About Chase Bank

Chase has a long history, dating back to the 1700s. Prior to a 2000 merger with JP Morgan it was known as Chase Manhattan Bank. Today, it is the biggest bank in the US according to Bankrate.

Top Reasons to Consider Chase Bank

- Access to over 5,200 branches and 16,000 ATMs across the US.

- Variety of financial services which means you can manage everything from checking accounts to credit cards or mortgages in one place.

- Online and mobile banking options.

Drawbacks to Using Chase

- Low-interest rates on savings accounts.

- ATM, checking, and savings accounts fees.

- Other lenders may provide better loan terms.

- Some users complained about customer service.

Want to know more about what Chase offers? Keep reading to see an overview of services and more information on what people like and dislike about using Chase.

Checking and Savings Accounts

Chase Checking Accounts

There are a few options for opening a checking account with Chase. At the most basic level, there is Total Checking. With a Total Checking account you get:

- A debit card to use online, in retail transactions, and without any fees at Chase ATMs

- Real-time fraud monitoring for debit card transactions

- Access to Chase online banking

- Access to the Chase mobile app, which lets you transfer money, pay bills online, and deposit checks from your smartphone

- An option to receive paperless statements

- Access to Chase QuickPay to send and receive money (without fees)

- Financial guidance from Chase bankers

- The convenience of banking at more than 5,100 Chase branches in 24 states

Chase touts its Total Checking program as the most popular. You can qualify for free checking if:

- You make monthly direct deposits totaling $500 or more

- Hold a $1,500 minimum daily balance

- Have an average daily balance of $5,000 or more in any combination of qualifying linked deposits or investments, which means your balance across all accounts—including a mortgage—must average more than $5,000 in any given month.

There is also a student checking option. This account provides many of the same benefits as a Total Checking account, with a $6 monthly service fee if you don't have direct deposit or maintain a $5,000 average daily balance. It is only available to high school and college students age 17 to 24.

Other options to consider include Premier Plus Checking and Premier Platinum Checking, which build on the services offered from a Total Checking account.

Chase Savings Accounts and CDs

If you're looking for the highest interest rates in a savings account, you won't find them from any of the big banks. Right now, Chase offers 0.01 % interest (December 2018, rates subject to change).

Online saving accounts or other options, such as money markets and CDs, offer higher yields.

Chase savings accounts have a $5 monthly fee. You can waive this by setting up at least one monthly automatic transfer of $25 or more into your savings account from your Chase checking.

But be careful: If you make more than six withdrawals from your savings account in any one month, you'll be charged a $5 fee. If you go over the limit, Chase may convert your savings account to a Total Checking Account.

Chase Certificates of Deposit

Certificates of Deposit may be an old-school method of saving money, but if you're looking for a sure thing in this economy, investing your money in a large and reputable bank in a CD can yield fair interest rates compared to a conventional savings account and no monthly fees.

Chase CDs:

- Require $1,000 minimum deposit

- Typically earn between .02 and 0.3 percent, but can go as high as .90 percent

- The longer you save and/or the bigger your savings, the more you can earn

- Early withdrawal penalties apply

Chase CD rates are comparable to the other big banks, but interest rates fluctuate so it pays to shop around before making your decision.

However, if you already have a Chase savings account with more than $1,000 you can convert it to a CD online and increase your interest earnings easily.

Once again, the convenience of Chase may win out over rates or service.

Digital Services

Of all the benefits of banking with Chase, the best might be its digital services.

From an app that lets you do virtually anything you can do in a branch or on your computer to its disruptive "QuickPay" service that puts money into your account instantly, Chase puts industry-leading technology at the core of its services— and it shows.

Some of Chase Bank's digital features include:

- Online bill pay

- Smartphone deposits

- The ability to manage your accounts online or through an app, with an easy-to-use interface

- EMF chip technology for enhanced fraud protection

- QuickPay to immediately send funds to others, even non-Chase account holders

Chase Online Checking and Bill Pay

You can pay Chase credit cards, loans, and other bills online. You can log in and do this each month, or set up automatic payments. Just make sure to give those payments enough time to process so you don't pay them late. Chase tells you the day your payment will arrive.

