You rely on your bank account for depositing money, paying bills, and everyday purchases. But do you know what happens to the money you deposit in your bank account?

Understanding how banks basically lend out deposits for profit is a key to knowing how they operate.

Banks take your deposited money, lend it back out, and profit from the interest. Those loans help people and companies achieve their goals.

Entire industries, like the housing market, construction industry, and auto sales, are able to boom with the support of bank loan financing.

Learning more about the processes of banking can help you plan better for your business as well as for your personal finances.

How Bank Deposits Work

If you want to understand banking, just follow the money

You can learn about our money system by following the lifespan of a dollar bill.

And we can learn about how banking works by following the money after it's been deposited.

It all starts with a paycheck. When you take your paycheck, put it in an envelope, and slip it into the ATM, do you ever wonder what happens to the direct deposit you just made?

Your bank sends it to a clearinghouse, where an image is taken of the check.

Then it's sent electronically to your employer's bank or credit union.

Your employer's bank then sends an electronic money transfer from the account of the check writer (the company you work for) to your bank, to place in your account.

Park your money safely until you want it. The money now "sits" in your checking account for you to access as you need it, either in the form of a cash withdrawal, a debit transaction using your debit card, or personal check.

Or you can set it aside for a rainy day in your savings account, but you won't be able to access it for payments.

Another savings option is a Certificate of Deposit (CD), where you can't touch the money for a length of time during which it earns interest.

It doesn't just sit there. The big question is, what does the bank do with your money while it's "sitting" in your account or in a CD?

According to the Federal Deposit Insurance Corporation (FDIC), in 2016, the total amount of money being stored in domestic bank deposits was $10.67 trillion.

$10+ trillion is a lot of money to be entrusted with.

It's also a massive source of funding for banks to loan out to make even more money.

Whether it comes to the bank in the form of business deposits, digital banking deposits, check cashing, or investment funds, what the bank does with the money is the same.

It's all about tracking. The most important task the bank performs to make the system work is to have secure, dependable systems for tracking.

Essentially, your money doesn't "sit" in your account at all, like it would if you put it in a safe-deposit box.

It's placed into the larger pool of funds and your account is credited.

With online banking becoming the norm, a lot of times there is no physical money changing hands at all.

It's all simply a series of well-tracked transactions that ensure the owners of funds are credited the correct amount they're due.

Transfers take time—to avoid fraud. You can withdraw money from your bank account through a debit transaction and have it show up instantly in your account activity.

But transfers from one account to another can take days.

The reason is so the banks can confirm no fraud is taking place.

It has been suggested that the reason for the delay is that banks like to hang on to your money for an extra couple of days to make a profit from it for as long as possible, but that's not really the case.

Some money is reserved, the rest is available for banks to lend

The bank doesn't take your entire paycheck or savings account bank balance and lend it out.

According to the rules, banks have to leave 10% of the deposits they receive untouched.

The untouched funds are called a bank's "reserves."

Here's how a reserve works with your paycheck. Let's say that paycheck you just deposited in the ATM was for $1,000.

The bank will put $100 aside into its reserves and take the remaining $900 (known as the "excess reserves") and make it available to borrowers.

If you have a bank balance of $100,000, your bank has to keep $10,000 handy.

Then it can lend out the remaining $90,000.

Your deposits are insured by the FDIC (up to a limit)

Is there anything about the system I've described that makes you uncomfortable?

Hopefully, there's no rush on the banks. You might have figured out that if everyone went to their bank at the same time and asked to withdraw their deposits, there wouldn't be enough cash at hand.

Or maybe you're asking:

What if the banks lend out my money but don't get repaid?

These are the kinds of scenarios that lead to banks failing.

It has happened, and it's not pretty. Although unlikely, the financial collapse of 2007 demonstrated that the common understanding that banks were "too big to fail" was false.

Fortunately, if your bank ever failed, you would not lose your money.

