If you're in your 30's, you may be feeling like you're out of the personal finance woods.

All those money mistakes you made in your clueless 20's are history.

You've mastered Basic Financial Habits 101:

- You know what your credit score is;

- That you gotta pay down more than the minimum on your student loans each month; and

- That you should be signed up for a savings fund like an IRA or 401(k)

But your 30's bring all new challenges.

This is the decade of your life where you'll be setting yourself up for major financial decisions — marriage, kids, a house, investments, even retirement — and the complexities can pile up.

If your 20's were about getting solid on your financial training wheels, your 30's are about learning to navigate without them. The dress rehearsal is over — this is real life.

And with so much at stake for your financial future, it's vital that you get on the right track fast.

The good news is, it's not that hard to get on that bike and keep going.

Just like when riding in traffic, you simply have to keep your head on a swivel and use common sense to avoid becoming roadkill.

But by the same token, while the many small, smart steps you make along your route can help you grow your wealth and achieve your financial goals, it can only take a couple wrong turns to derail your efforts and steer you off course — possibly for decades to come.

Fortunately, if you can avoid these ten big mistakes, you'll have a lot more cash to cruise comfortably toward all of your goals.

We've outlined these common money mistakes so that you can enjoy a head-start on the road toward financial security and avoid the pitfalls that many 30-year-olds make along the way.

Remember, even if you're still feeling shaky without those training wheels, there is no bad time to start making smart financial decisions.

You really can't go wrong if you simply keep your eyes on the road ahead.

Just make sure you're not making any of the mistakes below, and start taking control of your finances now!

1. Not investing in retirement

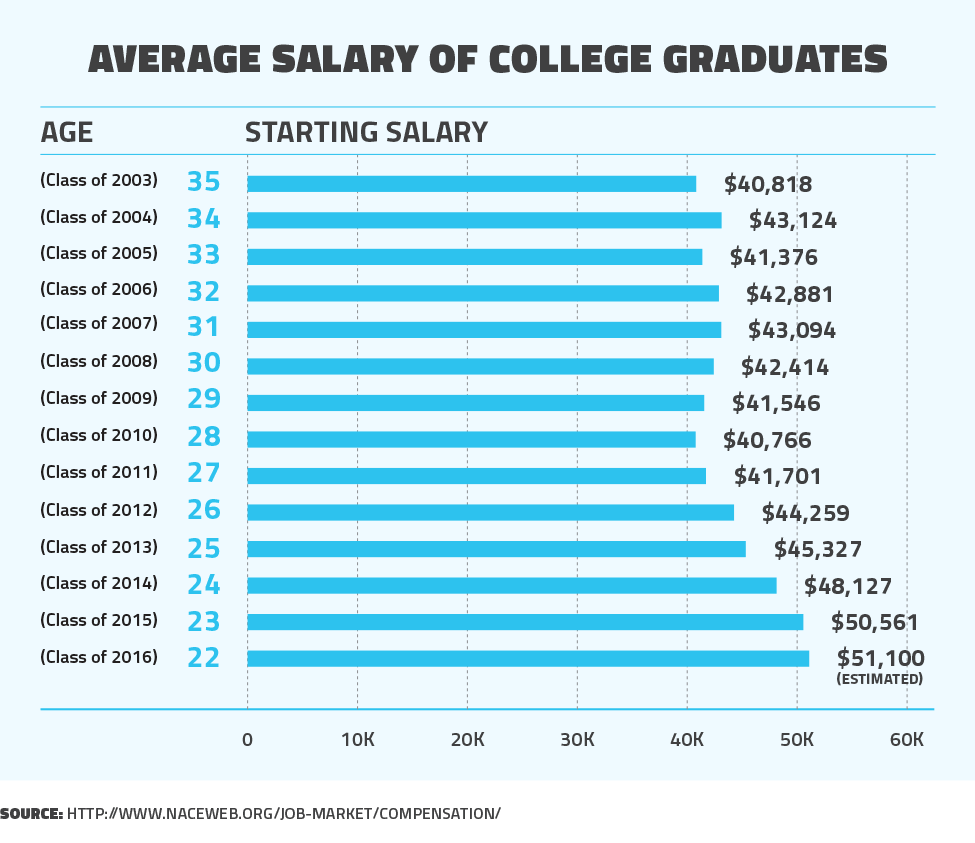

Long after they should know better, studies show that workers are still leaving lots of money on the table.