Chase QuickPay

In addition to transferring money between your own accounts, you can use Chase QuickPay to send money to people using just their cell phone number or email address.

Account holders who bank at members of the clearXchange (CXC) network can receive notifications about receiving money through QuickPay from their financial institution. Anyone with a Chase Liquid card or a Chase Checking account can send or receive QuickPay funds.

Funds typically clear in 1 to 5 days for clearXchange customers, for Chase customers deposits usually clear within 24 hours. There are no fees to send or receive money.

On-the-Go Banking

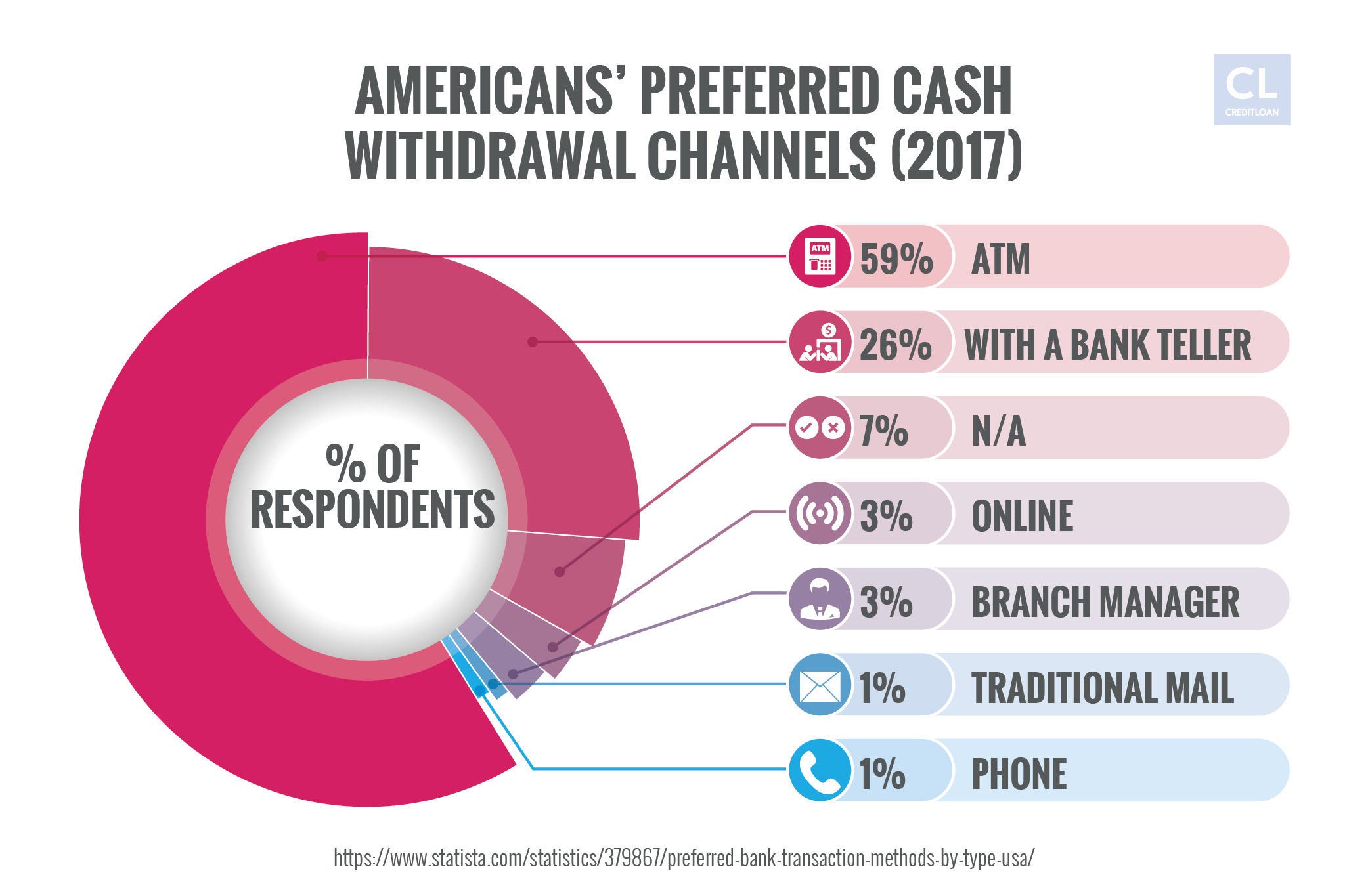

You can easily make deposits at branches, at ATMs, and even on your phone.