Or at least not all of it.

The FDIC insures all American deposit accounts up to $250,000 per person per bank.

An important tip for protecting your deposits. Since the FDIC only insures deposits at each bank only up to $250,000, you are at risk of not recouping all your money if you let your balances exceed that amount.

Once you have a balance of $250,000 with one bank, it's a good idea to start another deposit account with another bank.

What Banks Don't Do With Your Deposits

Don't worry, banks aren't gambling your money on the stock market (anymore)

It might also make you uncomfortable to think the bank can take your money and do whatever it wants with it.

In the past, the investment banking arm of most major banks could take excess reserves and invest those funds in the stock market.

We learned the hard way no bank was "too big to fail." Speculative investments by banks (like investing in the stock market) contributed to the collapse of 2007-2008.

The Volcker Rule (named after the former Chair of the Federal Reserve who recommended it) came into effect in 2015.

The rule stipulates banks can't take the money you deposit into your bank account and use it for speculative investments.

Banks also aren't paying you a lot of interest on your savings

Another thing banks aren't doing with your deposits is paying you decent interest on your balance.

In contrast to the interest rates the banks charge customers for loans, credit cards, and lines of credit, the interest rate banks pay on deposits is minuscule.

You get only nine-hundredths of 1%?!? The average annualized percentage yield (APY) banks pay customers as interest for their savings deposit accounts is 0.09%.

In contrast, the lowest possible APR (annual percentage rate) charged for a personal loan from the bank Wells Fargo is 7.24%.

That means the bank charges loan interest rates more than 80 times higher than the average interest paid out on customers' deposit balances.

Which is exactly why most smart people park their savings elsewhere (for example, CDs or mutual funds) so they can earn more interest, especially if they have a high balance.

Bank Lending

Banks take your money and lend it out for profit

Banks are in the business of making profits for their respective shareholders.

There is an alternative. If lining shareholders' pockets is not what you'd like to see your deposit money used for, consider a credit union instead of a bank.

Credit unions are owned by account holders and distribute profits fairly as dividends.

The primary money-making tool for credit unions is through loans.

Banks offer lots of borrowing options. There are eight main types of loans or credit lending products offered by banks.

Some, like personal loans, are offered by some banks but not others.

Banks are less likely than competitors to provide unsecured credit for risky clients, like personal loans for people with low credit scores.

Banks provide revolving credit through credit cards

Credit card companies like Visa and Mastercard don't actually lend out money.

The role of these companies is to provide a platform for the banks to pay for our transactions (from the pool of deposited funds) and then get paid back.

If the bank doesn't get paid back in full, it charges interest on the remaining balance.

The APRs banks charge for credit cards are among some of the highest interest rates out there.

The banks make whopping profits. It's no wonder the total amount of interest charged to credit card customers in 2016 alone was $63.4 billion.

Rewards and cash back are incentives influencing your choice. The credit card industry is so profitable, that banks are spending tons of money coming up with all sorts of ways to entice you to sign up and use your card.

Big signup bonuses, lucrative rewards and cash back programs, and zero-interest periods on purchases and balance transfers are among the attractive offerings banks make.

A few banks still offer personal loans, but at high rates

Some banks will take the funds available in their excess reserves pool and lend them out to individuals without requiring them to be backed up by a house or car.

Borrowing tools to achieve your goals. Those are called unsecured personal loans, and I know better than anyone how life-changing they can be.

As I hinted at earlier after the financial crisis of 2007–2008, many banks stopped offering unsecured personal loans.

The banks considered them too high-risk.

Only one source for a non-member personal bank loan. Currently, among the major banks only Wells Fargo offers personal loans to the general public.

Personal loans for insiders. Some banks, like Citibank, only provide loans to existing customers with a mortgage or a credit card, savings, or checking account.

Depending on the bank, the personal bank loans offered can range from $2,000 all the way up to $100,000.

