.

Within the system, customers can also enroll for Direct Pay and OneMain Rewards Programs.

Direct Pay

This service lets customers make automatic monthly payments from their bank accounts. This service can be stopped at any time with written notice to the customer’s service branch.

OneMain Rewards

Customers can earn points by visiting the website or interacting with OneMain through social media.

The points can be redeemed for retail gift cards or discounts on utilities, vacations and other items.

Paperless Statements

Customers can also opt to receive a monthly email alerting them that their statement is ready to view in the Online Account Management system instead of receiving it by mail.

Reviews & Ratings

- Better Business Bureau (BBB): A+, but customers only gave the company 3.79 out of 5 stars

- Consumer Affairs: 3 out of 5 stars

- Best Company: 4.8 out of 5 stars, Best Company Customers: 8.7 out of 10 stars

- Next Advisor: 3 out of 5 stars

Customer Reviews

My experience with OneMain was a great one, the loan officer called me to let me know the amount of the loan I could receive and why, proceeded to tell me all the paperwork I had to turn and to make the process fast, she suggested I fax in the paper work to make the transition much smoother and faster. She then set up a date and time to come in, which took about an hour at the most. From start to finish, I mean from the time I first submitted the loan, it took about two weeks to get everything done. Someone getting in touch with me took a while, about a week, so there was a delay in the response from OneMain, but once the process started, things were done quickly.

— Milton from Upper Marlboro, MD, Lending Tree Review

I only bothered trying to get the loan to consolidate my credit cards because I was pre-approved. However after completing the application, I was denied. I wouldn't have let them ding my credit except for the fact that I thought I would be approved. I will not be fooled again nor will I recommend them to anyone I know.

— Leighann from New Baden, IL, Lending Tree Review

They were very friendly and understanding and very patient with me and helped me out so much with consolidating my financial needs with a reasonable monthly payment that was good for my circumstance.

— Christopher from Lanham, MD, Lending Tree Review

This is absolutely the worst company that I have ever done business with. I would never, ever recommend them to anyone. They was great during the initial set-up, however, when I had a issue with my autopay, they were not willing to help me out at all despite the fact that the autopay error was caused by their error, which they gladly admitted was their error. They would not refund any charges back to me, even though this was totally their error. When the manager was questioned by myself about the error, they did not apologize for the error. The manager responded by saying "that this is our fault, but we will not refund the charges applied by your bank … We have your signature on the autopay form so the charges are valid.”

— David from El Cajon, CA, Lending Tree Review

Regarding improving your credit score, OneMain is kind of like a double-edged sword. Since your credit is bad, if you need a loan, they are one of your only options. But once you take out a loan with them, you realize just how much the interest is. They report the entire interest and principle to the credit reporting agencies, which makes the amount look so much worse on your end. But when you do pay it off, your credit score does improve.

— Anonymous, SuperMoney Review

I took out a loan about two years ago, and paid it off. A few months ago, I signed into my OneMain online account, and it said I had an outstanding balance. Turns out, there was a fee for the one time I was late on a payment. I never got any sort of correspondence to let me know. The fee kept accumulating. I contacted customer service, and they pretty much told me I should've checked my account (even though it was years old) and then I would've seen the charge.

— Anonymous, SuperMoney Review

Customer Service

With over 1,800 branches in 44 states, customers can receive one-on-one help with a customer service representative, as well as by phone and email. Customer reviews of OneMain’s service is mixed with varying positive and negative experiences.

Safety and Legitimacy

OneMain Financial is well-established and has been in operation for over 100 years. Its parent company, Springleaf Financial Services, is owned by Fortress Investment Group.

Strengths

- Quick, easy online application

- Receive funds within 24 hours (faster if you are approved before noon)

- No minimum credit score to apply

- No application fee

- No prepayment penalty

- 1,800 local branches in 44 states

- Established in 1912

Weaknesses

- High interest rates

- $25,000 maximum loan amount

- Lacks transparency: Difficult to understand eligibility without actually applying, but credit checks can affect applicant’s credit score

- Three stars on Consumer Affairs

- You have to visit the branch to meet with a representative before being approved for a loan

FAQs

If you're looking for a loan, it's always best to shop around. Check out The 8 Best Places to Get a Personal Loan.