Researchers at the independent investment advisory firm Financial Engines found that one in four employees are missing out on receiving a full company match, leaving an average of $1,336 on the table each year, or an estimated $24 billion altogether.

That's free money, people!

And a survey from Personal Capital found that a stunning 40% of millennials don't even own a single retirement savings account at all.

Of course, it makes sense that a generation that watched the markets crash and burn during the 2008 financial crisis has some PTSD where investing is concerned.

But what's scarier, missing out on nearly $3.5 million in potential retirement funds, or investing in the stock market?

That's the amount millennials stand to miss out on by age 65 by using savings accounts to save for retirement instead of investing, writes Mike Brown at LendEDU:

Even if you're risk averse, the answer is pretty clear. With the average projected savings needed to retire comfortably hitting at least $1 million, investing instead of stashing your cash under the mattress or in a bank account is a no-brainer.

The great news is that when it comes to saving for retirement, it's never too late. It's better to save later than not at all.

Don't let your money sit there

If you haven't started already, INVEST your savings.

It's easy to get on the right track to saving for retirement.

Often, the hardest thing is just getting started. Once you have begun, you can refine your plan as you gain more experience and familiarity.

Things to keep in mind:

You don't need to hire a fancy financial advisor

There are so many great financial services companies that use technology to grow your savings for very low fees. Here are two of the best: Wealthfront and Betterment.

If your employer offers a 401K, max out your contributions

And consider opening up your own IRA or Roth IRA account as well.

If you started an investment account with $1,000 and put in $200 extra each month for 30 years, you'd end up with an investment worth $168,000.

This assumes an average growth of 5% each year, which is slightly lower than what the stock market has done since it was created.

This figure also doesn't assume that your company is matching your investments.

If you put the same amount into a bank savings account, you'd only have $85,000.

Under your mattress?

You'd only squirrel away $73,000.

Moral of the story?

INVEST.

If you start today, you'll see your money grow via the amazing power of compound interest.

We've covered a lot this great stuff in our 12 Common Investment Mistakes (and How to Avoid Them) article, which I KNOW will help you.

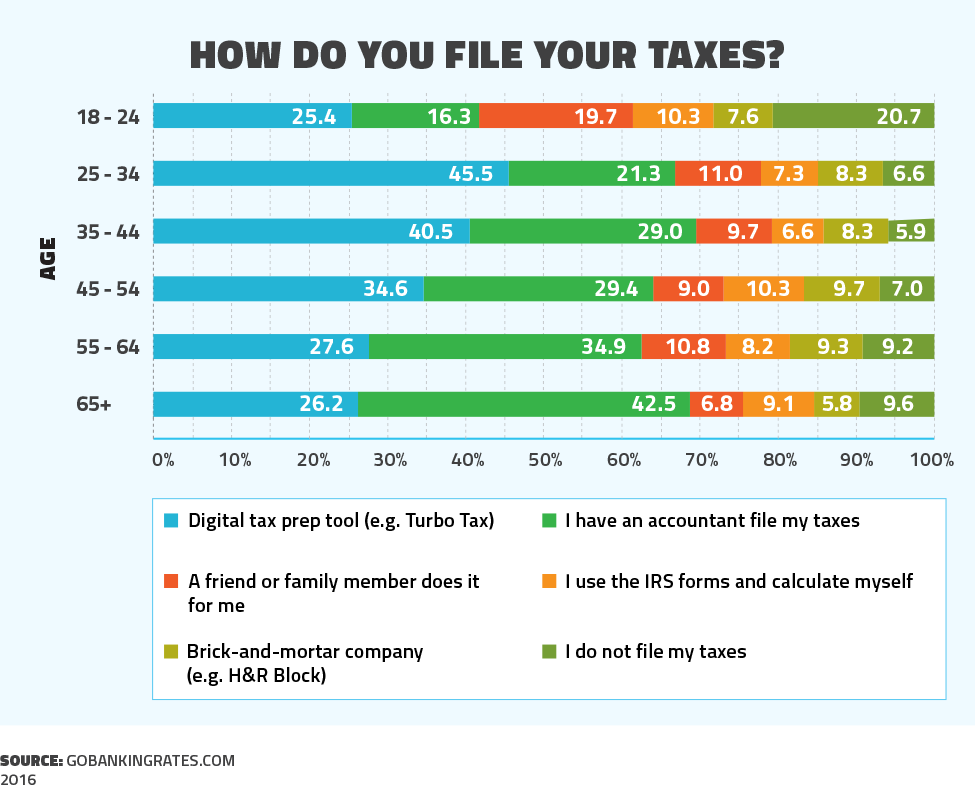

2. DIY'ing your tax return

Still doing your own taxes?