Expect to be charged a high APR. The APR the banks charge is quite high compared to other lenders providing unsecured personal loans.

For example, if an existing account holder with an "Excellent" credit score (a FICO score of 800–850) applies to Citibank for a $10,000 loan, they would be charged a rate of 9.9%.

In comparison, the online lender SoFi offers people with "Excellent" credit a loan interest rate of only 5.49%.

Difficult to get approved. Compared to online lenders and credit unions, it's also more difficult to get approved for an unsecured personal loan from a bank if you don't have the best credit score.

By the way, in case you need to bump up that credit score of yours to improve your chances of getting approved, a smaller personal loan just might help.

Lines of credit let you use and repay as much or as little as you like

The banks also lend out the money from their pools of deposited funds in the forms of lines of credit.

Take it or leave it. Rather than getting paid a lump sum, as with a personal loan, the credit line holder is given access to a certain amount of money.

They can use as much or as little of the total available credit as they need to.

Choose your own payback schedule. The credit can be paid back at whatever pace the borrower prefers, as long as a minimum monthly payment is made.

If they pay back what was borrowed in full after the subsequent billing cycle, no interest is charged.

The bank makes its profit from the interest. When the balance is not paid in full and gets carried into the next month, the bank charges interest.

As an example, Citibank offers its existing customers its Custom Credit Line.

It's an unsecured loan with no collateral required.

The amount made available is between $1,500 and $25,000, and the interest rate for people with "Excellent" credit is 8.99%.

The lowest interest rate Citi charges on its lines of credit is 1% lower than the best rate it charges on credit cards (9.99%).

Banks stimulate the economy with business loans

Although it might seem like our society is dominated by major corporations, the 28.8 million small businesses in the U.S. account for 99.7% of our country's business.

Supporting growth and innovation. Every business sector, from farming to retail to transportation, depends on banks to provide companies with the funds needed to start up or expand.

Banks take the money we deposit into the bank and lend it out to businesses, then charge interest to make a profit.

Our economy depends on loans. It's hard to imagine our society if loans for starting businesses weren't available.

So many great startups would never have been created.

Without loans, the opportunity for businesses to expand would be stifled.

When new technologies get introduced, companies wouldn't be able to invest.

It starts with the business plan. When a business banking rep reviews a solid business plan and sees profitable financial projections, they make the recommendation to lend funds to the business.

Best bank for business. Wells Fargo calls itself:

America's leading small business lender.

In fact, the bank made a five-year commitment in 2014 to lend out $100 billion to small businesses.

The bank's unsecured business loans offer $10,000–$100,000, with repayment terms from 1–5 years.

Interest rates range from 6.50–22.99%, based on eligibility.

Banks like Wells Fargo also offer business lines of credit to help companies manage their cash flow.

Banks help build communities with construction and real estate development loans

Banks also finance the real estate and construction sectors using the pool of deposited income from people like you and me.

Whether it's a loan for a family to construct a new home, a developer to build a condo, or a business to build a warehouse or factory, banks lend the required capital.

Mortgages allow families to pay off their homes over time

Another form of bank loan it would be hard to imagine our society without is the mortgage.

I can't think of a better use of the funds we deposit into the bank than lending it to families so they can live in the home they choose.

A bank lends a person or family the full amount of the home they purchase (minus any down payment).

The family can then pay it back with fixed monthly payments over a period that ranges anywhere between 5 to 30 years.

Of course, the longer the term, the bigger the total interest charged.

A highly profitable industry. The bank, as per usual, makes its money on the interest charged.

In fact, mortgages are designed to make sure the bank gets paid its interest first before the loan principal gets paid down.

Better chance to get approved. Banks will approve people for mortgages more easily than unsecured personal loans because their house is collateral in case they can't pay.

Bank of America is known to be a good mortgage lender.

You can apply for a mortgage online using BofA's Home Loan Navigator.

