Every year, states end up with millions of dollars that belong to their residents.

But for any number of reasons, they can't get the funds to their rightful owners.

If you've ever been in line at the DMV, you know how inefficient government management of things can be.

Money management is no different.

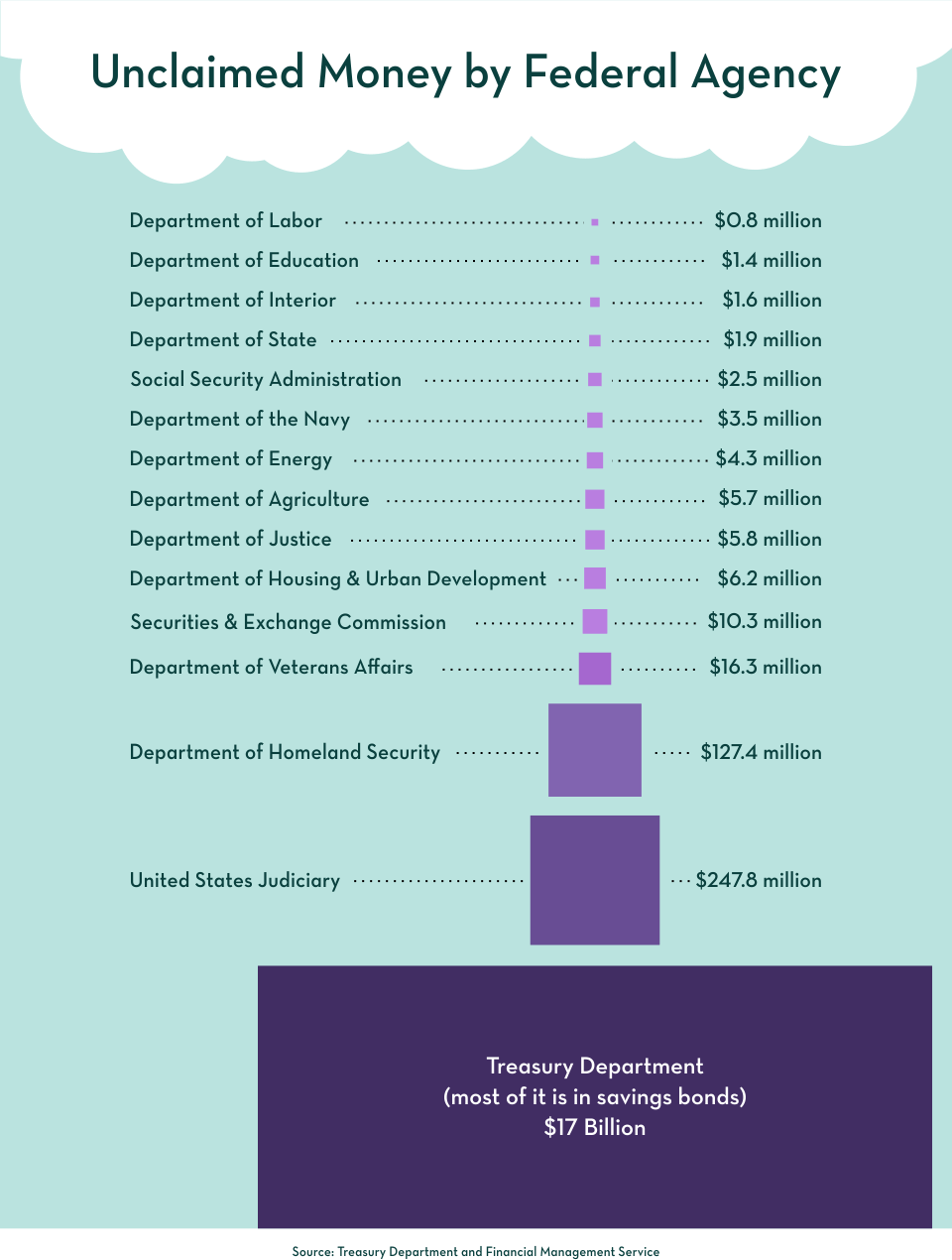

Right now, it's estimated that there are billions of dollars in unclaimed funds across the country, according to the National Association of Unclaimed Money Administrators.

Some of this money could be yours! And just think, with this money, you could pay off expensive credit card debt or finance an important expense.

Think the government doesn't owe you money? Think again!

