As the third-largest credit union in Florida, Space Coast Credit Union is certainly no stranger to the world of financial services.

Open since 1951 and currently providing banking services to nearly 400,000 members, Space Coast Credit Union (SCCU) has a well-known presence in and around Melbourne, FL, and surrounding areas.

But does Space Coast really give you better value and service for your money than a traditional bank?

And does it fare any better compared to other credit unions?

While it's no secret that credit unions often provide better interest rates than banks, they also tend to be a bit more selective when it comes to their membership.

But credit unions provide other advantages and benefits not found in traditional banking institutions, and their unique approach to banking certainly appeals to many.

In this detailed review of Space Coast Credit Union, we'll take a closer look at how it compares to traditional banks and other credit unions so that you can decide for yourself where your money belongs.

The Verdict: Stellar Financial Service

Membership requirements are easy to meet and the "small town" feel of local branches makes residents feel comfortable

With 58 branches across 14 different counties in Florida, and membership open to all who live or work in those counties, SCCU is the financial institution of choice for many Florida residents.

Its customer service and attentiveness consistently receive top marks from customers.

Moreover, you can expect its knowledgeable staff are well trained and competent enough to answer detailed questions about a wide range of financial products—from auto loans to wealth management.

Services

Space Coast Credit is worth it for the sheer number of services they offer at convenient locations

While its interest rates are not as competitive as online-only banks, having many local branches brings customers greater peace of mind.

Since SCCU has over 50 branch locations, customers can conduct their banking activities at a place that's convenient for them to travel to.

What's more, SCCU is member-owned, and the more you participate in the credit union and use their products, the more you get in terms of member rewards.

Rewards are based on a participation tier and can vary from a bonus on your CDs to free wire transfers, free checks, and more.

The credit union also offers a wide variety of financial services ranging from checking and savings accounts to home and auto loans.

The overhead and staff needed for their many branch locations do, however, make SCCU's savings account interest rates slightly lower than those from online banks.

Still, being able to walk into a local branch and be recognized and warmly welcomed adds an extra layer of trust and is a comfort for many customers.

Why People Love Them

Customers applaud the responsiveness and friendliness of their knowledgeable and experienced staff

Many customers are impressed, not only by the expertise of the staff, but by their kind and courteous demeanor as well.

Should a customer have questions about their auto loan, mortgage, or any of the other products that Space Coast Credit Union offers, they find that they can get a quick and satisfying resolution via phone or in person.

What Are the Problems?

SCCU's commitment to account security and fraud monitoring can go a bit overboard

SCCU prides itself on having ironclad account security, as evinced by its "financial watchdog" branding.

The company's fraud monitoring and detection service actively track customer accounts and transactions, and instantly blocks and alerts a user when account activity is suspect.

Sometimes, though, it can be too hawkish and heavy-handed with its security protocols.

A sudden uptick in your debit card usage at a gas station could spark an immediate deactivation of your card—something no customer wants to discover when they're on the road.

Customers also report being locked out of their accounts or having debit cards suddenly declined, and then having to wrangle with support just to verify themselves and prove their ownership of the account in order to regain access.

These headaches often seem unnecessarily burdensome to customers, and it somehow tarnishes what could otherwise be a nearly flawless credit union experience.

The Competition

SCCU competes with Launch Federal Credit Union

Launch FCU offers better rates on certain products, but comes with fewer branches and financial products overall.

Like SCCU, Launch FCU offers checking and savings accounts, as well as auto and recreational vehicle loans.

They also provide home loans, personal loans, and branded credit cards.

Unlike Space Coast Credit, however, they do not offer CDs or investment products, so if you're looking for more ways to grow your money, SCCU may be the better choice.

Still, of the products they do offer, Launch FCU does offer them at slightly better rates, so you'll need to consider your financial goals carefully before you decide.