The newest ATMs, which have replaced all but one or two tellers in some of Chase's more high-profile, high-tech branches, share a digital copy of your check on screen and on the receipt.

These ATMs have a number of convenient features:

- Take out money in almost any paper denomination

- Withdraw as much as $3,000 in one transaction

- Deposit checks without writing out a deposit slip

- The machine "reads" the amount on the checks to you, shows you the total of all checks deposited

- Receipts feature a digital copy of the check

You can also deposit checks using the mobile app. Simply sign the check and take a few photos with the app and you can deposit a check without leaving your house.

Other features of the Chase mobile app include the ability to view accounts, transfer money, pay bills, use QuickPay, or make a wire transfer from the top navigation menu. For added security, you can set up TouchID on the app.

Chase Credit Cards

Chase Bank offers a number of credit cards for users with good to excellent credit ratings, including 16 travel rewards cards and a total of 22 offerings.

There are cashback rewards cards like Chase Freedom and Chase Freedom Unlimited. Foodies and travelers will find plenty to like about Chase Sapphire Preferred and the Amazon Rewards Visa Signature Card caters to people who want to earn rewards on their Amazon purchases.

Other Services

Loans

There are a variety of home loan services you can take advantage of through Chase like fixed rate or adjustable rate mortgages, home equity lines of credit, and mortgage refinancing.

You can also take out, or refinance an auto loan.

Business Banking

Chase is known to support small businesses through its Mission Main Street Grants program and a number of business banking products.

In addition to business checking accounts and credit cards, the company offers merchant processing services.

Chase Private Client for High-Net-Worth Customers

Chase is touted as a great starter bank, with low requirements for checking account balances and a small monthly fee to retain an account.

But the Chase Private Client service offers concierge banking for individuals who maintain an average daily balance of $250,000 or more in linked Chase accounts.

Those who qualify, receive the benefit of a team of specialists to assist with banking and financial planning, plus private service in branches and on the phone, waived fees, and a host of other benefits.

Chase's Strengths

In spite of the complaints of poor customer service, Chase bank has a number of strengths as a prestigious and long-standing financial institution.

Customers appreciate:

- Thousands of branches and tens of thousands of ATMS across 26 states

- Technology that makes banking easy, including banking kiosks in branches, easy online banking, and a convenient mobile app

- Virtually any financial product and service, all under one umbrella

- Friendly, personalized service in the branches

From personal bankers who hand out lollipops (to the adults) in long lines, to cookies and coffee in the branches and friendly personnel, Chase does try to make its branch customers feel welcome.

The difference between Chase phone service and the service received within many branches couldn't have been more different in reviews.

In an era where online banking reigns, it's good to know consumers can get personalized service in branches.

Randy H. wrote:

I've never been so pleased with a bank branch like this one in my life. All personnel are a pleasure to do business with.

To which, Phemie of Huntington, NY, agreed:

I want to say… that the employees in my Chase Branch are wonderful people. They are very friendly and so nice, and do everything they can to help.

Chase's Weaknesses

The most common complaints about Chase bank all point back to the phone-based customer service.

Long wait times, conflicting stories from different phone reps, and overall lack of satisfaction seem to make it worth the trip to a branch if you have a problem.

Take it from CBSmith8 at MyBankTracker.com:

"If you enjoy getting the runaround on the phone and being sent to every department and having to retell your woes to every single one of them then this is the bank for you…I just got disconnected again after being on hold/passed around for another 40 minutes."