There are countless areas where unclaimed money can be found, including:

- Unpaid/back wages

- Veterans Affairs' life insurance funds

- Pensions

- Tax refunds

- Bank and credit union failures

- And much more

Most people don't even know the government owes them money – and even if they do, they're not sure how to go about claiming it.

There's no central "unclaimed money" government website and anyone who says otherwise is likely trying to scam you.

In this helpful guide, we'll show you exactly what steps you need to take to find out if there's any unclaimed money or property out there waiting for you, as well as how to claim it.

We'll also give you tips on how to spot a scam involving unclaimed funds so that you can protect yourself or your loved ones.

Fortunately, even if you've tried to hunt down unclaimed funds in the past and been unsuccessful, there are now newer, faster ways to get your money back in your hands.

Use Unclaimed.org and MissingMoney.org to find unclaimed money

Step 1: Start local.

The first step to find out if you have unclaimed money is to start local. That means searching state by state over at Unclaimed.org – a site managed by the National Association of Unclaimed Property Administrators (NAUPA).

You can search Unclaimed.org on a state-by-state basis, or visit MissingMoney.org, the NAUPA-backed multi-state search site.

You should search in the state you currently live in as well as any states you've lived in previously.

If you're married, also conduct a search under your maiden name.

You may also want to try searching with your first initial and last name – there's no telling how your name appears across various government databases, so it's a good idea to try multiple search variations.

The kicker is it costs you nothing to check.

Step 2: Get your documents together.

If you've found missing money in your name – that's great!

Now the next step is to claim it.

To do this, you'll need to verify your identity.

Different states have different requirements, so it's a good idea to have the following documents on hand:

- Your state-issued ID card, like your driver's license

- Your social security card

- Your IRS form W-2

- Your latest utility bill (as proof of your current address)

- Any utility bill associated with the property you're claiming

It's worth noting that some states will accept copies of the aforementioned documents, while others require the originals, so be sure to check with your state's specific requirements when filing your claim.

If you're claiming property on behalf of someone else who is still alive but unable to file the claim on their own, you'll need documents that prove your authority over them – such as a guardianship letter or a document signifying Power of Attorney.

If the owner of the unclaimed funds is a minor, you'll need a copy of their birth certificate.

If there's more than one claimant to the funds, everyone will need to provide proof of their respective identities.

If your name has changed from the name listed with the claim, you will need proof of the name change, such as a marriage certificate.

If the claim is for a cashier's check, you'll need the original check.

Step 3: File a claim.

Here again, each state has its own process outlined on its website.

Again, you can find out if you have any money by visiting, Unclaimed.org or MissingMoney.org.

Some states accept online submissions and others require you to mail in the details.

Online submission may mean that you receive your unclaimed funds faster, but even if you do fill out the forms online, you may still be required to print and mail them in along with proof of your identity.

The following states accept some or all online claims:

The following states require you to mail in your claim form:

The process doesn't take long, but the wait for details could take from two weeks to six months

After mailing in or submitting your claim form and requested identity verification documents online, the final step is to wait.

Here again, the process varies from state to state.

It could take as little as two weeks from the time you file your claim to receive your money, or it can take up to six months.

In some cases, you will be informed of the amount you will be reimbursed.

In many instances, however, you may not even know how much you're getting back.

You'll need a copy of the death certificate if you want to claim unclaimed funds for someone who is deceased

If the original owner of the funds is deceased, you'll need a copy of the death certificate, as well as one of the following items:

If the estate is currently in probate. You'll need a copy of the certified Letter of Administration or Letters of Testamentary.

If the estate was probated but the estate itself has been closed. You'll need a copy of the certified will. All heirs named in the will should file the claim.

You'll want to provide the addresses for all the heirs listed. Or if you are claiming for them, a notarized written disclaimer that gives you permission to claim on their behalf.

If the estate was not probated but the deceased person had a will. You'll need a copy of the will and may need to complete the Affidavit of Small Estate form, depending on the state you live in.

You may need to contact an attorney should you have questions about resolving the estate.

There are more places than Unclaimed.org and MissingMoney.org to look for unclaimed money

The Unclaimed.org and MissingMoney.org websites are only meant as a starting point to help you find unclaimed funds.

They are by no means exhaustive search databases containing every possible lost "pocket" of money.

Fortunately, there are many other places where you can search for other types of unclaimed money. Here are the best places to look:

Unclaimed federal tax refund money

In the event that your IRS tax refund was delayed or undelivered, the IRS may owe you money.

To see when and why tax returns are marked undelivered and how to fix that issue, as well as see if there are unclaimed refunds, visit the IRS.gov website.