If you live in counties serviced by Space Coast and Launch FCU, then you might also want to consider these credit unions

Community Federal Credit Union is open to residents of Brevard, Indian River, Orange, Osceola, Polk, and Volusia counties in Florida.

Navy Federal Credit Union is open to members of the armed forces and their immediate families, with a branch in Satellite Beach, FL.

Space Coast Credit Union Benefits

Numerous Financial Products at Competitive Rates

Get approved for an auto loan in as little as 10 minutes. SCCU also works with numerous dealerships to help you get your car loan and your car in one place.

Get a credit card that's backed by the financial strength of Visa. SCCU offers both secured and unsecured Visa credit cards, as well as low-interest rate cards for students looking to build a credit history.

Take the road less traveled with loans for RVs, motorcycles, and boats. With loan repayment terms as long as 144 months, driving home your vehicle of choice and going on that long-awaited road trip of a lifetime might be closer than you think!

Get the cash you need with a personal loan. SCCU provides both secured and unsecured personal loans of up to 2x your gross monthly income.

Low rates for mortgages, home loans, and construction. Space Coast CU provides both fixed-rate and adjustable rate mortgages, plus jumbo, condo, FHA, and construction loans.

Buy a second home in Florida. A fixed-rate home equity loan can make that dream of buying beachfront property a reality.

Refinance your existing mortgage. Whether you want a low fixed rate, or want to take advantage of today's historically low home loan interest rates, you can easily refinance your home loan through SCCU.

Use your home's equity for cash. A home equity line of credit provides a cash lifeline in an emergency, or to help pay down large debts like tuition or home remodeling projects.

Grow your savings with accounts, CDs, and IRAs. Whether you're saving for a big purchase or a golden retirement, SCCU offers savings accounts with great rates that can help you reach your goals.

Open a checking account that fits your goals and lifestyle. Whether you're a student earning money from your first job, or you want to create a health savings checking account for unexpected medical needs, SCCU has a variety of no-fee and interest-bearing checking accounts that can help.