At 30-plus, the 1040-EZ may no longer be so EZ (get it?) to tackle on your own.

Major life events begin to come down the pike in your 30's: Marriage, divorce, having kids, adopting kids, taking elderly relatives under your wing, receiving an inheritance, buying a house, launching a business.

If you've ticked off one of those boxes in the last fiscal year, it might be time to call in the pros.

And I don't mean your dad's accountant who lives three states away.

I mean your own tax professional who can help turn you on to tax-saving strategies that apply to your unique situation, including possibly itemizing your return.

According to Turbotax, itemizing instead of taking the standard deduction, lowers the tax bill of one out of every four taxpayers.

And the National Society of Accountants says hiring a professional to prepare an itemized Form 1040 with Schedule A and a state tax return cost an average of $273 in 2016, compared to $176 for a similar non-itemized return.

That roughly $100 difference can come back to you in dividends if any of those above 30-something life changes apply to you.

Don't go out into the tax wilderness alone

If you have a simple tax situation, feel free to file on your own, but if your "Status: filing single" has recently undergone a change, or if you've launched any new business or real estate adventures — consider having your taxes done by a pro for at least the first year.

That way, you can learn what deductions apply going forward and continue on your own assured you aren't making any mistakes.

Ryan Guina, an Air Force veteran who blogs about personal finance at Cash Money Life and The Military Wallet, says he chose to bring in professional tax help for the first time this past March after launching his business and realizing his tax situation was a lot more complicated than it was a year earlier:

"I had a laundry list of itemized income receipts, expenses, deductions, and credits, and I only had a "pretty good" idea what I was doing," Guina says.

"When it comes to taxes, "pretty good" isn't good enough… If you have a complicated tax situation and aren't experienced or simply don't have the time or desire, then I highly recommend hiring a tax professional."

The Wirecutter.com, The New York Times's product review site, found that for the fourth year in a row, the best online tax preparation site was TurboTax.

But they also advise that sometimes a human can't be replaced.

Tax preparer Mark Francis tells Wirecutter that the "solitary, repetitive nature of tax software, making you click Yes or No to get to the end, engenders more hasty action than answering a human being."

And the more complicated your return, with additional questions and boxes to fill out, the more chance for error and missed opportunities, which can compound as you make your way through the Choose-Your-Own-Adventure of tax prep software.

The biggest incentive to call in the big guns?

If you screw up on your tax return, you could either owe money to the IRS or simply not get what you deserve back.

Either way, that money, which could be squirreled away in your investment account earning interest, is then government property and lost earnings.

Just make sure to take the IRS's advice when hiring a tax pro:

Get referrals, check credentials, find out how your tax pro determines their fee, and make sure they have time for a new client and all the questions you'll want to ask.

3. Not diversifying your income

If you're expecting to work for the same company your entire career and retire with a slice of sheet-cake and a commemorative pin at a conference room sendoff party, think again.

A 2016 poll by the Associated Press-NORC Center for Public Affairs Research found that while more than 40% of America's baby boomers stayed with their employer for more than 20 years, it's unlikely that their children or grandchildren will experience the same job tenure.

The Bureau of Labor Statistics announced last year that median employee tenure across all ages —the length of time a worker has been with his or her current employer—was 4.2 years in January 2016, down from 4.6 years in January 2014.

That dip in overall job tenure among currently employed Americans, the first recorded since 2000, is actually a sign of a strong labor market — companies hiring and people quitting their jobs to take on new roles.

But in a churning job market that requires constant reinvention, having an alternate income source is a smart play.

There's more money to be made, if you hustle

Selling a service, a product, or investing in crowd-funded real estate can create new sources of cash flow and help distribute your precious eggs among a few different baskets.

You can do anything that makes you happy and earns you some extra scratch:

- Dog sitting in your own home

- Tutoring

- Re-selling thrift store clothing online

- Packaging and selling a cherished family recipe

10 of the best ways to make money from home

Want more smart ways to save and earn? If you're interested in more ways to put your hard earned money to work, check out 5 Steps and 50+ Tips to Stop Living Paycheck to Paycheck.