Your refund may also go unclaimed if you're eligible for a refund and don't file a return.

Even if you're not required to file a return, it may be in your best interest to do so if federal taxes were withheld from your pay and you qualify for the Earned Income Tax Credit (EITC).

If your wages were below the minimum filing requirement, you may still be able to claim federal tax refunds if you file a return within three years of the original deadline.

If you believe the state you live in (or have lived in previously) may have unclaimed tax refund money that belongs to you, contact your state tax department.

Unclaimed pension money

The U.S. Government has a specific agency devoted to pensions – the PBGC or Pension Benefit Guaranty Corporation.

From their website, located here, you can search for unclaimed pensions.

If a company went out of business or ended a pre-defined pension plan, you can search for unclaimed funds for those situations here as well.

Unclaimed savings bonds and payments

The U.S. Government used to maintain a site called "Treasury Hunt" that would let you search for bonds issued since 1974 that have matured and have stopped earning interest.

Though this service is no longer available, clicking the link above will provide you with the appropriate form and link to make a claim for lost, stolen, or destroyed bonds.

Conversely, if you'd like to find the value of your paper savings bond, you can do that as well.

Unpaid wages

You can search the U.S. Department of Labor's Wage and Hour Divisions database of workers if you believe you are owed back wages from your employer.

Unclaimed life insurance funds

The U.S. Department of Veterans Affairs (VA) maintains a database of unclaimed insurance funds that are either owed to certain current or former policyholders or their beneficiaries.

However, this does not include funds from SGLI – the Servicemembers' Group Life Insurance of VGLI – Veterans' Group Life Insurance policies from 1965 to today.

Unclaimed funds from bank failures

The FDIC (Federal Deposit Insurance Corporation) maintains a database of unclaimed funds from failed banking and financial institutions which you can search up.

Unclaimed funds from credit union failures

Like the FDIC for banks, the NCUA or National Credit Union Administration maintains a database of unclaimed deposits from credit union failures.

SEC claims funds

If a company or individual owes investors money, the SEC (Securities and Exchange Commission) lists enforcement cases for those funds.

Foreign claims

If you are a U.S. national and have lost property in foreign countries (for example, as a result of the nationalization of property by the foreign government, loss of property due to a military operation, and so on), the Foreign Claims Settlement Commission may be able to assist you.

Watch Out for Scams

Don't Pay Fees

Unclaimed money and property scams have been surging lately.

Scammers typically call, email, or even mail official-looking correspondence that tells you that you could be entitled to unclaimed funds, as long as you pay a fee to retrieve them.

Some of the most common scams include:

Claiming to work for the government

A scammer contacting you by phone or email pretending to be an employee or an affiliate of the treasurer's office in the state you currently live in or have lived in in the past.

Showing official looking, but fake documents

A scammer sends you a letter that comes on letterhead from the National Association of Unclaimed Property Administrators (NAUPA). NAUPA is a legitimate organization, however, it does not send letters out to contact citizens directly.

Pretending to be a legal middleman

People who claim to be brokers or "locators" claim they've found money owed to you and offer to do all the legwork on your behalf in exchange for a percentage of the funds.

In some cases, these are legal albeit unnecessary middlemen.

Others are simply scammers who are all too happy to collect all your personal and private information as well as payment details, then direct you to the websites we've mentioned above.

Scammers can be particularly convincing

Many of them frequent the Unclaimed.org or MissingMoney.org websites and actually locate things like past names, addresses, and even unclaimed funds.

These websites may require your social security number, but at no time will they require or even request your bank or credit card details.

That is the key difference that separates the scammers from legitimate government sources.

The steps we've outlined here for you are absolutely free.

It may take some time and paperwork – but it costs you nothing out of pocket to search for unclaimed money.

The Takeaway

Do not give any personal or financial information to anyone that you did not initiate contact with – including anyone claiming that they are from your state treasurer's office, the IRS, or other government organizations.

By following the steps outlined above, you'll be able to search for unclaimed money, and if you find that money is owed to you, get the proper paperwork and documentation you need to prove your identity and claim the money that is rightfully yours.

There's no fee and no financial information requested at any time in the process.

All it takes is a little time.

The reward for your effort could be beyond your wildest dreams.

A janitor in New Orleans–working for a company that offered stock options–discovered he was owed over half a million dollars in stock when he retired.

Wouldn't that be a nice retirement gift!

Have you ever tried to claim unclaimed money?

How wonderful (or horrible) was the experience?

Let us know in the comment section below!