For a thirty-year mortgage, the fixed rate Bank of America charges on a $200,000 loan is currently 4.5%.

Home Equity Loans/HELOCs let you borrow from your home's value

Another bank lending practice I'm a big fan of is the home equity loan.

Otherwise known as "home refinancing" or "second mortgages," home equity loans let people borrow from the bank based on the value of what they've paid into their home.

Home equity lines of credit (HELOCs) are also covered by the value of what you've paid into your home.

Secured forms of credit. Since your house is collateral in case you can't pay, the banks consider home equity loans low-risk (as far as they're concerned).

As a result, the interest banks charge for these forms of credit is low compared to credit cards or personal loans.

Bank of America's interest rate for its home equity line of credit is 6.36%.

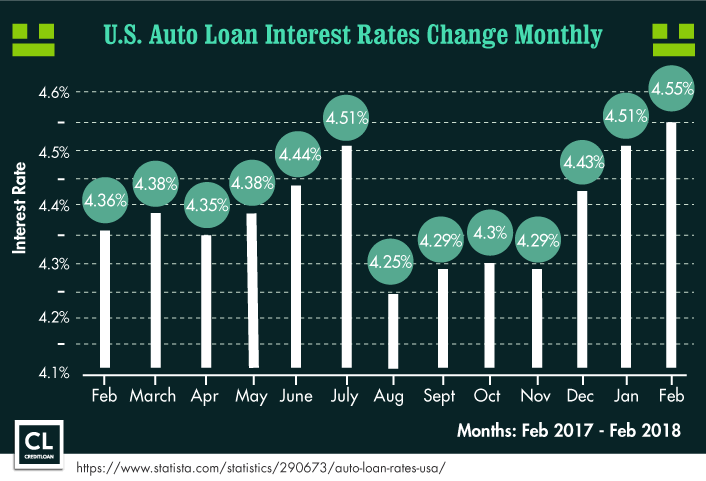

Auto loans put people in the driver's seat

The final thing banks do with the money we put into our deposit accounts is lend it out to people buying cars.

There are very few people with the cash on hand to purchase a new $40,000 car outright.

Most of us borrow the money we need to buy the car and pay it off over time.

Banks offer loans specifically to buy cars. The interest rates banks charge for new car loans are quite good, since the car is the loan collateral

(The bank can repossess the car in case the borrower defaults on loan repayment).

Since it's a secured loan, it would also be easier for someone with credit issues to get approved for a car loan compared to a credit card or unsecured personal cash loan.

Someone with an "Excellent" credit score (800+) can expect to get a four-year, $20,000 car loan from a bank with an APR of around 3.73%.

Monthly payments would be $449.

A person with a "Good" FICO score (670-739) would probably get approved for 7.08% with $480 monthly payments.

America's Largest Banks by Deposit

Banks with the most deposits are also the most profitable

For the first time in 23 years, JP Morgan Chase leads United States banks in total deposits.

The bank reached $1.31 trillion in deposits as of June 30, 2017, according to the FDIC.

Bank of America Merrill Lynch was not far behind with $1.29 trillion and Wells Fargo was a close third with $1.26 trillion in deposited funds.

Citigroup was the fourth-largest U.S. bank by deposits with $505 billion.

In total, the "Big Four" banks reported $4.365 trillion in deposited funds in 2017.

Not surprisingly, the banks with the most deposited money were also the banks earning the most profit for their shareholders.

JP Morgan Chase reported revenues of $108.2 billion in 2017, and Bank of America had income of $100.1 billion.

JP Morgan Chase is the biggest bank in America

With its headquarters in New York City, JP Morgan Chase is the largest bank in the United States and the sixth-biggest bank in the world.

Its total assets are $2.534 trillion.

The bank's earliest predecessor—the Bank of the Manhattan Company—was founded almost 220 years ago, in 1799.

No personal loans here. JP Morgan Chase no longer lends out its deposited funds in the form of unsecured personal loans.