Passive income is an especially great way to earn some extra revenue, advises Alexa Mason, who writes for TheCollegeInvestor.com.

Anything where you do some work up front but watch the profits roll in, like selling stock photos, is a smart play.

So join the 44 million Americans who gig on the side and pursue that side hustle!

And then, since that side hustle money is all gravy anyway, save it.

Sarah Berger, who writes for Bankrate.com, advises putting your side-hustle earnings toward a high-yield savings account, emergency fund, paying off loans, or retirement investments.

Consider the math: If you are 30 years old and make just $100 a month in your side hustle every year, that $1,200 invested in a traditional IRA would compound into $177, 496 before taxes, assuming a 7% return and a retirement age of 65.

That's almost double the amount compared to the $90,120 you'd earn if you socked the same amount away in a savings account over those 35 years.

4. Getting hitched without talking about money

It can be difficult to talk about finances — topics like your credit score, debt, salary, net worth, and how you spend and save can feel deeply personal to many people.

But this is the person you're planning to spend the rest of your life with, so like it or not, things are already pretty personal.

With research that shows that money is the top cause of friction in relationships, why take a chance?

A SunTrust Bank poll found 35% of respondents dealing with relationship stress said disagreements about money were the source of their problems.

Dr. Amy Wenzel, a clinical psychologist and couples counselor who writes about relationships at YourTango.com, says that among her patients who cite financial troubles in their relationship, none had discussed financial issues before getting married.

The Money Talk is nothing to panic over

With the help of some helpful guides, like our 14 Questions To Ask Before Combining Finances With Your Partner, or this handy money worksheet for couples from MoneyUnder30.com, you can get on the same page when it comes to finances.

The price tag of failing to communicate about finances could be big.

Financial issues are one of the top reasons for divorce, and if the potential dissolution of your marriage isn't incentive enough to talk about money before combining your financial fortunes, Legal Zoom estimates that the average cost of divorce is between $15,000-$30,000.

That's in court and legal fees alone.

In addition, there are costs involved in selling jointly owned property, moving, and buying or renting new residences for one or both spouses plus possibly paying for counseling if you have children.

Not to mention the loss of compounding interest your combined earning power could have made in investment funds.

So take a deep breath and embark on the Money Talk.

No matter how it goes, like every emotionally-charged talk worth having, you'll feel SO much better after you do.

5. Paying a lot for a big wedding or a blinged-out ring

Don't let anyone tell you that it's frivolous to have a party when you get married.

As we point out in our list of 9 ways smart couples pay for weddings, celebrating the union of two families with a wedding can be an important cultural and emotional experience.

And getting married is often a smart financial decision.

It increases wealth and income, making a home and more comfortable life for your family possible.

Researchers at the Ohio State University's Center for Human Resource Research found that married people had 93% higher wealth per person than singles.

Their data also showed that people who got married and stayed married showed a sharp increase in wealth accumulation after saying their "I dos."

But with the average wedding costing a whopping $35,329 in 2016, according to The Knot, there are many line-items where you can trim costs and put your savings toward investments in your future.

Stick to a budget for the wedding and the ring.

Think of it as something important that requires thoughtfulness instead of a high credit card limit.

Come up with a creative plan and spend on what's important to you while paring down the rest.

Before you even get to decide between a massive guest list or a small City Hall ceremony, it's easy to overspend on nuptials right out of the starting gate.

The Knot also reports that the average price paid for an engagement ring topped $6,000 in 2016.

If you can avoid being blinded by the bling, you can get a head start on setting up good marital money habits.

So before you hit the jewelry store, talk to your parents and future in-laws.

There may be an heirloom ring in the family that you could have adjusted or reset.

If a ring shopping trip is required, set a budget and stick to it.

There are plenty of beautiful rings to be had, whatever your budget.

After all, a modest but meaningful ring is SO much more romantic than going into debt for a big, shiny rock.

Looking for other wedding budget tips? Check out our post on 9 Ways Smart Couples Pay For Weddings for more ways to save.

6. Living lavishly

One of the biggest money mistakes we make in our 30s, according to a decade-by-decade roundup by the Wall Street Journal, is living too large too early, leading to credit-card debt, subsisting from paycheck to paycheck and missing out on compounding interest we could be earning with the money we're spending.