Chase phone representatives seem unwilling to make any exceptions to rules, waive fees, or accommodate customers.

And customers who reported fraud have also had challenges, like JColeman, who said:

"I've had my account for 5 years with Chase, never had any problems until now. I filed a fraud against my account on my debit card for transactions I did not do. Part of the claim was approved, part was declined… Someone had my card and made $480 in transactions now that I'm responsible for."

RonJohn, on the other hand, had a positive experience with the technology and fraud department.

"Direct Deposits are always cleared within one business day, EFTs within two days, the on-line system is intuitive and useful, and Customer Service always prompt and helpful. The CC Fraud department is on the ball about notifying us regarding suspicious charges. We're on our 5th CC: every time there's a suspicious charge, they close the account and send us a new one. That's NOT a bad thing."

Chase Bank's bounty of branches and ATMs

Chase has, hands-down, the most ATMs in the U.S, according to Bankrate.

This is a great convenience if you travel but, of course, you'll want to make sure there are plenty of ATMs in your area, too.

Here's a breakdown of the major banks and their ATMs.

- Citi – 3,200

- Wells Fargo: 12,800

- Bank of America: 16,062

- Chase Bank: 18,623

Meanwhile, Wells Fargo leads the pack in branches with 6,300 to Chase's 5,200.

But Chase's online banking and an app that allows you to do virtually everything you can in a branch, online (including deposit checks) may just allow Chase to tip the scales for convenience.

Chase is only available in 26 states, while Bank of America serves 34.

Also, keep in mind that some services, like Chase Private Client, may not be available in all branches.

How to Find a Branch Near You

You can use their online branch locator, or download their app on Google Play and iTunes.

Chase Bank Routing Numbers

| State | Routing Number |

|---|---|

| Alabama | n/a |

| Alaska | n/a |

| Arizona | 122100024 |

| Arkansas | n/a |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Delaware | n/a |

| District of Columbia | n/a |

| Florida | 267084131 |

| Georgia | 061092387 |

| Hawaii | n/a |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Iowa | n/a |

| Kansas | n/a |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Maine | n/a |

| Maryland | n/a |

| Massachusetts | n/a |

| Michigan | 072000326 |

| Minnesota | n/a |

| Mississippi | n/a |

| Missouri | n/a |

| Montana | n/a |

| Nebraska | n/a |

| Nevada | 322271627 |

| New Hampshire | n/a |

| New Jersey | 021202337 |

| New Mexico | n/a |

| New York —downstate | 021000021 |

| New York —upstate | 022300173 |

| North Carolina | n/a |

| North Dakota | n/a |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Pennsylvania | n/a |

| Rhode Island | n/a |

| South Carolina | n/a |

| South Dakota | n/a |

| Tennessee | n/a |

| Texas | 111000614 |

| Utah | 124001545 |

| Vermont | n/a |

| Virginia | n/a |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

| Wyoming | n/a |

Frequently Asked Questions

Internet users had many questions about Chase bank, including how it stacks up against other banks.

Users touted the online banking interface as a benefit to Chase and said it stacks up "about the same" as other big banks, namely Wells Fargo and Bank of America.

"No difference whatsoever," writes Quora user Serge Milman. "The interest rate on the money [in a savings account] is likely to be very close zero at virtually any large bank."

The only advantage you might find is the convenience factor of having a savings account in the same bank as your checking account, which enables you to link the accounts (for ease of transferring money and overdraft protection).

Our Verdict

If you're looking for convenience, high-tech digital banking services, a variety of financial products all under one roof, and a prestigious name in banking, Chase is one of a handful of banks that fit the bill.

Chase isn't going anywhere soon and only promises to expand its accessibility and continue to increase its services and offerings as it grows.

From rewards credit cards to convenient everyday banking, Chase remains a viable option as a:

- First bank for students and young adults

- One-stop shop for adults who need credit cards, mortgage, and bank accounts and want the convenience of having it all in one place

- Trusted financial advisor and more for high-net-worth individuals.

In short, Chase offers services and financial products for everyone, in every walk of life, and is worth considering if you'd like the security and longevity of a big bank.