It does provide mortgage refinancing loans, credit cards, mortgages, and car loans.

A leader in credit cards. Chase is also the top issuer of general-purpose credit cards in America with 31.7% of the total market share.

The company's credit cards include the Chase Sapphire Reserved for travel rewards and the Chase Freedom Unlimited for cash back.

Bank of America provided personal loans when no one else would

Back in 1904, the Bank of America was founded in San Francisco as the Bank of Italy.

Its founder changed the way banks operated by lending to working-class immigrants at a time when most banks would only lend to the rich or to businesses.

Times have changed. Sadly, Bank of America no longer provides personal loans today—a glaring departure from what its founder originally envisioned.

Largest for investors. It purchased the investment firm Merrill Lynch back when it was struggling in 2008, helping it grow along the way to become what is currently the biggest wealth management corporation in the world.

BofA is the second-largest bank by assets and ranks 26th on the list of biggest company in the U.S. by revenue.

Bank of America invented the general-use credit card. The BankAmericard was a consumer credit card launched in California in 1958.

Eventually, it got renamed to—you guessed it!—Visa.

Today, Bank of America lends out some of its excess reserves in the form of multiple credit card offerings.

They include the Bank of America Premium Rewards card for travel rewards and the Bank of America Cash Rewards card for earning cash back.

Wells Fargo continues to offer personal loans and business loans

Wells Fargo was just $30 billion behind Bank of America in deposits for 2017.

Wells Fargo prides itself on being a bank for the community with a ubiquitous network of 8,700 branches and 13,000 ATMs.

It's also the only one out of all these big banks to lend those deposits out to the general public in the form of unsecured personal loans.

Student loan provider. Its personal loans also include private student loans to help students pay for college expenses.

The bank for businesses. In addition to lending to individuals and families, Wells Fargo is well known for its business lending.

In fact, it's equipment financing division is the country's largest.

Solid credit card offerings. Wells Fargo also offers credit cards suiting a variety of needs.

For example, Wells Fargo's CashWise Visa lets you earn cash rewards at a rate of 1.5% for everything with no annual fee.

Citigroup has the most credit card accounts

Citibank came in a distant fourth for total deposits, with less than half of the deposits reported by any one of the top three banks.

But it's #1 for the number of active credit cardholder accounts, with 17.09% of the U.S. total market share.

Founded in 1812 as the Bank of New York, its headquarters continue to reside in the Big Apple.

One card for everything. Back in 1968, Citibank created its own credit card, known as the "Everything Card."

It eventually became Mastercard.

Today Citibank continues to offer a variety of cards for different preferences.

Branded credit card experts. Citibank has partnered with multiple big retailers to provide credit cards with features specific to their businesses.

These branded cards include ones for Costco, Home Depot, and Staples.

A simple credit card choice. The Citi Simplicity credit card charges no late fees ever and offers a low APR on purchases.

Earn cash back twice. Citi's Double Cash Card lets cardholders earn cash back at a rate of 1%, then doubles it when the balance is paid.

Your deposits are being put to good use by the banks

As you might have noticed, I'm a fan of the modern banking system.

Giving people a secure place to store and access their money, then using those funds to provide loans to help families and businesses thrive, to me, is pure genius.

The banks themselves generate massive profits for their shareholders from this system, making it a "win-win-win".

If you've ever wondered what happens to your money once it is deposited, now you know it's being put to great use.

I've seen first-hand how loans—even small ones—can change someone's life, and the banks are making that happen on a huge scale.

Now that you know all about the banking system and the biggest banks in America by deposits, look each of them over and see if there's one you would like to entrust depositing your hard earned money.

Someday when you're applying for a bank loan yourself, you'll know where the funds are coming from to finance it.

Did you learn something new from this article?

Do you have any experience with any of the Big Four banks?

Any tips or stories you'd like to share?

Please let us know in the comments below!