Manisha Thakor, director of wealth strategies for women at Buckingham & the BAM Alliance, tells the WSJ that she meets many people in this phase of life who expect the same standard of living they remember enjoying when they left home.

These people, she says, are forgetting it took their parents decades to get where they are.

"Early on, you may live more like a recent graduate student than the overly romanticized images we see in TV and movies," Thakor says.

And it's not just keeping up with your parents' lifestyle.

In a world saturated by social media and ruled by FOMO, it can be easy to feel like you need to spend to keep up with the perfectly-filtered, carefully-curated lives of your peers.

This can lead to buying on credit and then the mistake that sends people spiraling into debt: Not paying your credit card bill off each month.

According to a survey by CreditCards.com, 28% of Americans admit to not paying their credit card bill in full each month and 43% of those say they've carried a balance for two or more years.

Meanwhile, a striking 78% of full-time workers said they live paycheck to paycheck, up from 75%, according to a CareerBuilder survey.

Spending within your limits takes a mind shift

What are the memories you most look back on with the most fondness in your life?

Childhood road trips with the whole family — or whether the car you took to get to your destination still had that new-leather, fresh-off-the-lot smell?

Chances are good it's the moments, not the things, that stay lodged in your memory.

Erin, at JourneyToSaving.com, says a great way to spend wisely without making yourself feel pinched tracking every single penny is to institute a value-based spending system.

Instead of setting a traditional budget and beating yourself up every time you go $10 over your monthly allotment for gym classes, she recommends defining the values in life that mean the most to you.

Whether that's family, friends, your career, health, travel, self-care, or anything else, write them down and ask yourself if your spending is in-line with your stated priorities before every purchase.

If your values don't include keeping up with the Joneses (and they shouldn't, the Joneses are probably going broke) this system is likely to help you put unnecessary purchases back on the shelf and keep your spending in line while still allowing you to enjoy what really matters.

With the help of some goal-based savings accounts she maintained on the side, Erin says she was able to use this mindset to adopt a dog and plunk down the cash to finally dye her hair the amazing purple color she'd been dreaming of for years, all while improving her relationship with money.

And when all else fails, enlist technology to reward saving instead of spending.

Melissa Vera who writes about saving tips AdventuresOfFrugalMom.com used Unsplurge, an app that helps you track your savings goals, to save up enough for season tickets to her favorite sports team.

The iOS app tracks your progress and gives you visual incentives to keep you motivated — think photos of a white-sand beaches if you're saving for a trip to the Caribbean.

But the best part, says Vera, is the built-in social community that cheers you on toward your savings goals.

"Sometimes when I am being held accountable for what I am doing makes it easier on me," she says. "Plus I get a great feeling of accomplishment watching things grow."

7. Avoiding dealing with death

Look, we all die, right?

It's the one guarantee out there.

That and taxes, and we've covered those already.

So how can you face your eventual demise in a fiscally responsible way?

Three big steps:

Talk to your parents about their estate plans

Sad to say, but usually our parents precede us in death, so it's important to have a frank discussion with the older generation about their assets and their plans for their later years and eventual passing.

Are they able to take care of themselves in retirement if they become sick or infirm?

Who is going to be the executor of their wills?

Are they willing you money directly or putting it in a trust?

Or are you counting on an inheritance you might not, in fact, be in line for?

What are their wishes for their respective funerals and do they have money set aside for that?

These are all better facts to learn before your parents have passed away, not afterward, when you're likely to feel emotionally tapped out.

In a post on TheBillfold.com, web developer and storyteller Rob Penty says he learned a lot about money and his parents' lives the hard way — after they died within six months of each other.

"Until it sold, I paid the mortgage on my childhood home (my father had taken out a second mortgage to pay for my college education). This was also my first exposure to property taxes" Penty writes.

"As this process went on, I discovered how personal money and debt could be."

Buy life insurance while it's cheap

Speaking of death, your own is inevitable, too.

And as the crowd hitched to your wagon grows with a spouse or kids, you need a better safety net to catch them.

As a rule, life insurance gets more expensive the older you get, so there's no time like the present to lock in a policy, even if you don't see kids and marriage until sometime later up the road.

Jeff Reeves, the editor of InvestorPlace.com explains in USA Today that in the vast majority of cases, term life insurance policies are best.

(In term insurance, you pay a regular premium in exchange for a guaranteed benefit should you die during a set "term" — say, the next 20 years.)