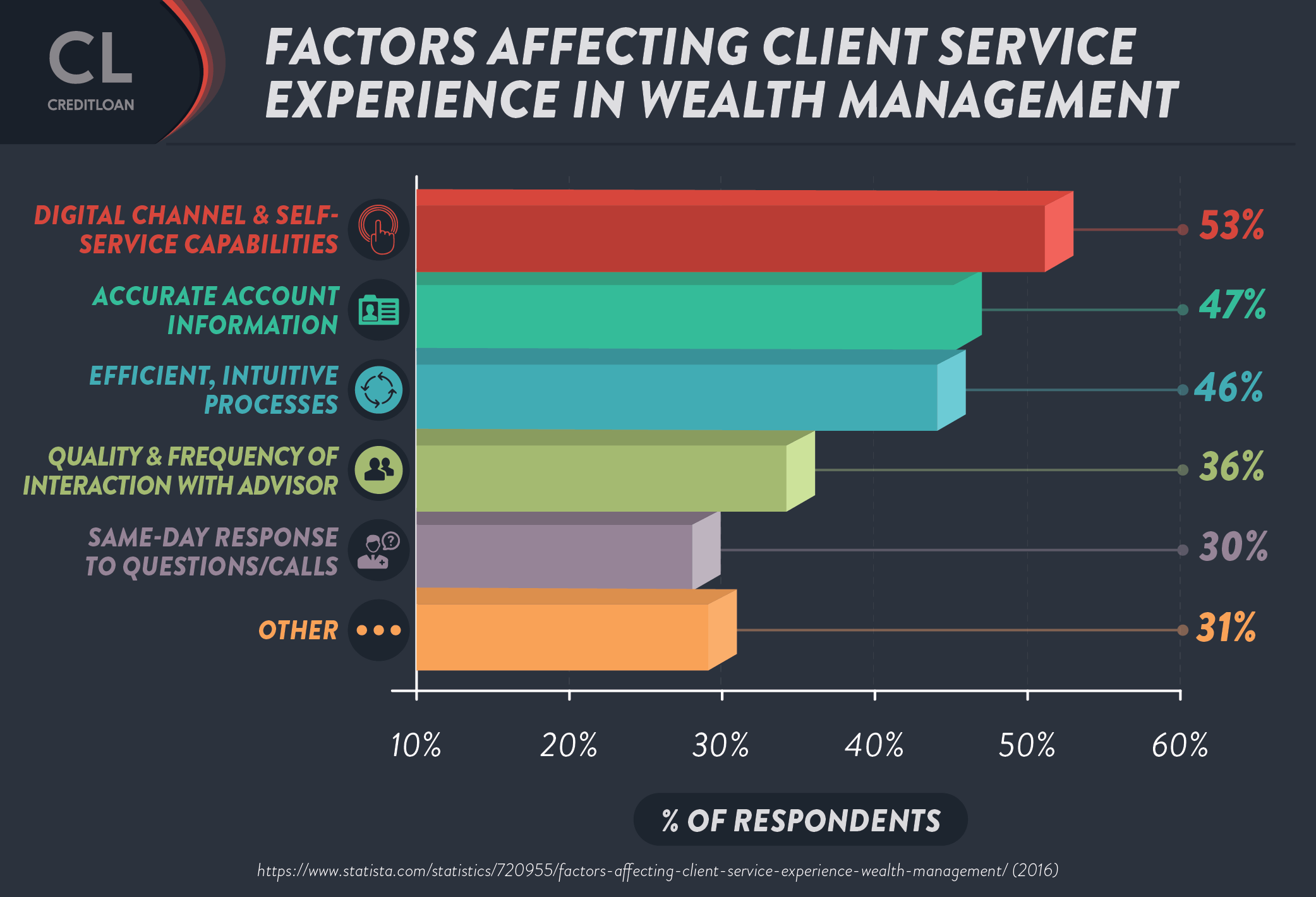

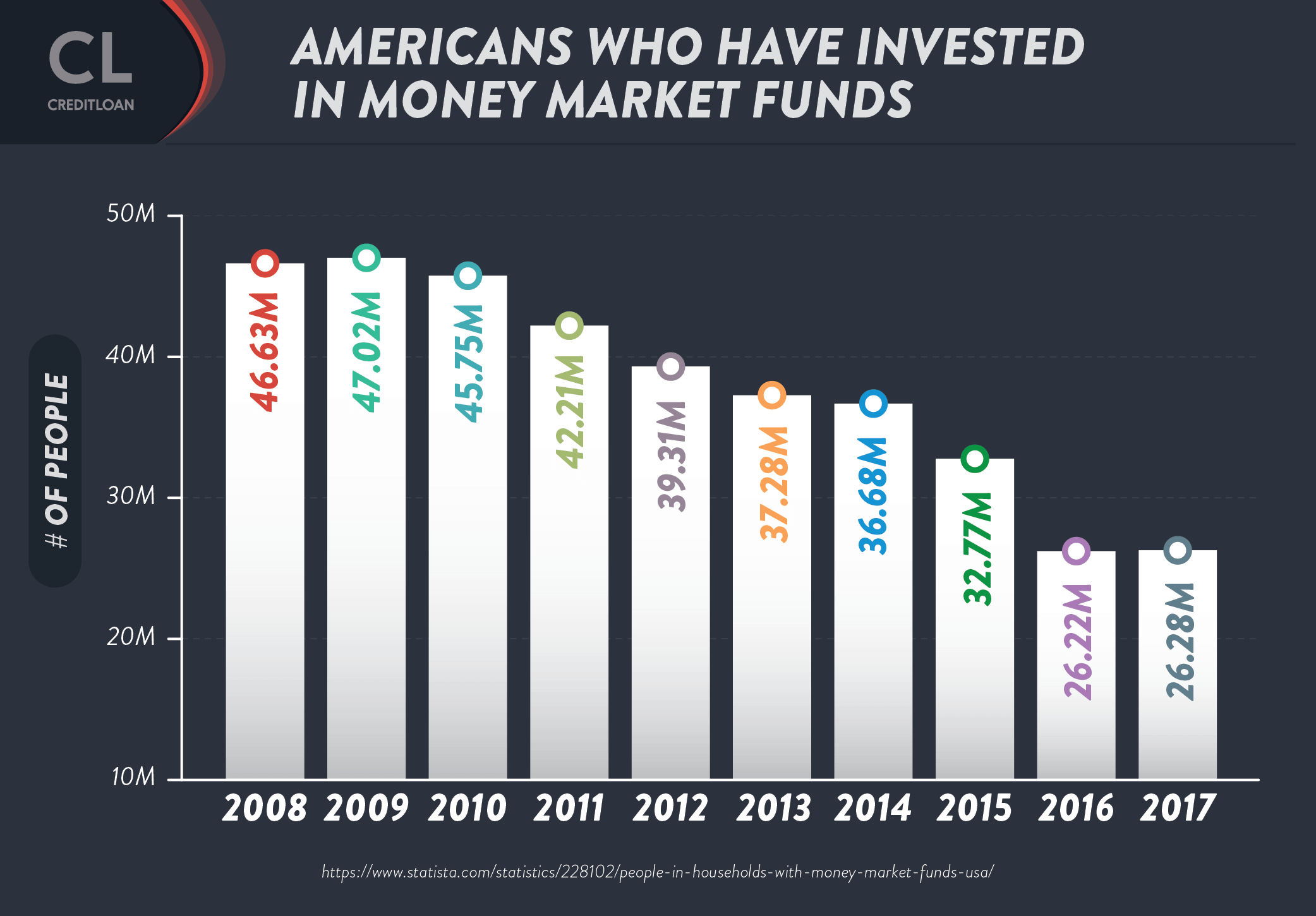

Invest wisely with money market accounts and wealth management services. SCCU is unique among credit unions in that they also offer high-yield money market accounts as well as wealth management and investment services.

Enjoy additional benefits as a credit union member. These benefits include discounts on homeowners insurance, GAP coverage, life insurance, and more.

Digital Services

Space Coast Credit Union offers a mobile app through both Google Play and the Apple App Store which allows customers to securely manage many common banking services.

Members can use the app on their phone to conveniently deposit checks, pay bills, check their account balances and transaction history, as well as transfer funds.

They can also use the app to find the nearest SCCU ATM locations and local branch offices.

And although the app is secure, the interface itself kind of feels a bit outdated as it does not make the most use of the higher resolutions and larger screen sizes of today's mobile devices.

Many customers complain that the "check deposit by photo" feature routinely rejects their submissions due to less-than-perfect lighting and other issues.

This can make something that should ordinarily be incredibly convenient, feel more of a nuisance and a hassle.

Routing Number

Space Coast Credit Union Routing #: 263177903

FAQ

SCCU: Accessible and Friendly

Thanks to its commendable customer service, convenient branch locations, and wide variety of financial products, SCCU is worth considering.

It's not hard to find a Space Coast Credit Union branch or ATM along the Florida coast, which addresses the most common complaint people have about credit unions—they don't have nearly the presence that big banks do.

This kind of accessibility, along with the friendly and knowledgeable staff, the broad range of services, and better rates, make SCCU a good pick for those who want that special brand of financial service that credit unions offer.

If this style of banking appeals to you, you'll find Space Coast Credit Union a welcome alternative to traditional banking.

And while rates may not be as competitive as smaller credit unions or online-only banks, they are nevertheless very reasonable, overall.

Taking all these positive points into consideration, it's easy to see how Space Coast Credit Union has maintained and grown its loyal customer base over the past 67 years.

Have you used any of Space Coast Credit Union's financial products?

How has your experience with them been so far?

Any interesting story or feedback you'd like to share with the rest of us?

Let us know in the comments below!