They're customizable, easy to compare, and simple, with no confusing financial structures or big fees that can be involved in whole and universal life insurance.

And Jeff Rose at LifeInsuranceByJeff.com says that at age 30, it's smart to buy at least a 30-year term policy since you'll likely be working that long before retiring.

Write a will

Having a written will in place ensures that all your hard earned savings go where you want them.

But according to a poll by RocketLawyer.com, an astonishing 64% of Americans don't have a written will.

If you die without one in place, your state government will choose the executor of your estate and divvy it up for you, with your unmarried partner, friends, and favorite charities getting a whole bunch of nothing.

It's not that hard to create a written will. If you're in the middle class, you can likely use an online legal forms site. But, says U.S. News & World Report, if you are upper-middle class or worth more, you should almost definitely hire an estate attorney.

So grow up and face down the Grim Reaper.

There's nothing like facing your mortality to make you feel alive!

8. Not having a financial plan before having kids

Children are game-changers, and not just when it comes to your sleep cycle.

You wouldn't buy a car without a plan in place to pay for it, right?

So why would you do things any differently when it comes to a living, breathing human?

According to the Department of Agriculture, the cost of raising a child through the age of 17 has hit $233,610 for a middle-income family.

And that doesn't include the cost of a college education (see #9, below).

The takeaway: Although it's the least sexy part of baby-making, there's some serious financial planning to do before you decide to have kids.

Kumiko Erhmantraut, at TheBudgetMom.com, recommends making four key financial moves before having a baby:

Understand your health insurance

First up, know what your health insurance does and doesn't cover and what costs to expect.

Even with insurance coverage and an uncomplicated pregnancy, Ehrmantraut says she was left with a hefty hospital bill.

Plan for maternity/paternity leave

Step two, if you're like most newbie parents, you started at your company without knowing what the parental leave policy was.

Find out and consider negotiating with your boss for more leave.

Most people don't realize that's something they can ask for, but TheFairyGodBoss.com, a site for women in the workplace, says doing your research pays off.

The key is to present your boss with a detailed parental leave plan and framing your argument in terms of how it will help the company, and hopefully, land yourself some valuable extra time caring for your child at home.

Create a new budget

Kids grow fast, and, especially for first-time parents figuring out the lay of the land, there's a whole industry out there dedicated to selling you baby stuff you don't need. (Remember, just say NO to Diaper Genies.)

To keep expenses in check, try a few of Mint.com's recommendations on how to save as a parent-to-be:

- borrow big-ticket items like cribs

- join a toy library

- make your baby registry work for you

- skip the unnecessary high-priced accessories

- save $200 a month in formula costs simply by breastfeeding, if you can.

Start an emergency fund

Finally, get that emergency fund going if you haven't already.

Kids do the darnedest things — like landing in the ER with small toys stuck up their nostrils or deciding they hate ballet and want to play soccer instead after you've already paid for six months worth of lessons.

You're going to want to have at least three to six months of living expenses set aside.

If you're just starting out on an emergency fund and that sounds overwhelming, remember that something is better than nothing.

Dave Ramsey, who created his company Ramsey Solutions to help people dig out of debt, says all you have to do is put just $1,000 away to start.

Remember, baby steps.

9. Prioritizing your kids' college funds over your retirement

You know how in those airline safety videos they always instruct you that, in case of an emergency, you should put on your own drop-down oxygen mask before your help your child or companion?

The same principle applies.

You haven't helped Junior much if you've funneled all your savings toward paying for his college degree, only to end up being unable to support yourself in retirement and becoming a financial burden.

But surprisingly, 70% of millennial parents say they would prioritize their child's college education over their own retirement, according to a survey by digital wealth planners, Personal Capital.

That's a huge mistake.

While plenty of loans exist to help finance college educations — the same can't be said about retirement.

And unlike college, which is extremely important but not a necessity, old age is an inevitability and working forever is not possible.

So get your priorities straight!

Pay yourself first, college later.

And if you want to get your little one's college funds started early, great!

Chances are, your family and friends are asking how they can help when you have a baby.

It's not much of a leap to ask them help to seed a college fund as an alternative to buying your baby a stroller or pack of onesies

So along with your baby registry, create a 529 plan, a tax-advantaged investment account that gives families a way to save for college.

Then tell your family and friends it's open for business. It's easier than ever to do these days with more and more 529 plans adding crowdfunding-style tools that make it a snap for grandparents, godparents, aunties, and friends to contribute to a kid's college fund.

Some funds even let account holders create private, shareable web pages personalized with their kid's picture and college dreams so you can leverage social media to help pay for higher education.

There are no fees for the service in which money is withdrawn from the gift giver's checking account and goes directly into the 529, where the funds grow tax-free and can be withdrawn to pay for tuition without incurring any taxes.

And once the trend is established, it's a gift-giving tradition your loved ones can keep going for milestone events to come.

A 2014 poll by Fidelity, which operates 529's in Arizona, Delaware, Massachusetts and New Hampshire, said 9 out of 10 grandparents said they would be likely — if asked — to contribute to a college savings fund in lieu of other gifts for a holiday, birthday, or special occasion.

In the meantime, contribute the maximum you can to your retirement fund each year before you put money in the college piggy bank.

With the 529 in place, you can save for retirement with the peace of mind that your child's college education is not being entirely ignored.

And in the meantime, instead of yet another LEGO set, your kid gets a gift that truly keeps on giving.

10. Giving your investments too much or too little attention

Congratulations, you heeded Mistake #1 and opened some long-term investment accounts.

It's easy to be so addicted to your returns that you constantly check them with every peak and valley in the markets, or to be so daunted by the prospect of investing that you ignore your portfolio altogether.

But ignoring your investments and checking in on them too much are both big mistakes.

It's kind of like caring for a cactus.

If you constantly water it, you'll kill it.

If you never water it, you'll kill it.

But it still needs water.

So what's the happy medium? Certified financial planner Owen Rich tells his clients to schedule a periodic performance review once or twice a year, or quarterly at most.

It's great to let your portfolio perform over the long term, but markets change and goals change.

So it's smart to revisit your retirement objectives from time to time to make sure you're on track to hit your targets.

Banish the bad habit of setting and forgetting your retirement goals.

The key is to focus on "rebalancing" the mix of stocks and bonds in your 401K or Roth IRA accounts, which you should only aim to execute once a year.

As investment strategist Lyn Alden explains, while the ideal mix changes as you age, the balance can get lopsided when certain asset classes vastly outperform or do worse than others.

By the same token, you shouldn't check your investments obsessively, either.

Studies show that the more you check in on your portfolio, the more likely you are to second-guess your decisions and fiddle with them instead of letting your investments perform over the long haul.

Andy Rachleff, co-founder and CEO of Wealthfront financial management explains that, according to what economists call the loss-aversion theory of investor behavior, people hate losing money so much that, in the name of avoiding future pain, they will often make irrational decisions when they see a stock or fund performing badly.

And of course the more they check in on their portfolio, the more they will see temporary fluctuations and be tempted to make tweaks.

As wealth blogger Ramit Sethi says, "Sweating out the slightest variation of your stocks daily is a recipe for an anxiety attack AND poor financial management."

But as Sethi, who penned the NYT-bestselling book "I Will Teach You To Be Rich," explains, if you're a long-term investor (and you ought to be), "The daily changes in stocks are almost always noise — plain and simple.

And very few (read: almost none) of your investments will be determined by the news of one day."

Case in point, a 2001 academic study showed that men who invest, trade 45% more times than women with money in the market, which resulted in net returns reduced by 2.65 percentage points a year, as opposed to 1.72 percentage points for women.

While the men's many added investment tweaks that ended up taking a bigger bite out of their bottom line, the more risk-averse cohort of women fared better by simply doing less.

(Mention that to whoever tells you men are more innately financially savvy than women, by the way.)

So whether you're male or female, resist the urge to keep checking your investment stats sheet the way you check your fantasy football team.

Chances are you're going to pull the running back you should have kept in your starting lineup to begin with.

Instead, avoid picking individual stocks and follow Sethi's two simple steps (Which just happen to echo billionaire Warren Buffett's best investing advice):

Pick a low-cost, diversified index fund

These funds invest your money across the whole market, so you don't need to worry about picking the "best" stock.

Automate your investing

That way, you do it consistently and can stop chasing stocks and relying on guesswork.

Stick to a periodic performance review

And create ground rules for when to make changes and when to let your portfolio be.

You'll be avoiding an emotional roller coaster and setting yourself up for better long-term financial success.

Win, win.

Do you know any other important mistakes we haven't covered?

Let everyone know in the comments below!